- Bitcoin’s whitepaper was launched by pseudonymous Satoshi Nakamoto in 2008

- Whitepaper has had a big impact on world economic system and facilitated a shift in paradigms

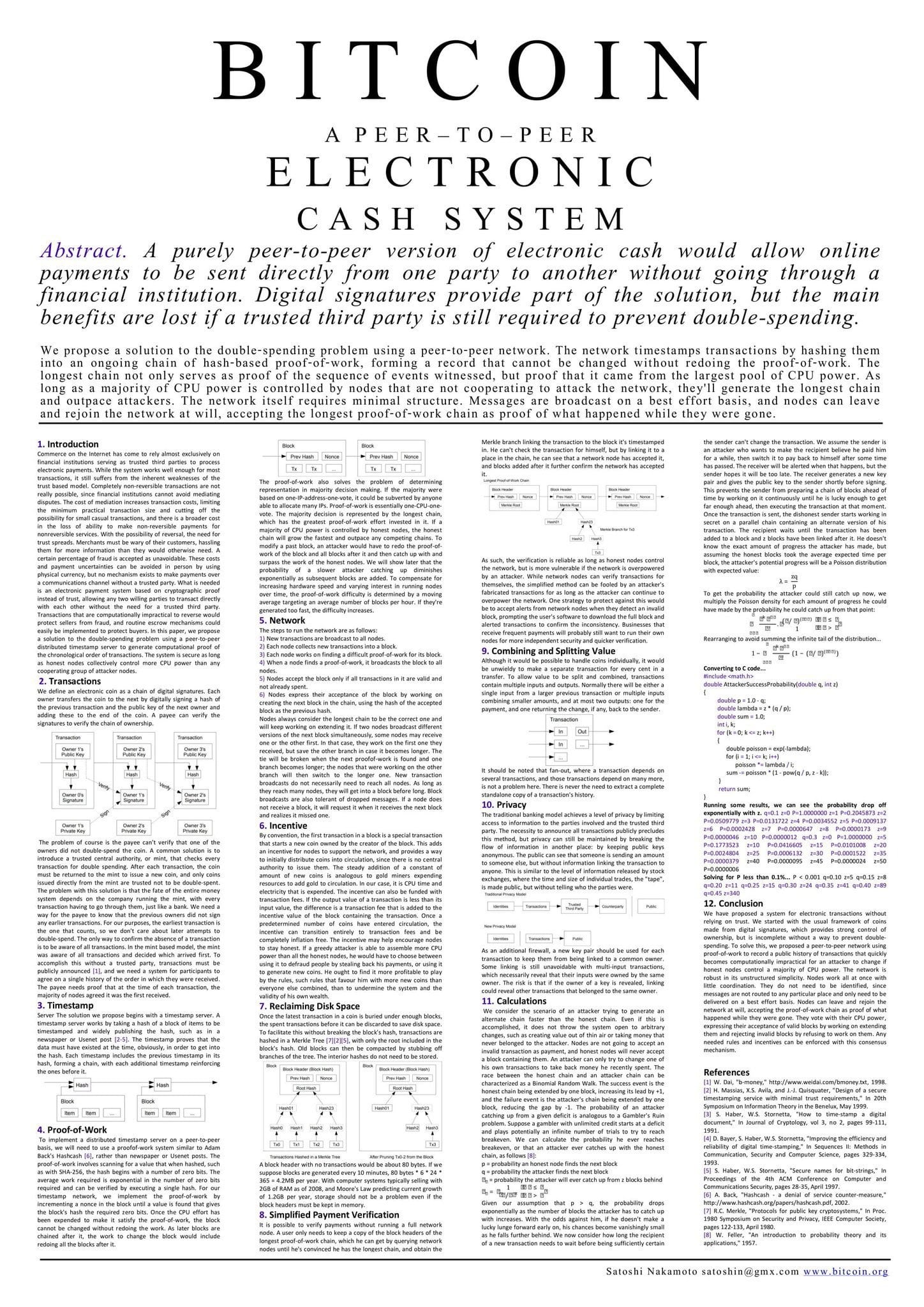

Sixteen years in the past, Bitcoin’s (BTC) whitepaper, printed by the pseudonymous creator Satoshi Nakamoto, launched the world to a revolutionary idea – A decentralized, peer-to-peer digital foreign money.

This groundbreaking doc laid the muse for blockchain expertise and sparked the creation of Bitcoin (BTC), the primary cryptocurrency.

Bitcoin’s whitepaper didn’t simply suggest a brand new kind of cash; it launched a imaginative and prescient of economic freedom, permitting individuals to manage their cash exterior conventional banking methods.

Privateness and possession

Since its inception, Bitcoin has reshaped the monetary panorama by selling privateness and possession.

In contrast to conventional banking the place establishments management funds, BTC has empowered people to personal and handle their property instantly, with out intermediaries.

This shift has pushed a monetary sovereignty revolution, inspiring individuals worldwide to discover the chances of decentralized cash.

The thought of self-custody and privateness resonated with customers, making a motion in direction of a extra clear and accessible monetary ecosystem.

Bitcoin laid the muse for crypto and DeFi

Past privateness, Bitcoin’s whitepaper laid the groundwork for your complete cryptocurrency ecosystem.

Bitcoin’s success inspired the event of over 20,000 cryptocurrencies, every exploring new purposes of blockchain expertise.

Bitcoin, typically referred to as “digital gold,” stays probably the most worthwhile crypto asset and has turn out to be an emblem of this digital financial shift. Its affect goes past finance, sparking industries centered on blockchain purposes, from decentralized finance (DeFi) to tokenized property.

Bitcoin’s affect additionally catalyzed the DeFi revolution, the place conventional monetary companies like lending, borrowing, and buying and selling happen with out intermediaries. Constructed on blockchain, DeFi has grown right into a multi-billion-dollar sector, attracting each particular person customers and main establishments. Main asset administration corporations like Franklin Templeton have even begun tokenizing property, additional bridging conventional finance with blockchain innovation.

DeFi’s enlargement displays Bitcoin’s core rules, providing a decentralized different to traditional finance and fostering broader financial participation.

The discharge of Bitcoin’s whitepaper not solely launched digital foreign money, but additionally initiated a shift in financial and monetary paradigms. As extra individuals undertake BTC and cryptocurrencies, monetary fashions are evolving to embrace digital property.

Bitcoin’s repute as a “retailer of worth” asset has continued to develop too, positioning it as a hedge in opposition to inflation and financial instability.

This angle has drawn important curiosity from establishments. Particularly since they view Bitcoin and different cryptocurrencies as important elements of recent funding portfolios.

Trying forward…

Going ahead, Bitcoin’s foundational position might drive additional transformations within the international monetary system.

Its whitepaper has established a legacy of decentralization, privateness, and monetary autonomy, inspiring new generations to reimagine financial buildings.

As blockchain expertise matures and integrates additional into on a regular basis finance, BTC might proceed shaping the way forward for digital cash and decentralized finance.

In essence, Bitcoin’s whitepaper laid the primary stone in a brand new financial path, with BTC on the forefront of a monetary revolution.