The co-founders of the crypto analytics platform Glassnode consider that Bitcoin (BTC) could begin heading greater after retracing to the low $90,000s primarily based on one metric.

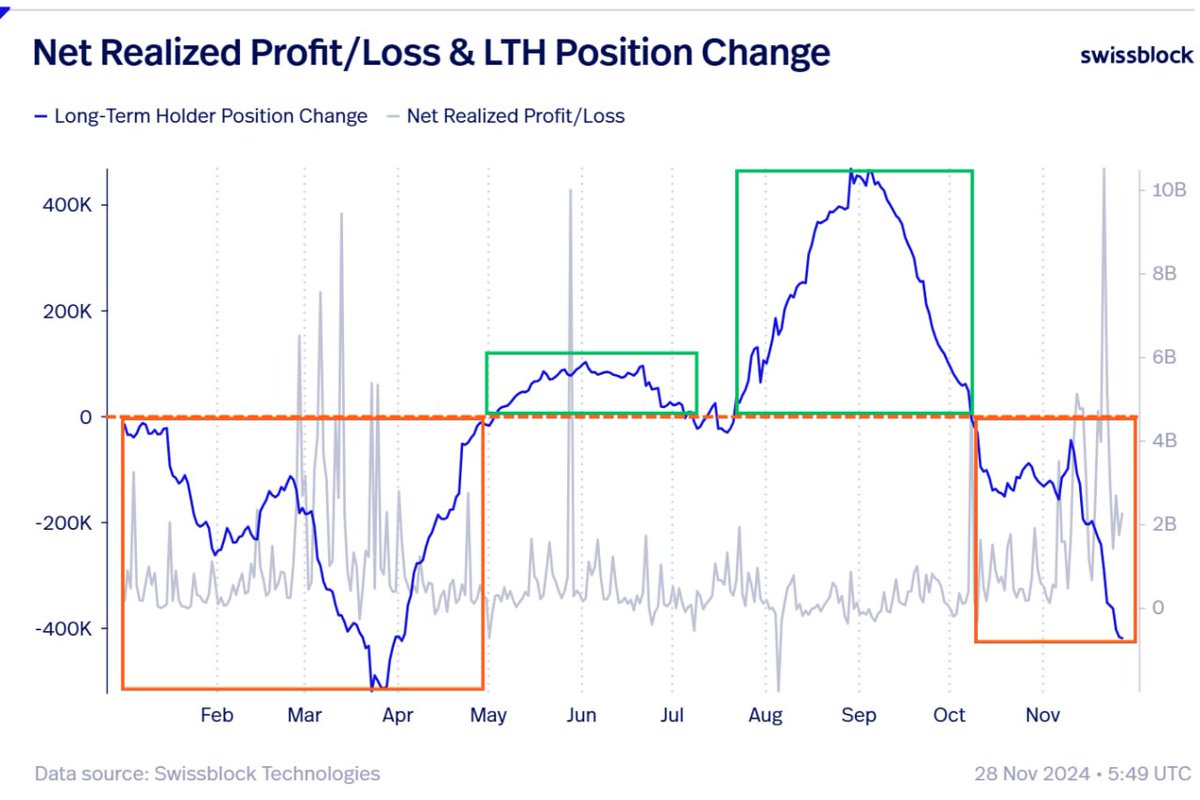

Jan Happel and Yann Allemann, who go by the deal with Negentropic, tell their 63,200 followers on the social media platform X that Bitcoin’s correction could also be over after long-term holders (LTHs) bought lower than within the first quarter of the 12 months.

LTHs are addresses that maintain cash for no less than 155 days they usually are likely to exit the market when BTC makes a bull run.

“Lengthy-term holders have taken income close to $100,000, however not as aggressively as in Q1. The shortage of steady realized revenue spikes suggests fewer LTHs exited throughout this correction – probably signaling we’ve already hit the underside.”

Bitcoin is buying and selling for $96,726 at time of writing.

Subsequent up, the analysts are immediately turning bullish on the substitute intelligence (AI)-based crypto challenge the Synthetic Superintelligence Alliance (FET).

“When Bitcoin corrects in an uptrend, we use the three-factor authentication (3FA) guidelines for altcoin alternatives:

- Sturdy fundamentals and a part of a story with traction.

- Relative Energy Index (RSI) is impartial (weekly/every day).

- Worth hasn’t exploded, nonetheless in accumulation.

FET checks all containers, compressing since July. Accumulate at vary lows for environment friendly dollar-cost averaging!”

FET is buying and selling for $1.62 at time of writing, up 8.1% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Price Action

Comply with us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney