- There was a constructive transfer within the conventional market on fifteenth July.

- Crypto shares had a extra constructive begin to the week.

Crypto shares have skilled a big rise within the final 24 hours, reflecting comparable positive factors seen throughout Bitcoin [BTC] and different cryptocurrencies. This surge in crypto-related shares is notably linked to the current assassination try on Donald Trump, a presidential candidate perceived to be favorable in direction of cryptocurrencies.

Good day for crypto shares?

The inventory market has lately demonstrated sturdy performances from crypto-related shares, signaling a sturdy outing for the sector. Firms reminiscent of Riot Platforms, Coinbase, and MicroStrategy all concluded the final buying and selling session with double-digit positive factors.

Such sturdy performances from these firms, that are closely intertwined with cryptocurrency markets, underscore digital currencies’ rising affect and integration in mainstream monetary portfolios.

How key crypto shares trended

The current efficiency of MicroStrategy’s (MSTR) shares has been notably sturdy, beginning the week with a big surge. On fifteenth July, the inventory opened at roughly $1,515 and closed at round $1,611, marking a formidable achieve of over 15%.

As the most important company holder of Bitcoin, MicroStrategy’s inventory has elevated by greater than 150% this 12 months, reflecting the strong well being of its funding technique amid a good crypto market surroundings.

Equally, Coinbase (COIN) additionally exhibited sturdy efficiency, with its inventory worth growing by 11.42% on fifteenth July. The inventory moved from round $229 to over $242 by the shut of buying and selling.

Notably, Bitcoin transactions accounted for 33% of the buying and selling quantity on Coinbase within the first quarter, whereas Ethereum transactions made up 13%.

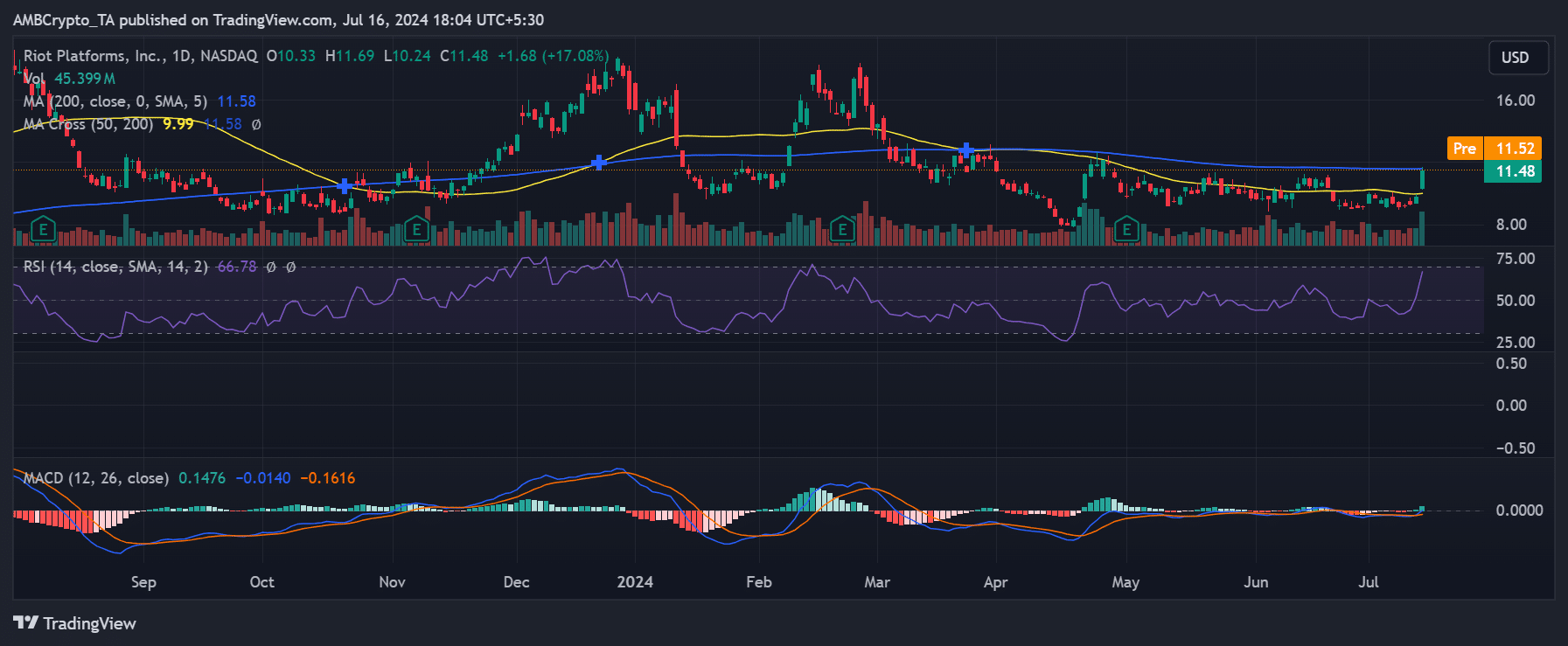

Moreover, Riot Platforms, a Bitcoin mining firm, additionally noticed a notable surge in its inventory. The inventory worth elevated by over 17%, from roughly $10.3 to over $11.4.

The rise in Bitcoin costs usually advantages mining operations like Riot Platforms, because it will increase the worth of the Bitcoin they mine, enhancing the general profitability of their operations.

Bitcoin strikes the remainder of the market

Evaluation of Bitcoin on a day by day timeframe revealed a big uptick in worth on fifteenth July. The cryptocurrency’s worth elevated by 6.49%, rising from roughly $60,804 to $64,747.

This marks a return to cost ranges not seen since twenty second June, when BTC was buying and selling at round $64,235.

The present studying on BTC’s Relative Power Index (RSI) additionally trended above the impartial line, indicating a powerful bullish momentum.

An RSI worth above the impartial 50 usually suggests that purchasing strain has surpassed promoting strain, supporting a bullish pattern available in the market.