- ETH has struggled to provoke an uptrend on the charts

- Most market indicators and metrics appeared bearish

At press time, Ethereum’s [ETH] every day and weekly worth charts remained inexperienced. Nonetheless, the development could be short-lived. In reality, as per a current evaluation, there could also be probabilities of ETH dropping to $2.7k earlier than it even begins a bull rally. Therefore, AMBCrypto checked ETH’s present state to raised perceive what to anticipate within the short-term.

Bears v. Bulls for Ethereum

Ethereum was considerably bullish on the charts within the final 24 hours, with its worth mountaineering by simply over 1%. In accordance with CoinMarketCap, on the time of writing, ETH was buying and selling at $3,035.04 with a market capitalization of over $364 billion.

Nonetheless, bears would possibly quickly step up, with a current evaluation suggesting that ETH would possibly drop to $2.7k. Crypto Tony, a preferred crypto-analyst, lately shared this projection, highlighting ETH’s potential future trajectory. As per the tweet, ETH’s worth will first attain its assist degree of $2.7k, earlier than starting a rally, which could enable it to the touch $5.4k.

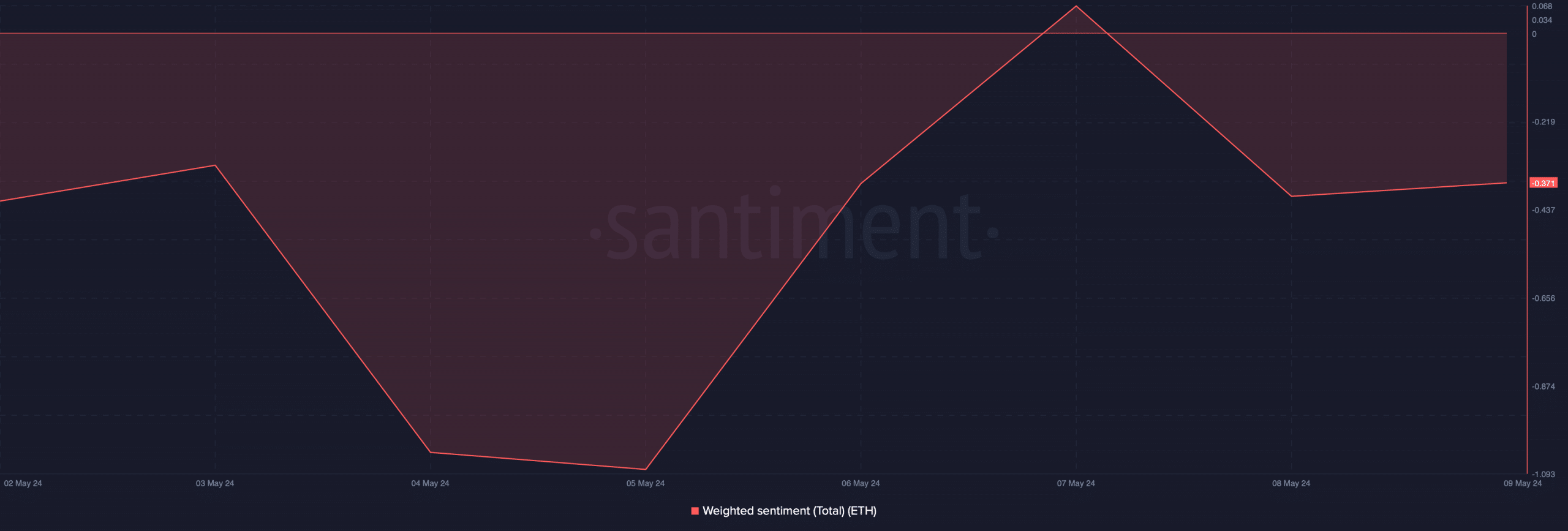

The opportunity of ETH dropping to $2.7k appears probably since traders’ confidence within the token has fallen dramatically. AMBCrypto’s evaluation of Santiment’s information additionally revealed that ETH’s weighted sentiment was within the unfavourable zone – An indication that bearish sentiment retained its dominance available in the market.

Other than that, fairly just a few different metrics additionally appeared considerably bearish too.

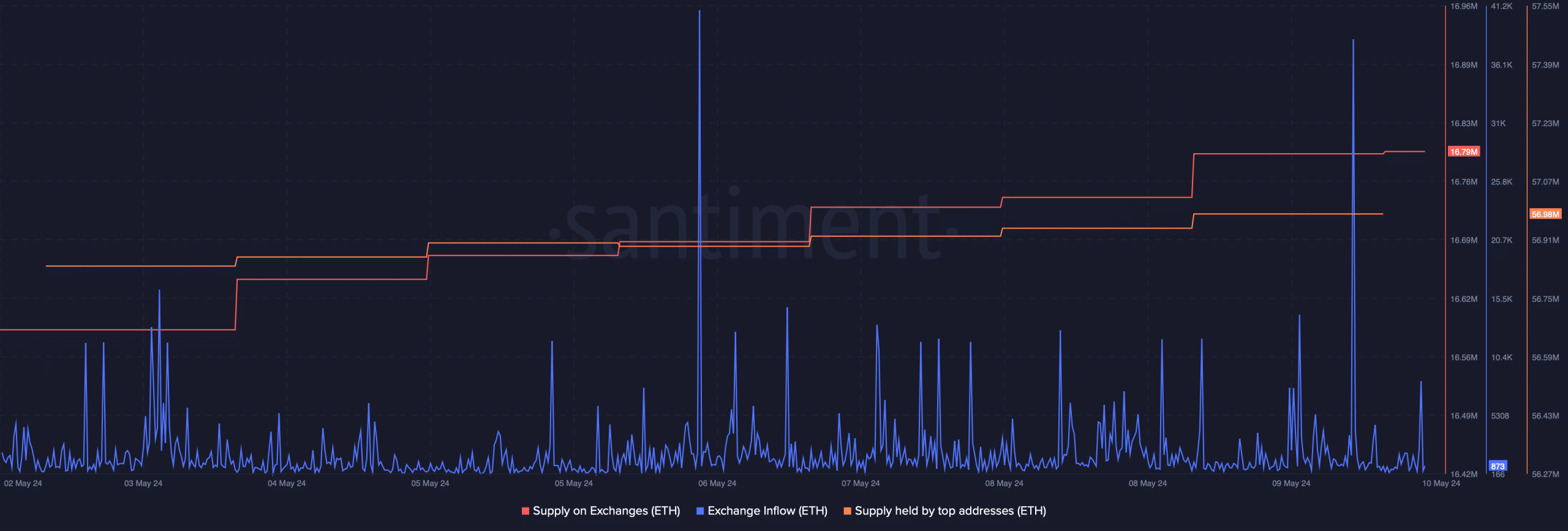

For instance, ETH’s change influx spiked, reflecting a hike in promoting strain. The truth that traders have been promoting ETH was additional confirmed by its provide on exchanges, which elevated over the previous week.

Notably, whereas traders bought their holdings, whales went the opposite route as they stored accumulating – As evidenced by the slight rise within the provide held by prime addresses.

Future targets

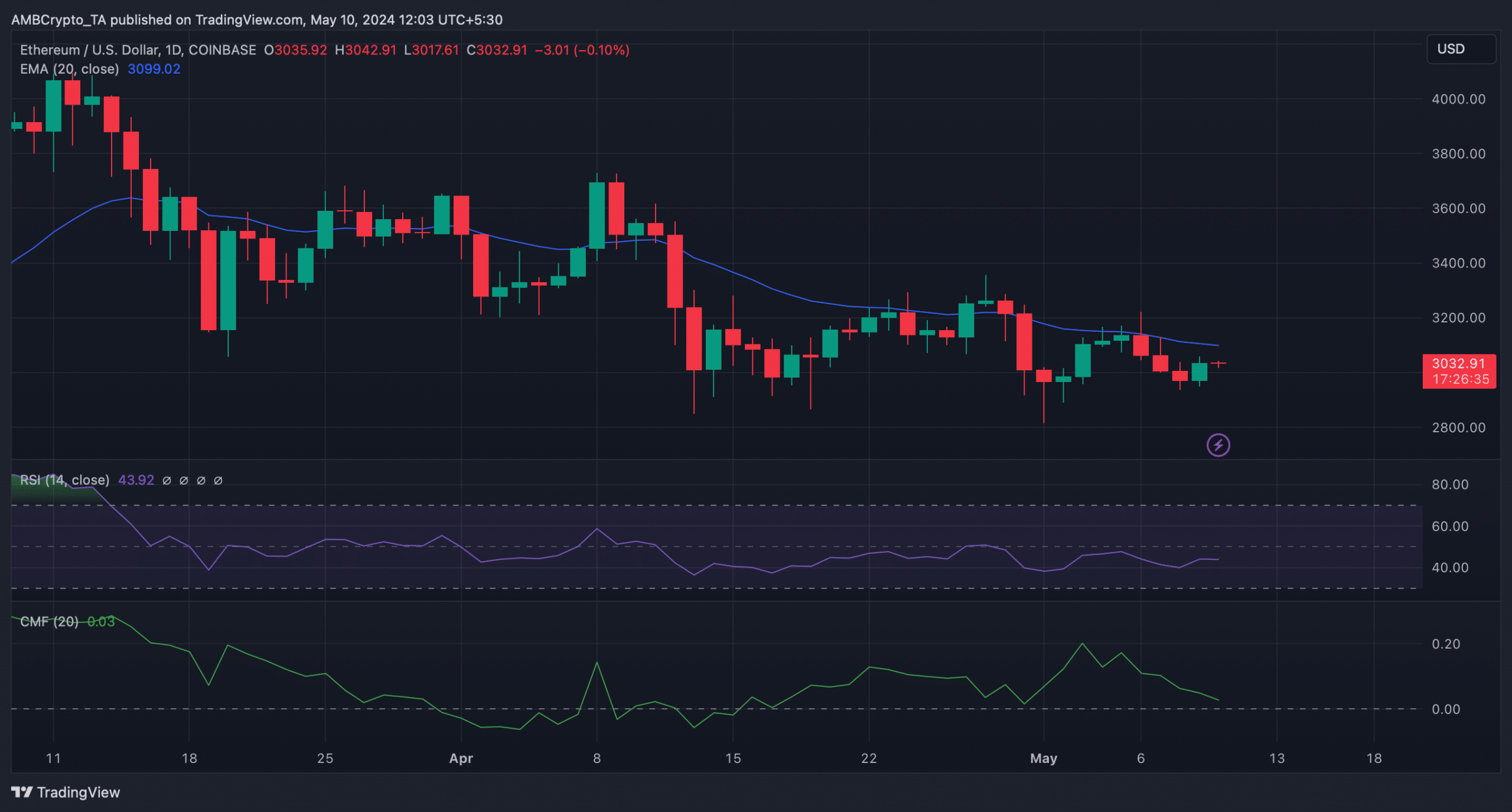

AMBCrypto reported beforehand that the crypto-market was bearish on Ethereum. To see whether or not that was nonetheless the case, we then analyzed ETH’s every day chart. As per our evaluation, market indicators continued to stay bearish.

The token’s worth was resting decrease than its 20-day Exponential Shifting Common (EMA). The Relative Energy Index (RSI) was below the impartial degree. Moreover, ETH’s Chaikin Cash Move (CMF) additionally went south, suggesting that the probabilities of ETH dropping to $2.7k had been excessive.

Is your portfolio inexperienced? Try the ETH Profit Calculator

That being mentioned, traders shouldn’t fear about ETH’s worth development being all dangerous since there’s a chance of a development reversal earlier than $2.7k.

If ETH manages to check its assist close to $3k, then the situation would possibly flip bullish. A drop beneath that degree would end in ETH touching one more resistance close to $2.92k, relying on whether or not it would rebound if issues fall into place.