- Ethereum’s value dropped by over 2% within the final seven days.

- A metric steered that ETH’s value was close to its market backside.

Ethereum [ETH] bears dominated the final week because the token’s value dropped. Nevertheless, this may be the final probability for buyers to build up extra ETH whereas its value is low.

ETH was at a vital resistance degree, and a breakout above it might lead to an enormous rally within the coming weeks or months.

Do you have to purchase ETH now?

CoinMarketCap’s information revealed that Ethereum witnessed a value correction final week as its worth dropped by greater than 2%.

On the time of writing, ETH was buying and selling at $3,687.02 with a market capitalization of over $442 billion. Nevertheless, this bearish value pattern may change quickly as ETH is testing a key resistance degree.

Milkybull, a preferred crypto analyst, lately posted a tweet revealing this growth. A breakout above the resistance would spark an enormous bull rally.

Due to this fact, this may really be the final probability for buyers to purchase ETH underneath $3.7k on this cycle.

AMBCrypto then checked ETH’s on-chain information to see whether or not buyers utilized this chance to build up.

As per our evaluation of CryptoQuant’s data, ETH’s web deposit on exchanges was low in comparison with the final seven days’ common, reflecting excessive shopping for strain. Nevertheless, the opposite datasets steered in any other case.

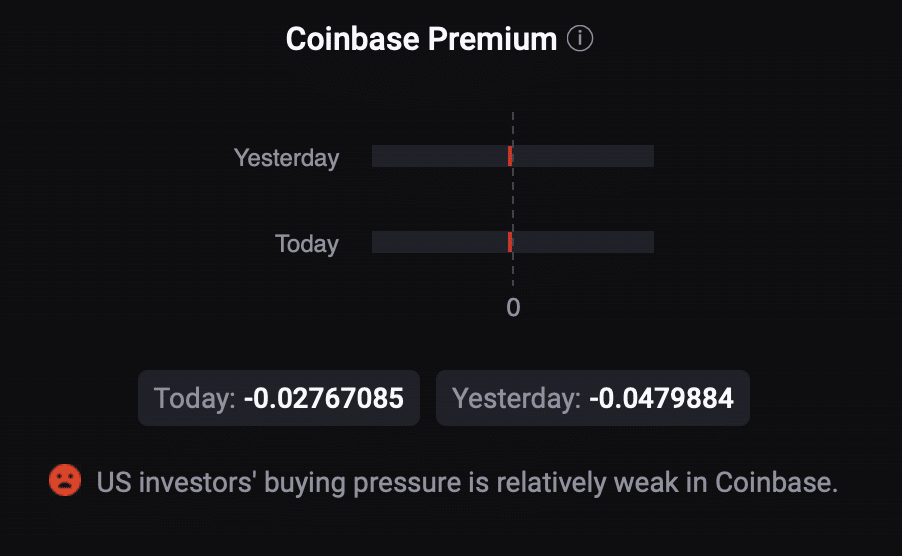

For instance, ETH’s Coinbase Premium was purple. This clearly meant that promoting sentiment was dominant amongst U.S. buyers.

Odds of a bull rally

AMBCrypto then took a more in-depth have a look at Ethereum’s present state to raised perceive whether or not a value improve is feasible within the close to time period.

AMBCrypto’s have a look at Glassnode’s information revealed that ETH’s value was close to its market backside, as per the Pi cycler prime indicator.

This meant that the possibilities of ETH gaining bullish momentum within the coming days are excessive. If that occurs, then ETH may quickly contact $4.8k, which is optimistic to take a look at.

We then took a have a look at the token’s 12-hour chart to see what market indicators steered relating to a value uptick within the quick time period.

As per our evaluation, the MACD regarded within the sellers’ favor because it displayed a bearish crossover.

Learn Ethereum’s [ETH] Price Prediction 2024-25

Its Relative Energy Index (RSI) additionally remained bearish because it was underneath its impartial mark. These indicators hinted at a continued value decline.

Nonetheless, the Chaikin Cash Move (CMF) turned bullish by shifting northwards in the direction of the impartial mark in the previous few days.