- Bitcoin Spot ETFs noticed inflows price $253.54 million on 11 October, coinciding with a 3% value hike

- Ethereum Spot ETFs proceed to battle although, with cumulative damaging netflows of -$558.88 million

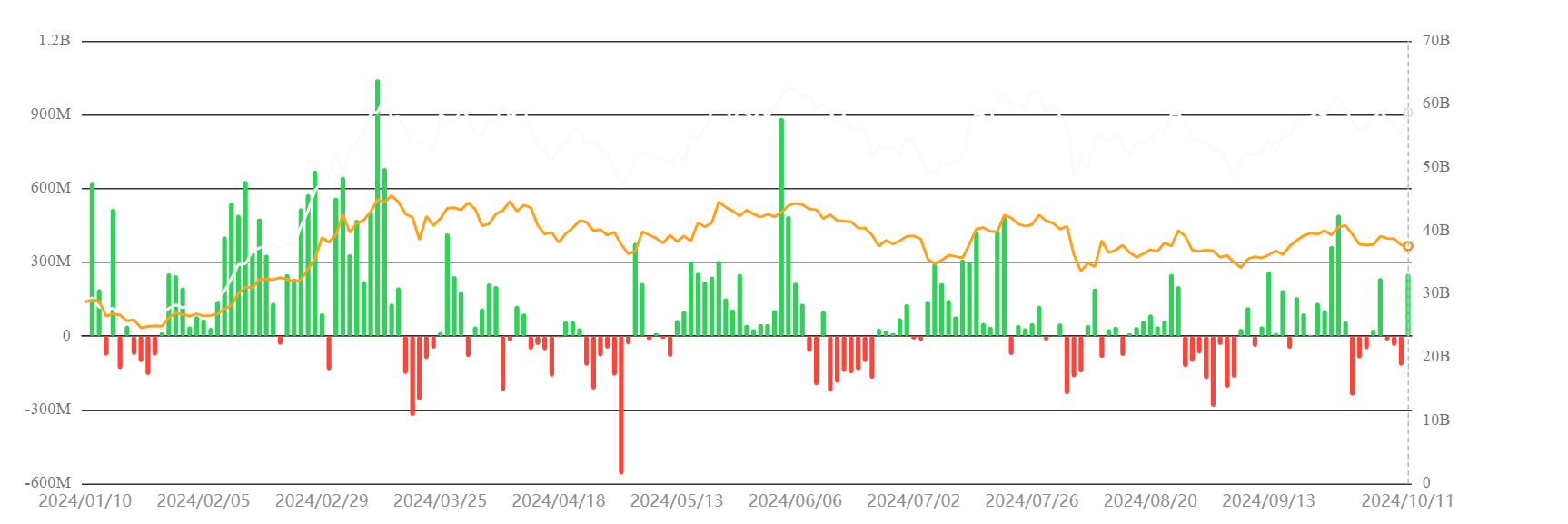

Bitcoin Spot ETFs ended the previous week with optimistic internet inflows, marking the second time throughout the week it noticed a hike. Whereas 4 main Bitcoin Spot ETFs contributed to those inflows, others noticed zero flows.

In the meantime, Ethereum spot ETFs have been persistently recording damaging netflows. By doing so, they’re falling behind Bitcoin when it comes to optimistic motion.

Bitcoin ETFs see optimistic inflows

In response to knowledge from SosoValue, Bitcoin ETFs recorded inflows of $253.54 million on 11 October. This was the second episode of influx for Bitcoin ETFs throughout the week, following three consecutive days of outflows.

Constancy, Ark 21 Shares, Bitwise, InvescoGalaxy, and VanEck have been accountable for the inflows among the many ETFs. Quite the opposite, BlackRock and several other different ETFs noticed no flows throughout this era.

If the aforementioned figures are damaged down, it may be seen that Constancy had the biggest inflows with $117 million, whereas Ark 21 Shares adopted carefully with $97.6 million. Bitwise contributed $38.8 million, with the remaining inflows distributed among the many different ETFs.

On the time of writing, the cumulative whole netflows for Bitcoin spot ETFs stood at $18.81 billion, with a complete internet asset worth of $58.66 billion.

Bitcoin’s value rally and ETF inflows align

The influx to Bitcoin spot ETFs coincided with optimistic value motion for BTC. Following a number of days of damaging flows and value declines, Bitcoin hiked by over 3% on 11 October, transferring from $60,279 to $62,518. This upward pattern continued on 12 October, with Bitcoin buying and selling at round $63,000, on the time of this writing.

If Bitcoin maintains its optimistic momentum via the weekend, extra ETF inflows might comply with within the coming week – An indication of rising investor curiosity.

Ethereum spot ETFs see damaging netflows

Quite the opposite, Ethereum spot ETFs have struggled to see the identical stage of optimistic inflows as Bitcoin ETFs. Whereas Ethereum noticed a small influx of $3.06 million on 11 October, seven out of the 9 Ethereum ETFs reported zero inflows, and the day before today noticed no inflows in any respect.

– Learn Bitcoin (BTC) Price Prediction 2024-25

The cumulative whole netflows for Ethereum Spot ETFs stays damaging at – $558.88 million, with a complete internet asset worth of $6.74 billion. Regardless of occasional inflows, Ethereum’s Spot ETF efficiency has lagged behind Bitcoin’s, underlining a more difficult market atmosphere for ETH buyers.