- ETH ETF’s first-day outcomes outperformed analysts’ estimates of 15-15% of BTC ETFs.

- BlackRock’s ETHA led the best way, however Grayscale bled out practically a half-billion in outflows.

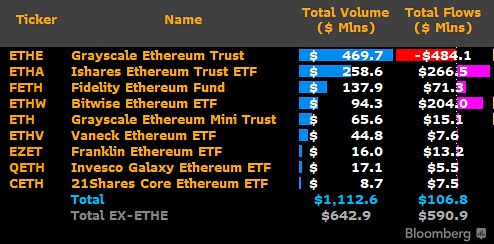

U.S. spot Ethereum [ETH] ETFs had a outstanding debut, clocking over $1 billion in buying and selling volumes. Grayscale’s ETHE, alongside BlackRock and Constancy ETH ETFs, noticed over $100 million in day 1 buying and selling volumes.

The remaining, together with Vaneck, Franklin and Invesco Galaxy, noticed their ETFs hit each day buying and selling quantity above $10 million other than 21Shares.

From a circulate perspective, Bloomberg data revealed that the merchandise logged $107 million in web inflows, led by $266.5 million from BlackRock’s ETHA and $204 million from Bitwise’s ETHW.

Nonetheless, Grayscale’s ETHE was the one one with outflows totaling $484.1 million, whereas its mini model recorded a $15.1 million influx.

ETH ETF first day outcomes beats analysts’ estimates

Regardless of Grayscale’s outflows, the above +$1 billion in buying and selling quantity and over $100 million in web flows beat analysts’ estimates.

Bloomberg analyst Eric Balchunas had earlier projected that the merchandise would outperform their ‘20% of BTC ETF’ estimates if BlockRock crossed $200 million in quantity.

“Utilizing BlackRock’s ETF as a proxy, $ETHA quantity after first hour will probably be round $50m. If it might go $200m by EOD, it is going to be outperforming our ‘20% of BTC’ estimate (given $IBIT did $1b first day).”

Curiously, ETHA hit $258 million in quantity by the top of Tuesday’s buying and selling session. That interprets to about 26% of BlackRock’s IBIT first-day quantity, beating the estimates.

Commenting on the stellar outcomes, Zaheer Ebtikar of crypto hedge fund Break up Capital additionally reiterated that the day 1 outcomes outperformed analysts’ estimates.

“Last figures on our finish displaying about $1.3 billion in complete quantity throughout ETH ETFs. Roughly 28% of BTC’s debut and considerably greater than most estimates between 15-20%.”

In reality, some merchandise like Vaneck Ethereum ETF (ETHV) eclipsed its BTC ETF based mostly on day 1 efficiency. Reacting to the explosive outcomes, VanEck’s head of digital asset analysis, Mathew Sigel, mentioned he was ‘proud’ of the fete.

“And proud that $45M of $ETHV traded, beating our day 1 $HODL volumes of $26M!”

Nonetheless, Grayscale’s ETHE’s outflow fears appear warranted after a $484.1 million outflow on the primary day. This was approach better than the GBTC’s $95.1 million outflow throughout its debut on eleventh January.

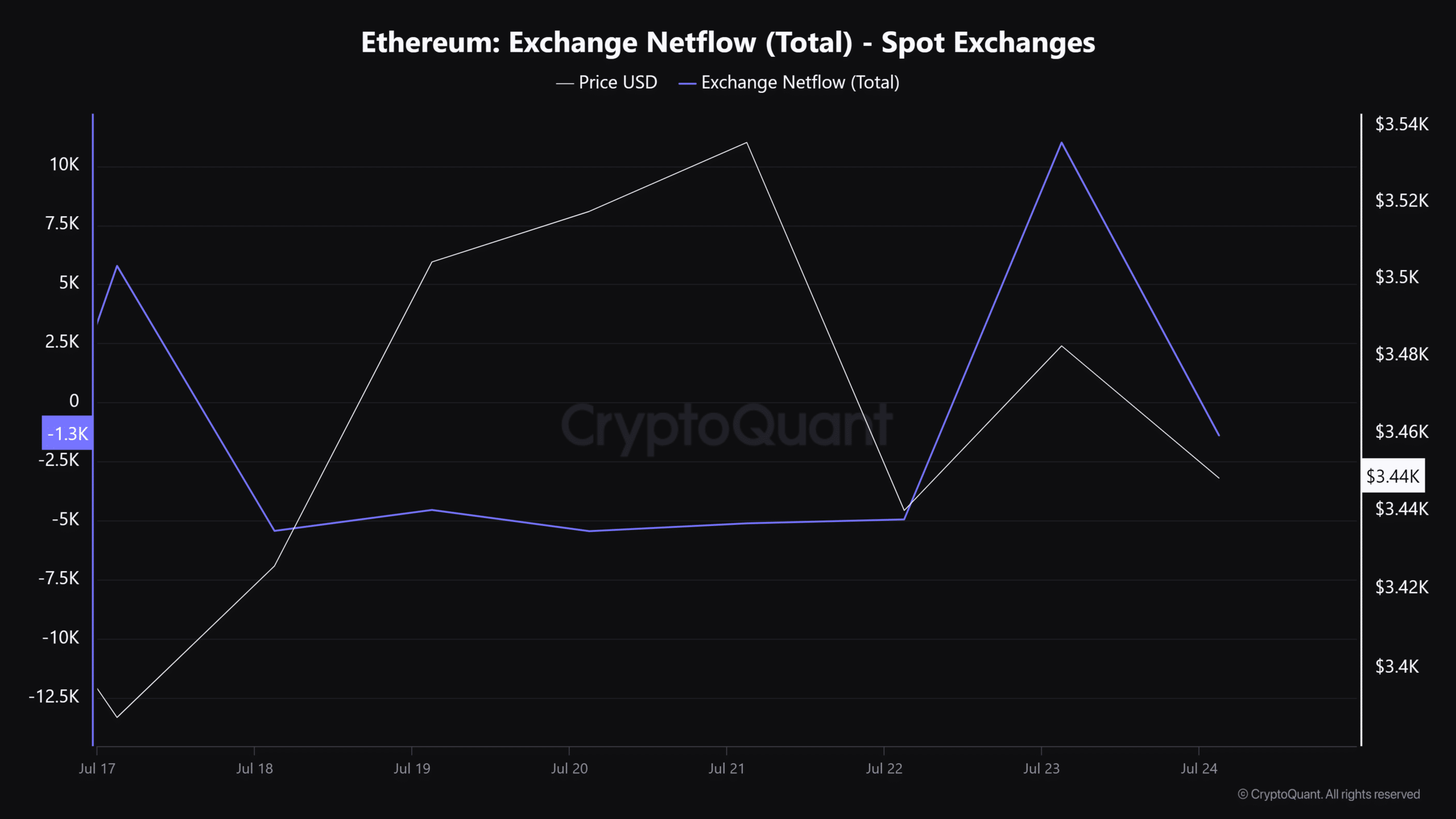

In the meantime, the ETH worth rose negligibly on the ETF debut day. It rose 1.25% and hit $3.54k however declined barely beneath $3.5k as of press time.

Nonetheless, the ETH spot market had no important promote strain after the ETF debut, as denoted by a drop in Trade Netflow.

This meant extra ETH was moved from exchanges than in, underscoring elevated accumulation of ETH despatched to private wallets.