- Bitcoin mining income hits $45M each day, exhibiting indicators of wholesome community progress

- Spikes in mining income might sign a shift in direction of sustained progress or upcoming value rallies

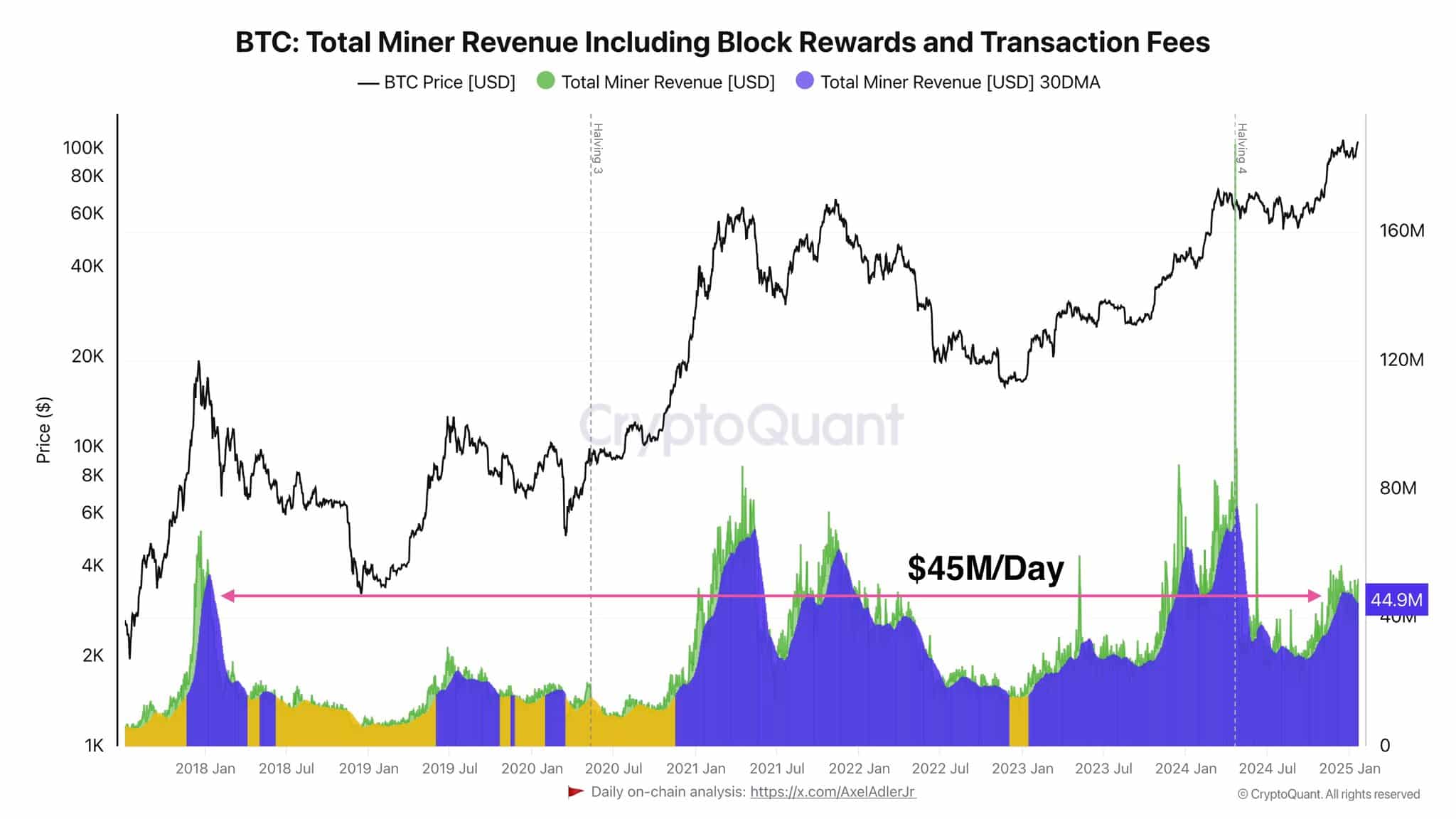

Bitcoin [BTC] mining has lengthy been a key indicator of market well being. Current spikes in mining income and community exercise appeared to counsel that the Bitcoin community could possibly be getting into a brand new part. With each day mining income reaching roughly $45 million, present circumstances carefully mirror the excessive community exercise seen throughout Bitcoin’s earlier bull cycles.

Nonetheless, the massive query stays – Does this surge in mining income sign the beginning of one other explosive bull run, or is it a sign of sustained progress that’s much less tied to fast value fluctuations?

The function of Bitcoin mining within the community

The current surge in Bitcoin mining income, reaching roughly $45 million each day, highlights a big increase in community exercise. This hike indicators not solely a wholesome ecosystem, but in addition heightened miner confidence. As miners proceed to safe the Bitcoin community, metrics like hash fee and block problem present invaluable insights into its general power.

A rising hash fee means better participation and computing energy, whereas climbing block problem hints at a tougher atmosphere for miners. Collectively, these indicators level to a thriving Bitcoin community that could possibly be gearing up for a brand new part of progress.

Historic comparability and patterns

The each day mining income of $45 million appeared to align carefully with these historic thresholds, suggesting a possible bullish sign. Nonetheless, the impression of this determine can prolong past fast value hypothesis. It underlined sturdy community exercise, miner confidence, and rising adoption, hinting that Bitcoin’s ecosystem is solidifying.

If historic patterns maintain, the present mining income might foreshadow a big value rally or sign sustained, regular progress pushed by a thriving, safe community. Both state of affairs would reaffirm Bitcoin’s place as a resilient, maturing asset class.

Bitcoin exhibits bullish momentum

On the time of writing, Bitcoin was buying and selling at $104,551 with a gradual upward development in current classes. The RSI at indicated bullish momentum however not but overbought territory, suggesting room for additional upward motion.

On-balance quantity at -89.25K mirrored rising accumulation, supporting the value motion.

Historic resistance ranges close to $110,000 might act as a essential check for continued momentum. If breached, it could sign the onset of a broader bull run.

Nonetheless, sustained quantity and a push past the RSI threshold of 70 are wanted to substantiate a powerful development. The press time knowledge supported optimism, however necessitated cautious monitoring for affirmation of a sustained breakout.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

Past the bull cycles

Bitcoin mining seems to be getting into a part of sustained progress, impartial of conventional market cycles. Growing institutional adoption by main gamers like BlackRock and Constancy is stabilizing the market, whereas international demand for Bitcoin as a hedge towards inflation and an alternate monetary system continues to develop. Technological developments in mining {hardware}, corresponding to energy-efficient ASICs, are additional enhancing profitability, making certain miners keep aggressive whilst block rewards lower.

Lengthy-term traits level to a metamorphosis in mining economics. As block rewards halve each 4 years, transaction charges are anticipated to grow to be the first income supply, driving miners to undertake renewable power and cost-efficient practices. By aligning with sustainability and technological innovation, Bitcoin mining might well-positioned for continued progress and relevance within the evolving digital financial system.