- Bitcoin reached an area excessive of $57.1k, and may prolong larger

- The late, high-leverage bullish speculators could be punished quickly.

Bitcoin [BTC] broke out previous the twelve-day vary that it had established as bullish euphoria soaked the crypto markets. Information that MicroStrategy had acquired one other 3000 BTC bolstered the bullish conviction.

Mixed with the huge capital inflows into Bitcoin ETFs, the latest breakout has some severe momentum behind it.

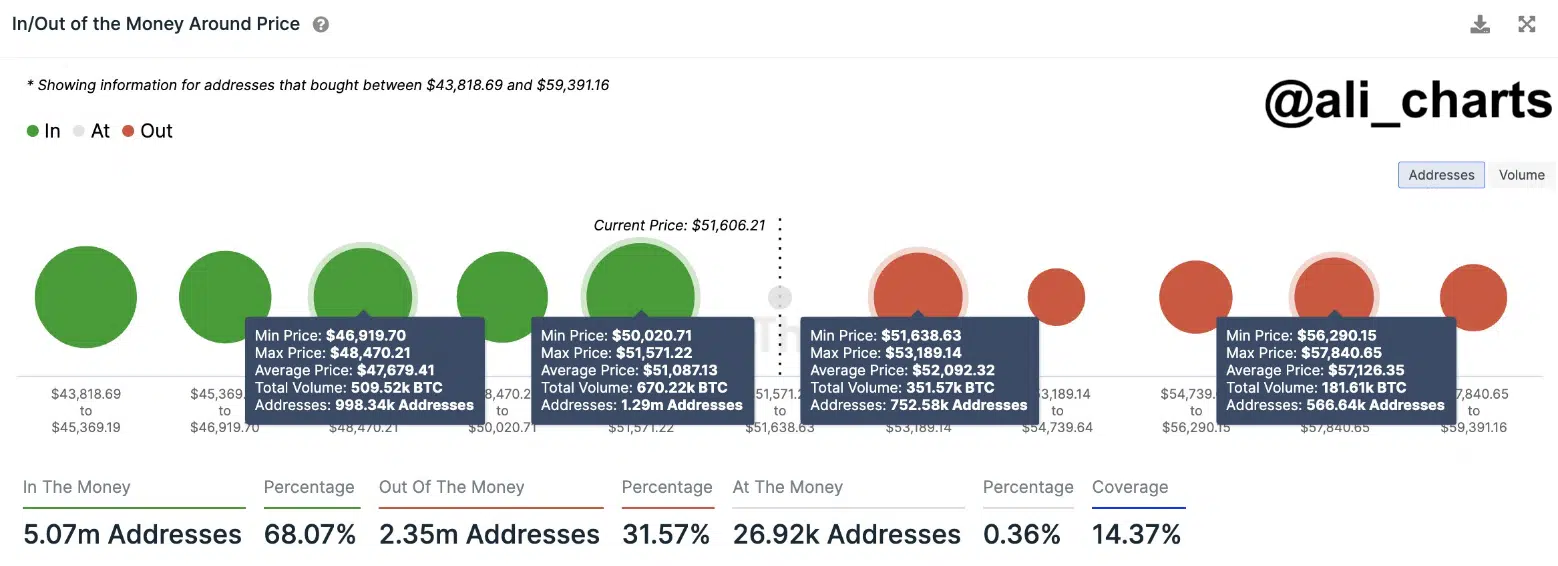

Ali Martinez, a distinguished crypto analyst, posted on X (previously Twitter) that the $57.1k is a major pocket of resistance. This has come to move in latest hours, however the power of the transfer was a shock.

Supply: Ali on X (previously Twitter)

The vary has been blown extensive open

Highlighted in purple was a variety that Bitcoin has traded inside for the reason that seventeenth of February. It stretched from $50.6k to $52.5k. The latest surge noticed an H4 candle shut above the vary highs and proceed to the $57.1k degree.

The RSI and the OBV noticed an enormous transfer upward. The RSI confirmed overbought circumstances and the OBV mirrored heavy shopping for quantity. The upper timeframe chart confirmed that the following important resistance degree was on the $59k level.

Was the rally pushed by the futures markets?

Supply: Coinalyze

The Open Curiosity and the spot CVD soared larger throughout the rally. Apparently, the Open Curiosity had been muted from the twenty third of February to the twenty sixth. The speculators confirmed frenzied exercise as BTC raced above the $51.8k mark.

In the meantime, the spot CVD has steadily trended larger prior to now 5 days. It accelerated throughout the breakout and has not stopped. Due to this fact, it appeared that there was extra room for good points.

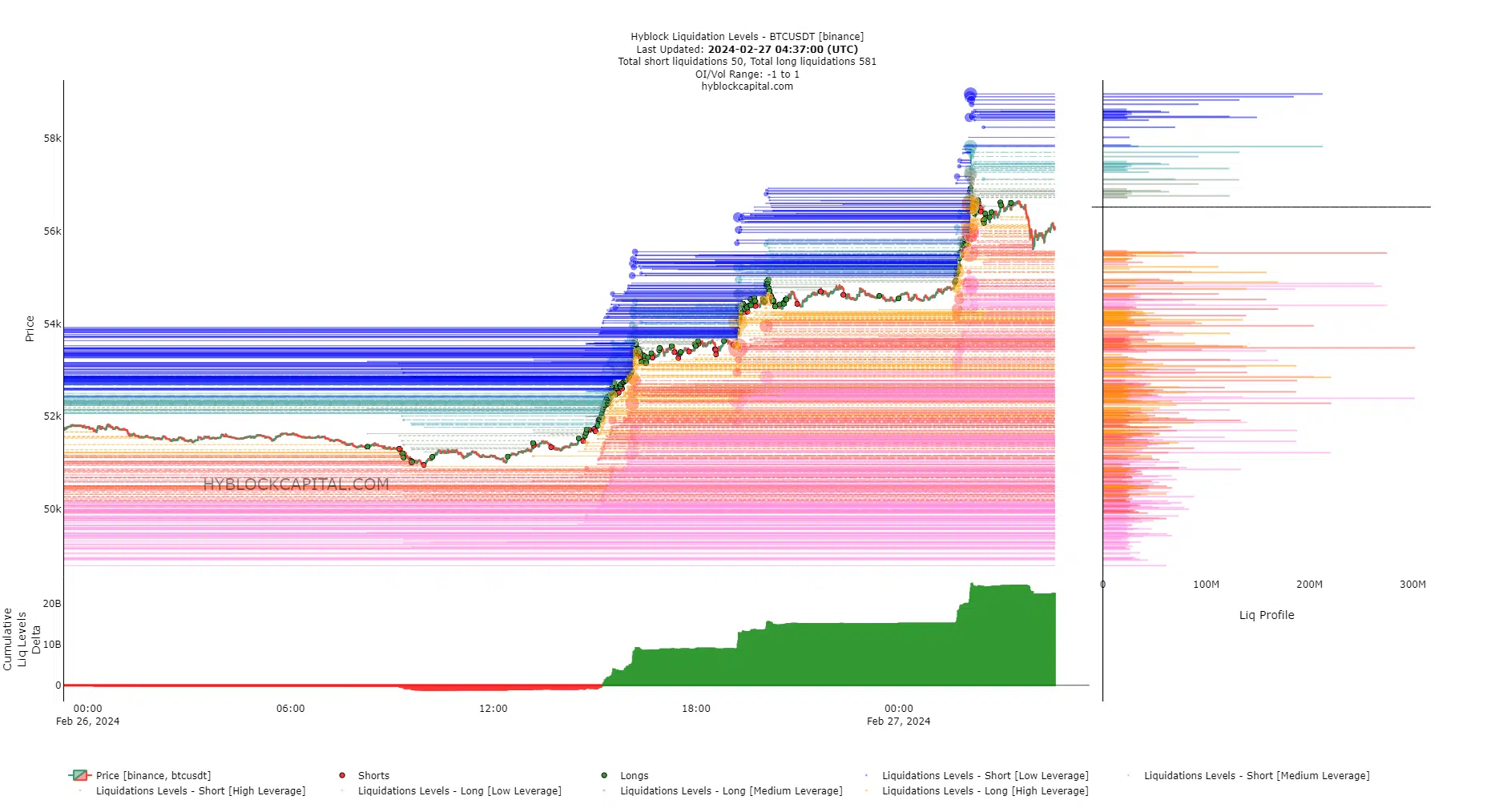

Supply: Hyblock

But, there have been legit issues that the market could be overheated on the decrease timeframes. AMBCrypto’s evaluation of the Liquidation Ranges confirmed that the Cumulative Liq Ranges Delta was massively inexperienced.

It confirmed a studying of +22.45 billion at press time, which meant the lengthy liquidations far outweighed the quick ones. In flip, this meant that Bitcoin would are likely to retrace southward over the following couple of days to power these positions to shut.

Is your portfolio inexperienced? Test the BTC Profit Calculator

The $55.5k, $53.5k, and $52.4k ranges have been estimated to have round $300 million in lengthy liquidations.

The previous two have been high-leverage bulls. Therefore, a revisit of the $53.5k degree shortly appeared very probably. A drop to the $52.4k degree could be a retest of the previous vary highs and would supply a shopping for alternative as nicely.