Actual Imaginative and prescient analyst Jamie Coutts believes Bitcoin (BTC) and a sure breed of altcoins can be beneficiaries of synthetic intelligence’s (AI) rise to prominence.

The previous Bloomberg analyst tells his 16,200 followers on the social media platform X that AI will want a cash system, and that BTC could also be the most effective out there type.

Nevertheless, Coutts says that stablecoins and the native tokens of sensible contract platforms, similar to Ethereum (ETH), Solana (SOL), and NEAR, are additionally well-suited.

“AI wants a cash.

Bitcoin is the most effective type issue, but it surely received’t be the one one. Stablecoins and native tokens for sensible contract platforms can even see widespread use.

SOL ETH NEAR.”

Coutts just lately said that synthetic intelligence (AI) expertise might ship the overall market cap of the layer-1 crypto sector hovering from the present $1.9 trillion valuation to as excessive as $25 trillion by 2030.

The analyst shares an excerpt from his agency’s Professional-Crypto November 2023 report that implies AI will improve the demand for on-chain verification and authentication companies.

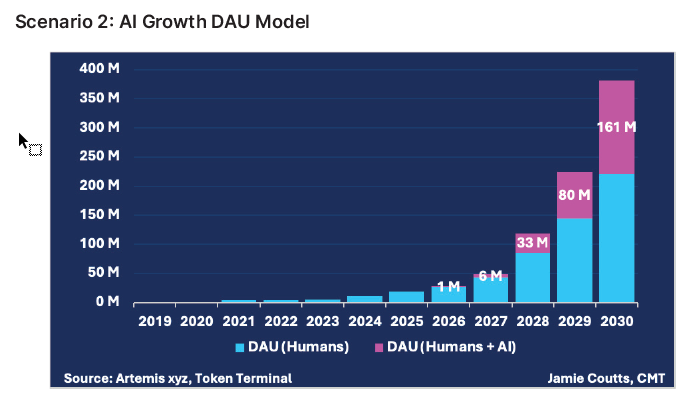

The report additionally says that human-directed or autonomous AI brokers might make use of sensible contract platforms to trade worth, considerably rising the expansion price.

“By incorporating an ‘AI development issue’ beginning in 2026, which provides 10% to the annual development price, we will start to gauge this influence. Initially, the impact is modest, however by 2030, AI brokers might comprise over 40% of complete day by day lively customers (DAU). This clearly creates some quite astronomical valuations for the blockchain property, which is able to profit from the transaction charges generated by an rising variety of AI brokers.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Price Action

Comply with us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses chances are you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/studiostoks