In his newest video revealed on December 21, crypto analyst Rekt Capital tried to reply the query “What’s The Worst Case State of affairs For Bitcoin Proper Now?”. After reaching a brand new all-time excessive at $108,374 on December 17, the BTC value is down greater than -11%.

How Low Can Bitcoin Value Go?

Rekt Capital put the Bitcoin price pullback in a historic perspective, underscoring the historic significance of weeks 6, 7, and eight in a “value discovery uptrend.” Drawing upon previous cycles comparable to 2013, 2016–2017, and 2021, he defined that Bitcoin has a robust tendency to appropriate throughout these particular home windows, with some dips reaching as steep as 34% and even increased.

“Understanding these weeks is essential as a result of they are usually problematic for Bitcoin,” Rekt Capital acknowledged, referencing previous cycles the place vital downturns occurred inside this timeframe. As an illustration, in week 7 of the 2013 cycle, Bitcoin skilled a dramatic 75% pullback over 13 weeks. Equally, the 2016-2017 interval noticed a 34% decline in week 8, underscoring the recurring vulnerability throughout these particular weeks.

Associated Studying

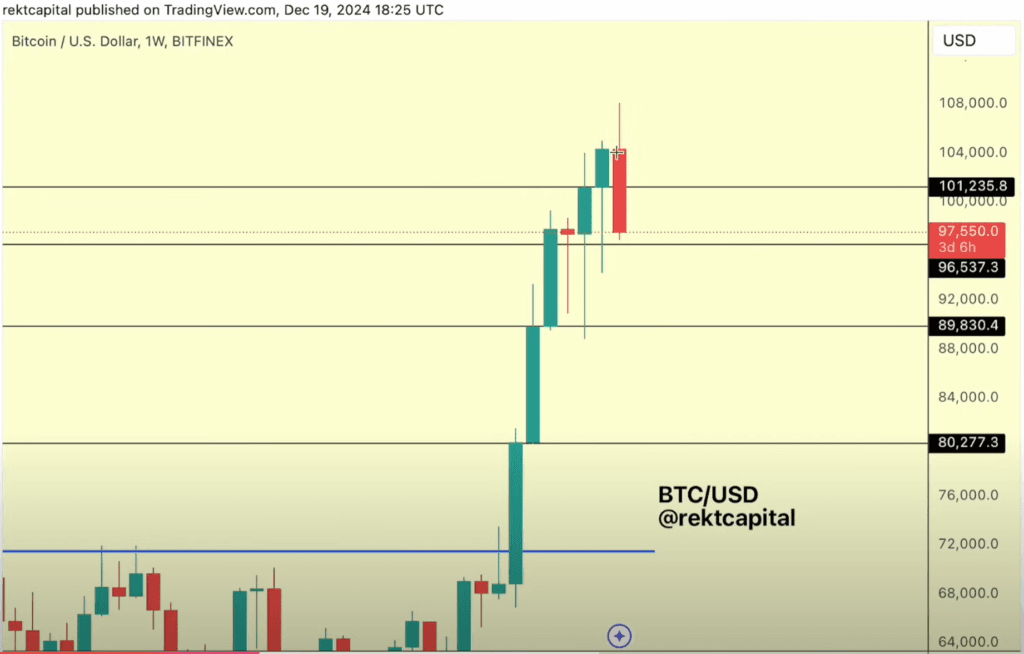

As of the present cycle, Bitcoin has undergone a ten%+ retracement, bringing its value right into a traditionally important help zone at $96,537 on the weekly chart. Rekt Capital emphasised the significance of this help degree, noting, “This space of historic help has enabled the transfer to $108,000.” He cautioned that failure to take care of this help might set off a extra extreme correction right down to $89,830.

Inspecting the value motion of the previous couple of days, Rekt Capital identified the emergence of a bearish engulfing candle within the weekly timeframe—a technical indicator typically related to potential reversals. “We’re shedding resistances that changed into help,” he noticed. This loss signifies a possible transition right into a corrective interval, as the value struggles to take care of its upward trajectory.

Associated Studying

Rekt Capital additionally identified the significance of sustaining the 5-week technical line in his evaluation. “If we lose this 5-week technical uptrend and the orange pattern line, it could be mounting proof that we could be transitioning right into a corrective interval,” he warned.

Moreover, he addressed the CME gap between the $78,000 and $80,000 value ranges, a important space that has remained unfilled. “Delving into 26%, 27%, 28% dips might fill all the CME hole,” Rekt Capital famous.

Traditionally, CME gaps have the tendency to get stuffed whereas there are a couple of ones which have by no means been stuffed.

Regardless of all cautionary alerts, Rekt Capital maintains a bullish stance within the long-term “These pullbacks are what allow future uptrends within the parabolic section of the cycle,” he defined. Drawing from earlier cycles, he illustrated how corrections have traditionally offered the required “breather” for the market.

Within the 2021 cycle, for instance, Bitcoin skilled a 16% pullback in week 6 and an 8% dip in week 8, but the general pattern continued upward. Equally, the present 10% retracement, whereas vital, might function a preparatory section for the next leg of price discovery.

At press time, BTC traded at $95,000.

Featured picture created with DALL.E, chart from TradingView.com