- Bitcoin was gaining consideration with bullish momentum, as analysts predicted a possible surge to $135,000

- Key metrics level to robust fundamentals, although dangers stay.

Bitcoin [BTC] is as soon as once more capturing the highlight, fueled by renewed bullish momentum that has merchants and analysts eyeing formidable value targets.

With the cryptocurrency market rebounding, BTC’s trajectory has drawn comparisons to its meteoric rise in late 2020, sparking hypothesis a couple of related cycle enjoying out.

Analyst maps Bitcoin’s path to $135,000

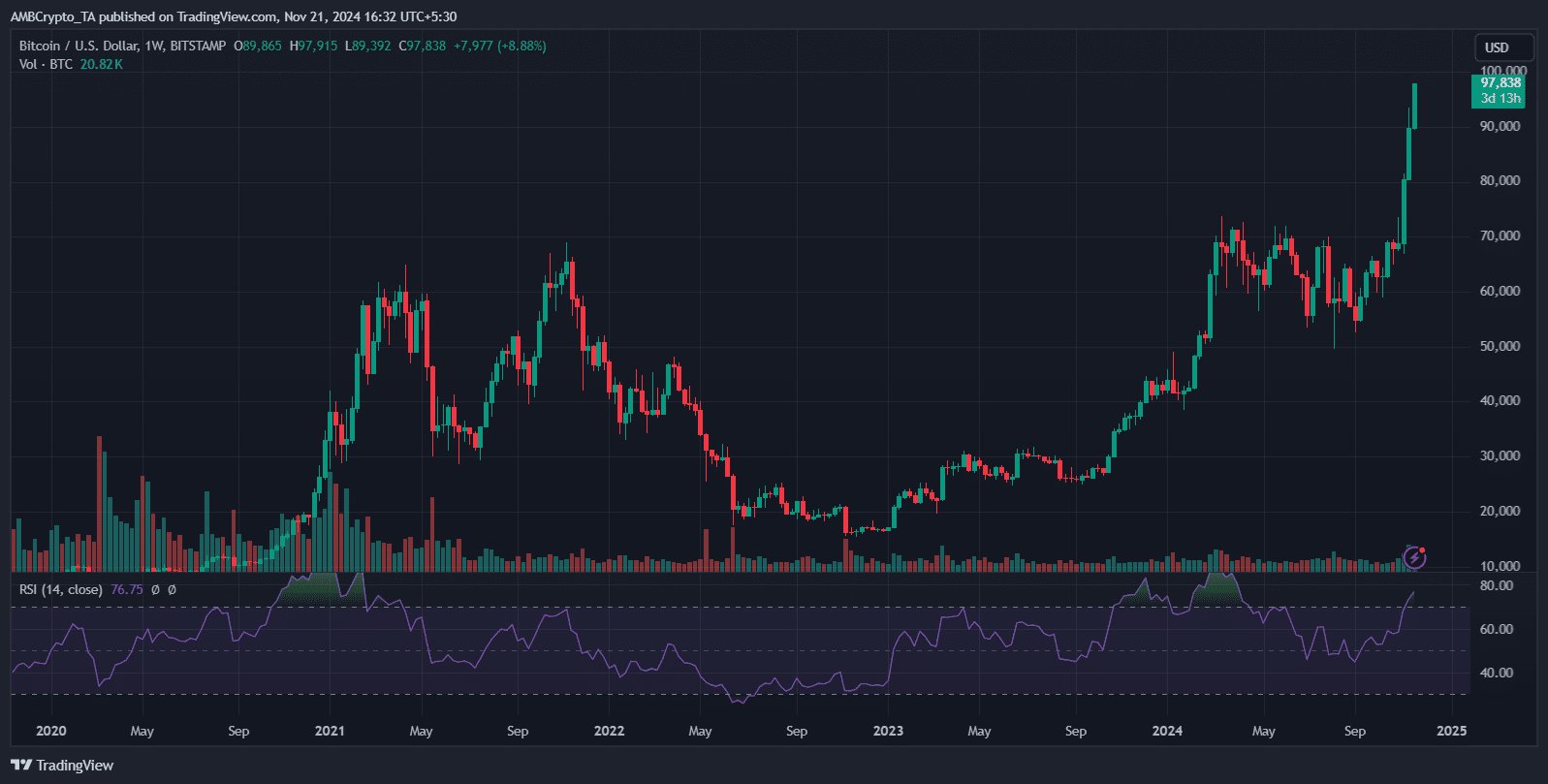

Fashionable crypto analyst Ali Martinez lately drew a parallel between BTC’s present value motion and its December 2020 rally.

By highlighting the near-identical alignment of Bitcoin’s value trajectory and RSI ranges, Martinez recommended a possible roadmap for Bitcoin.

In line with his projection, BTC may rally to $108,000, expertise a pullback to $99,000, and finally surging to $135,000. The comparability to 2020 emphasizes the cyclical nature of Bitcoin’s market conduct, reinforcing the opportunity of historical past repeating itself.

Parallels to 2020 and key metrics

The present Bitcoin value motion mirrored the December 2020 breakout, with each durations showcasing constant greater highs and regular RSI ranges that mirror rising bullish momentum.

In late 2020, Bitcoin transitioned from $20,000 to over $40,000 in only a few weeks, pushed by institutional adoption and heightened retail FOMO.

Equally, Bitcoin’s current surge, crossing $97,000, displays acceleration fueled by renewed curiosity from institutional traders and macroeconomic uncertainty.

The resemblance in trajectory identified the opportunity of a multi-leg rally, with consolidation phases doubtless alongside the way in which. Nevertheless, market situations at this time embody greater volatility and a extra numerous crypto ecosystem, which may form the end result in another way.

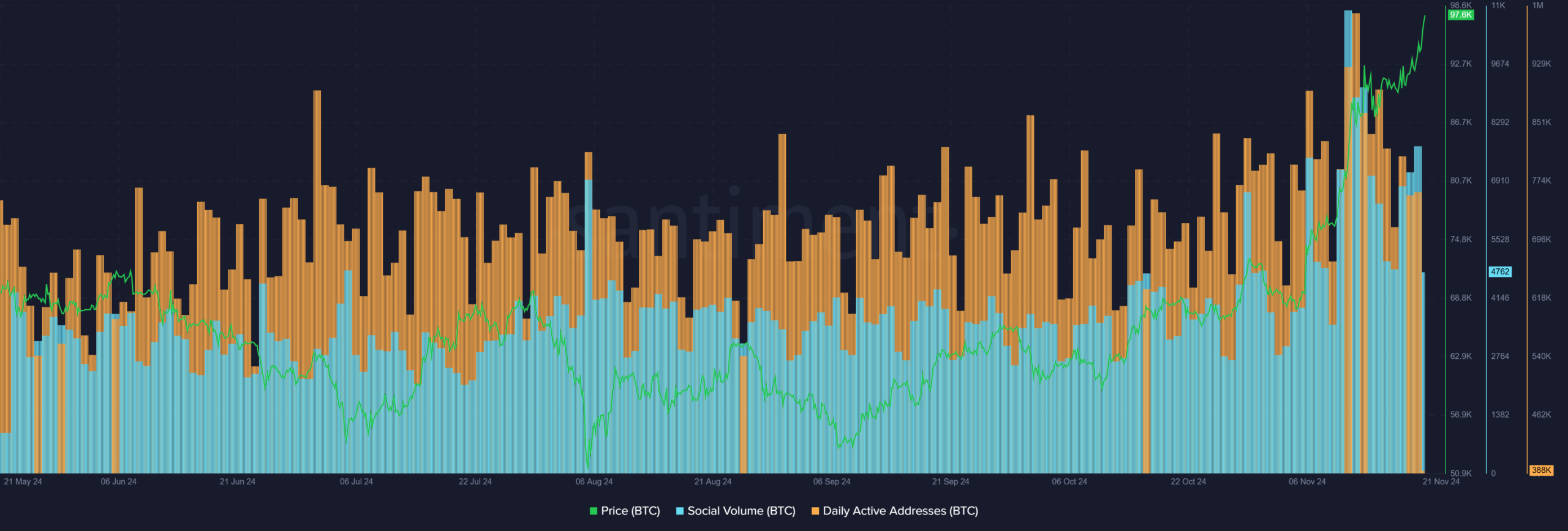

BTC’s each day lively addresses have surpassed 476K, indicating constant community development. Concurrently, social quantity remained elevated at 388K, reflecting robust market engagement.

These metrics reinforce Martinez’s projection, as rising adoption and neighborhood exercise align with historic patterns of sustained value momentum.

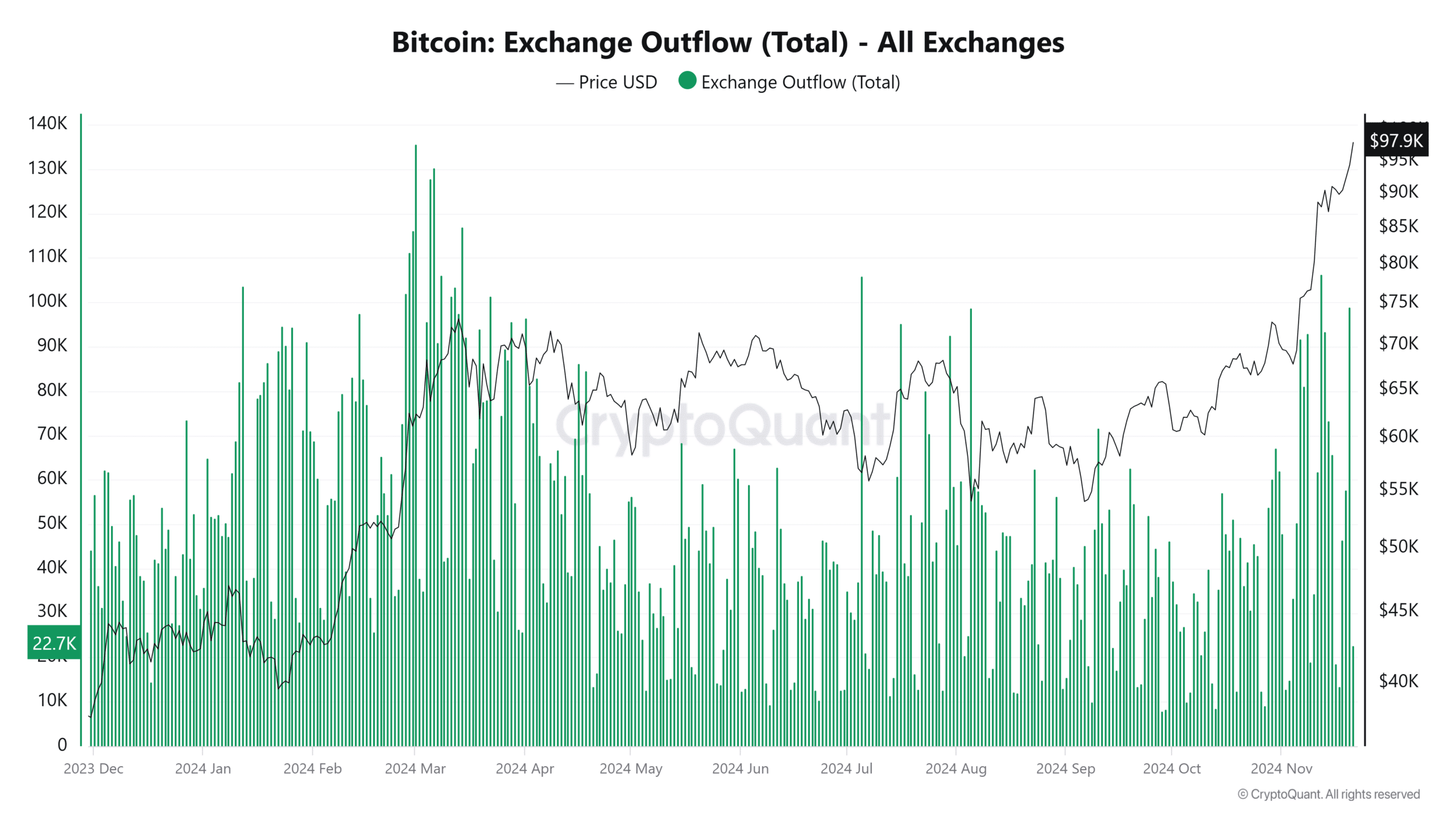

The rise in change outflows signaled robust accumulation as traders moved Bitcoin off exchanges, decreasing obtainable provide—a traditionally bullish indicator.

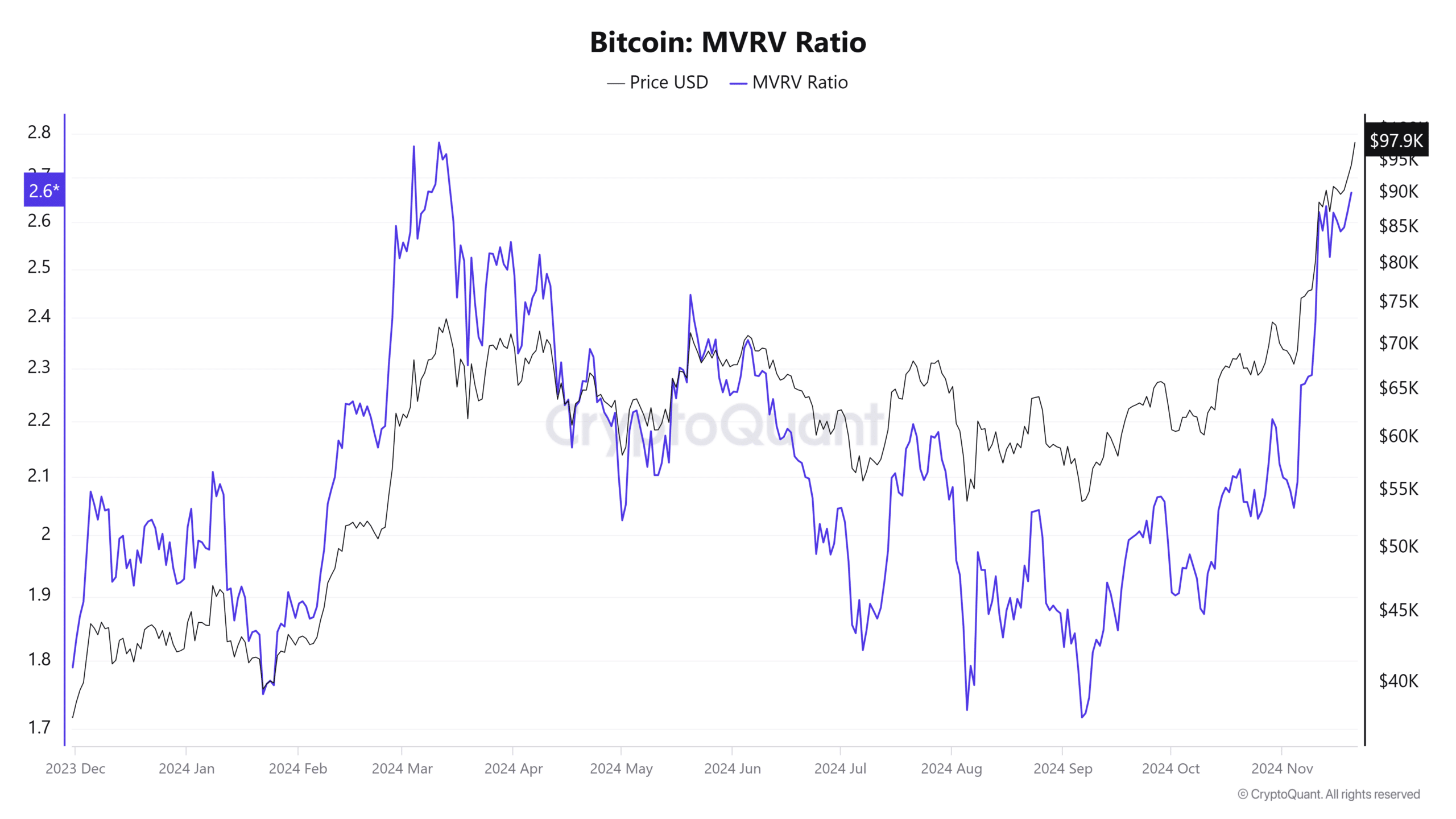

Concurrently, the MVRV Ratio approaching 2.6 mirrored rising unrealized earnings however stays beneath peak euphoria ranges seen in previous cycles, suggesting room for additional upside.

This decreased promoting strain, coupled with heightened demand, creates a provide shock situation. Such dynamics, beforehand noticed in late 2020, catalyzed fast value surges, reinforcing the viability of Martinez’s $135,000 goal.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Challenges and dangers to Bitcoin’s $135k journey

Whereas Martinez’s projection is compelling, traders ought to take into account a number of dangers. Bitcoin’s heightened volatility and unpredictable macroeconomic elements may disrupt the anticipated trajectory.

Moreover, the various crypto ecosystem introduces competing property, probably diluting Bitcoin’s dominance.

The MVRV Ratio nearing overbought territory additionally raises the danger of sharp corrections. Market sentiment can shift abruptly, amplifying draw back strain.

As with all projections, cautious optimism and disciplined danger administration are important when navigating Bitcoin’s unstable market.