- BTC reclaimed $100k, albeit briefly, after cooler-than-expected inflation knowledge

- XRP reclaimed its 7-year excessive whereas ONDO confronted $2.4B token unlock strain.

On Wednesday, Bitcoin [BTC] bounced off and retested $100k following cooler-than-expected U.S inflation knowledge, lifting the whole market. The inflation knowledge, CPI (Shopper Value Index), got here in at 3.2% YoY(year-on-year) in opposition to the three.3% projected by economists.

This dampened inflation fears and Fed charge lower outlook that had earlier tanked markets and dragged BTC beneath $90k.

Price declaring, nonetheless, that the markets are nonetheless pricing a 97% likelihood of an ‘unchanged’ Fed rate of interest within the subsequent assembly in direction of the tip of January.

AI brokers lead restoration, XRP hits new excessive

Following BTC’s rally, Solana [SOL] and Ethereum [ETH] posted 14% and 12% positive aspects, respectively. Nonetheless, the AI agent sector noticed an even bigger rally, with Virtuals Protocol [VIRTUAL] and Aixbt [AIXBT] recording positive aspects of 25% and 35%, respectively.

Different tokens with the AI agent narrative, like Fartcoin and Cookie, additionally logged double-digit positive aspects. In truth, some agent tokens posted triple-digit positive aspects in a day too.

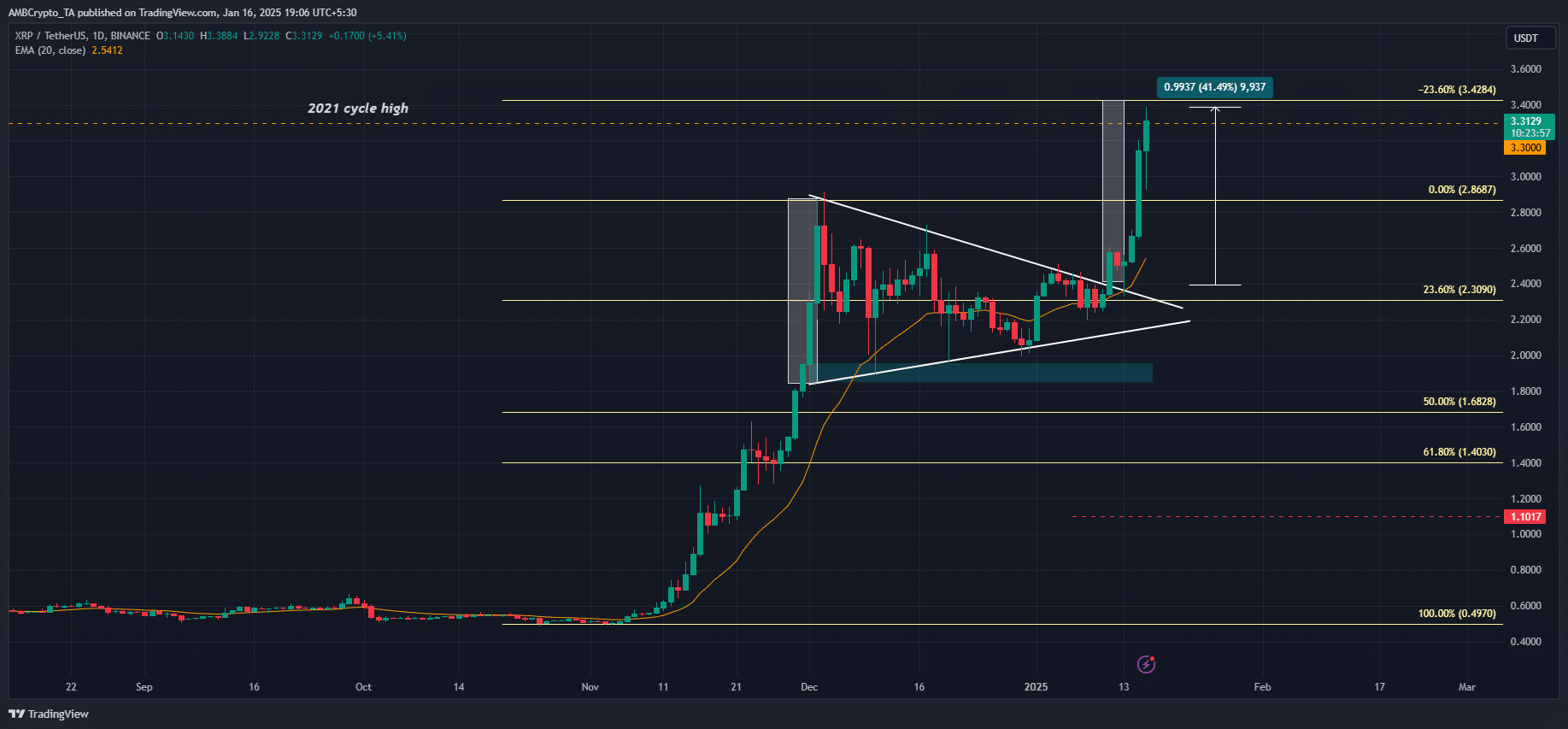

Nonetheless, the important thing market spotlight was XRP. At press time, the altcoin hit a excessive of $3.38, crossing its 2021 cycle excessive within the course of. The feat successfully prolonged its breakout positive aspects to +40%, with the altcoin unfazed by authorized developments because the SEC filed an attraction in opposition to Ripple Labs.

The company is dissatisfied with U.S District Choose Analisa Torres’s ruling that categorised XRP as non-security and lowered Ripple Labs’ $2B positive to $125M.

Regardless of hypothesis that the company wouldn’t attraction the case, it did so, irking Ripple’s leadership, who termed the transfer a waste of taxpayer cash. Nonetheless, there are experiences that the brand new Trump administration might ‘freeze’ some crypto lawsuits, together with Ripple’s case.

Lastly, the RWA (real-asset tokenization) market chief, Ondo [ONDO], will unlock almost 800M tokens (price $2.4B) on 18 January.

This may translate to 134% of its market cap and will expose the token to important volatility and promoting strain. Regardless of a broader market restoration at press time, the altcoin is already down by 42%. Priced at $1.2, it hasn’t recovered from December’s sell-off up to now.

Supply: CryptoRank

Lastly, subsequent week marks the D-day of Donald Trump’s presidential inauguration, and a brand new chapter for crypto shall be ushered in.

Because the market shifts focus to this historic occasion, buying and selling agency QCP Capital famous better curiosity from Choices merchants within the $100k-$110k worth targets. The agency stated,

“On the choices entrance, BTC JAN calls dominated the market yesterday as merchants adopted an more and more bullish view, snapping up contracts with strikes starting from $100K to $110K. This can be a promising signal as we head into March which at present holds the best focus of open curiosity on the $120K strike.”