- The altcoin market was performing effectively prior to now 5 months, however the halving fears stalled it.

- The subsequent such run might take some time to materialize, however will depart telltale indicators.

The altcoin market has misplaced a whole lot of worth prior to now month as fears swirled round a Bitcoin [BTC] halving.

Outstanding crypto analyst Ali Martinez noticed on X (previously Twitter) that altcoin seasons begin shortly after Bitcoin halving.

An alt season is when the market capitalization of altcoins multiplies. Given how capital rotation is believed to work within the crypto house, this normally doesn’t final quite a lot of months.

But, it offers buyers an important alternative to seize income.

Is one other altcoin season looming?

Supply: Ali_charts on X

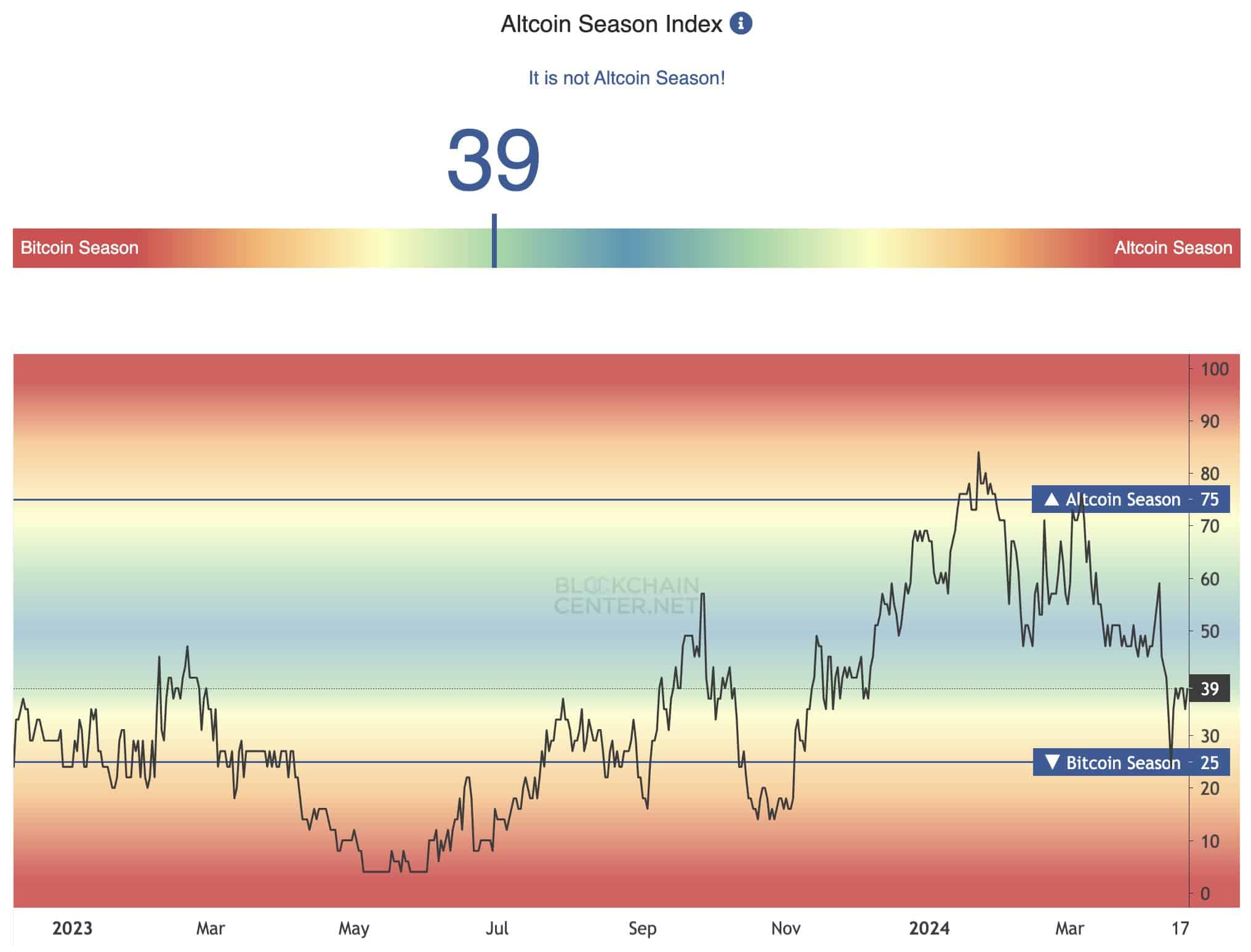

The altcoin season index reached above 75 in early 2024. The halving occasion noticed the index oscillate to the 25 worth to mirror Bitcoin season- however in actuality, altcoins misplaced much more worth than Bitcoin prior to now month.

This was a results of the concern of promoting stress behind Bitcoin. At press time, the index was at 39 and didn’t mirror an altcoin season upon us.

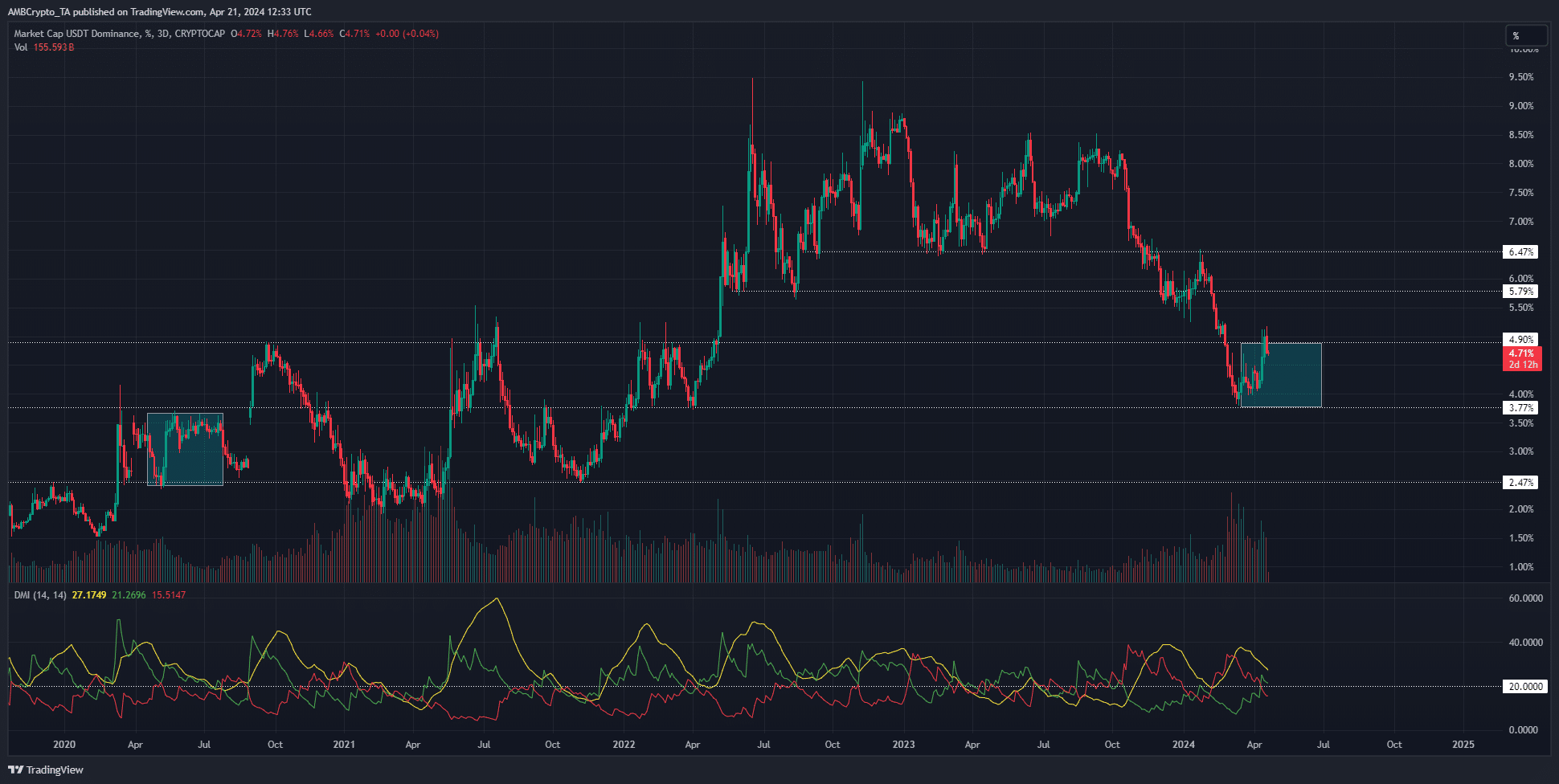

Technical evaluation of the Tether [USDT] dominance chart confirmed that its downtrend was nearing an finish.

The USDTD trending downward is an effective signal as a result of it denotes buyers assuming threat and exchanging stablecoin for crypto property.

A USDT dominance’s upward pattern would present the other.

Due to this fact, in an altseason, we wish a robust downtrend. The Directional Motion Index on the 3-day chart confirmed {that a} downtrend was in play from late October to early April.

This was a sizeable period of time and urged that the market would want time to reset earlier than the subsequent downtrend. Moreover, the cyan bins spotlight the 2020 and 2024 BTC halvings.

If the 2020 similarities play out, we might see altcoins lose extra worth within the coming weeks.

Shopping for energy out there was rising

Supply: CryptoQuant

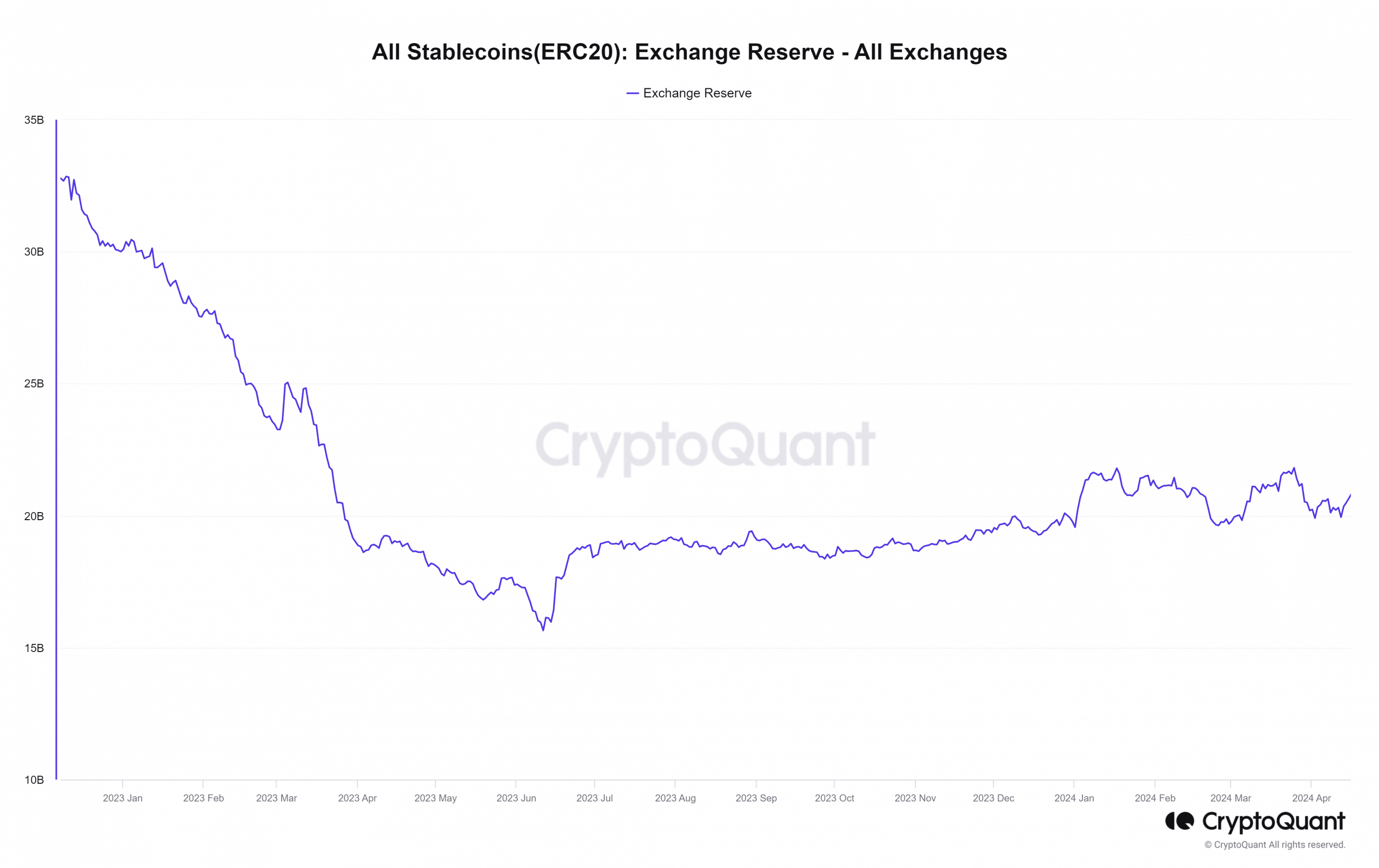

AMBCrypto’s evaluation of CryptoQuant information confirmed that the shopping for energy was climbing increased since mid-October. The alternate reserve of stablecoins is a mirrored image of the shopping for energy within the crypto market.

Evaluating it to the 2020-2021 run, the metric has not but gone parabolic prefer it did within the earlier cycle. The huge enlargement of market capitalization in 2021 noticed the alternate reserves climb dramatically.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Due to this fact, one other fast rise in stablecoin reserves could be an indicator that one other altcoin season is upon us.

Combining it with the Tether dominance chart and the altcoin season index might give buyers an edge within the markets.