- BTC’s market construction confirmed indicators of a possible shift for the higher.

- Customers who opted for the BTC holding technique hit new highs.

Bitcoin’s [BTC] downtrend and subsequent consolidation since peaking in March might finish quickly.

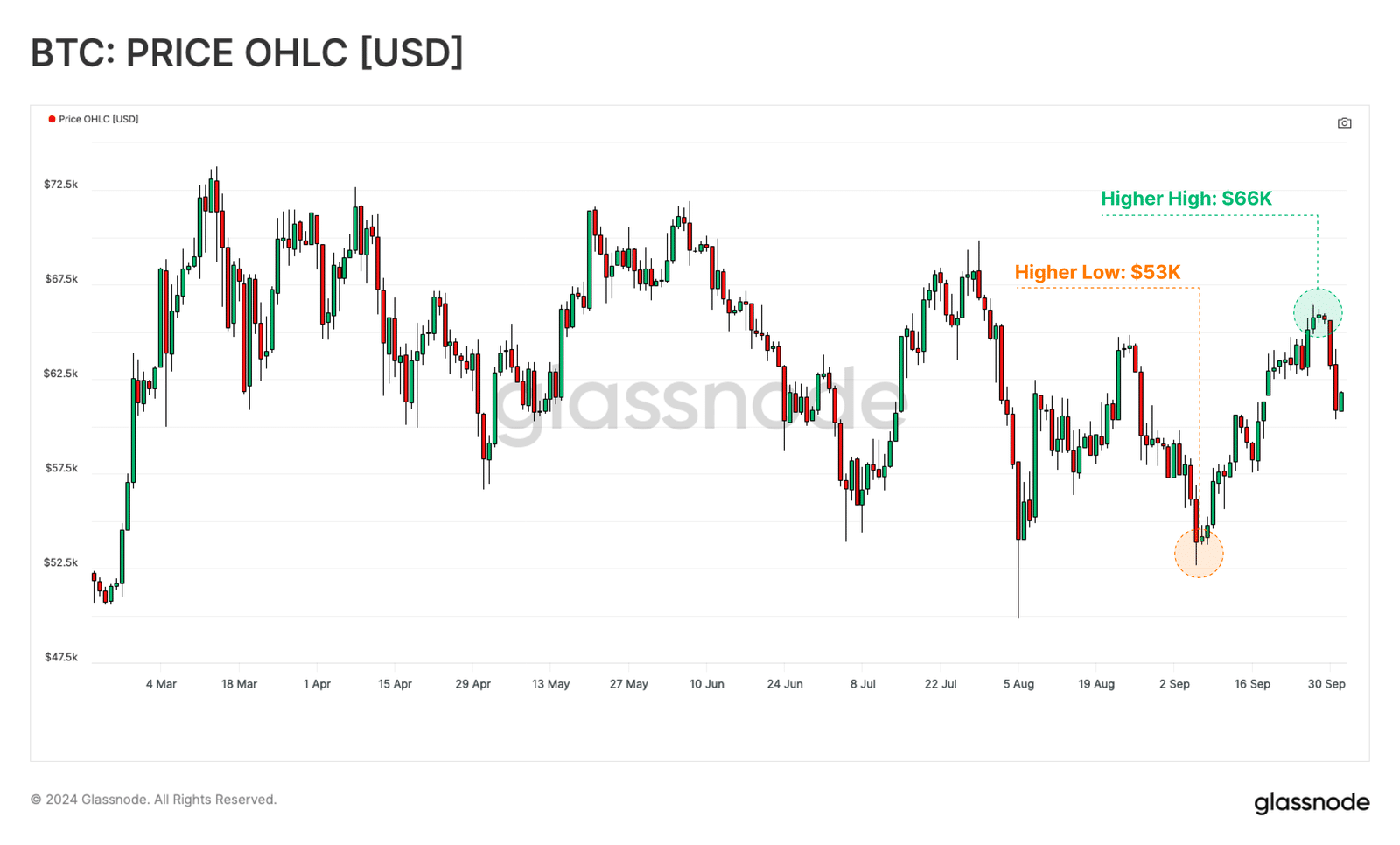

In line with blockchain analytic agency Glassnode, final week’s aid rally to $66K introduced a primary greater excessive since June.

Moreover, a few on-chain metrics additionally printed new highs. The analytics agency famous that these have been rising indicators of a market construction shift, which might mark the potential finish of the continued Bitcoin re-accumulation section seen since March.

“This value motion supplies the primary inclinations that the structured downtrend could also be approaching a section shift.”

Bitcoin cycle aligns with previous developments

Regardless of the extended consolidation, BTC was on the similar stage as in previous market cycles after cycle lows. It was up over 300% from its cycle lows, additional reinforcing that BTC value nonetheless had extra room for growth.

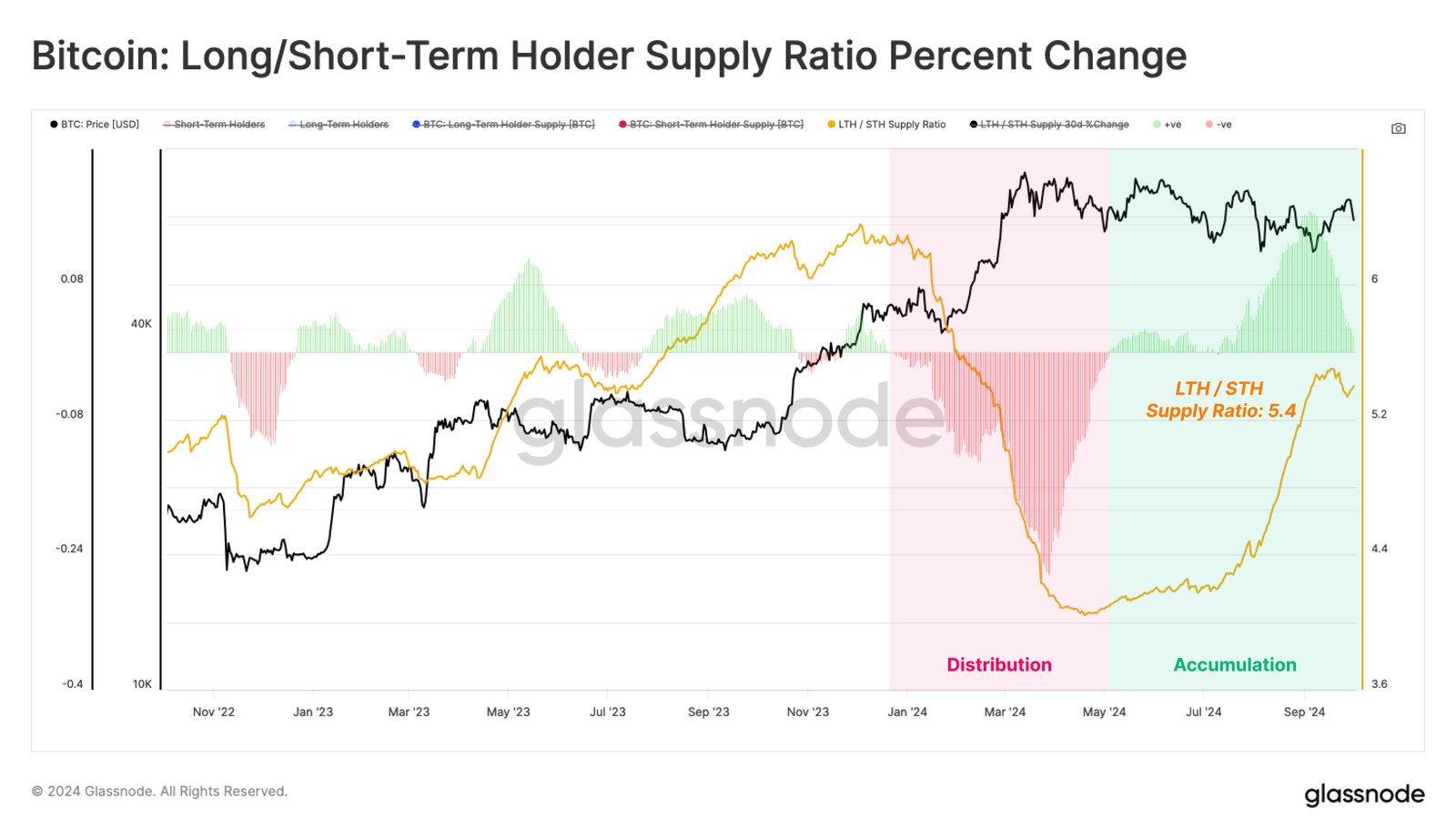

The bullish prospect was additionally illustrated by the rising variety of customers and whales adopting the BTC holding technique. Since Might, the Lengthy/Quick-Time period Holder Provide Ratio has elevated to five.4, underscoring that customers held moderately than bought their BTC.

“This means that HODLing persists because the dominant behaviour of Bitcoin traders.”

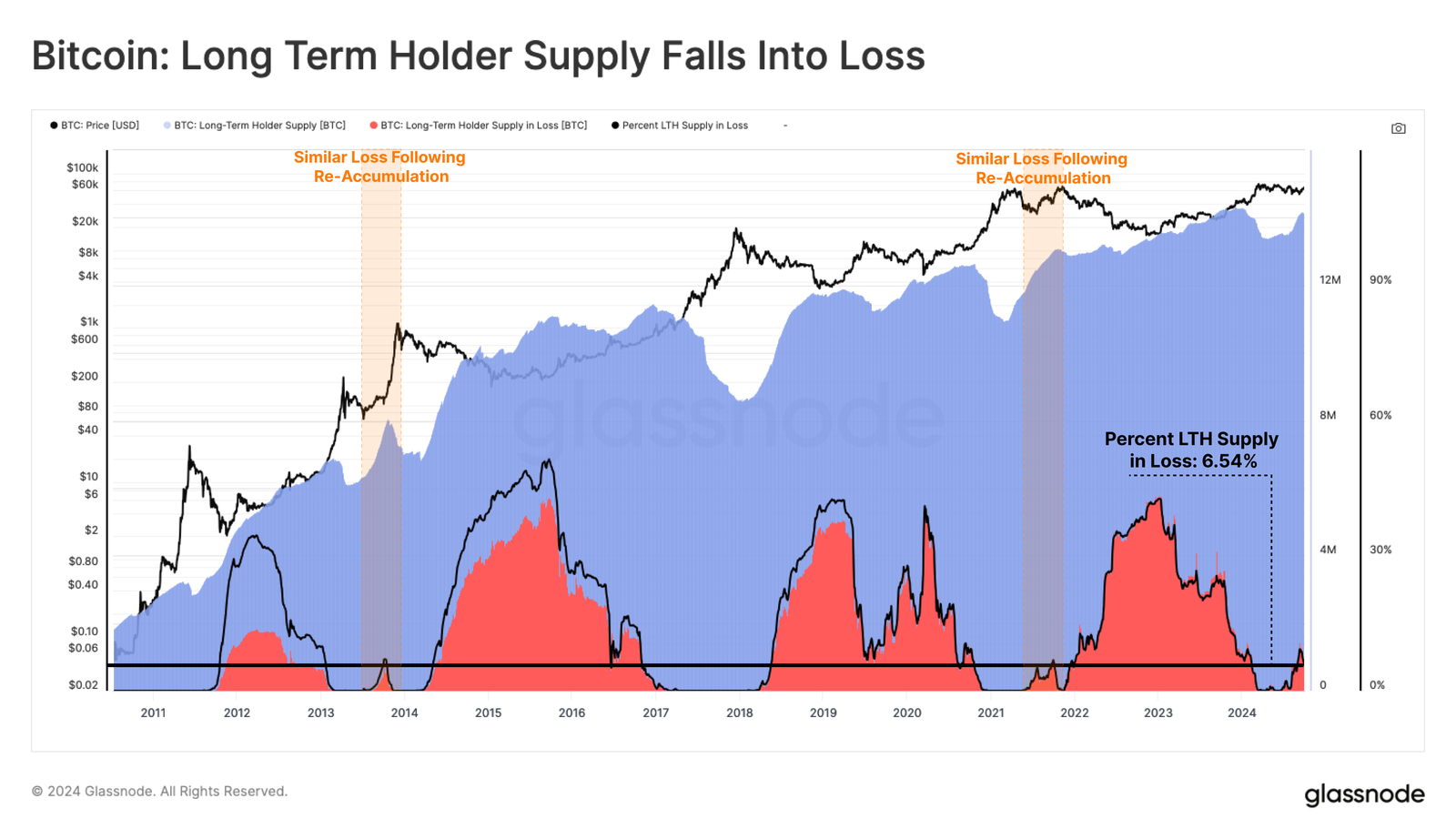

That being mentioned, about 6.5% of Lengthy-Time period Holders (LTH) have been in loss as of the first of October.

Nevertheless, Glassnode acknowledged that the unrealized losses throughout the LTH cohort have been comparatively small however have been per previous re-accumulation phases.

The analytics agency added that the latest aid rally boosted STH into income, a special situation from the previous couple of weeks.

Collectively, these strengthened the concept of a possible market construction shift to increase the re-accumulation interval.

Nevertheless, Peter Brandt believed the market construction shift might solely occur if BTC surged above $71K.

At press time, BTC weakly held the psychological stage of $60K after a latest sell-off.