- Ethereum whale withdraws 5160 tokens value $20 million.

- ETH has made a reasonable restoration rising by 3.7%.

Over the previous month, Ethereum [ETH] has traded in an upward development. As such, since hitting a neighborhood low of $2,355, the altcoin has surged to hit $4096.

Nonetheless, since reaching this degree, it has skilled a correction and retraced to $3501. As of this writing, Ethereum was buying and selling at $3,899. This marked a 0.6% decline on each day charts.

This market pullback created a shopping for alternative particularly for big holders with whales turning to purchasing the dip.

Whales proceed accumulating ETH

In line with On-chain tracker Lookonchain, whales are accumulating ETH after the altcoin’s worth drops. As such, a whale created a brand new pockets and withdrew 5160 ETH tokens value $20 million from Binance.

With whales accumulating ETH, it reveals giant holders confidence particularly as long-term holders’ earnings proceed to rise.

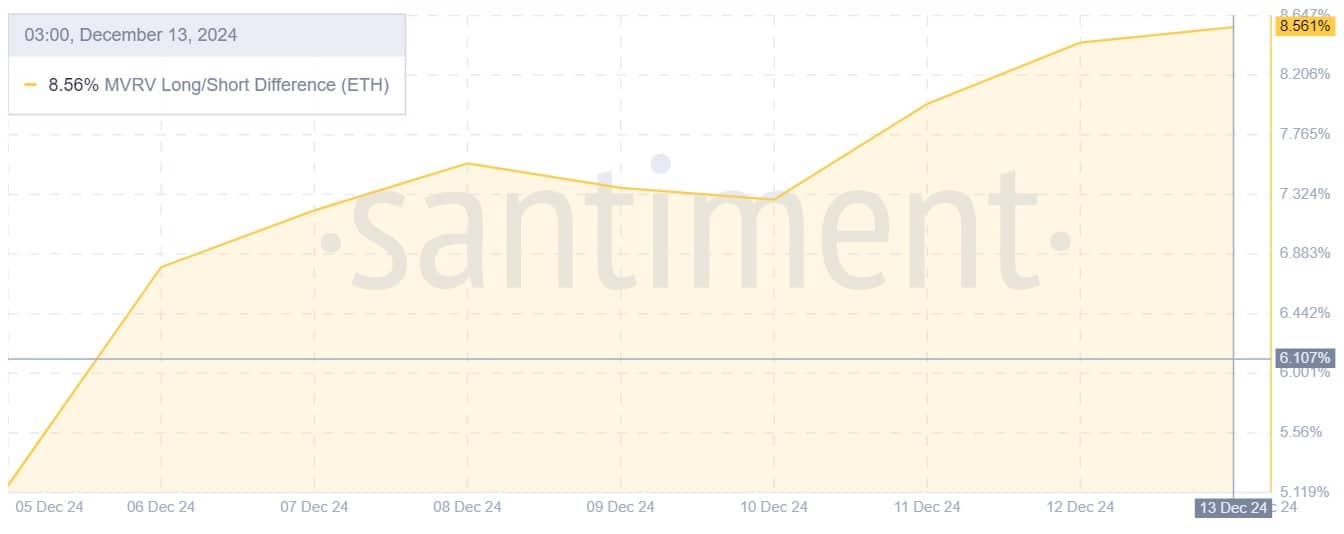

We are able to see this as Ethereum’s MVRV lengthy/quick distinction has regularly elevated over the previous week. It has risen from 5.17% to eight.56% signaling not solely market confidence but additionally rising profitability.

What ETH charts say

In line with AMBCrypto’s evaluation, Ethereum is at present experiencing a powerful bullish sentiment amidst shopping for strain from giant holders.

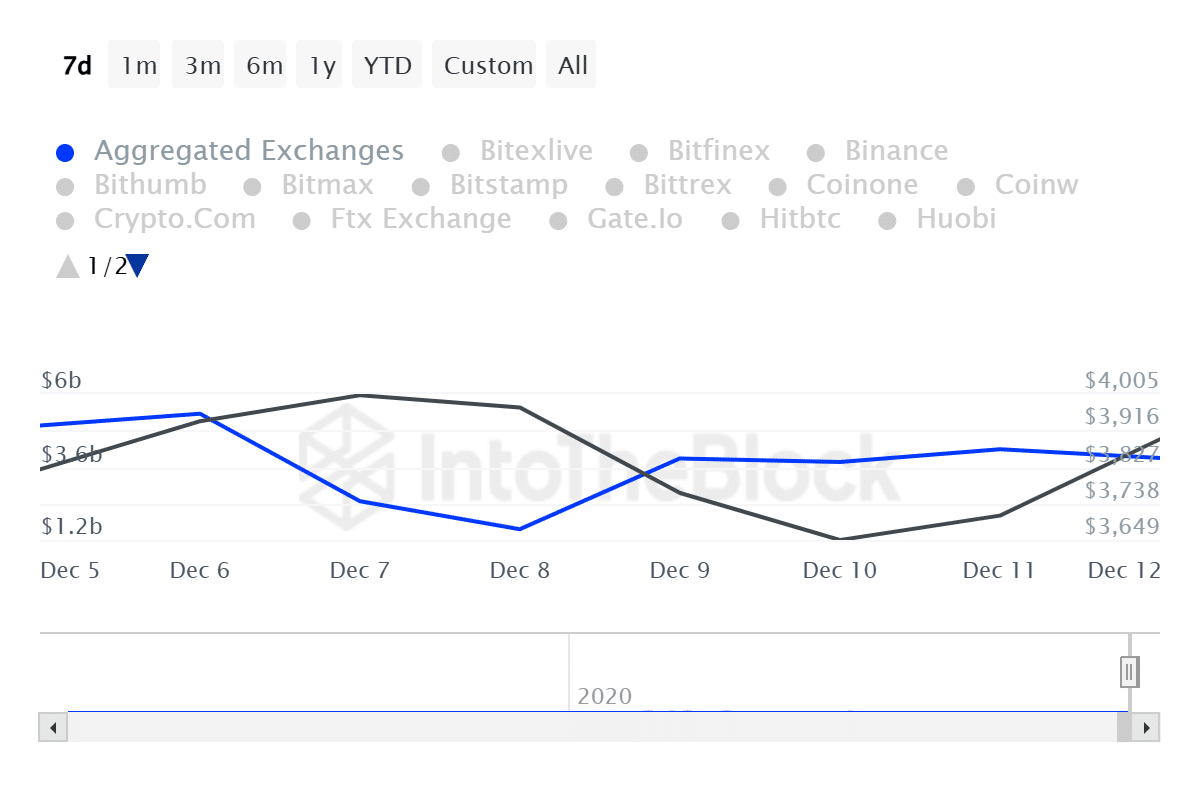

As such, Ethereum traders have turned to accumulating the asset. This accumulation development is evidenced by a rising outflow quantity.

In line with IntoTheBlock, outflow quantity from exchanges has surged from $1.56 billion to $3.89 billion over the previous week. This suggests that extra traders are transferring their ETH tokens into non-public wallets than exchanges.

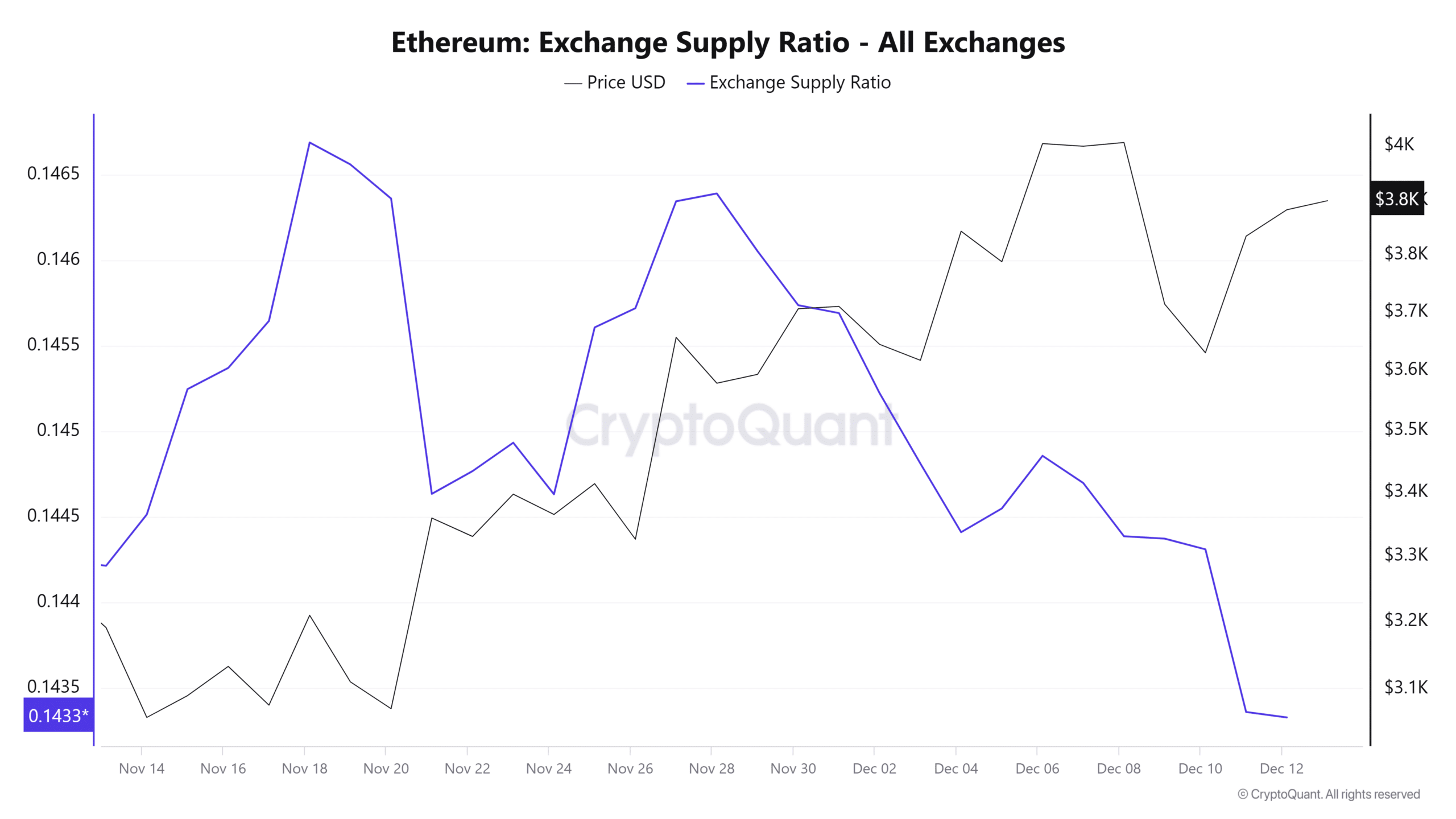

This development is additional supported by a declining change provide ratio. This has dropped from 0.1468 to 0.143. Such a drop implies that extra traders are bullish and are preserving their property off exchanges.

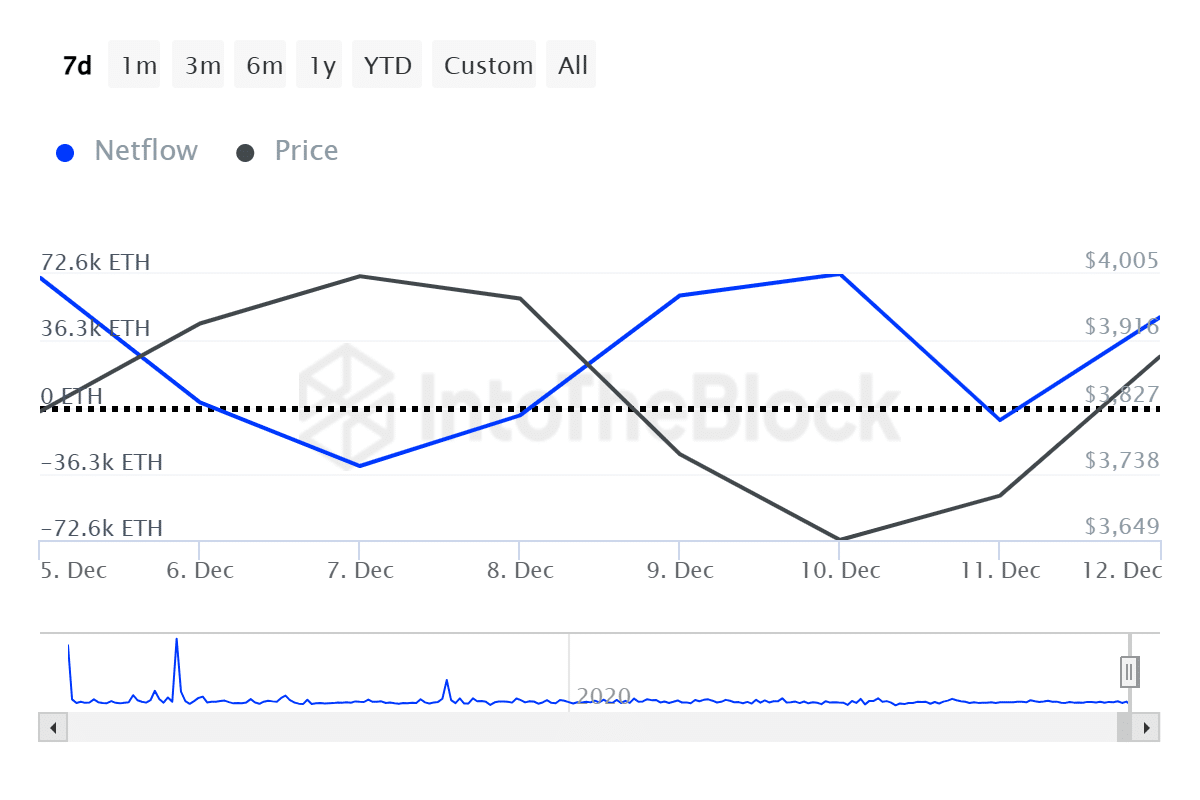

Lastly, this bullishness amongst whales is evidenced by a rising giant holder netflow. Over the previous day, this has surged from unfavourable 7.16k to 48.96k. When netflow sees such an enormous surge, it implies that there’s extra capital influx into an asset than outflows.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

As noticed above, Ethereum is at present experiencing constructive sentiments amongst giant holders. Subsequently, with elevated accumulation and funds influx, ETH might see extra restoration on its worth charts.

As such, if these sentiments prevail, Ethereum might reclaim $4000 within the quick time period. Subsequently, if consumers fail to retake the market, ETH might fall to $3713.