- Bitcoin whales continued to build up regardless of the value surge, signaling long-term confidence in its potential.

- Bitcoin ETFs noticed large inflows, boosting market confidence and elevating questions on future tendencies.

The post-election influence on the crypto market has been simple, with Bitcoin [BTC] experiencing a outstanding surge. BTC was buying and selling at $93,515.07, at press time, almost a 30-fold improve in a month as per CoinMarketCap.

Because the cryptocurrency nears the psychologically vital $100,000 mark, many are speculating that it might hit this milestone at any second.

Bitcoin whales’ transfer indicators…

Nevertheless, regardless of Bitcoin’s spectacular rally, its largest holders, sometimes called “whales,” haven’t cashed in on the positive factors.

As an alternative, they proceed to build up Bitcoin at these elevated worth ranges. This hinted at a doubtlessly bullish outlook for the digital asset transferring ahead.

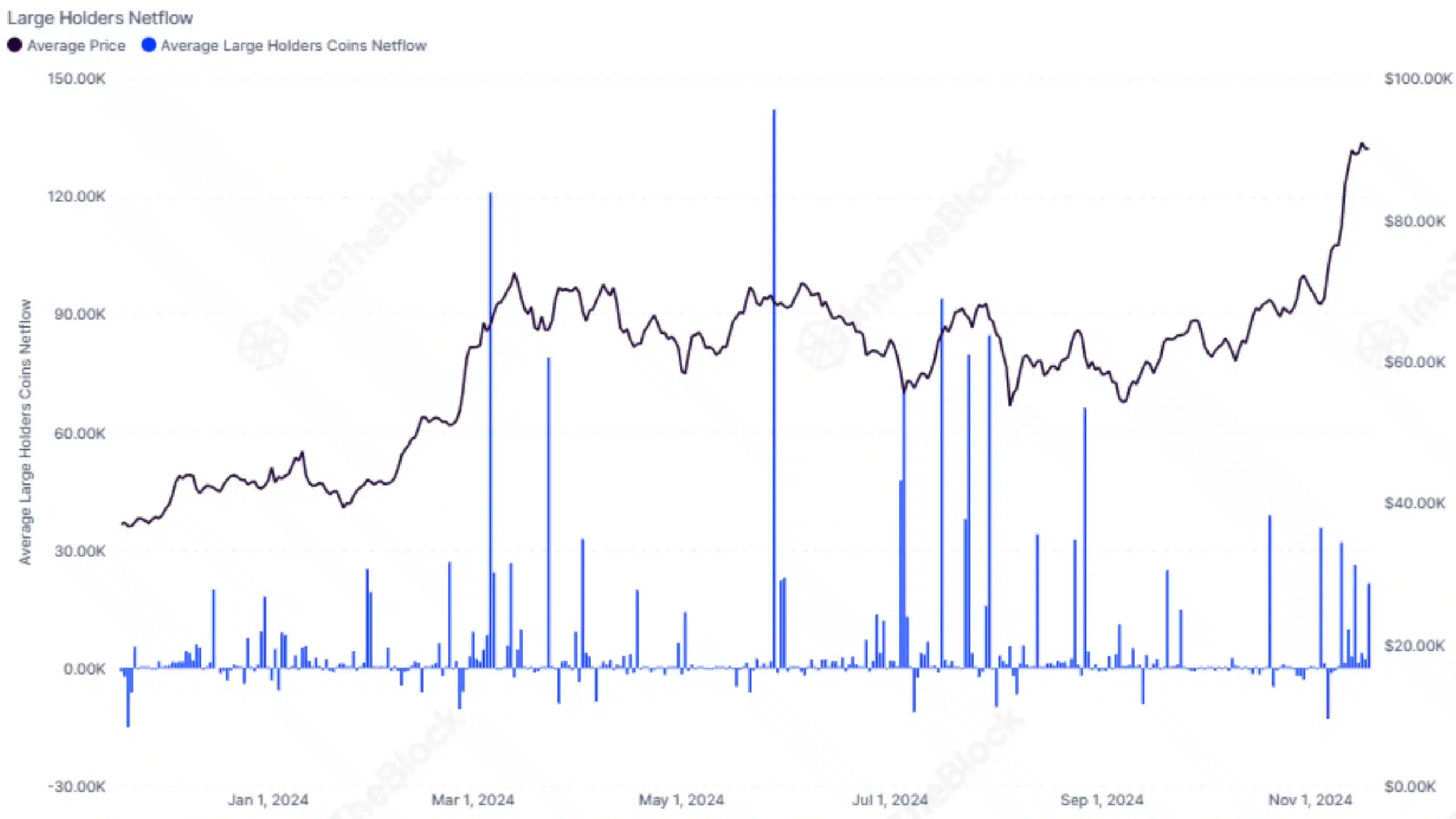

Information from on-chain analytics agency IntoTheBlock revealed that web outflows from the biggest Bitcoin wallets have remained remarkably low all year long.

This implies that the whales weren’t promoting their positions regardless of Bitcoin’s spectacular worth surge.

Relatively, they’re persevering with to build up, signaling robust confidence within the long-term potential of the cryptocurrency and additional indicating that these giant gamers could also be positioning themselves for even higher positive factors sooner or later.

Bitcoin’s long-term viability

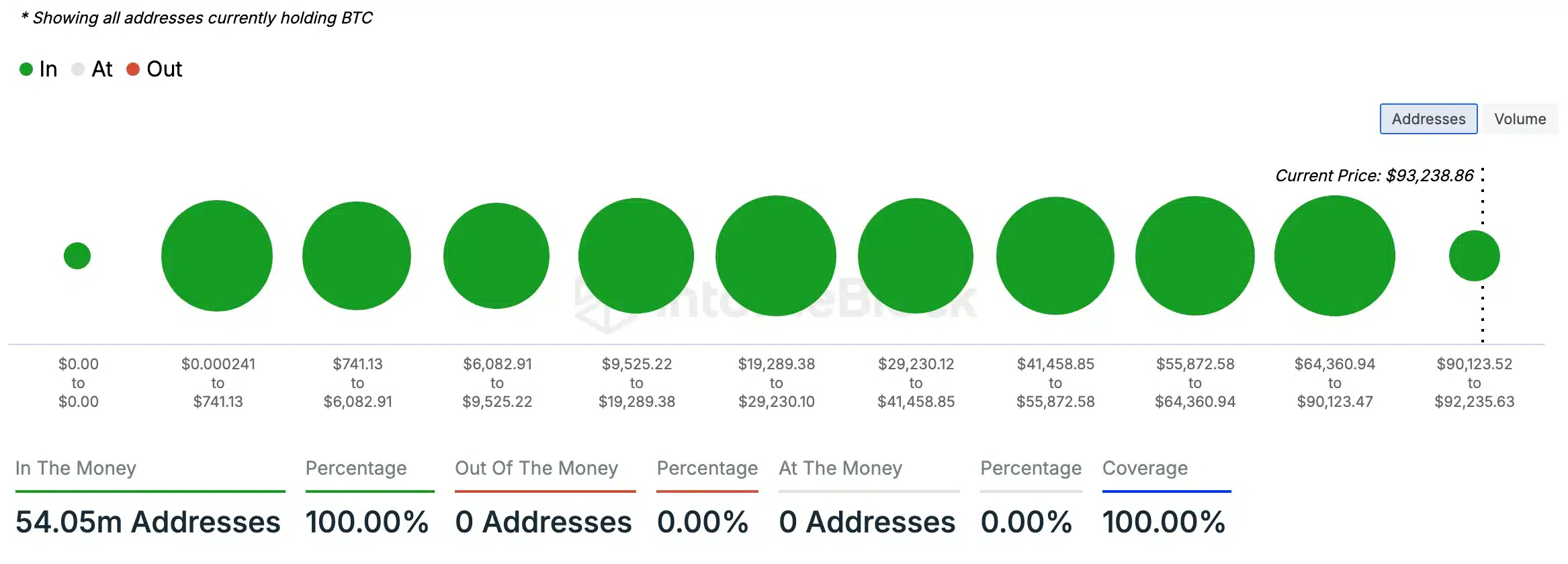

Additional supporting this bullish outlook, AMBCrypto’s evaluation of IntoTheBlock knowledge exhibits that 100% of Bitcoin holders are presently holding tokens value greater than their authentic buy worth.

This implies all BTC holders are “within the cash,” a transparent indication of widespread profitability.

Conversely, there have been no holders within the “out of the cash” class, reinforcing the prevailing optimistic sentiment round Bitcoin. This implies a possible for additional worth will increase shortly.

Nevertheless, in mild of this exponential rise, some merchants are urging warning, warning of potential dangers forward.

Crypto inflows spike

This follows per week when cryptocurrency funding merchandise experienced a outstanding $33.5 billion in inflows. Over $2.2 billion flowed in simply the previous week.

The rising momentum in cryptocurrency funding merchandise, with property below administration reaching a report $138 billion, highlights growing confidence out there.

Bitcoin ETF additionally makes information

Bitcoin ETFs are seeing vital inflows, with $816.4 million getting into BTC ETFs on the nineteenth of November, in line with Farside Investors.

A current 13F filing from a distinguished Wall Avenue agency revealed $710 million in spot Bitcoin ETFs holdings, together with a considerable stake in BlackRock’s iShares Bitcoin Belief.

As Bitcoin’s dominance rises, it will likely be fascinating to see how these developments form the cryptocurrency panorama. These modifications will affect the methods of each institutional and retail traders.