- Stablecoin provide surged by 17% in This fall, with extra traders leaping into Bitcoin regardless of the excessive danger

- BTC soared by over 50% consequently – Is one other rally on the charts?

Stablecoin provide and Bitcoin’s value are tightly linked – When stablecoins circulation, Bitcoin usually follows. Take the ‘Trump Pump’ in This fall final 12 months, for example – Stablecoin provide soared by 16.9%, hitting $188.82 billion, and Bitcoin [BTC] climbed from $67.8k to $106.1k. It was a textbook case of liquidity driving momentum.

However now, the tides are turning. Liquidity inflows are slowing, signaling that traders are beginning to hesitate. With one other Trump Pump simply days away, is the ‘high-risk, high-reward’ attract of crypto beginning to lose its enchantment?

Market shifts in direction of warning

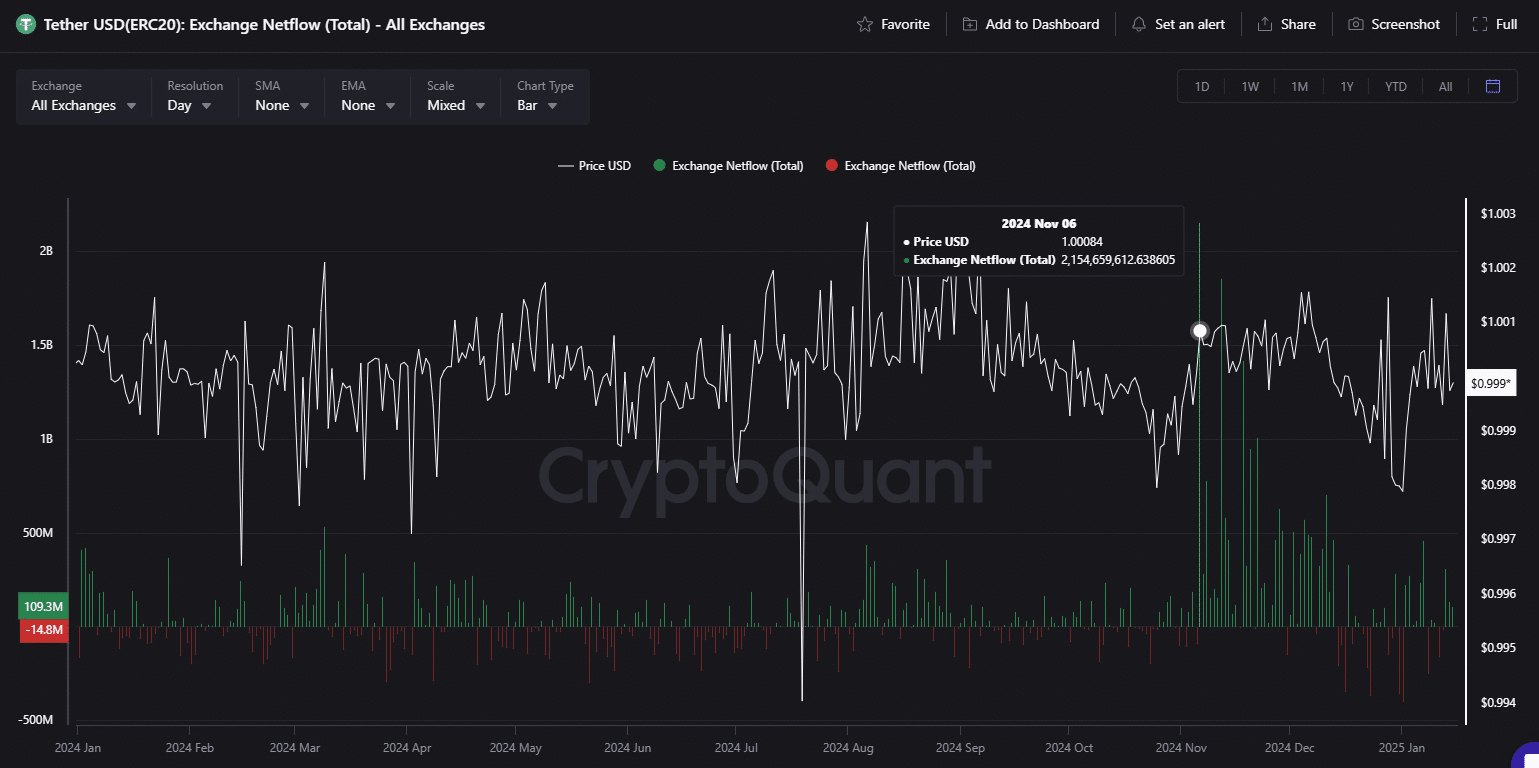

Bitcoin’s spectacular restoration from $91k to $97k (On the time of writing) – a 6.6% bounce in only a week – exhibits that merchants are bracing for the following massive rally. And, it’s no coincidence that Tether USD (ERC20) stablecoins noticed $311.5 million in inflows throughout the identical interval.

This backs up AMBCrypto’s idea – When liquidity rises, traders aren’t hesitating. They’re doubling down, loading up their portfolios.

Nonetheless, that is only the start. It’s nonetheless nothing in comparison with final 12 months’s Election Day, when an enormous $2.15 billion in stablecoins flooded the market, marking the best inflow of the 12 months. The outcome? BTC surged by 8.24% in at some point, breaking via $70k for the primary time in eight months.

And, it didn’t cease there. Within the two months following the Trump pump, $27.35 billion in stablecoins flowed throughout exchanges, fueling BTC’s 56.5% surge to $106.5k. This fall really shattered stablecoin’s ‘secure haven’ picture.

Since then although, issues have modified. Two clashes with the Fed, excessive inflation, and rising promoting stress have taken their toll. Open Curiosity (OI) has dropped from $68 billion to $61 billion, and the stablecoin market cap has solely seen a modest +0.56% change within the final 30 days.

And but, there’s a silver lining. Whereas liquidity is extra restricted, it might result in better market stability. Mixed with the drop in Open Curiosity (OI), this recommended traders have gotten extra cautious, speculating much less on BTC’s future. With excessive stakes at play, it’s a signal that the market is maturing.

So, will Bitcoin outshine stablecoins?

Mathematically, a 56.5% surge just like the Trump pump might push Bitcoin previous $140k by Q1, with $90k performing as a strong assist stage. Much more promising, the previous three days have seen stablecoin web flows flip constructive, sparking a rally that’s bringing the market again into the inexperienced.

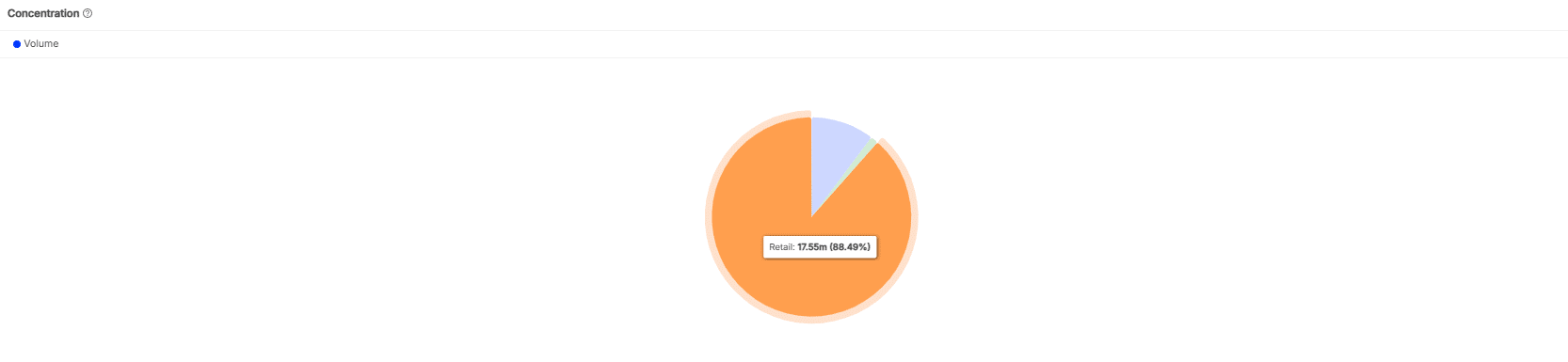

However let’s not get forward of ourselves – A 50% rally would possibly nonetheless be overly formidable. With 88% of Bitcoin’s provide in retail fingers, their subsequent strikes could possibly be the important thing to pushing BTC nearer to its Q1 goal. So, the actual game-changer? A stablecoin inflow crossing the billion mark, a far cry from the present 130 million.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

A $100k breakthrough within the quick time period appears doubtless, however whether or not it could actually maintain the degrees stays in query. So, eyes on the stablecoin chart are essential. Even a slight panic might flip the market purple very quickly.