- Bitcoin ETFs shine with $307M inflows, overshadowing Ethereum’s $186M outflows.

- Shifting traits trace at rising BTC dominance over ETH in ETF markets.

Investor curiosity in crypto-focused ETFs has taken middle stage as Bitcoin[BTC] and Ethereum[ETH] present contrasting traits in fund flows. Whereas Bitcoin spot ETFs get pleasure from important inflows, Ethereum ETFs grapple with notable outflows.

This divergence reveals shifting investor sentiment and raises vital questions in regards to the components driving these dynamics.

BTC ETFs: A beacon of energy?

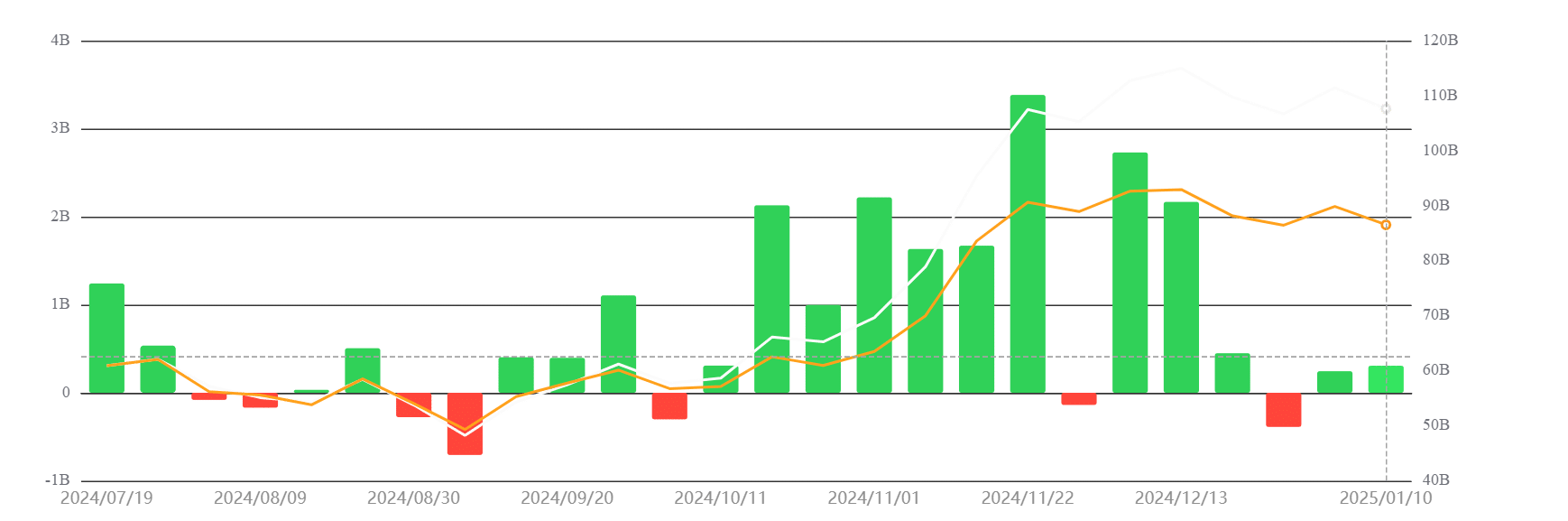

Bitcoin spot ETFs noticed exceptional inflows of $307 million final week on the sixth of January, reflecting heightened investor confidence within the main cryptocurrency. BlackRock’s IBIT ETF emerged because the standout performer, pulling in $498 million.

This sturdy efficiency highlights the rising attraction of Bitcoin as a dependable retailer of worth, notably as macroeconomic uncertainties persist.

Nonetheless, not all Bitcoin ETFs shared this optimistic momentum. The Ark & 21 Shares ARKB ETF skilled a internet outflow of $202 million, indicating that whereas institutional inflows drive the general development, some funds face challenges in retaining capital.

Evaluation of the chart illustrates the constant rise in Bitcoin ETF inflows, showcasing BlackRock’s pivotal function in steering the market.

ETH ETFs: A battle to maintain up

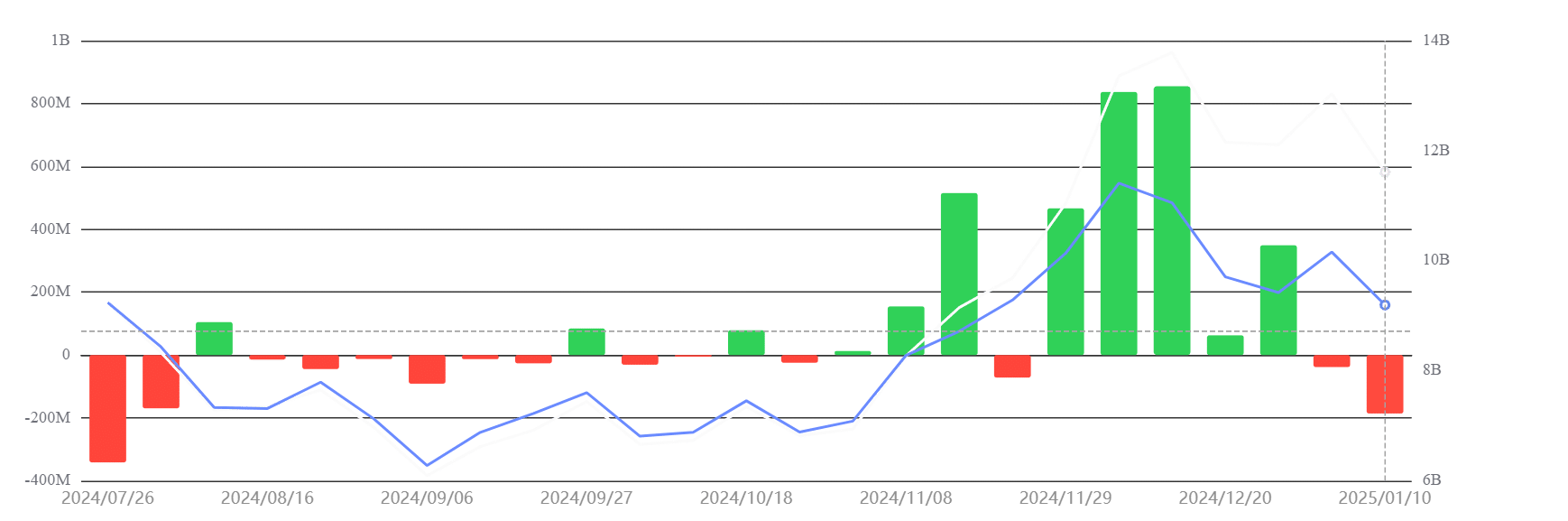

In sharp distinction to Bitcoin’s success, Ethereum ETFs recorded a internet outflow of $186 million over the identical interval. This marks a continuation of Ethereum’s latest struggles to draw investor curiosity.

Regardless of this, BlackRock’s ETHA ETF managed to buck the development, attaining a modest internet influx of $124 million. In the meantime, Constancy’s FETH ETF confronted substantial outflows, totaling $276 million, additional underscoring Ethereum’s challenges.

ETH ETF circulation chart evaluation highlights this disparity, with inflows waning since late 2024. Issues round staking dangers, Ethereum’s dominance in DeFi, and aggressive pressures from different layer-1 networks may very well be contributing to this decline in sentiment.

The info paints an image of buyers reassessing Ethereum’s long-term prospects.

What BTC ETH ETF traits reveal about market sentiment

The divergence in Bitcoin and Ethereum ETF flows presents beneficial insights into investor psychology and market dynamics. Bitcoin’s potential to constantly appeal to capital indicators its rising status as a safe-haven asset.

Institutional confidence, spearheaded by main gamers like BlackRock, reinforces this narrative.

Alternatively, Ethereum’s efficiency raises questions on its future. Though it stays the second-largest crypto asset, it has struggled to maintain up with BTC, and there may be rising competitors.

As Bitcoin solidifies its place, Ethereum faces mounting stress to deal with these considerations and regain its footing.

Broader implications for the crypto market

These BTC and ETH ETF traits will not be simply numbers; they replicate broader market shifts. Bitcoin’s sturdy inflows spotlight its potential to function a hedge towards volatility, capturing each institutional and retail consideration.

For Ethereum, the outflows recommend a necessity for clearer narratives to construct confidence as a viable different asset class.

BlackRock’s dominance in each Bitcoin and Ethereum ETF markets underscores the rising affect of conventional monetary establishments within the crypto house. This development indicators a maturing market but additionally raises questions in regards to the decentralization ethos that has lengthy outlined cryptocurrencies.

– Learn Bitcoin (BTC) Price Prediction 2025-26

The most recent ETF knowledge highlights a story of two cryptocurrencies. Bitcoin’s sturdy inflows reaffirm its place because the dominant drive available in the market, whereas Ethereum’s struggles emphasize the challenges it faces in sustaining investor confidence.

As crypto evolves, ETF flows will stay a vital barometer of sentiment and a information to understanding the shifting panorama.