- Buyers withdrew $563.7 million, signaling a possible sentiment shift post-inflows

- BNP Paribas revealed its Bitcoin funding, marking a reversal in perspective

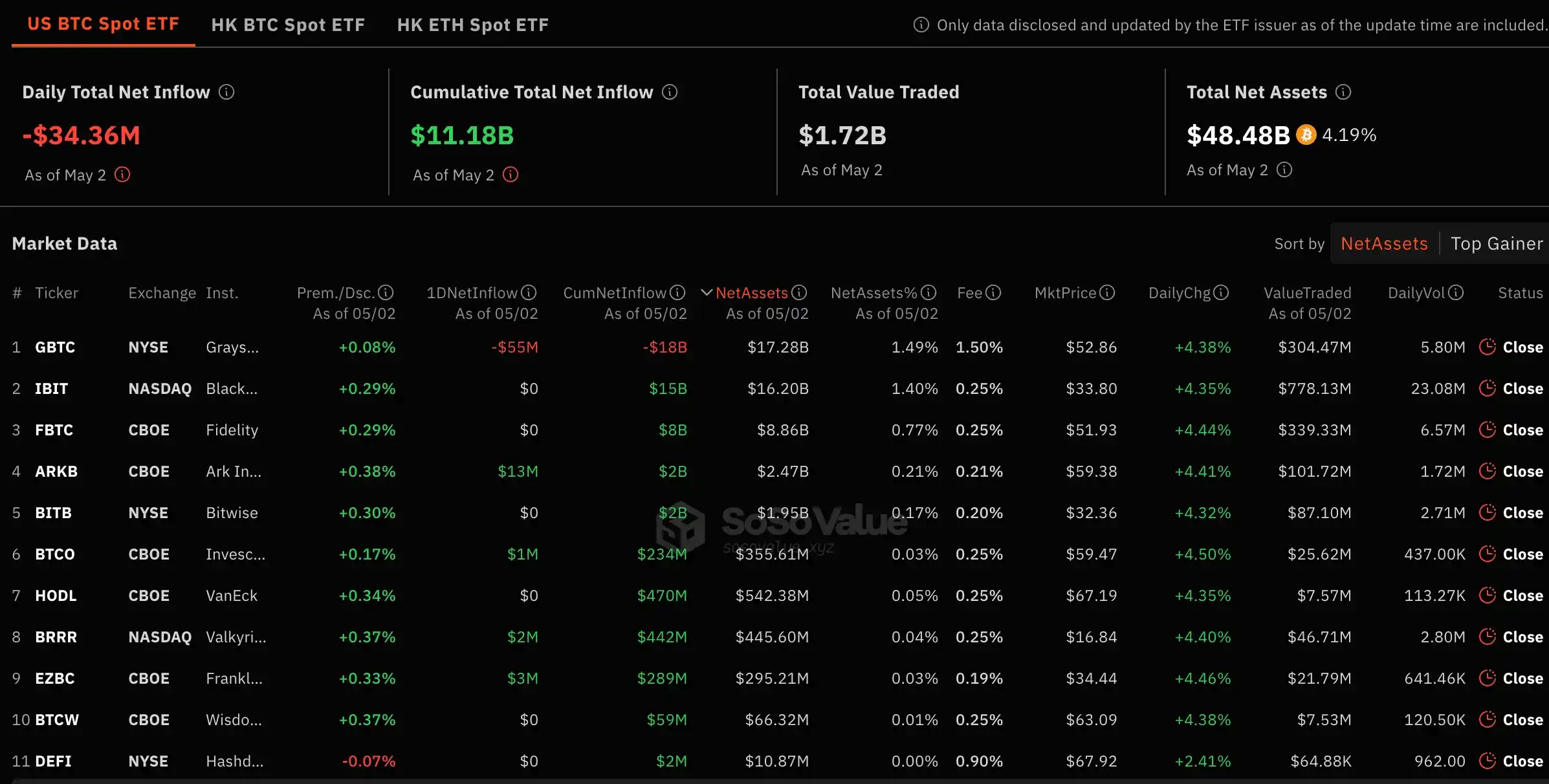

Bitcoin [BTC], on the time of writing, gave the impression to be recovering from its latest dip under $60,000. Nevertheless, it wasn’t all excellent news as spot BTC exchange-traded funds (ETFs) skilled a break of their inflows after a exceptional 71-day streak.

In truth, in accordance with a Bloomberg report, traders withdrew value $563.7 million from BTC ETFs on 1 Might. This marked the most important single-day outflow since these spot ETFs’ debut in January, signaling a possible shift in investor sentiment after a chronic interval of inflows.

Robert Mitchnick clears the confusion

Clearing the air across the similar, Robert Mitchnick, Head of Digital Belongings for BlackRock, in a latest interview mentioned,

“Don’t be fooled…the present lull is prone to be adopted by a brand new wave from a distinct kind of investor.”

Right here, the exec is perhaps referring to a resurgence of curiosity in Bitcoin amongst institutional traders, together with sovereign wealth funds, pension funds, and endowments.

One thing comparable was confirmed when BNP Paribas, one of many largest banks in Europe, made its play by buying shares in BlackRock’s iShares Bitcoin Belief (IBIT).

In response to a Kind 13F filing with the U.S. Securities and Alternate Fee (SEC), BNP Paribas, Europe’s second-largest financial institution, bought 1,030 IBIT shares for $41,684.10 in Q1 2024. Every share was priced at $40.47, considerably decrease than the present worth of a single Bitcoin.

Apparently, again in September 2022, Sandro Pierri, Head of the fund administration group BNP Paribas Asset Administration, had mentioned,

“We aren’t concerned in cryptocurrencies and we don’t need to be concerned.”

What this demonstrates is a reversal within the financial institution’s place, whereas additionally reflecting a newfound curiosity or willingness to interact with Bitcoin as an funding asset.

Remaking on the identical, Coinbase CFO Alesia Haas, in a dialog with CNBC, mentioned,

“Properly, ETFs have unlocked a flywheel of engagement on our platform. Sure, we noticed $11 billion of inflows into ETFs however, we additionally noticed a rise in client buying and selling on our platform…”

Rising acceptance of digital property

All this has additional resulted in a horse race amongst varied Bitcoin ETFs. Topping the charts proper now are IBIT and Grayscale’s GBTC.

In conclusion, institutional curiosity in BTC and Bitcoin ETFs alerts the rising acceptance of cryptocurrencies. BlackRock’s academic efforts in direction of Bitcoin and Ethereum [ETH] ETFs and their adoption, as highlighted by Mitchnick, additional spotlight a shift in direction of recognizing digital property’ potential in portfolios.