- Bitcoin raises combined sentiments amongst merchants as its worth tendencies between $70k and $71k.

- Skeptics argue that Bitcoin is unfit to be thought of even near conventional asset lessons.

Regardless of a short decline, Bitcoin [BTC] has as soon as once more climbed to $71,000, surpassing expectations set earlier than the halving occasion. But, amidst this heightened demand, Bitcoin skeptics keep sturdy of their criticism, usually evaluating its price to conventional asset lessons.

This prompts a vital query – How is Bitcoin being evaluated and understood within the broader monetary panorama?

Bitcoin’s resilience amidst rising skepticism

Yassine Elmandjra, Director of Digital Belongings at Ark Make investments, in a current dialog on the Bitcoin Buyers Day in New York, weighed in on the continued debate. He emphasised that Bitcoin’s lack of yield technology, not like bonds, is what poses a problem in its analysis. He mentioned,

“I feel a lot of bitcoin’s skepticism stems from, you understand, its incapability to suit neatly inside conventional asset class frameworks particularly from a basic valuation standpoint.”

Individually, Chris Kuiper, Director of Analysis for Constancy Digital Belongings, highlighted, that Bitcoin’s worth actions have intently aligned with modifications in inflation expectations, significantly when measured over a five-year horizon. He mentioned,

“In case your inflation expectation goes from 3% a yr to six%, that’s an enormous change and Bitcoin tracked that completely throughout COVID and post-COVID, with all the cash creation.”

On remarks that Bitcoin just isn’t an inflation hedge, Kuiper exclaimed,

“I feel it’s!”

This sentiment was additional confirmed by the Woodbull Charts which highlighted the drop in Bitcoin’s personal inflation charge from 3.72% in 2020 to 1.7% in 2024.

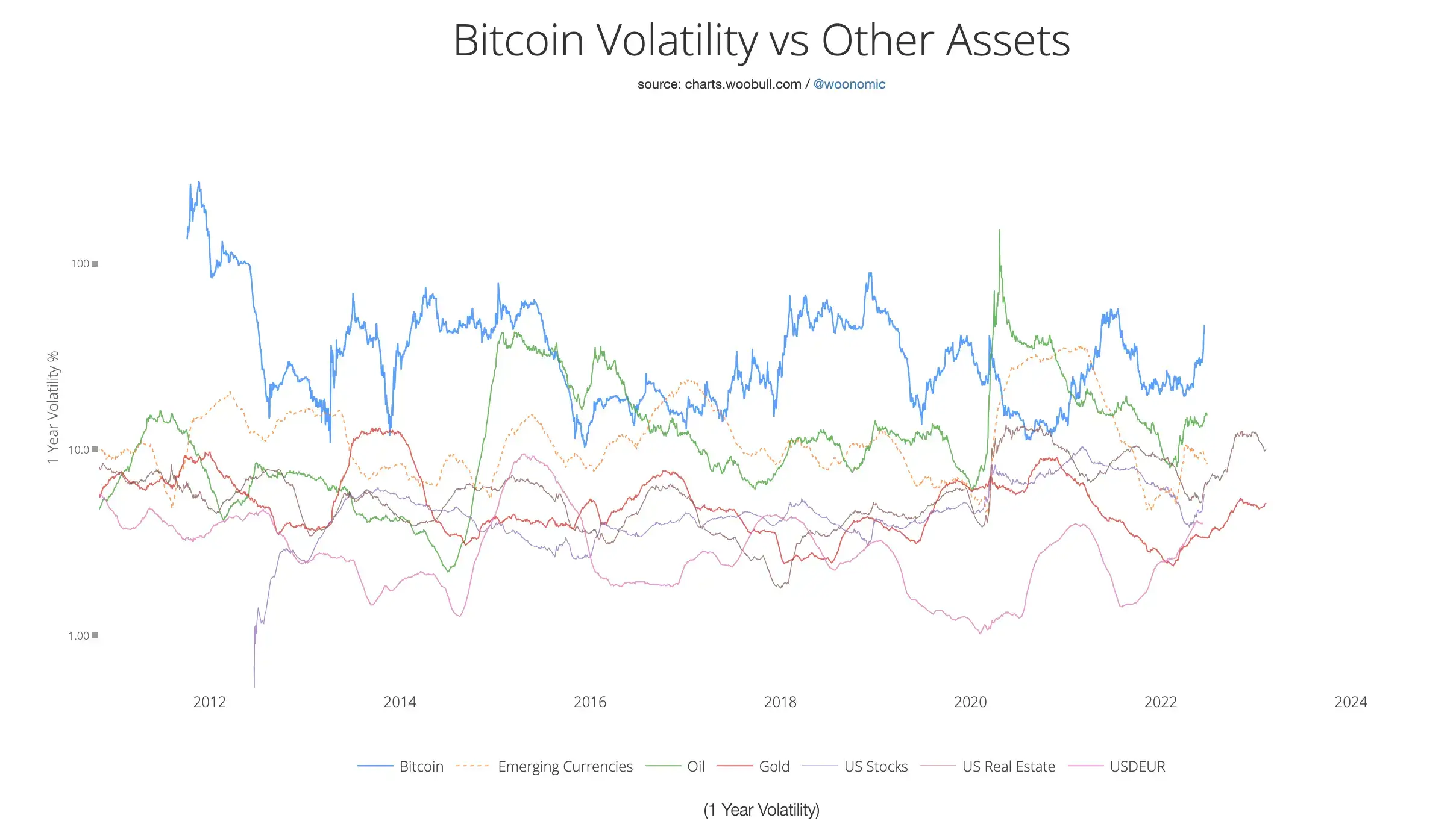

Nonetheless, when inspecting the 1-year volatility chart of Bitcoin alongside different asset lessons, a stark distinction emerges. Bitcoin’s volatility stands out at 46.95%, whereas gold, reveals considerably decrease volatility, of simply 5.6%.

This comparability underscores the notable distinction in worth fluctuations between Bitcoin and gold over the previous yr.

In response, Matthew Siegel from VanEck famous that Bitcoin’s effectiveness as an inflation hedge may need been affected by current coverage selections, inflicting a brief setback. He famous,

“We all the time need to remind ourselves that is an rising market asset, frontier market asset. People are into it as a result of we will speculate simply with our ETFs”

What lies forward?

With the uncertainty relating to whether or not the upcoming Bitcoin halving occasion could have an analogous impact on worth as earlier ones. Kuiper acknowledged that the halving occasion coincides with election cycles and liquidity cycles. This means that a number of elements can affect worth tendencies.

Thus, regardless of missing a transparent comparability from the previous, the specialists consider that the halving occasion will seemingly dampen sure points of worth volatility.