Ethereum, the world’s second-largest cryptocurrency, has been on a rollercoaster journey recently, dipping beneath the psychologically essential $3,000 threshold solely to claw its manner again, Ethereum’s price action has been a complicated mixture of bullish and bearish indicators.

Bullish Whispers: New Buyers And Quick-Time period Spikes

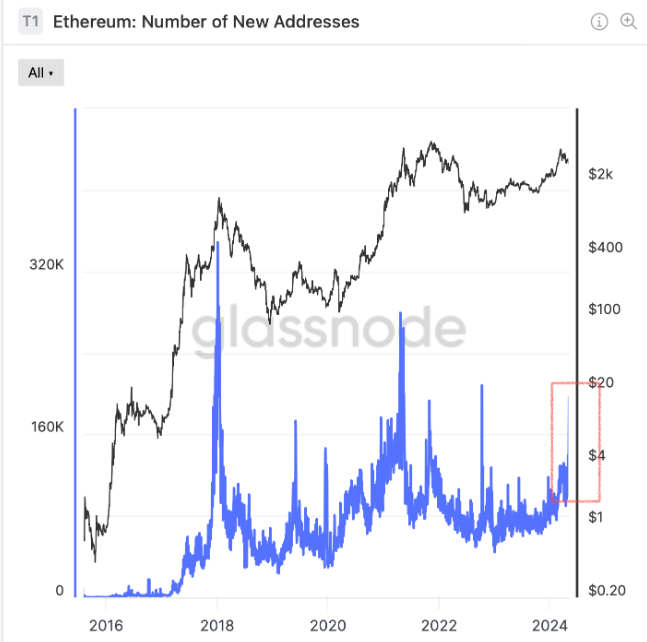

A glimmer of hope emerged for Ethereum bulls with a latest surge in new addresses on the community. In keeping with Glassnode data, the variety of new Ethereum addresses has skyrocketed, surpassing 160,000 – a stark distinction to the lows of beneath 100,000 witnessed in January.

This inflow of recent customers suggests rising curiosity and potential funding in Ethereum, even amidst its latest struggles.

Supply: Glassnode

Moreover, technical indicators on the 4-hour chart trace at a potential short-term upswing. Analysts at NewsBTC level in the direction of elevated volatility, signified by the widening Bollinger Bands, which may pave the best way for a brief value hike. This strategic transfer by the market is likely to be geared toward luring in patrons earlier than the prevailing downtrend resumes.

Bearish Shadow Looms: Market Sentiment And Technical Tendencies

Nevertheless, the jubilation could also be short-lived. The general market sentiment surrounding cryptocurrencies stays decidedly unfavourable, a development persisting because the much-anticipated Bitcoin halving occasion in April did not ship a major market surge, information from Santiment reveals, suggesting investor warning regardless of the transient value restoration.

😒 The sentiment towards #crypto‘s prime cap property remains to be quite unfavourable. This has been the case because the April nineteenth $BTC #halving didn’t instantly lead to rising market caps all through #cryptocurrency. With uncertainty excessive, small wallets dropping out of the sector could also be… pic.twitter.com/7FXYheGnX0

— Santiment (@santimentfeed) May 9, 2024

Including gasoline to the bearish hearth, Ethereum’s every day chart continues to color a hazy image. Technical analysts level in the direction of sustained breaks in value construction to the draw back, indicating a possible continuation of the downtrend. Even the Relative Power Index (RSI) sits at a low 40, additional reinforcing the bearish sentiment gripping the market.

Ethereum is now buying and selling at $2,904. Chart: TradingView

Chart Patterns And Breakout Potential: A Impartial Take

Amidst the conflicting indicators, seasoned dealer Peter Brandt supplied a extra impartial perspective. Analyzing Ethereum’s value chart, which he described as “intriguing,” Brandt recognized two potential technical patterns: a flag and a channel.

ETH $ETH is turning into a really intriguing chart to me

The sample is simply too lengthy to be thought-about a flag, however a channel is the almost certainly labeling

I may go both manner with this chart pic.twitter.com/EeSa7SyAmA— Peter Brandt (@PeterLBrandt) May 9, 2024

Whereas a flag sometimes signifies a continuation of the present development after a quick pause, a channel permits for value motion inside an outlined vary. The paradox surrounding the precise sample suggests a possible breakout in both route, leaving Ethereum’s quick future unsure.

Ethereum: The Street Forward

With conflicting technical indicators and a market shrouded in negativity, Ethereum’s future trajectory stays shrouded in uncertainty. Whereas short-term value spikes are a risk, the long-term development seems to be leaning bearish.

The approaching weeks might be essential for Ethereum, because it navigates these turbulent waters and makes an attempt to chart a transparent course within the coming weeks or months.

Featured picture from Pexels, chart from TradingView

Supply:

Supply: