- ETH’s Fund Market Premium has reached its highest degree since November 2021.

- The coin’s worth might witness a short pullback as soon as patrons’ exhaustion units in.

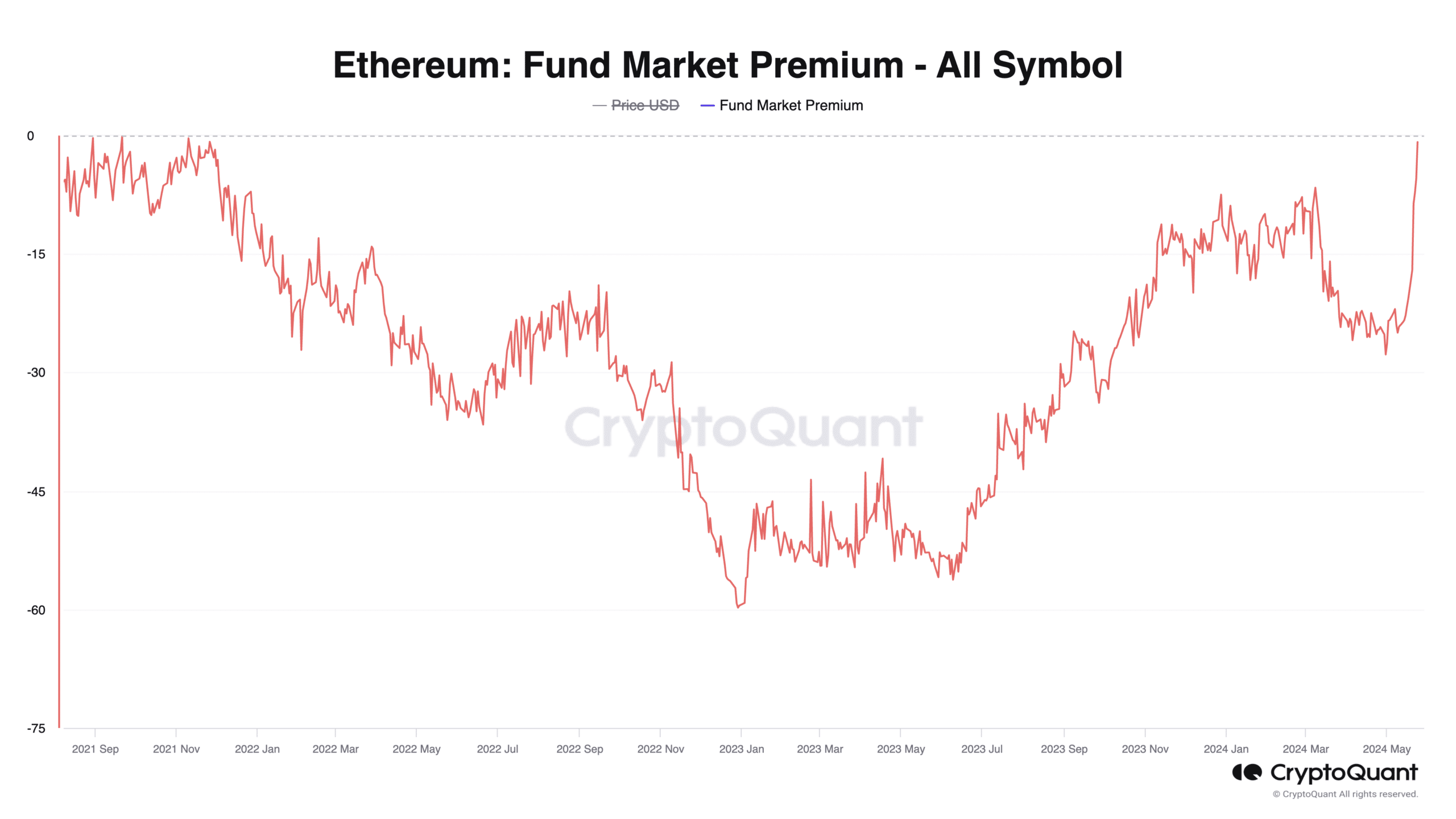

Ethereum’s [ETH] Fund Market Premium has rallied to a three-year excessive, in accordance with CryptoQuant’s information.

Though the metric has maintained an uptrend for the reason that starting of Might, a lot of the rally got here after the U.S. Securities and Change Fee (SEC) accepted the eight purposes for spot ETH exchange-traded funds (ETFs) on twenty third Might.

ETH’s Fund Market Premium measures the distinction between the coin’s value in spot markets and the worth of an Ethereum-based fund or belief.

When this metric surges, it signifies a rising demand for ETH in funding funds.

It signifies that buyers are keen to pay a premium to achieve publicity to Ethereum by means of funding funds relatively than shopping for it at market costs on the spot market.

At press time, ETH’s Fund Market Premium was -0.81.

In response to CryptoQuant information, it final reached this excessive on tenth November 2021. A couple of days later, on sixteenth November, the altcoin clinched an all-time excessive of $4,891.

Coinbase bears the brunt

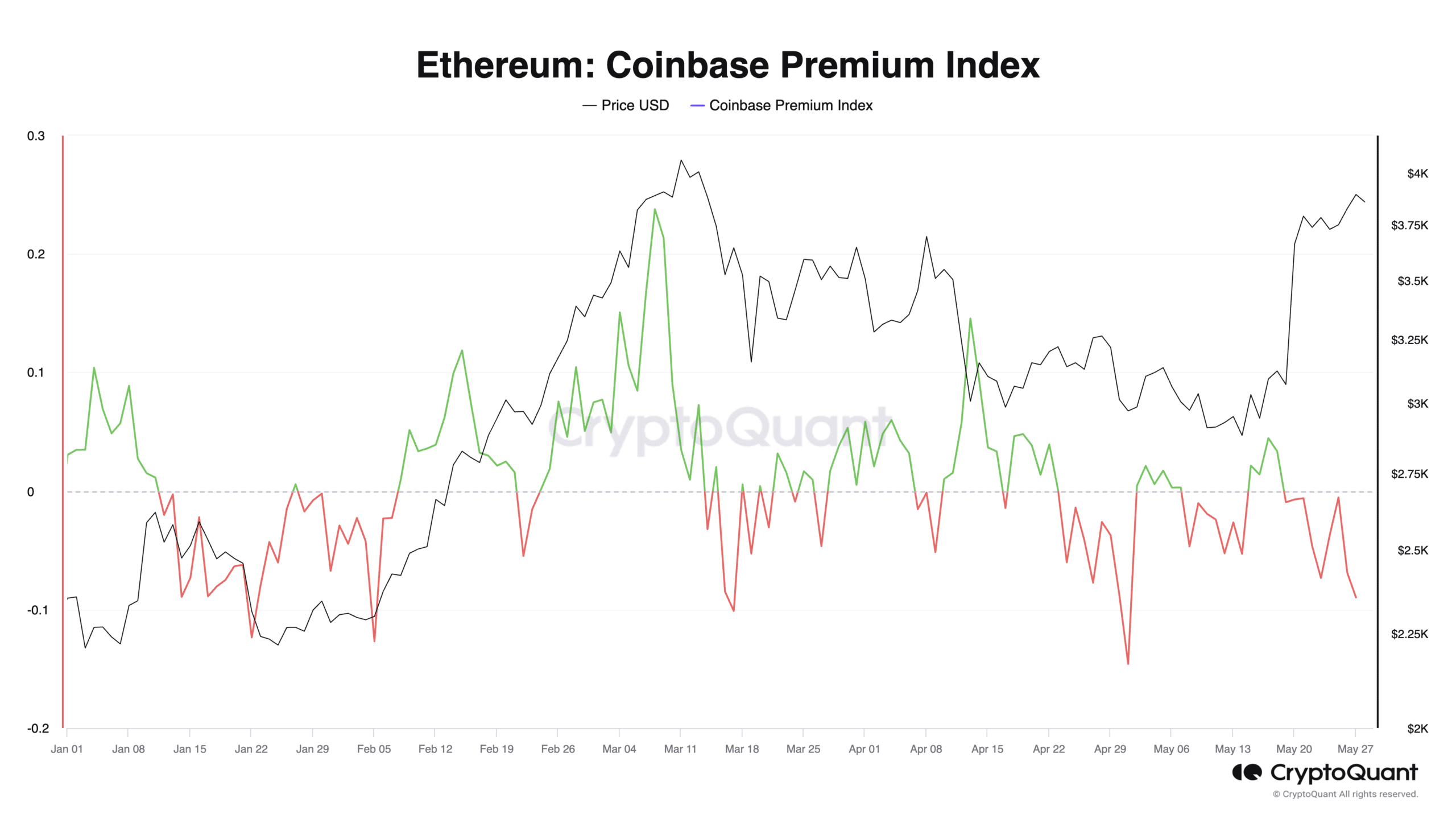

The declining Coinbase Premium Index (CPI) additionally depicted American buyers’ choice for gaining publicity to ETH by means of funding funds.

The coin’s CPI, which tracks the distinction between its costs on Coinbase and Binance, has dipped again into detrimental territory, suggesting much less buying and selling exercise on the US-based trade.

As of this writing, ETH’s CPI was -0.08.

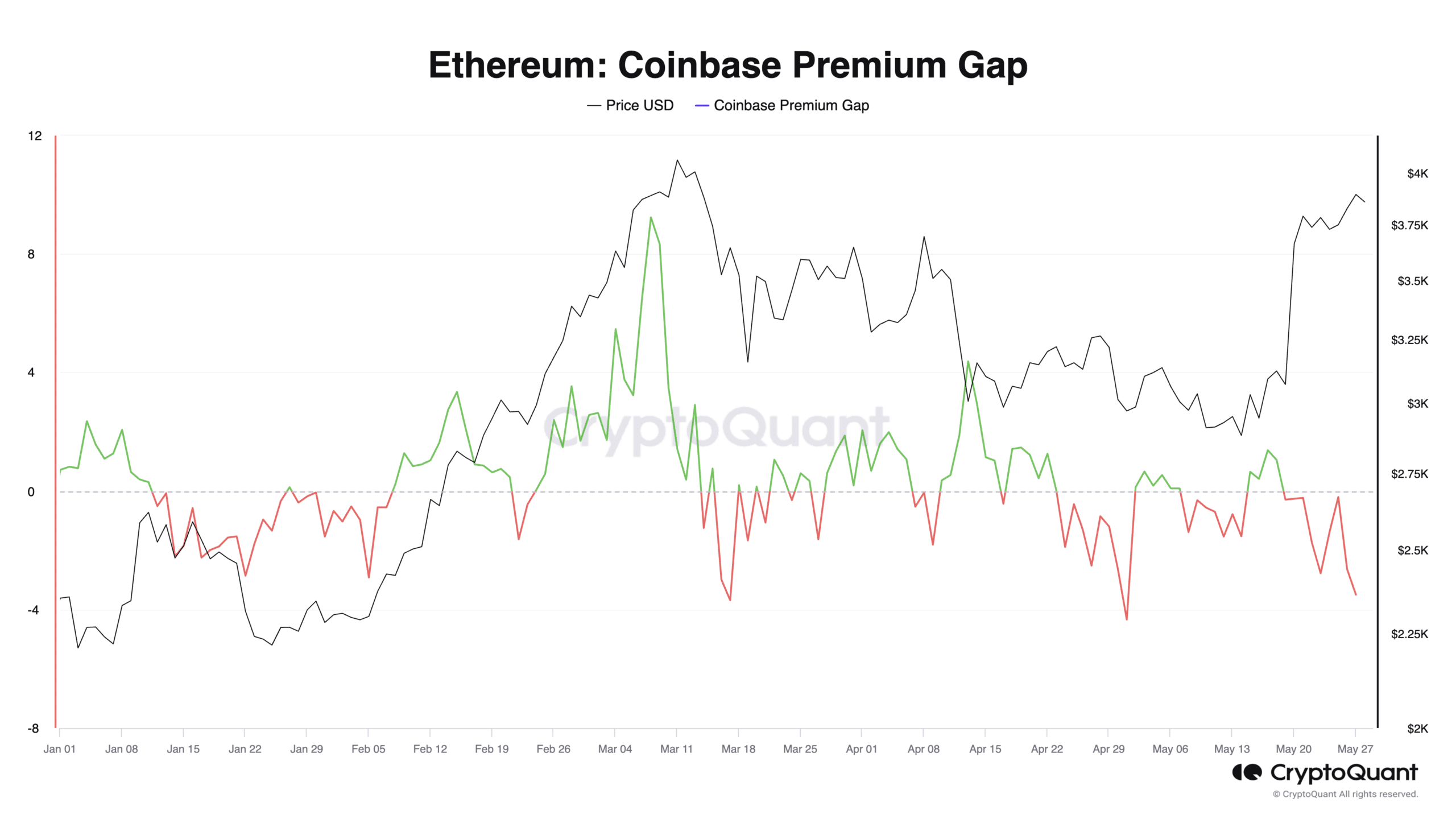

Confirming this development, the worth of ETH’s Coinbase Premium Hole (CPG) was additionally detrimental at press time.

A detrimental CPG signifies that the altcoin is buying and selling at a cheaper price on Coinbase in comparison with different main exchanges.

This can be resulting from a variety of causes, starting from market imbalances to liquidity points. However on this case, it is because of a shift in consideration towards ETH-based funding merchandise.

ETH to witness a slight pullback

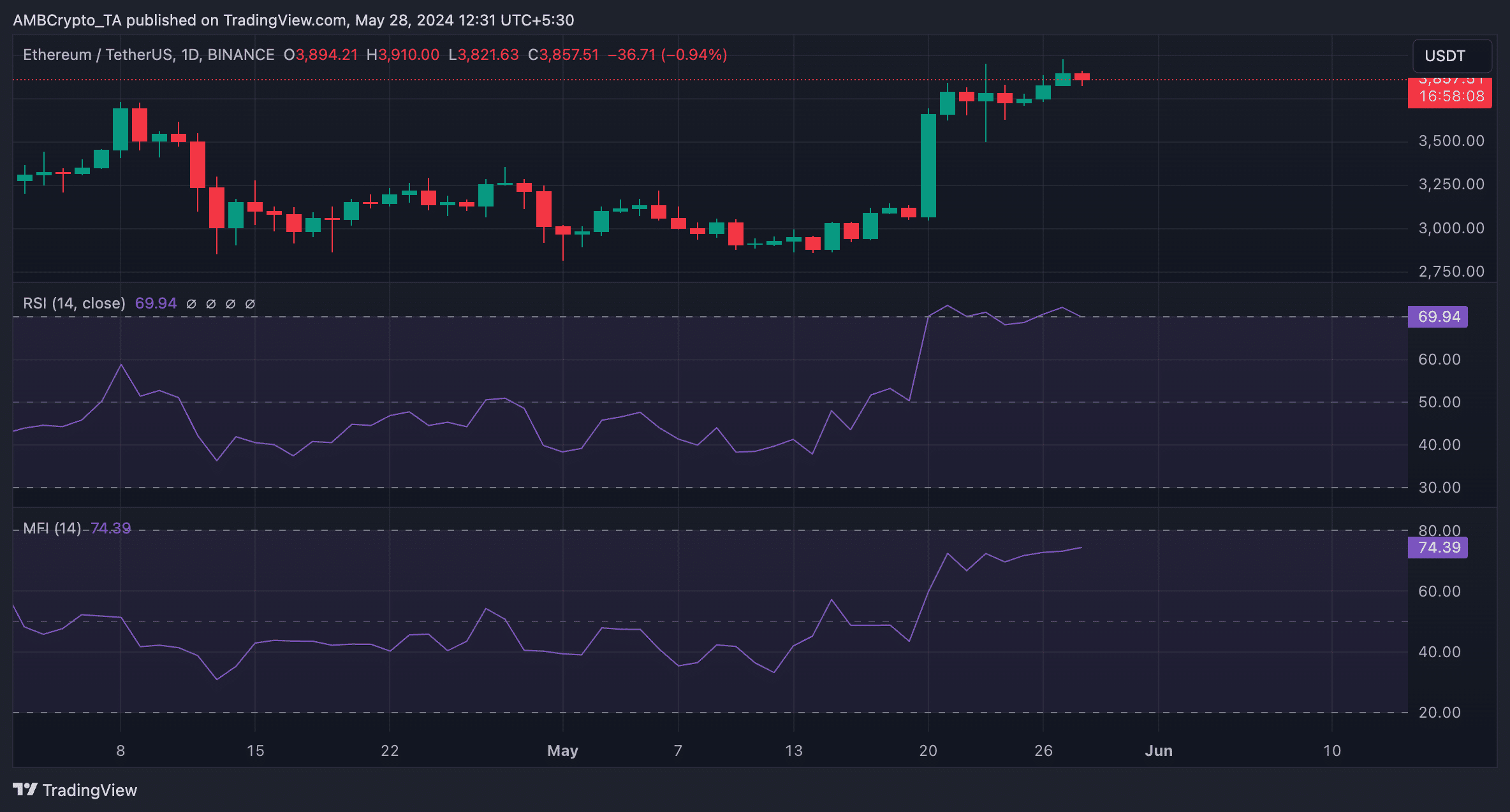

In response to CoinMarketCap’s information, ETH exchanged palms at $3,859 at press time.

As depicted by its rising key momentum indicators, ETH accumulation has considerably surged prior to now few days.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

At press time, ETH’s Relative Power Index (RSI) was 70.17, whereas its Cash Circulation Index (MFI) was 74.41.

It’s key to notice that at these values, patrons’ exhaustion may set in because the market turns into overheated. Therefore, a possible minor value correction is likely to be on the horizon.