- Bitcoin shorts may contribute to larger costs in a brief squeeze situation

- At press time, bulls remained in management regardless of the current highs and rising expectations of draw back

AMBCrypto beforehand checked out the potential of lengthy liquidations if Bitcoin retraces after attaining it most-recent all-time excessive. Effectively, regardless of being overbought, promote stress remained weak throughout the board and at press time, BTC holders had been nonetheless going sturdy.

One of many essential the explanation why Bitcoin promote stress has not taken over is as a result of market confidence was nonetheless sturdy after the current prime. Heavy Bitcoin ETF inflows within the final 24 hours contributed to this. ETF flows have proved to be a comparatively correct measure of market confidence. The truth is, in response to Bloomberg’s Eric Balchunas,

“HOOVER CITY: Bitcoin ETFs took in a record-smashing $1.4b yesterday (the Trump impact). $IBIT alone was +$1.1b. That’s +$6.7b in previous mo and $25.5b YTD. All advised they feasted on about 18k btc in at some point (vs 450 mined) and are actually 93% of the way in which to passing Satoshi’s 1.1mil btc.”

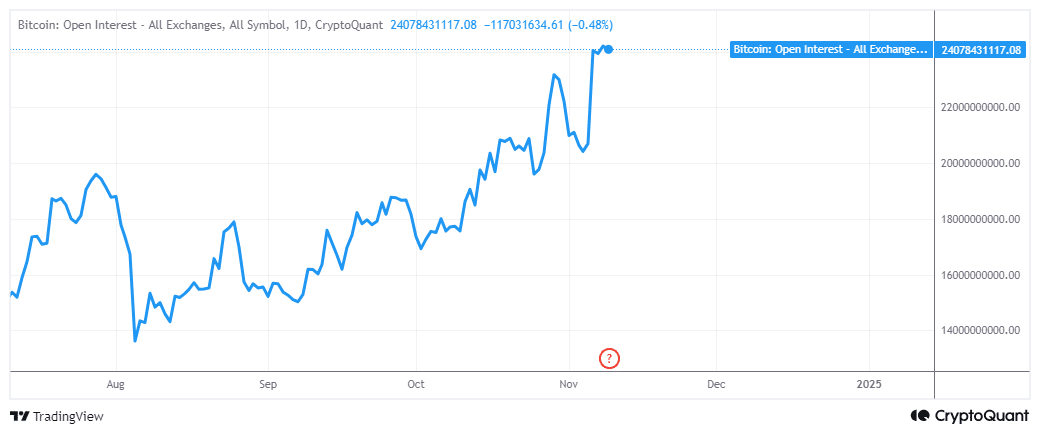

The surge in ETF inflows might push Bitcoin to higher highs. A current cryptoQuant analysis just lately appeared into the potential of such an end result forming a brief squeeze. In line with the evaluation, whereas the Open Curiosity was excessive, the funding charges had been unfavourable.

Destructive funding charges traditionally point out a shift in market sentiment, particularly, to a bearish outlook within the derivatives phase. This shift was supported by Coinglass’s BTC lengthy/brief ratio which revealed that shorts had been larger than longs during the last 3 days.

This surge in brief positions was doubtless as a result of derivatives merchants anticipated the earlier prime to behave as a resistance degree. Or not less than short-term revenue taking to set off one other pullback. Nonetheless, shorts can be liable to liquidations if the worth pushes up.

In the meantime, Bitcoin’s Open Curiosity seemed to be levelling out after attaining a brand new ATH. Figures for a similar peaked at $24.19 billion on 8 November.

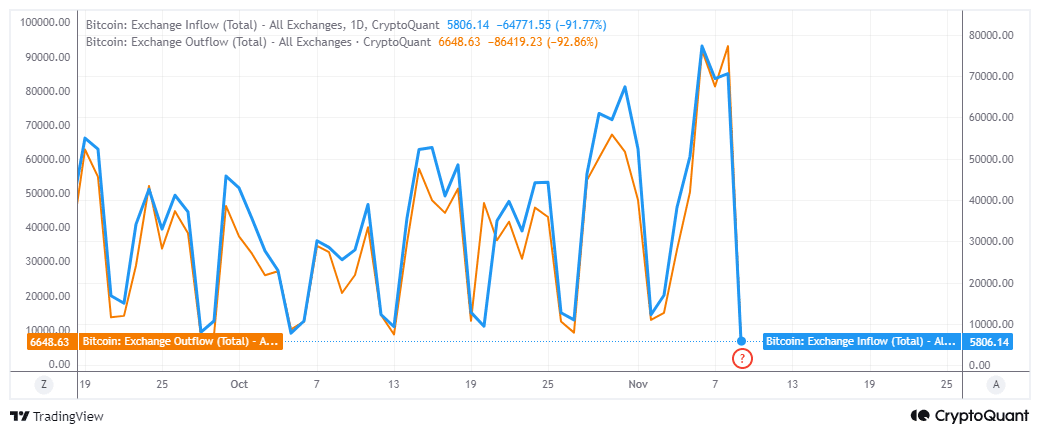

Trade flows point out that demand was nonetheless larger than promote stress

Trade circulation knowledge dropped significantly just lately, indicating indicators of potential bullish exhaustion. Regardless of this discovering, nonetheless, the quantity of BTC flowing out of exchanges was nonetheless barely larger than BTC trade inflows.

Bitcoin had 6,648 BTC in trade outflows on 9 November, in comparison with 5,806 BTC in inflows. This urged that demand was nonetheless in favor of the bulls and the worth may nonetheless tick up.

Based mostly on the aforementioned knowledge, it appeared clear that there was nonetheless some bullish momentum stopping the bears from taking up. This, mixed with the demand coming from Bitcoin ETFs, might clarify the prevalence of optimism. Nonetheless, this doesn’t essentially imply that the scenario will stay like that.

BTC’s price action demonstrated that the bulls have been struggling to push larger. This can be an indication that demand is cooling down, which can then pave the way in which for a bearish retracement as soon as promote stress begins to realize traction.