- An analyst foresees ETH outperforming BTC in January.

- A shift in ETF flows and seasonality information supported this outlook.

Ethereum [ETH] may outperform Bitcoin [BTC] in January if the market shift seen prior to now two days continues.

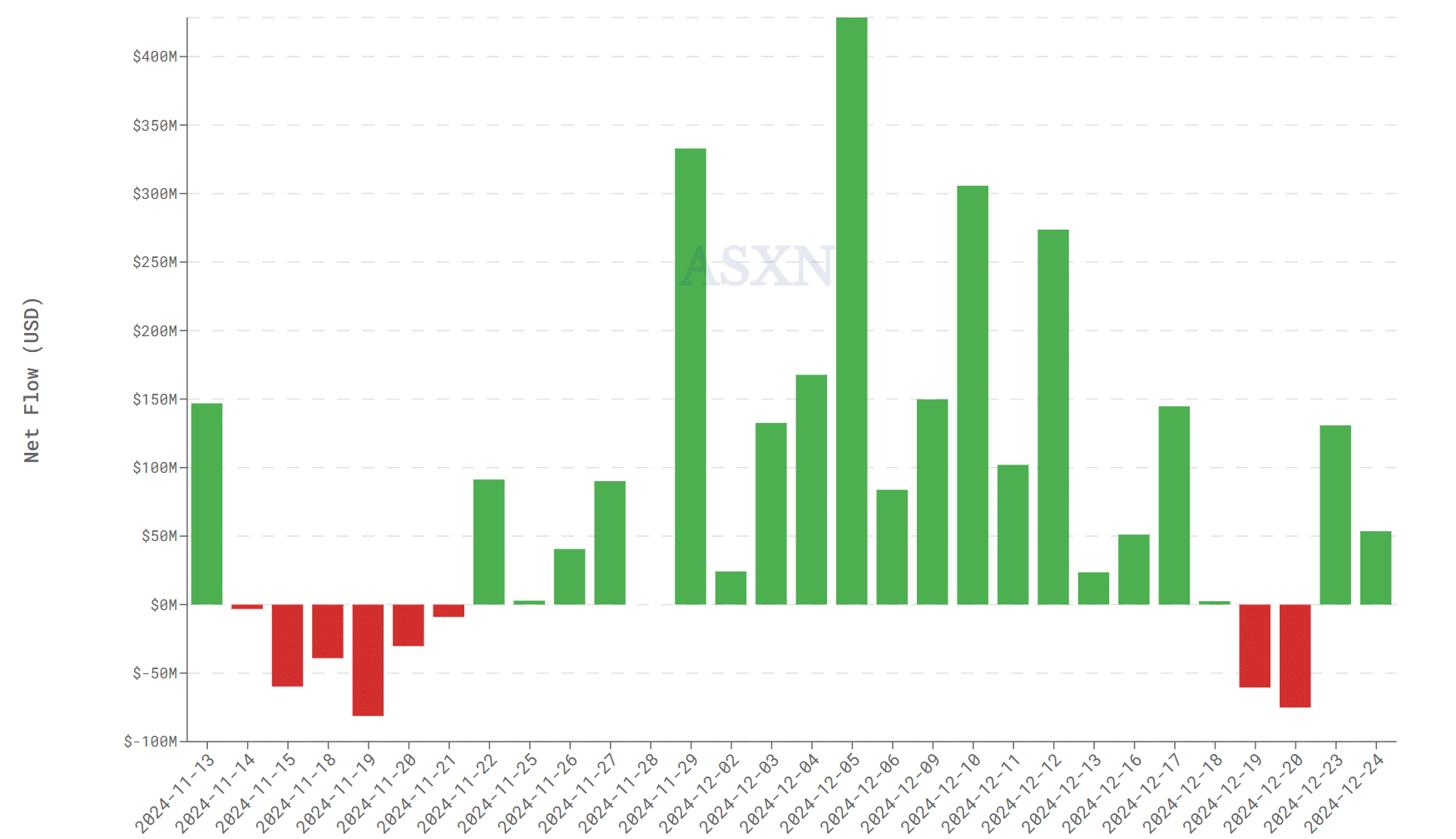

In response to crypto analyst and investor Michael van de Poppe, ETH’s outperformance could possibly be probably as a consequence of outflows in U.S. spot BTC ETFs whereas ETH recorded inflows.

For context, BTC ETFs have seen 4 consecutive day by day outflows, not like ETH, which noticed optimistic inflows price $183M prior to now two days.

This could possibly be thought-about a optimistic outlook for ETH relative to BTC within the quick time period.

Supply: ASXN

ETH to outperform BTC?

Poppe added that the ETH/BTC ratio, which tracks ETH’s relative worth efficiency in opposition to BTC, may cross 0.04 in January.

At press time, the ratio was at 0.033, so a transfer to 0.04, as predicted by Poppe, would translate to ETH rallying in opposition to BTC by 20%.

Nonetheless, the 0.04 has been a short-term resistance since November. The earlier recoveries, which additionally triggered the altcoin season momentum, had been stopped on the roadblock.

Nonetheless, cracking the hurdle may speed up ETH outperformance to the trendline resistance.

Though the 2 days’ information of ETF flows may not be sufficient to foretell a medium shift appropriately, seasonality information leaned in the direction of Poppe projection.

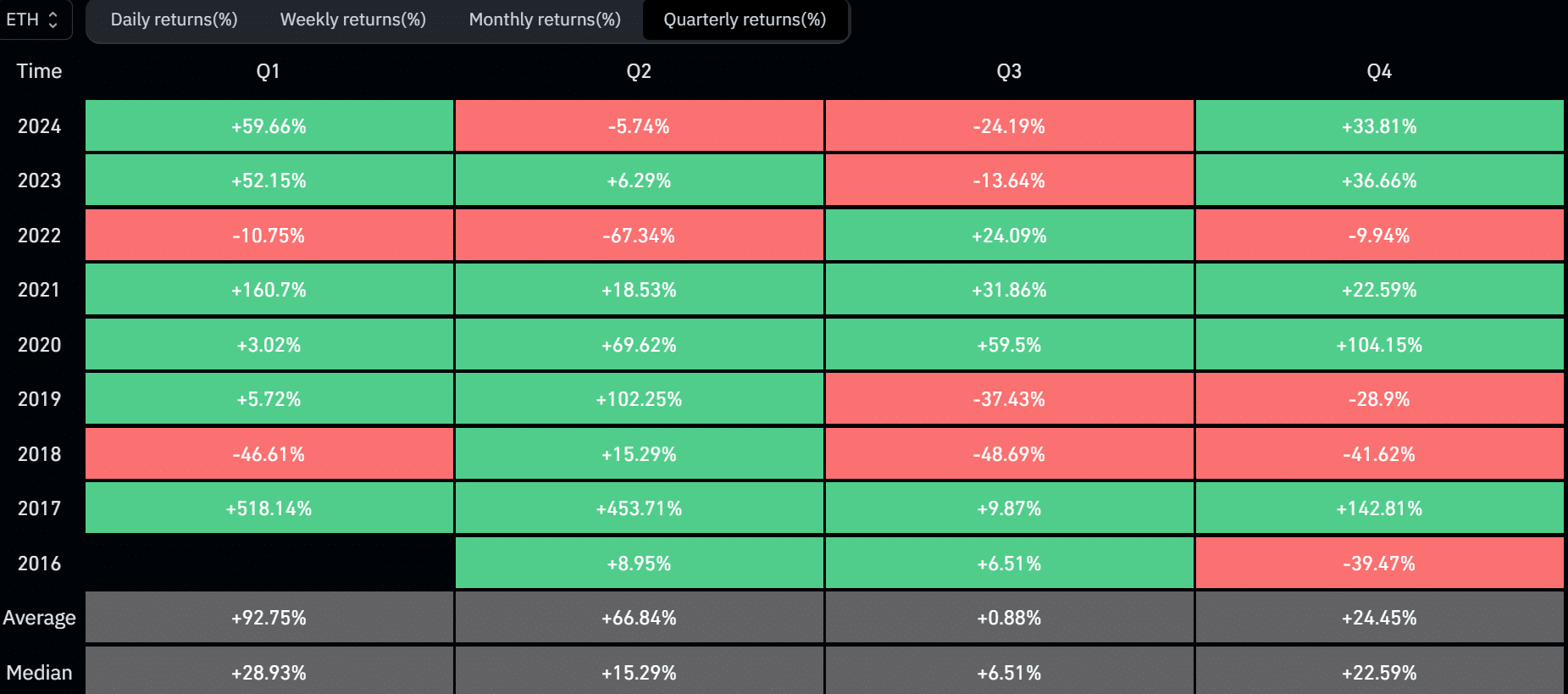

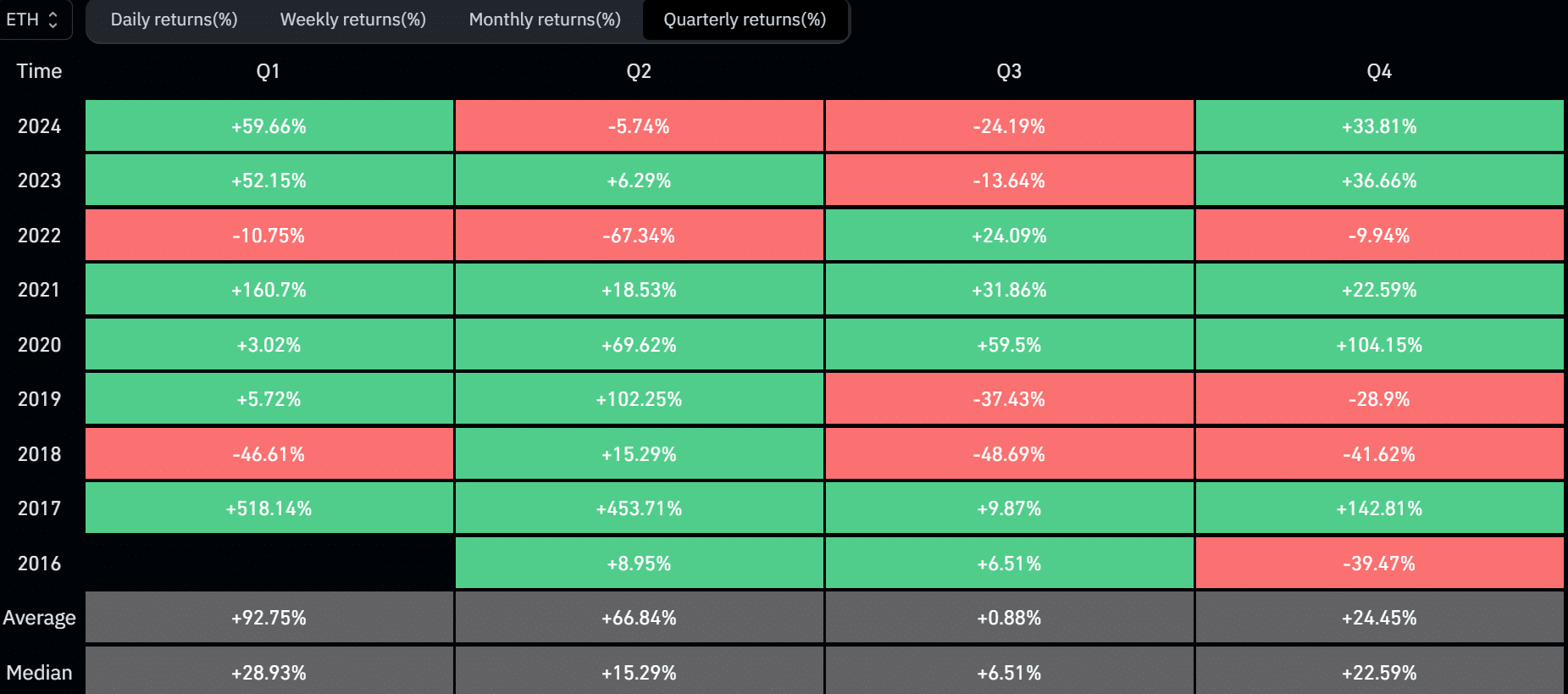

Since 2017, ETH’s strongest worth efficiency has at all times occurred in Q1. Coinglass information confirmed that, on common, ETH noticed 92% good points in Q1. Out of the previous six years, ETH has solely closed two years in pink.

From a month-to-month perspective, ETH noticed the most effective rallies in January, with a median of 23% good points, additional reinforcing the potential bullish outlook for early 2025.

Supply: Coinglass

Learn Ethereum [ETH] Price Prediction 2024-2025

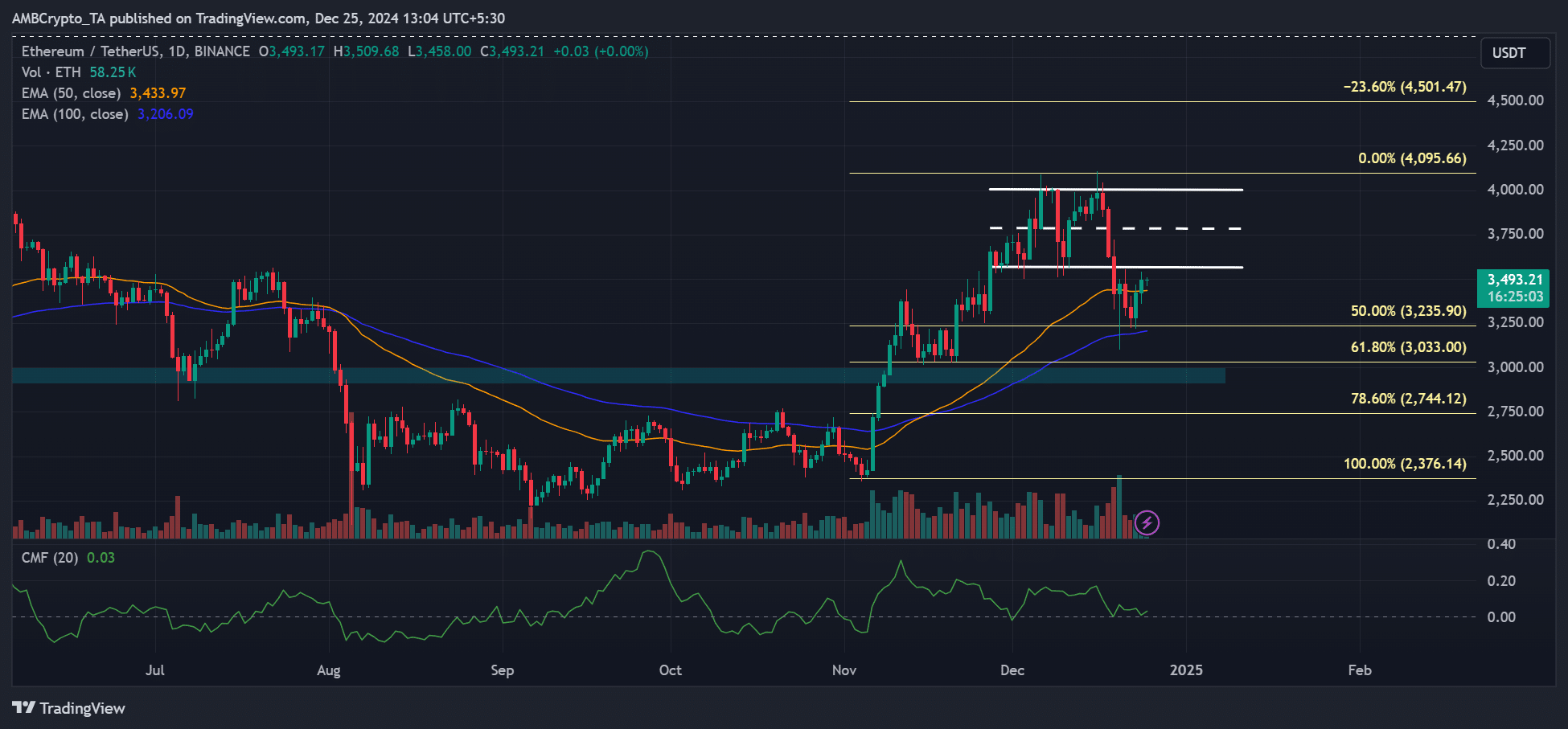

On the worth charts, the fast stage that would kick off ETH’s bullish reversal was the earlier help and vary lows at $3.5K.

Regardless of the optimistic outlook, as proven by the worth being above key shifting averages, the $3.5K may entice extra merchants.