- Bitcoin’s value was about to achieve an important help degree.

- Most metrics hinted at a value improve quickly.

Bitcoin [BTC] witnessed a value correction within the final 24 hours. A significant cause behind this may very well be the rise in liquidation.

Nonetheless, BTC was approaching an important help degree from which it may make a development reversal within the coming days or perhaps weeks.

Why Bitcoin is down

CoinMarketCap’s data revealed that BTC was down by greater than 3% within the final 24 hours. On the time of writing, BTC was buying and selling at $60,862.71 with a market capitalization of over $1.2 trillion.

Ali, a preferred crypto analyst, lately posted a tweet revealing a attainable cause behind this downtrend. As per the tweet, BTC’s liquidation rose sharply close to the $61,490 mark.

At any time when liquidation rises, it will increase the possibilities of a value correction. Due to this fact, traders might need chosen to exit their positions after hitting that degree.

This latest value decline has pushed BTC down in the direction of a essential help degree.

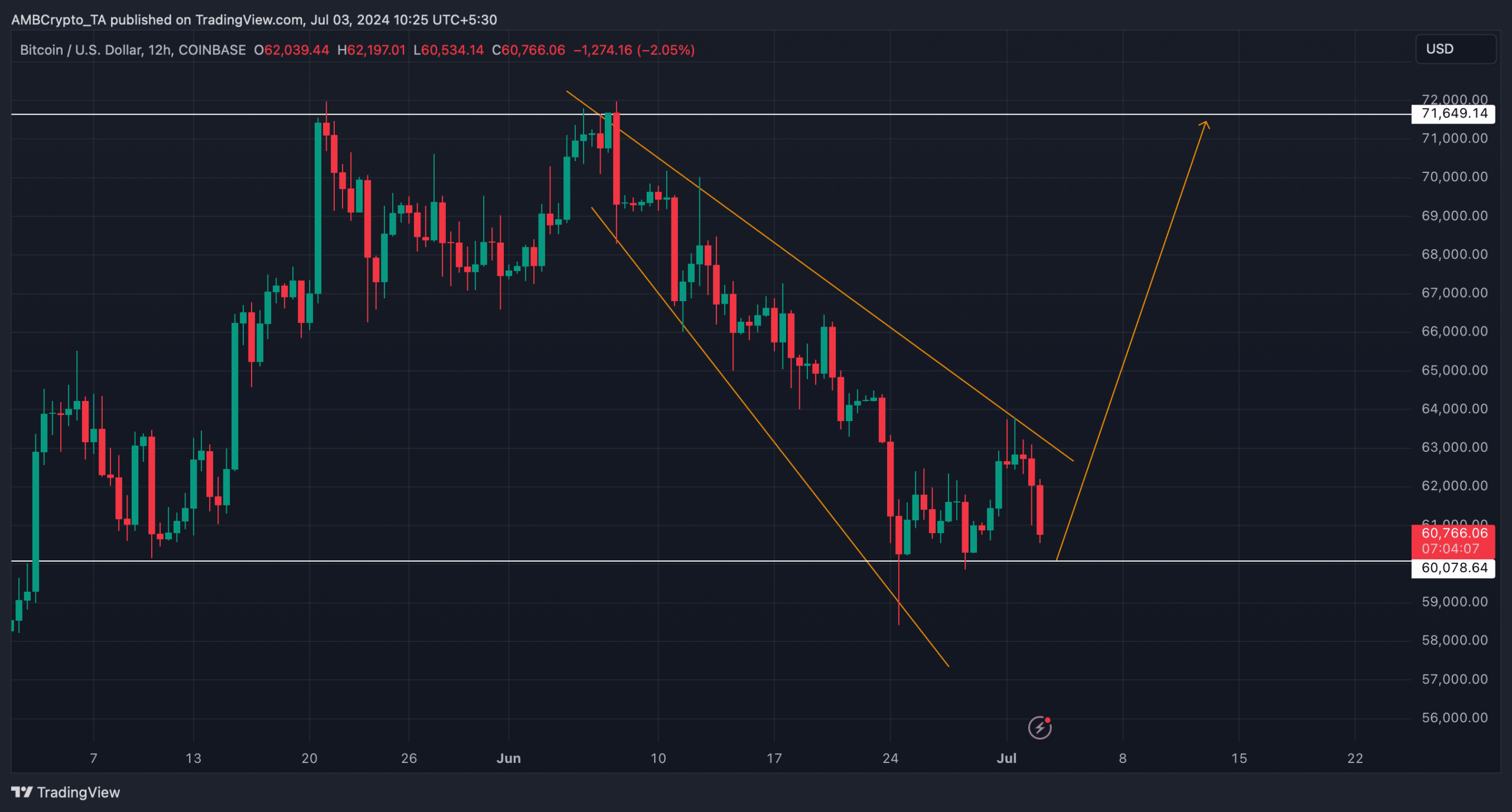

AMBCrypto’s evaluation of the coin’s every day chart revealed a widening, falling wedge sample. If the downturn continues, then traders may witness BTC dropping to $60,078.

At that time, BTC would have an opportunity to rebound. If that occurs, then the king of cryptos’ value may achieve bullish momentum and attain $71k within the coming weeks or months.

Will BTC rebound quickly?

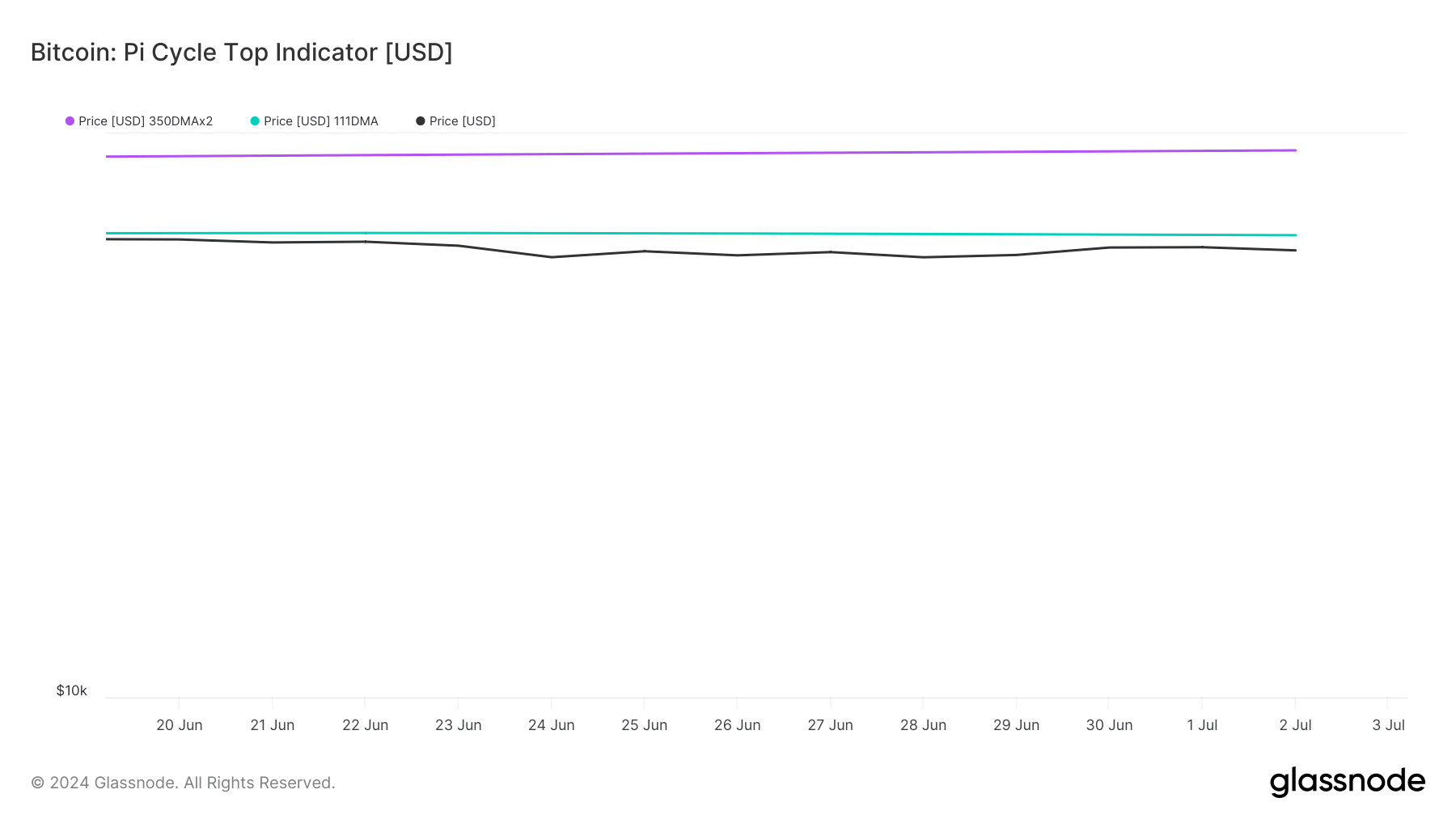

AMBCrypto then deliberate to try the king coin’s on-chain knowledge to see whether or not the coin was prepared for a rebound. Our evaluation of Glassnode’s knowledge revealed a bullish metric.

Notably, BTC’s Pi Cycle High indicators identified that BTC’s value was buying and selling beneath its attainable market backside. If that’s true, then BTC may flip bullish quickly.

For the uninitiated, the Pi Cycle indicator consists of the 111-day shifting common (111SMA) and a 2-times a number of of the 350-day shifting common (350 SMA x 2) of Bitcoin’s value.

In reality, as per CryptoQuant’s data, BTC’s web deposit on exchanges was low in comparison with the final seven days’ common. This clearly meant that promoting strain on BTC was low, which often ends in value upticks.

BTC’s Binary CDD was additionally within the inexperienced, that means that long-term holders’ actions within the final seven days have been decrease than common. They’ve a motive to carry their cash.

Issues within the derivatives market additionally seemed good, as BTC’s Funding Price was rising.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

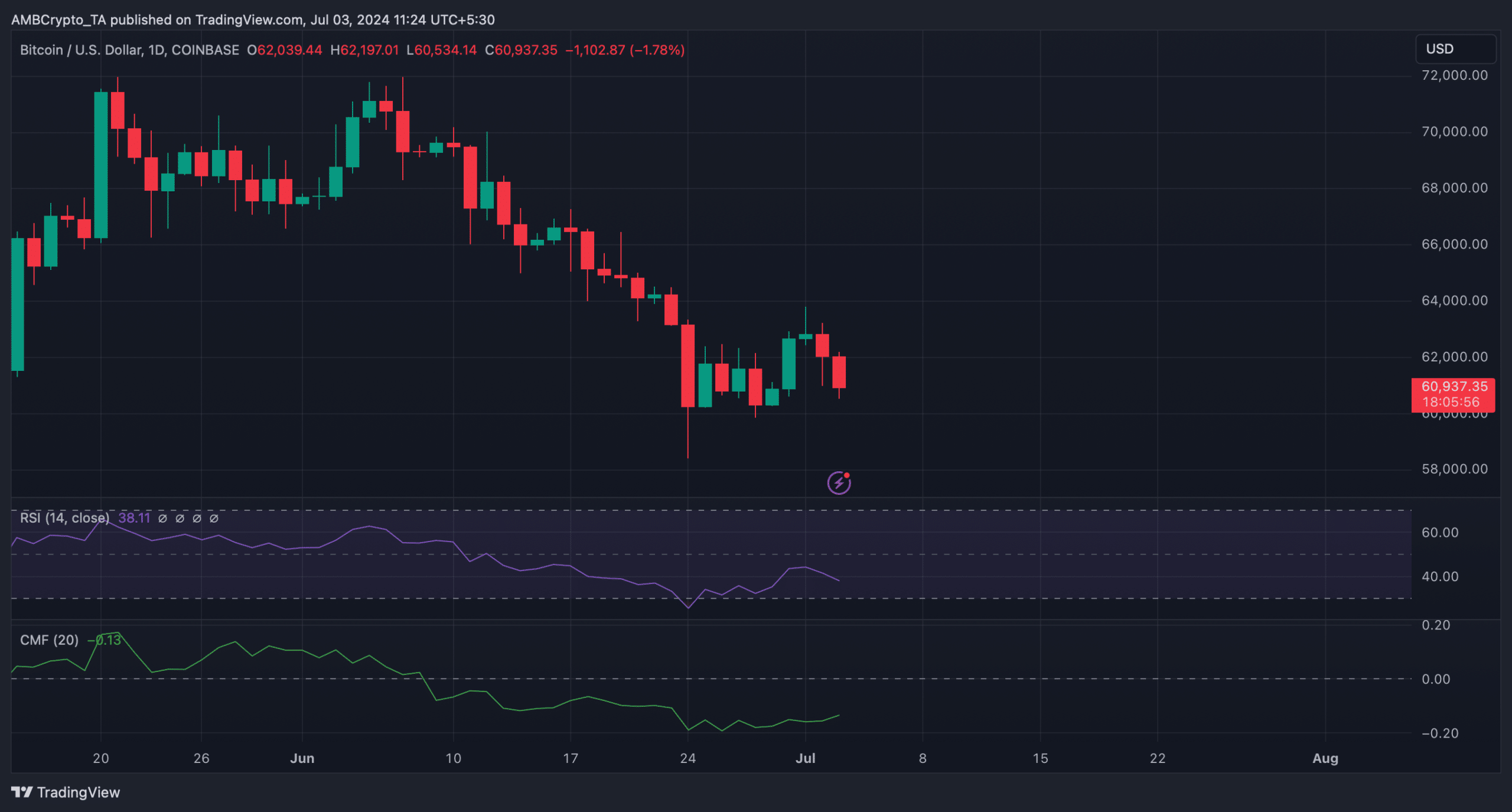

The Chaikin Cash Stream (CMF) additionally registered a slight uptick, which steered that the possibilities of a value improve have been excessive.

Nonetheless, the Relative Power Index (RSI) supported the bears because it plummeted sharply at press time.