NFT volumes start to fall

Over the previous month, the whole gross sales of Ethereum NFTs fell by 55%. Widespread Ethereum NFT collections corresponding to BAYC (Bored Ape Yacht Membership), MAYC (Mutant Ape Yacht Membership) and Crypto Punks witnessed a big decline of greater than 40% when it comes to gross sales and flooring costs.

NFTs on different networks corresponding to Solana and Bitcoin have been gaining traction in comparison with the Ethereum community.

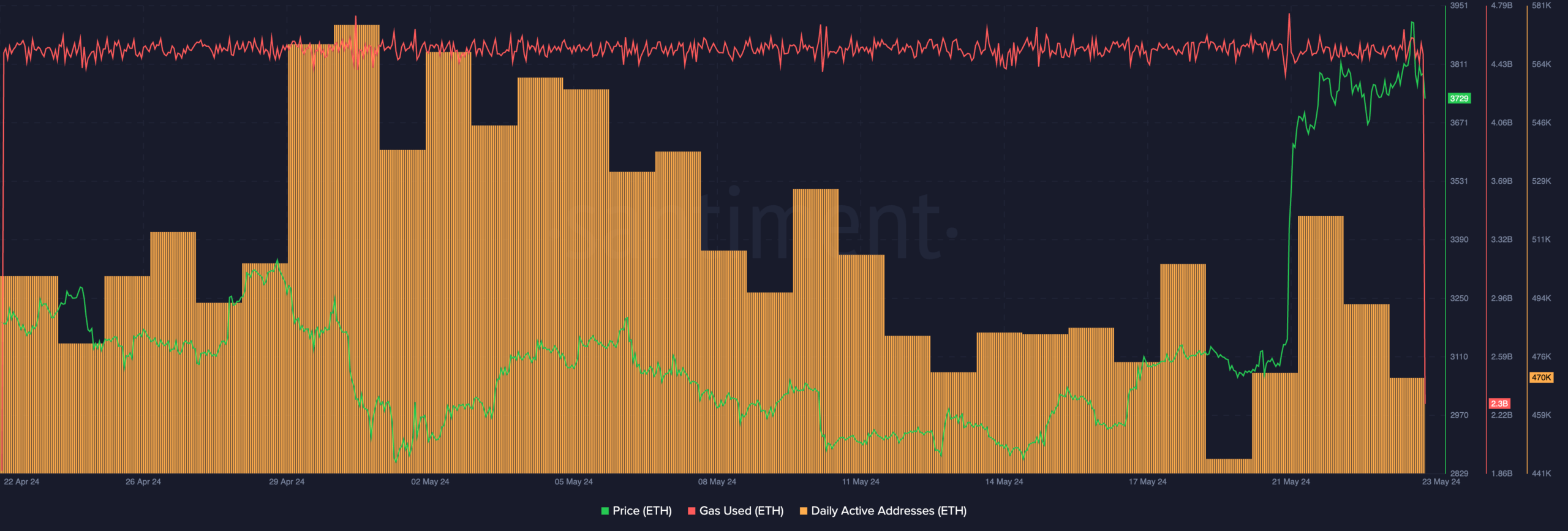

Furthermore, the every day lively addresses on the Ethereum community additionally fell considerably over the previous few days together with the gasoline utilization on the community, implying declining total exercise on the Ethereum ecosystem.

This possibly an indication that Ethereum’s reputation as an ecosystem was waning considerably.

Although the curiosity in ETH as a result of hype round its ETF has risen and triggered the value to develop, a waning curiosity within the Ethereum ETF’s may trigger an issue for ETH in the long term.

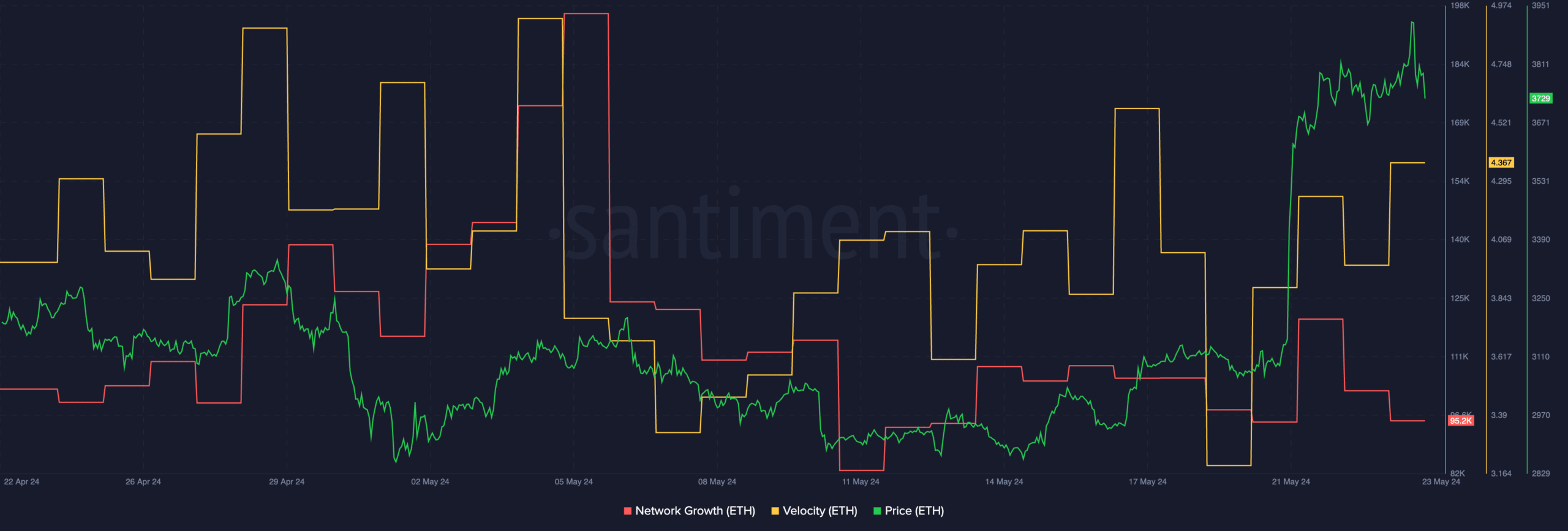

At press time, ETH was buying and selling at $3,786.76 and its value had fallen by 0.68%. The community progress across the ETH token had fallen considerably, implying that the variety of new addresses attention-grabbing with ETH had drastically declined.

A scarcity of curiosity from new addresses prompt that the market was not prepared to purchase ETH at its present value.

Some bulls might anticipate a correction earlier than accumulating extra ETH sooner or later.

Moreover, the rate at which ETH was buying and selling at had grown, indicating that the frequency with which ETH was buying and selling at had risen.

Solely time will inform whether or not the value motion of ETH co relates with the rising velocity, giving bulls some hope concerning the future.

Is your portfolio inexperienced? Examine the Ethereum Profit Calculator

How are addresses holding up?

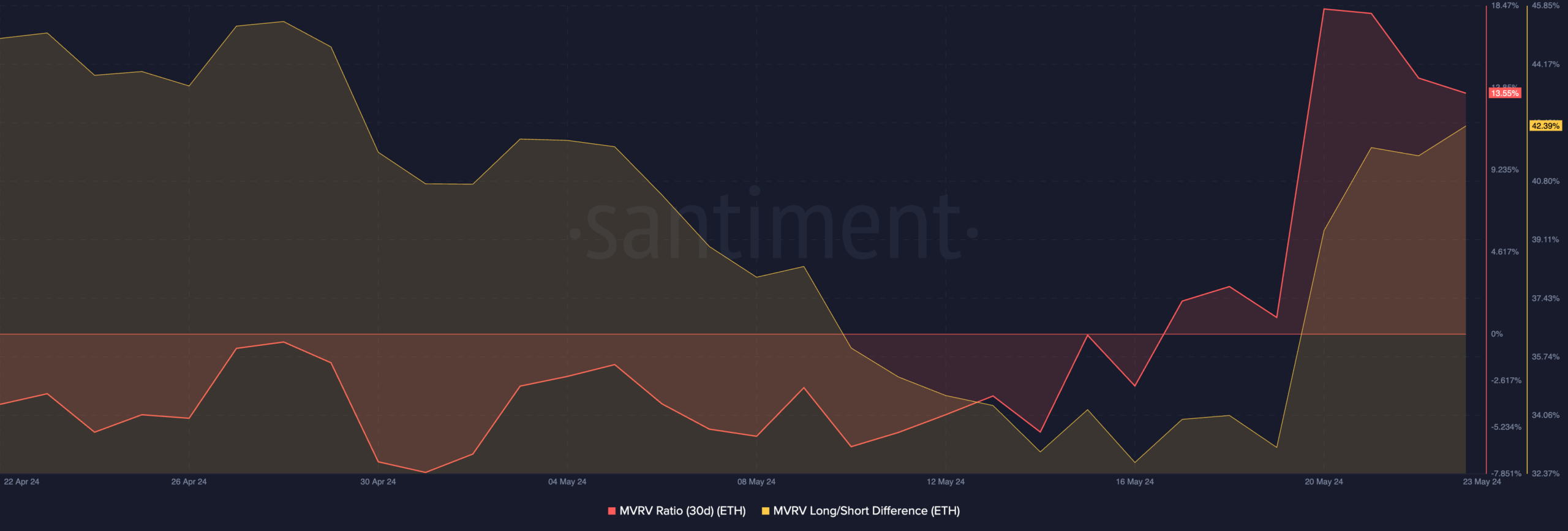

Coming to the state of the holders, it was seen that almost all addresses have been worthwhile, as indicated by the excessive MVRV ratio for ETH.

Although a excessive MVRV ratio implies that extra holders are incentivized to promote their holdings, the presence of long run holders showcased by the excessive Lengthy/Brief distinction implies that a big sell-off might not occur anytime quickly.