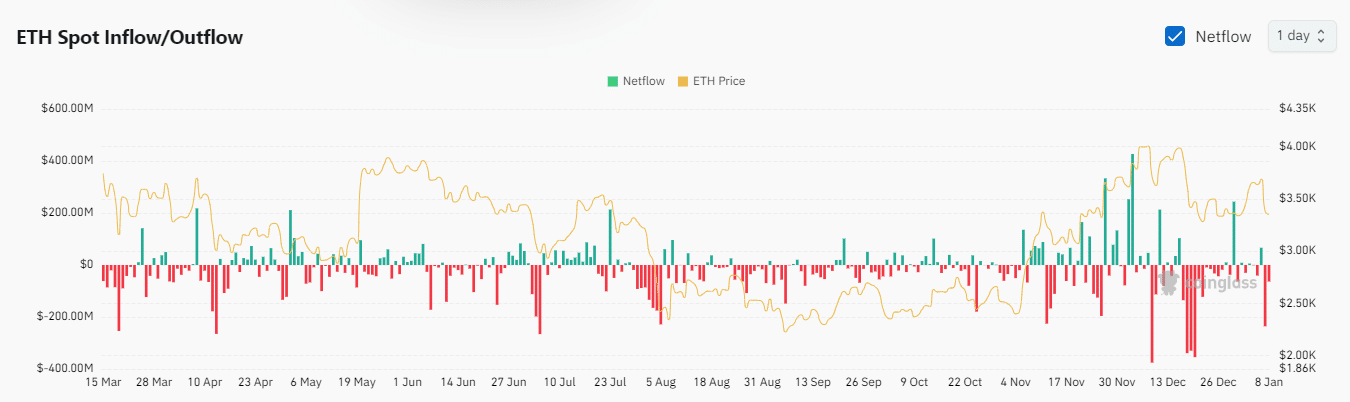

- Spot flows, together with ETFs, turned detrimental, wiping out current good points.

- Why a brief time period leverage shakedown performed out just lately and what’s subsequent as whales make a comeback.

An sudden wave of promote strain has worn out the current good points that Ethereum [ETH] achieved in its first few days of January.

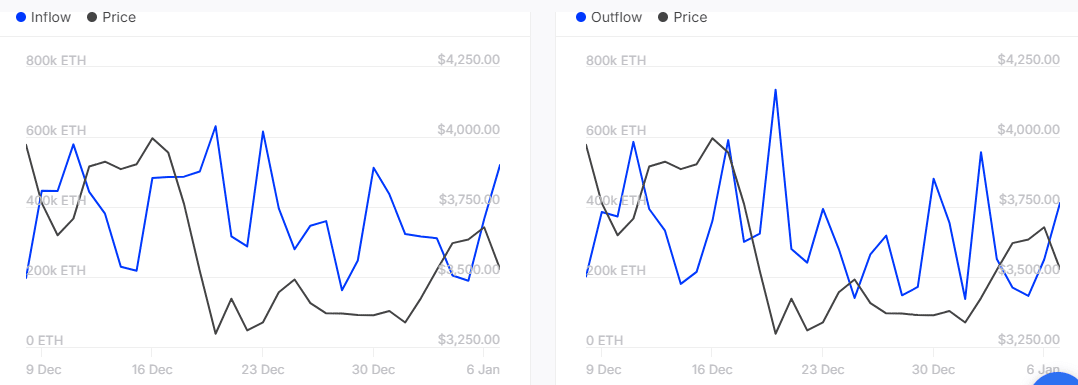

There have been a number of causes behind the promote strain, together with a leverage shake-down and spot outflows, amongst others.

ETH spot ETF outflows had been arguably probably the most noteworthy signal of promote strain. It had initially kicked off this week with $128.7 million price of inflows on the sixth of January, constructing on the inflows from the third of January.

This may increasingly have created a false sense of reduction, and resulted in a FUD-filled selloff after ETFs pivoted on the seventh of January.

In distinction, Bitcoin ETFs had been nonetheless constructive within the final 24 hours regardless of the other consequence on ETH’s facet. This was a mirrored image of the dominance scenario.

ETH ETF outflows amounted to $86.8 million on the seventh of January. This was in step with the overall detrimental spot flows noticed on exchanges throughout the identical interval. Outflows peaked at $235.66 million on this date.

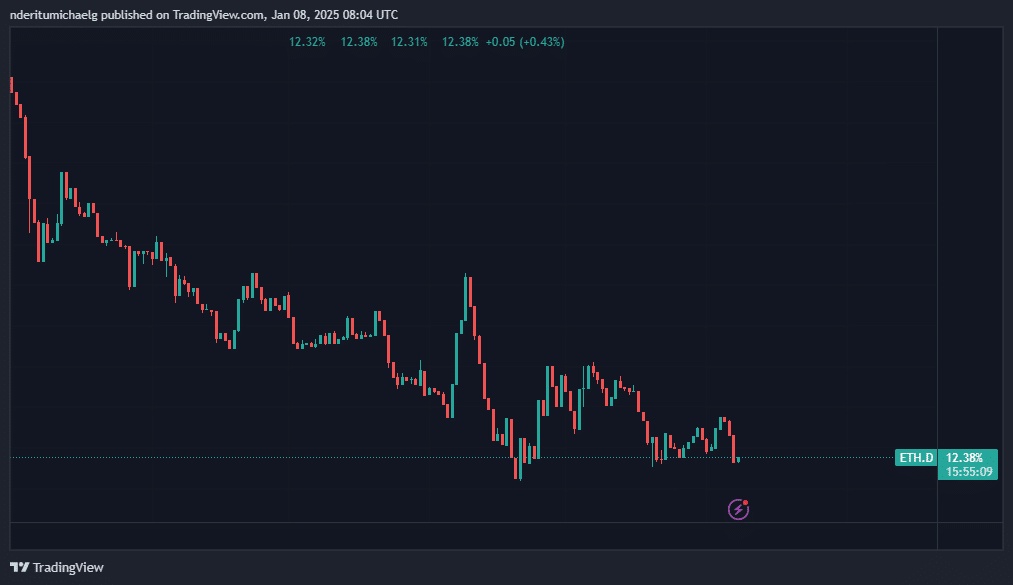

ETH dominance dips, however might be able to pivot

The current promote strain hammered down on ETH dominance, which beforehand rallied as excessive as 12.87% in the course of the weekend. Nonetheless, the most recent flip of occasions despatched it as little as 12.32%.

ETH would possibly try one other crack at larger dominance from its present stage. This as a result of the identical zone beforehand demonstrated assist.

The identical ETH dominance assist additionally aligns with the assist retest on ETH value motion. However is the most recent pullback over, or will value dip even decrease?

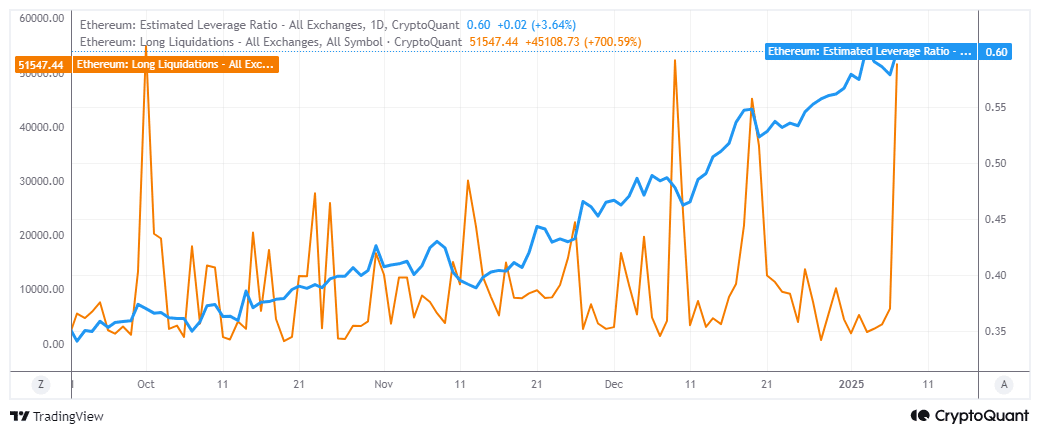

Leveraged lengthy liquidations doubtless had a hand within the newest wave of promote strain noticed within the final two days.

Urge for food for leverage has been on the rise over the previous few months. Lengthy liquidations had been up by over 700% because the third of January.

Greater than $173 million price of liquidations had been noticed within the final 24 hours. This implies that the most recent rally within the first week of January could have been a set-up for a leverage shakedown.

Will ETH bounce again within the second half of the week? That is believable due to one main commentary which will provide insights into the subsequent transfer. Whales have been promoting because the begin of January.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

Nonetheless, current knowledge reveals that they’ve been accumulating in the course of the newest dip.

ETH whales amassed 519,620 ETH on the seventh of January whereas outflows had been decrease at 411,300 ETH on the identical day. This confirmed that whales have been shopping for the dip and will doubtlessly help in a mid-week restoration.