- Miner sell-offs might sign short-term bearish sentiment or liquidity struggles.

- Bitcoin’s value might face volatility relying on ongoing miner conduct and outflows.

Bitcoin [BTC] miners have offered 771 BTC, totaling round $76 million, up to now 24 hours, elevating issues over its potential impression on the value. Such important sell-offs typically create supply-side stress, which might have an effect on market sentiment, particularly throughout risky intervals.

As Bitcoin hovers close to vital value ranges, questions are mounting over whether or not this transfer alerts short-term bearishness or displays miners’ struggles to cowl rising operational prices.

With the market in flux, all eyes are on miner conduct as a key indicator for the approaching days.

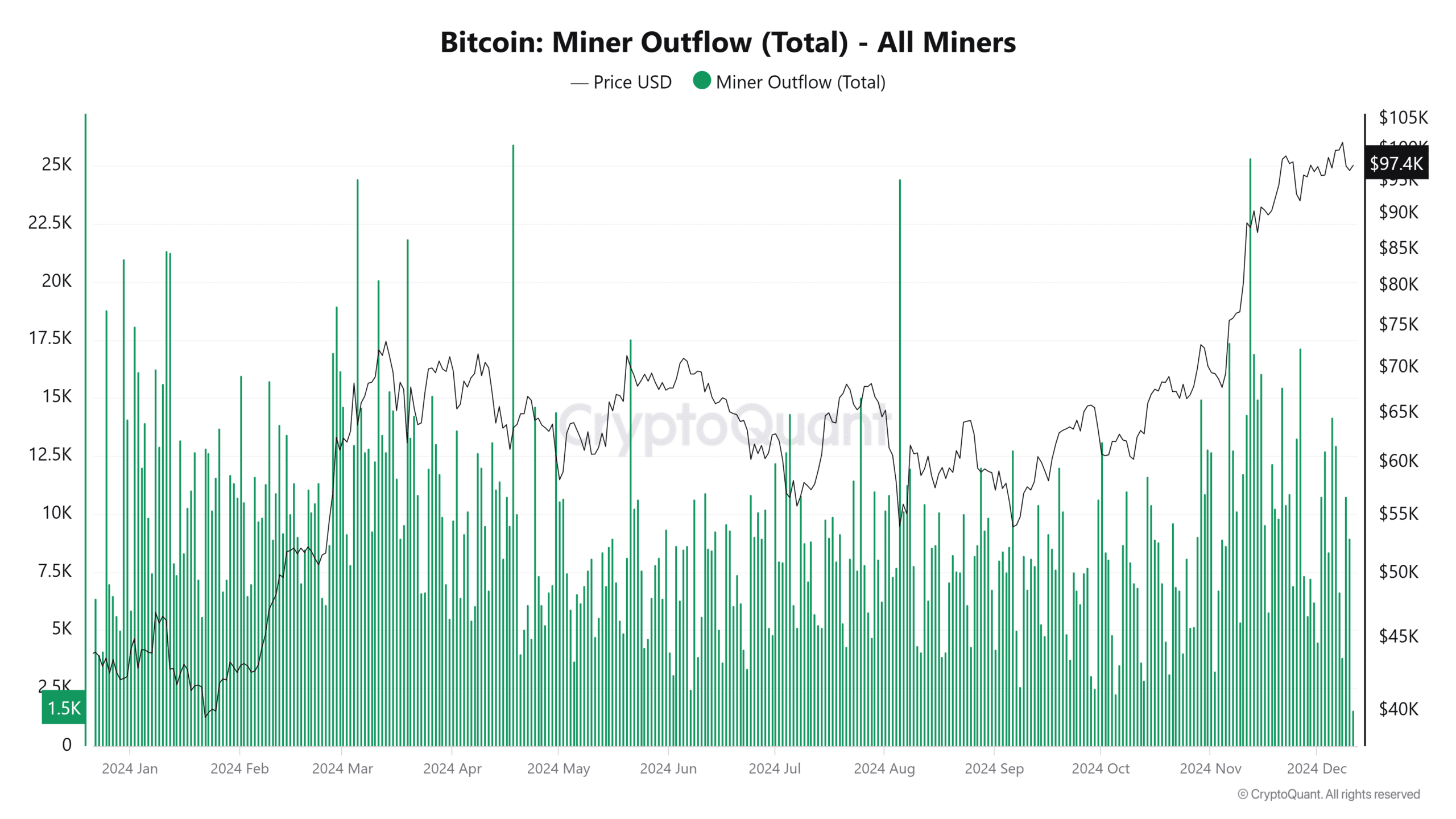

Bitcoin miner outflows

The current surge in Bitcoin miner outflows, coincides with rising operational prices and a market correction.

Notably, giant outflows are inclined to sign a shift in miner sentiment, typically reflecting the necessity to liquidate property both for fast money circulate or to hedge towards risky situations.

In periods of excessive volatility, such because the one we’re presently experiencing, miners might launch bigger portions of BTC to cowl vitality bills or repay money owed, notably as the value hovers close to key ranges.

This development of escalating outflows could possibly be seen as a short-term bearish indicator, particularly when coupled with declining miner profitability.

Nonetheless, it is usually essential to think about that such conduct might point out an overleveraged mining sector, which could exacerbate value corrections if additional liquidity pressures mount within the coming days.

The promote offs sign rising stress available in the market. JPMorgan upgraded value targets for miners like Riot and CleanSpark, factoring of their BTC holdings and energy property.

Whereas the sell-offs recommend short-term bearishness, these miners could also be hedging towards operational pressures, positioning themselves for future features regardless of volatility.

The position of miners within the Bitcoin ecosystem

Bitcoin miners are pivotal in sustaining the community’s safety and validating transactions. Nonetheless, their sell-offs have traditionally exerted a big affect on value dynamics.

When miners liquidate giant quantities of BTC, it will increase market provide, doubtlessly triggering downward stress on costs.

That is notably evident when miner sentiment turns bearish, typically linked to rising operational prices or lowering profitability. In earlier cycles, substantial miner sell-offs have marked native tops or sign intervals of consolidation.

Whereas not at all times indicative of a chronic bear market, these sell-offs are a vital market sign to observe.

Affect on BTC value efficiency

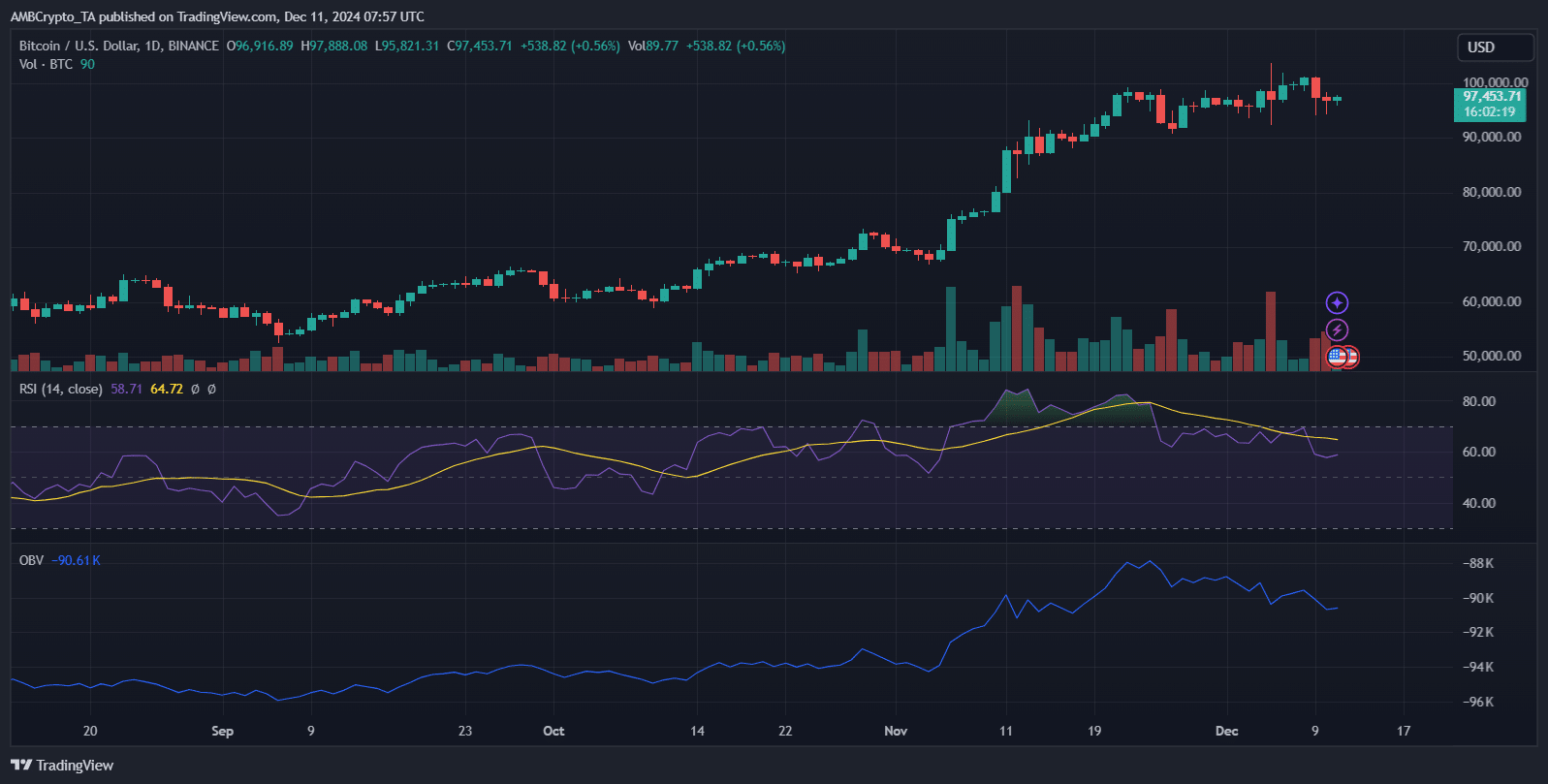

The miner sell-off coupled with Bitcoin’s present value tendencies, highlights a possible problem for the market’s bullish momentum. Bitcoin has been exhibiting robust upward motion, however miner conduct suggests warning.

The outflows might create momentary downward stress, particularly if miners proceed liquidating giant positions as a consequence of rising operational prices.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Given Bitcoin’s proximity to key psychological ranges, miner sell-offs might set off elevated volatility.

With market sentiment at a crossroads, Bitcoin’s skill to keep up upward momentum will rely upon whether or not miners determine to cut back their outflows or additional intensify promoting.