Ethereum has kicked off the brand new 12 months with a powerful efficiency, surging over 9% in only a few days. This rally has introduced renewed optimism to the market, particularly amongst analysts and buyers who had grown involved about Ethereum’s extended underperformance in comparison with Bitcoin. Over the previous months, ETH struggled to take care of momentum, inflicting many to query its near-term potential.

Associated Studying

Nevertheless, prime analyst Daan lately shared an insightful chart that has shifted the narrative. Based on Daan, Ethereum has traditionally proven vital exercise throughout the first quarter of the 12 months, even in durations the place it lagged behind Bitcoin. This pattern underscores Ethereum’s potential for a rebound as market dynamics shift in its favor.

Whereas Ethereum’s worth motion is gaining power, the subsequent few weeks might be essential. Traders are watching intently to see if ETH can sustain this momentum and reclaim dominance inside the altcoin house. The market’s general sentiment means that 2025 might be a pivotal 12 months for Ethereum, with the Q1 pattern probably setting the tone for a powerful run forward.

Ethereum Begin To The Yr Sparks Optimism

Ethereum has begun 2025 on an optimistic notice, with buyers and analysts watching intently to see if this momentum can maintain. Whereas the beginning of the 12 months has been sturdy, Ethereum’s efficiency might want to break free from previous traits of underperformance relative to Bitcoin to really thrive within the months forward.

Prime analyst Daan lately shared a detailed analysis of the ETH/BTC ratio on X, highlighting the historic significance of Q1 for Ethereum. Based on Daan, Ethereum has typically seen substantial motion durin.g this era, even in years when it lagged behind Bitcoin.

Throughout the earlier bull cycle in 2020 and 2021, the ETH/BTC ratio skilled vital surges that coincided with the beginning of an alt season. This historic information means that Ethereum’s efficiency in Q1 may set the tone for broader market exercise.

For Ethereum to construct on this promising begin, the ~0.04 degree within the ETH/BTC ratio stands as a important resistance level. A decisive break above this degree may reignite investor confidence and probably result in vital good points. Nevertheless, failure to maintain momentum or surpass key ranges may trigger Ethereum to proceed the broader pattern of relative underperformance.

Associated Studying

The subsequent few weeks might be pivotal. If Ethereum can leverage this Q1 power and push previous important thresholds, 2025 may mark a standout 12 months for the main altcoin.

ETH Testing Important Zone

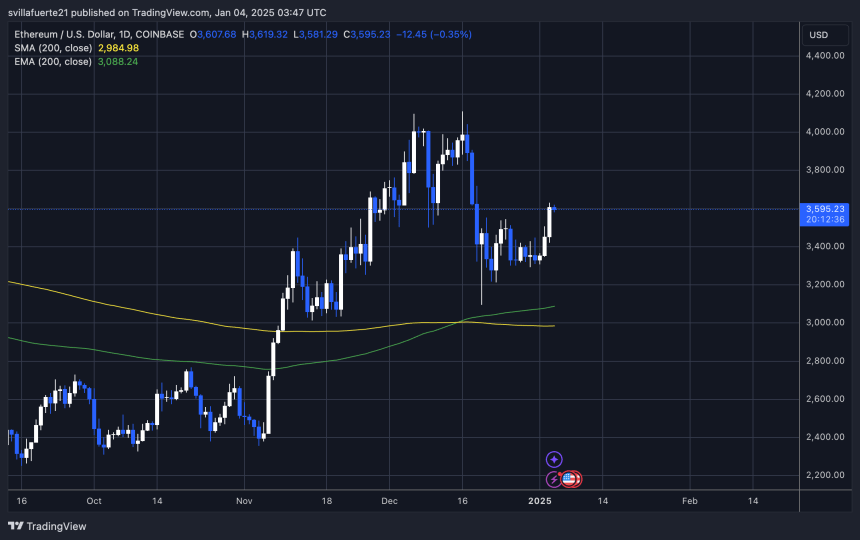

Ethereum is buying and selling at $3,595 after reaching a excessive of $3,629 yesterday, testing a important degree that might decide its short-term path. The worth has proven resilience, bouncing again from the late December dip, however bulls now face the problem of breaking by way of this vital resistance to maintain upward momentum.

This degree represents a vital juncture for Ethereum. A breakout above $3,629, adopted by a powerful shut, may sign the beginning of a bullish rally, probably setting the stage for a transfer towards greater targets within the weeks to return. Nevertheless, the market stays in a section of restoration, with buying and selling exercise reflecting cautious optimism as buyers weigh the potential for continued upward motion.

Regardless of this constructive outlook, the trail ahead could require persistence. Consolidation across the present ranges is feasible because the market seeks readability and momentum builds. Bulls might want to keep Ethereum’s place above $3,500 to make sure that the bullish construction stays intact.

Associated Studying

Because the market begins to get up from the seasonal correction, Ethereum’s efficiency at these ranges might be important. A decisive transfer in both path may set the tone for the altcoin’s trajectory within the coming months, making this a key second for buyers and merchants alike.

Featured picture from Dall-E, chart from TradingView