- BTC crossed $70K and hit a 4-month excessive, partly pushed by a liquidity seize.

- BTC was solely 3.5% away from its ATH, however there was a roadblock to clear.

Bitcoin [BTC] crossed the $70K psychological stage and surged to a four-month excessive of $71.5K. The upswing introduced its ‘Upbtober’ positive aspects to 11%, marking an efficient breakout from its multi-month consolidation vary since March.

Why is Bitcoin up?

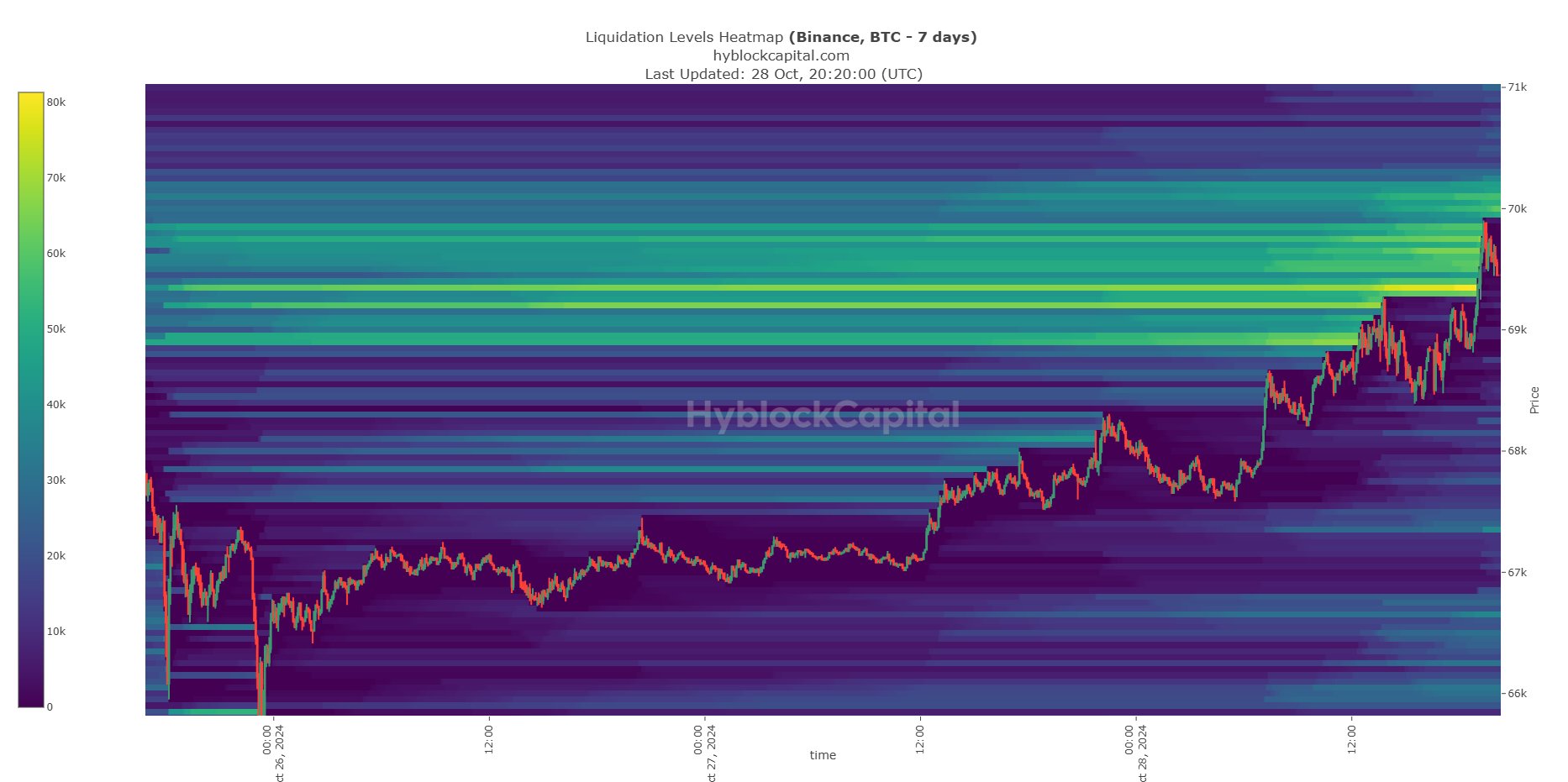

A liquidity seize drove a part of the pump above $70K. There have been appreciable liquidity clusters (brief positions) between $69.4K and $70K, as noted by BTC analyst and dealer CrypNeuvo.

For context, the value motion tends to observe these liquidation ranges (shiny yellow), influenced largely by market maker strikes. Therefore, the cluster at $ 70K acted as a magnet for the latest upswing, liquidating appreciable brief positions at $70K.

Over $80 million shorts rekt

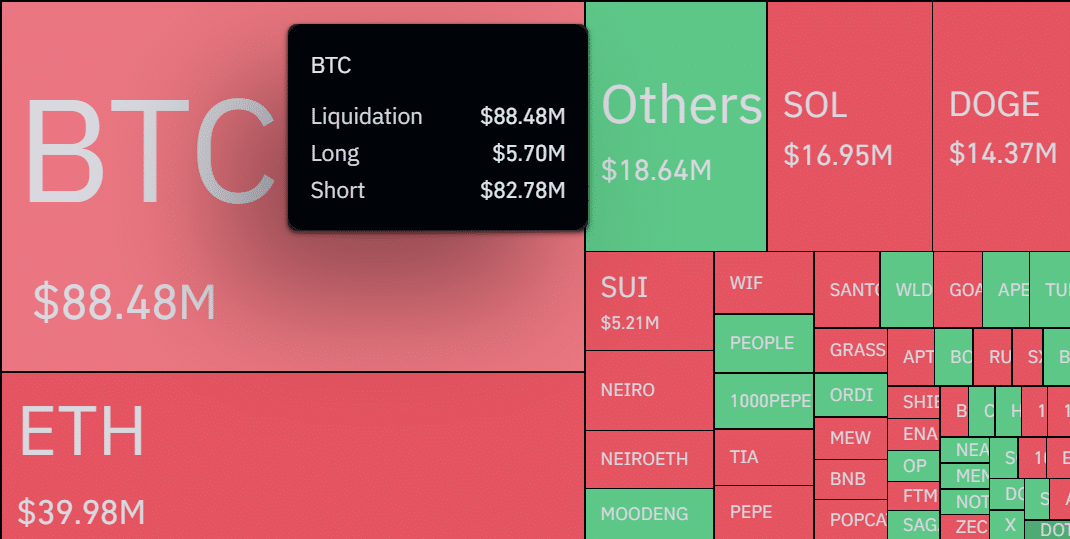

Based on Coinglass information, $88 million positions had been liquidated after BTC broke above the $70K psychological stage.

Speculators who positioned bets for doubtless worth rejection at $70K (brief positions) suffered probably the most, with practically $83 million in losses up to now 24 hours.

By extension, this additionally advised a robust bullish sentiment because the market awaits US election outcomes subsequent week.

With growing odds of Trump profitable the US elections per predictions websites, Bitfinex analysts believed that US elections could possibly be a ‘good storm for BTC.’ The analysts stated,

“The convergence of election uncertainty, the “Trump commerce” narrative, and favorable This fall seasonality create an ideal storm for Bitcoin, promising an thrilling interval forward no matter noisy worth actions heading into the election in two weeks’ time.”

Analyst Peter Brandt shared an identical projection and believed the transfer above $70K may begin the much-awaited post-halving parabolic rally.

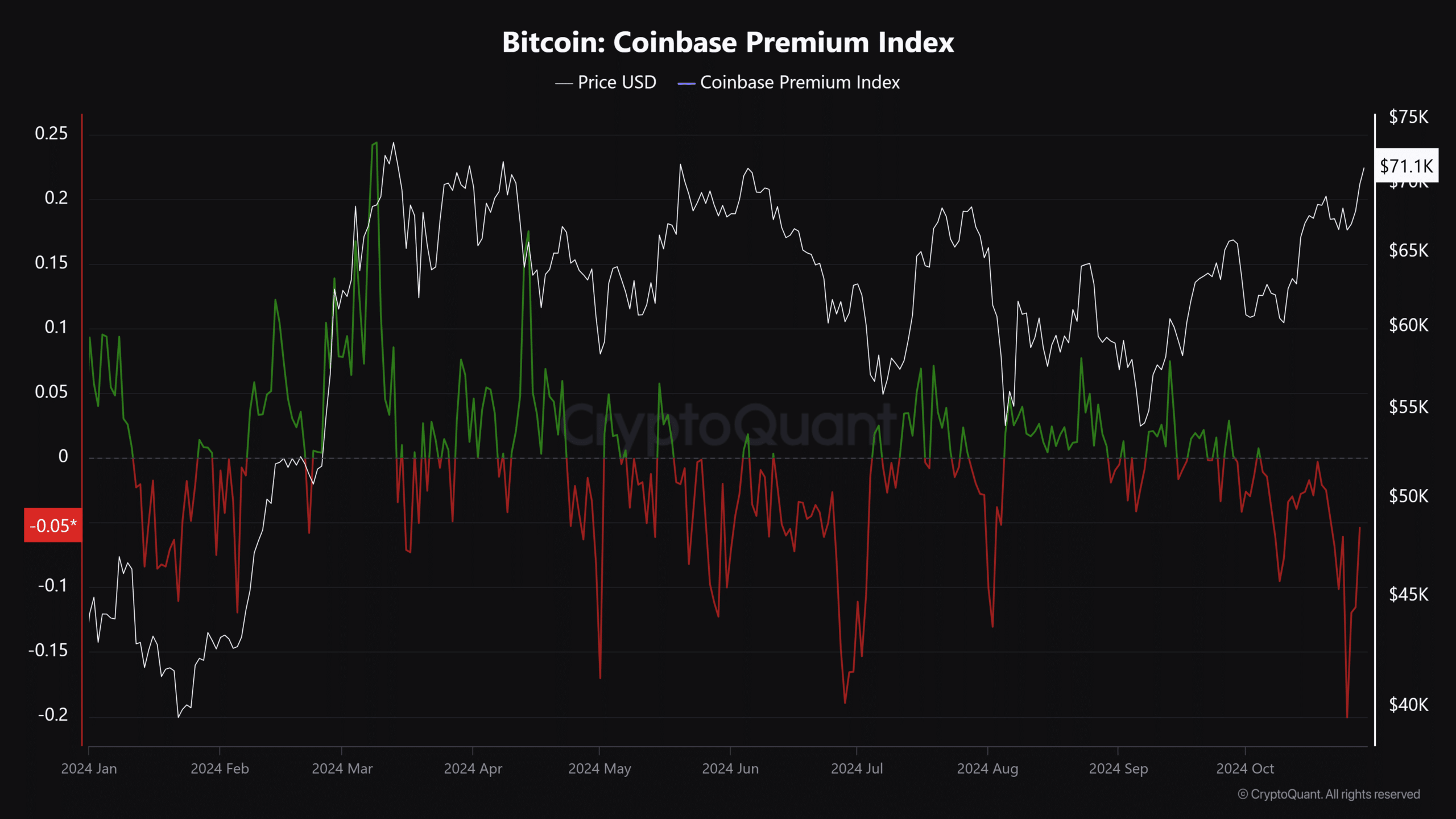

That stated, there was renewed demand from US traders as BTC soared, as famous by the reversal of the Coinbase Premium Index.

Normally, a robust US demand (inexperienced) all the time coincides with a sustainable restoration for BTC.

Whereas the latest enchancment was nice for BTC, the weak studying meant that investor curiosity was nonetheless comparatively low in comparison with March, when BTC hit a brand new all-time excessive.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

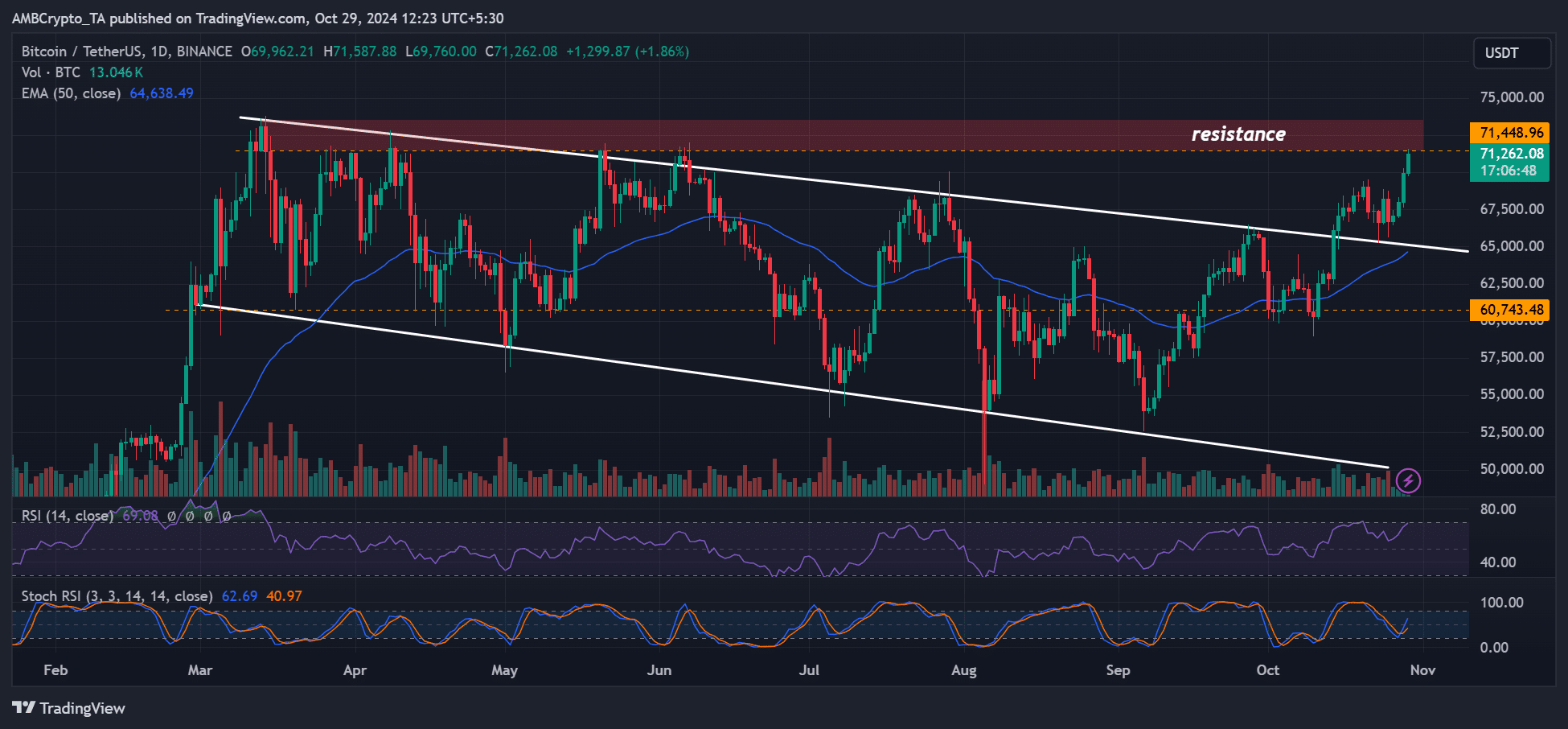

On the day by day worth chart, BTC was in a bullish market construction. It was solely 3.5% away from its ATH and will quickly hit worth discovery.

Nevertheless, it hit resistance, and a bearish order block (purple) fashioned at March’s ATH. For the uptrend to proceed within the brief time period, BTC needed to clear the $71K-$73K roadblock.