- Bitcoin may doubtlessly attain $79,000 if present market circumstances persist.

- Technical evaluation and buying and selling patterns recommend an imminent vital value motion for Bitcoin.

Bitcoin [BTC] stays on the forefront of many discussions and analyses. At the moment, the premier cryptocurrency is buying and selling simply above the $69,000 mark, a slight rise from latest fluctuations, and has reached a 24-hour peak of $69,133.

Regardless of this upward development, Bitcoin has not but managed to surpass its March peak of over $73,000. Over the previous week, the foreign money has seen a modest improve of 0.7%, with a extra noticeable rise of two% within the final 24 hours.

Bitcoin to $79k?

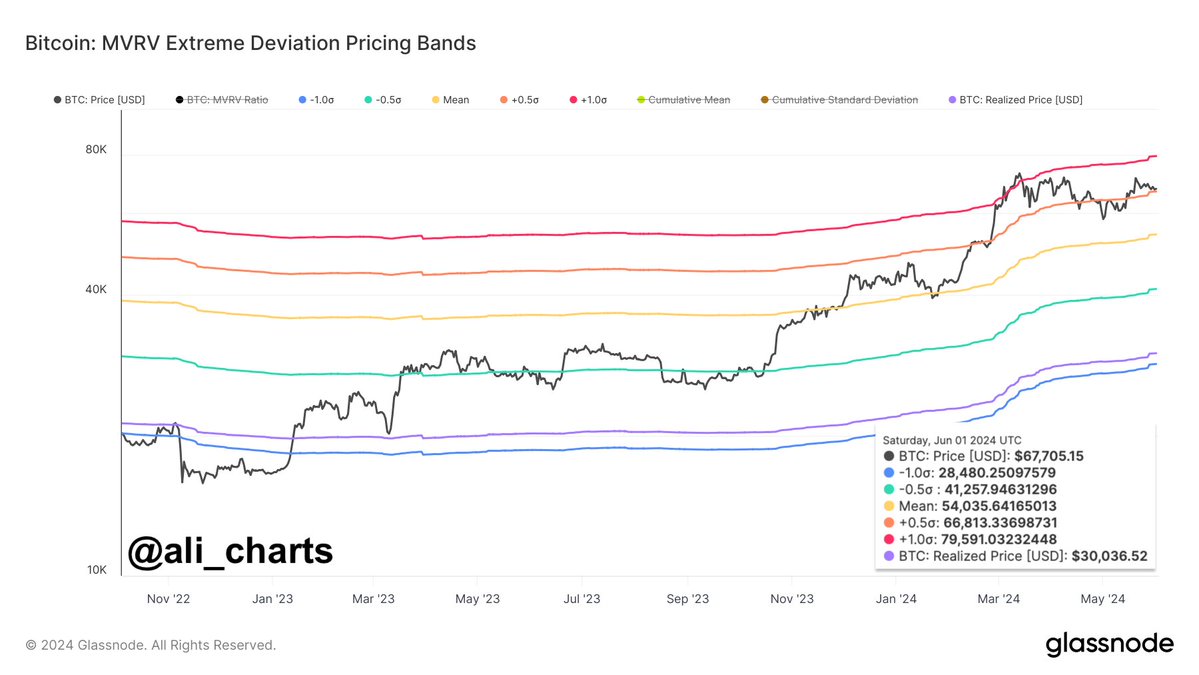

Famend crypto analyst Ali Martinez brings a contemporary perspective to Bitcoin’s future along with his newest technical evaluation.

Using the MVRV Excessive Deviation Pricing band chart, Martinez factors out that BTC is close to the +0.5 Commonplace Deviation (σ) pricing band at $66,800.

This positioning suggests a possible rise to the 1.0σ pricing band, which may see Bitcoin escalating to round $79,600. His evaluation hinges on Bitcoin’s means to take care of its present stage, setting the stage for a doable vital improve.

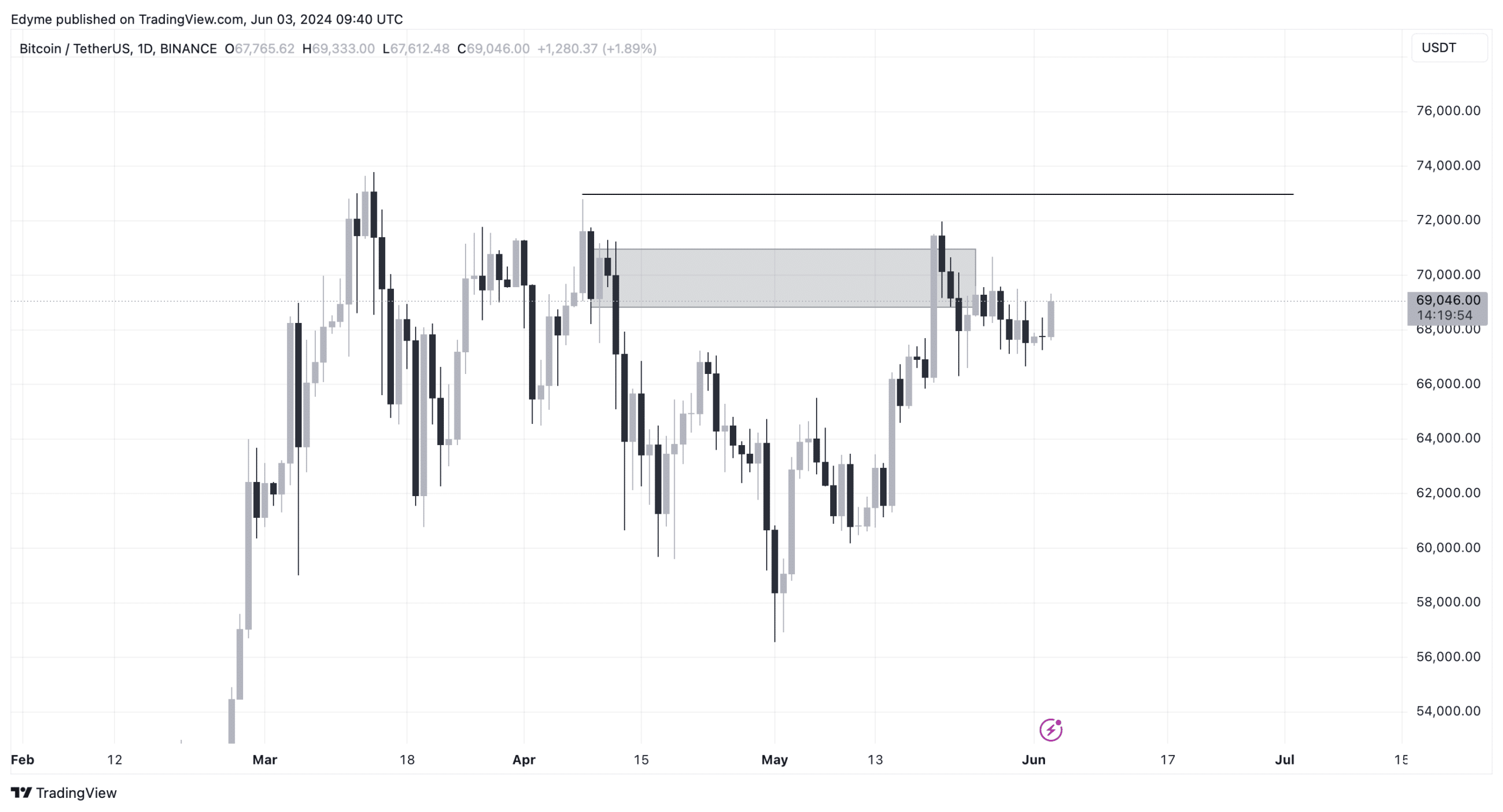

Echoing Martinez’s optimistic outlook, one other outstanding determine within the crypto buying and selling group, MMCrypto, has taken to X to voice his predictions.

He posits that BTC may both climb to $74,000 or drop to $62,200, depending on market actions within the coming days.

His predictions are accompanied by a chart illustrating a pivotal triangle sample. In keeping with MMCrypto, this sample is because of resolve inside 48 hours, suggesting imminent vital value motion.

Bitcoin’s future outlook

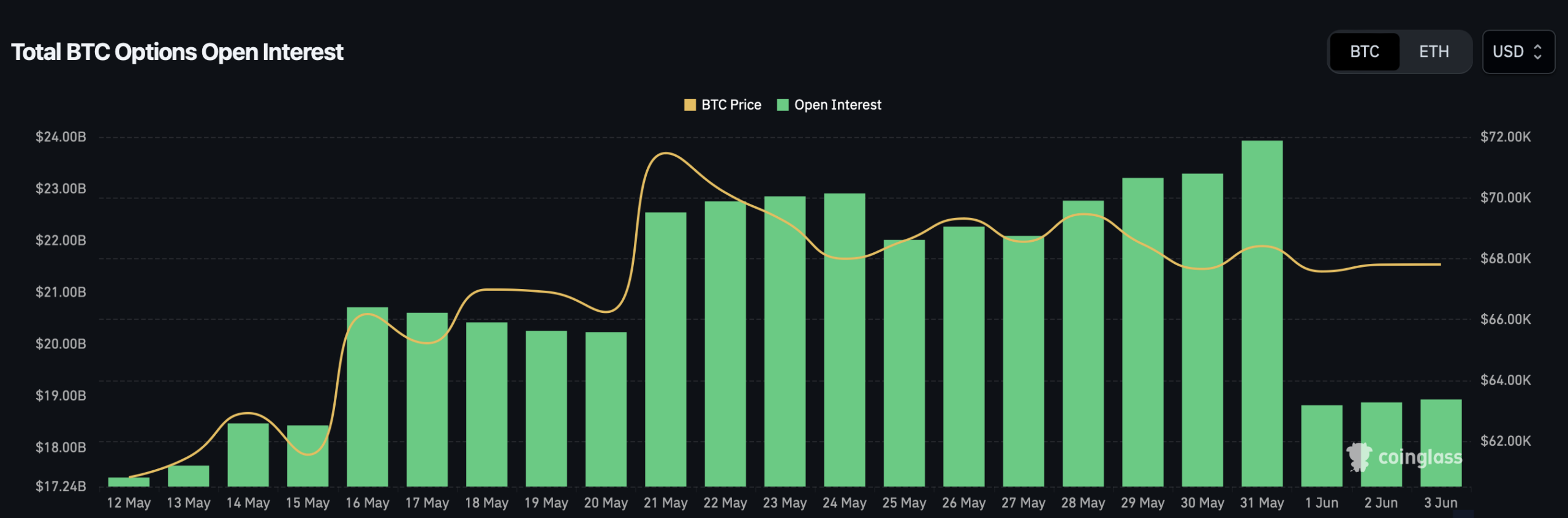

Present market data from Coinglass reveals a lower in open curiosity in Bitcoin, dropping from $22 billion in late Might to $18 billion at press time.

This discount in open curiosity, which measures the overall variety of unsettled contracts, could possibly be a precursor to market stabilization or a shift in dealer sentiment.

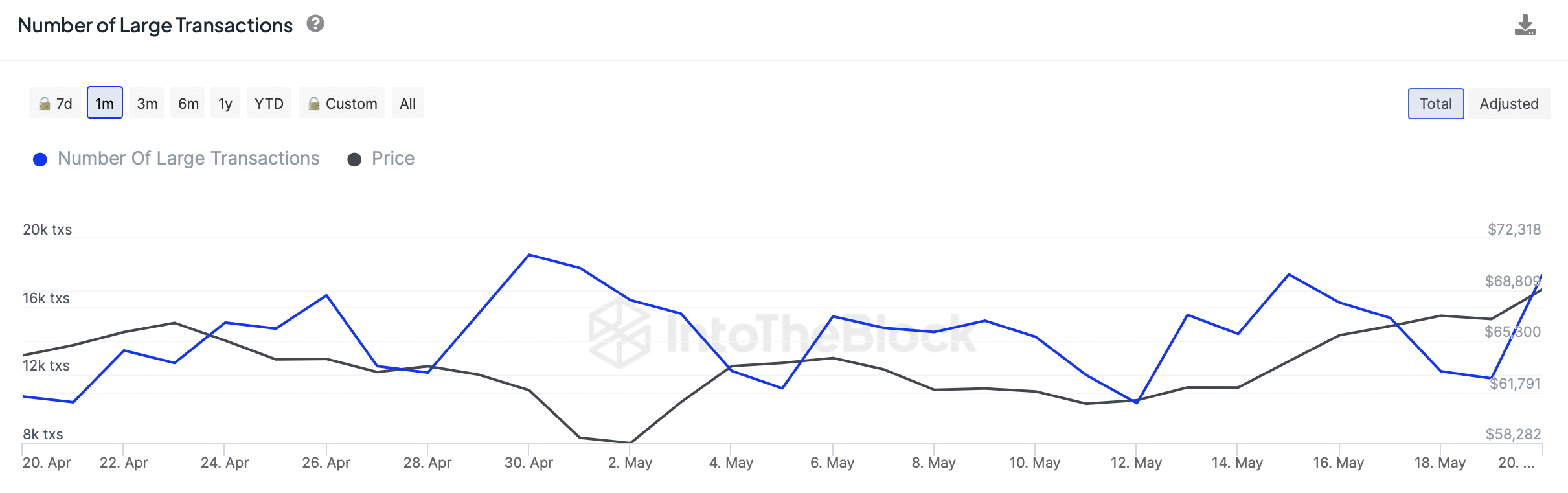

Furthermore, data from IntoTheBlock signifies a rise within the variety of giant Bitcoin transactions, hinting at potential upward momentum as substantial market gamers presumably gear up for extra substantial strikes.

Technical evaluation of BTC’s every day chart reveals that the asset has not too long ago encountered a significant provide zone after breaking downward buildings.

This encounter at a important resistance stage could dictate Bitcoin’s short-term value trajectory. If Bitcoin can breach the $72,000 mark, surpassing the earlier decrease excessive, it may invalidate bearish forecasts and sign a robust bullish development.

Is your portfolio inexperienced? Test the Bitcoin Profit Calculator

In keeping with a latest report by AMBCrypto, which references CryptoQuant analyst XBTManager, BTC is presently consolidating energy in anticipation of an upcoming surge.

The analyst predicts a steep ascent in Bitcoin’s worth, much like patterns noticed within the third and fourth quarters.