Bitcoin supporter Fred Krueger has not too long ago voiced considerations about Ethereum’s (ETH) elementary tendencies and potential regulatory hurdles. Krueger’s remarks, shared in a post on X, underscored notable statistics concerning Ethereum’s community exercise and transactional utility.

Ethereum’s Declining Utility Raises Alarms

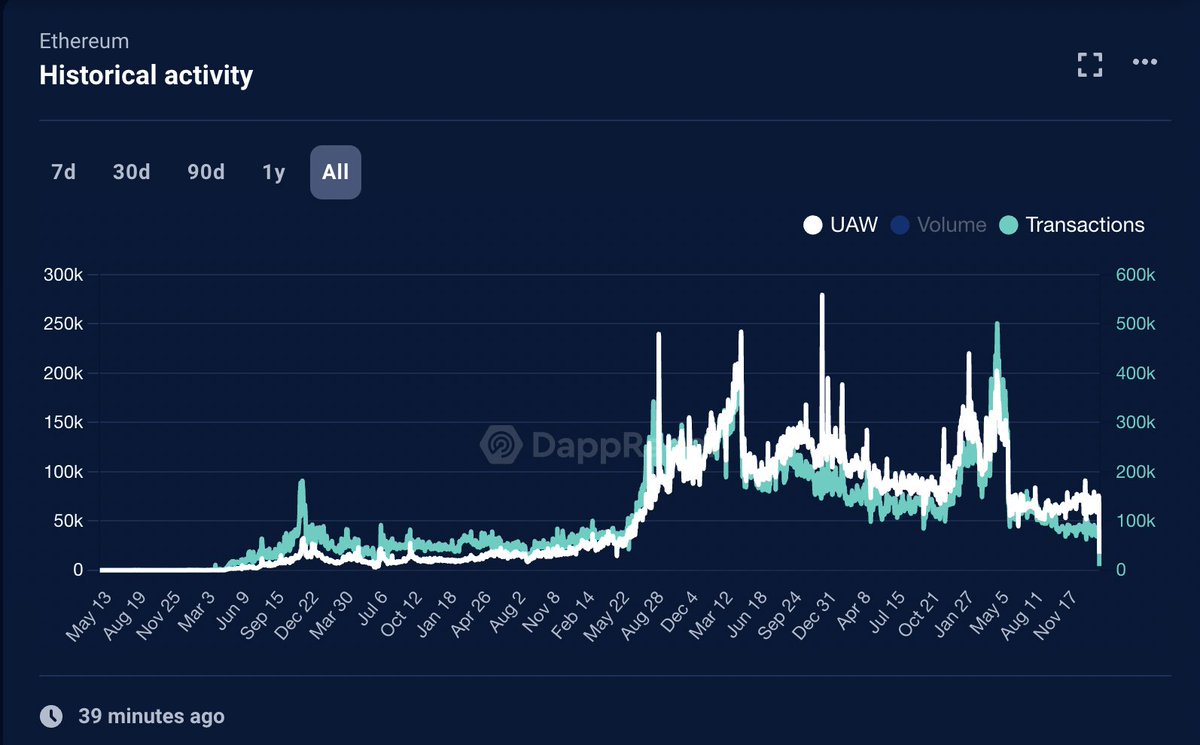

Krueger’s critique highlighted Ethereum’s hovering value, particularly its not too long ago achieved two-year peak juxtaposed with declining community utilization. Regardless of ETH reaching $3,000, Krueger famous a major drop in Each day Lively Customers (DAUs) from 120,000 in 2021 to simply 66,000 up to now 12 months.

The Bitcoin Maxi additionally highlighted the decline in consumer exercise on the blockchain’s “high app,” Uniswap V3, Ethereum’s main decentralized exchange protocol, highlighting it as a notable concern.

Krueger famous:

The highest app, Uniswap V3 is simply getting 16K DAUs. I keep in mind, again in 2020 this quantity was 60K or extra. It’s positively the case the ETH as a sequence is not used immediately.

Krueger additionally starkly in contrast Ethereum’s present standing and a “meme coin,” citing similarities to property like Shiba Inu (SHIB).

Regardless of Ethereum’s price performance, Krueger highlighted a perceived erosion in its utility, particularly when contrasted with various blockchain networks comparable to Solana, Avalanche, and Close to.

The Bitcoin Maxi continued, noting:

After all, that doesn’t cease traders from bidding it as much as a $361 Billion greenback market cap. It actually has change into a kind of meme coin, much like Shiba Inu. It’s not particularily low cost ($1.50 per transaction), or quick. In case you are simply inquisitive about reward factors for video games, or casino-style DeFi apps — Solana, Avalanche, Close to and so forth.. all crush it.

Regulatory Uncertainty And Group Response

Krueger’s critique prolonged past Ethereum’s utility to its regulatory outlook. He expressed doubts about the opportunity of a spot Ethereum Exchange-Traded Fund (ETF) approval, citing considerations over regulatory scrutiny:

Lastly, I don’t assume Gensler goes to permit an ETH ETF. When you imagine within the Tooth Fairy, have enjoyable. I simply don’t assume Gary desires to make his second ETF a large pre-mine. Units a really dangerous precedent.

The Bitcoin Maxi concluded: “Keep away from ETH in any respect prices.” Regardless of Krueger’s evaluation, the ETH group’s perception in ETH stays unshaken. Below Krueger’s submit, many had been discovered countering Krueger’s comment.

An X consumer named “n o okay a” commenting on Krueger’s submit identified that Ethereum has a roadmap centered on scalability by way of a modular and rollup-centric strategy. They argue that solely contemplating Each day Lively Customers (DAU) on the mainnet is deceptive, akin to assessing Bitcoin’s worth primarily based solely on its mainnet utilization.

Whereas they agree that depicting Ethereum as sound cash “was/is clownish,” they famous: “however you [Fred Krueger] discredit your self right here.”

Even L2s like Arbitrum have been in decline final 12 months.

This isn’t the case that each one is properly in ETH-land pic.twitter.com/oOIPwyCrj2

— Fred Krueger (@dotkrueger) February 21, 2024

One other consumer, “John Doe,” argues that there was a major decline in complete worth locked (TVL) throughout the DeFi house, indicating a development of decentralized finance (DeFi) customers decreasing their publicity to threat earlier than probably reinvesting sooner or later.

Sir, as a lot as you’re properly revered within the ETF house, you’re not properly conscious of how Defi Cycles work, simply try Defillama and see the TVL charts from the final bull run v/s right now. There’s been sharp decline throughout the house. That is degens de-risking, earlier than we Ape in once more

— John Doe (@h0dlboi) February 21, 2024

Featured picture from Unsplash, Chart from TradingView