- Ethereum has a barely extra bullish bias for the approaching week.

- The Bitcoin consolidation part was nonetheless ongoing, and a revisit to $60k was rising extra seemingly.

Bitcoin [BTC] merchants have been going via a comparatively powerful interval after the simple, easy rallies which have been the norm since final October.

Ethereum [ETH] has been extra sophisticated, however BTC’s halving occasion final month has modified the market circumstances to cut and vary formations everywhere in the market.

AMBCrypto investigated what the market sentiment was trying like over the weekend, and the place this week’s worth motion may go.

One of many two has speculators expectant of bullish returns within the close to time period

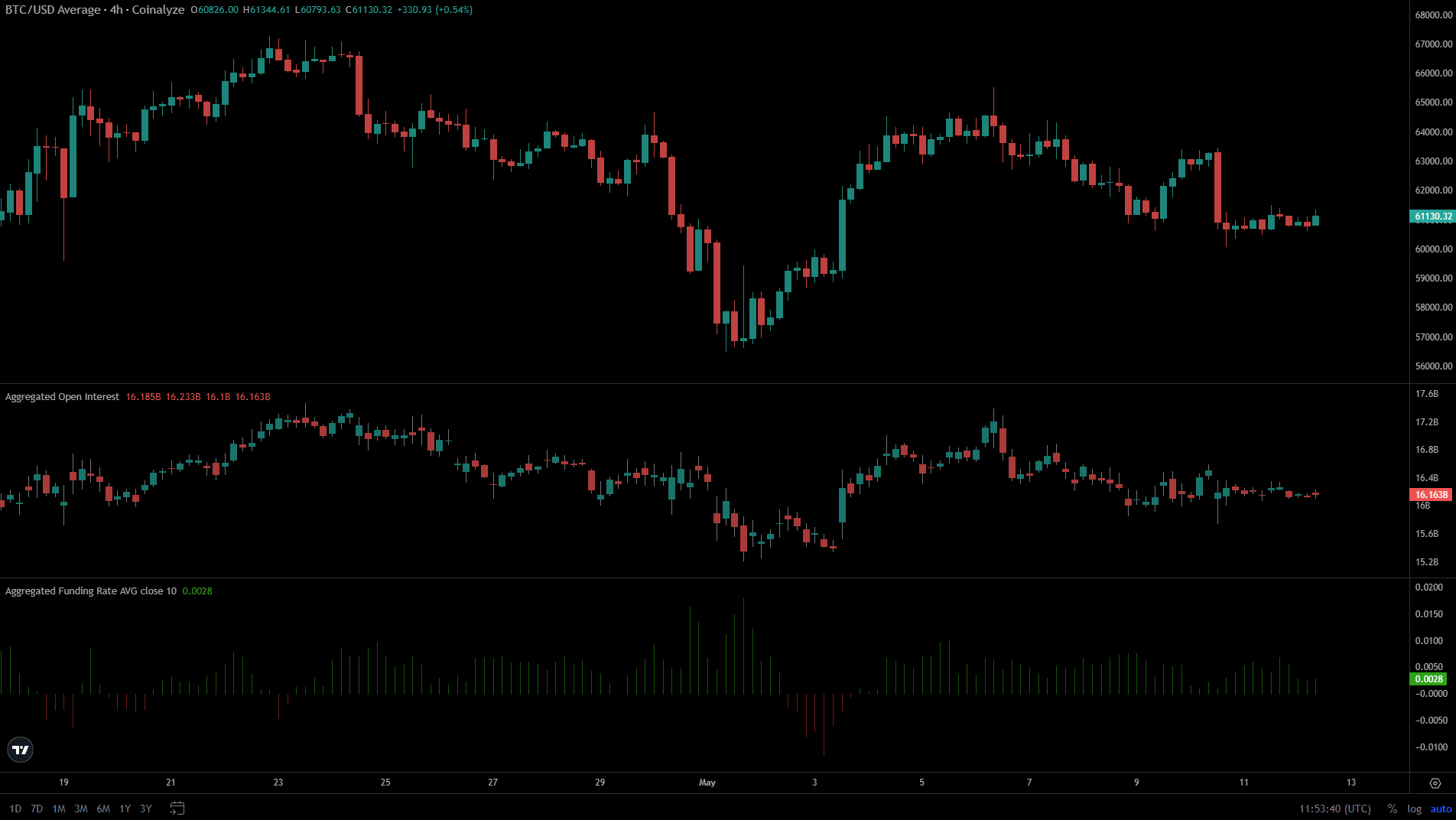

Supply: Coinalyze

The tenth of Might noticed a rise within the Bitcoin Open Curiosity, however the OI has been trending downward because the worth spike on the sixth of Might.

In the meantime, the worth additionally fashioned a sequence of decrease highs over the previous week, descending from $64k to $61.1k at press time.

The Funding Fee was adverse at the beginning of Might when Bitcoin plummeted to $56k. Since then, the Funding Fee has recovered.

Nonetheless, previously few days, it has been barely above zero, which indicated the sentiment was not strongly bullish.

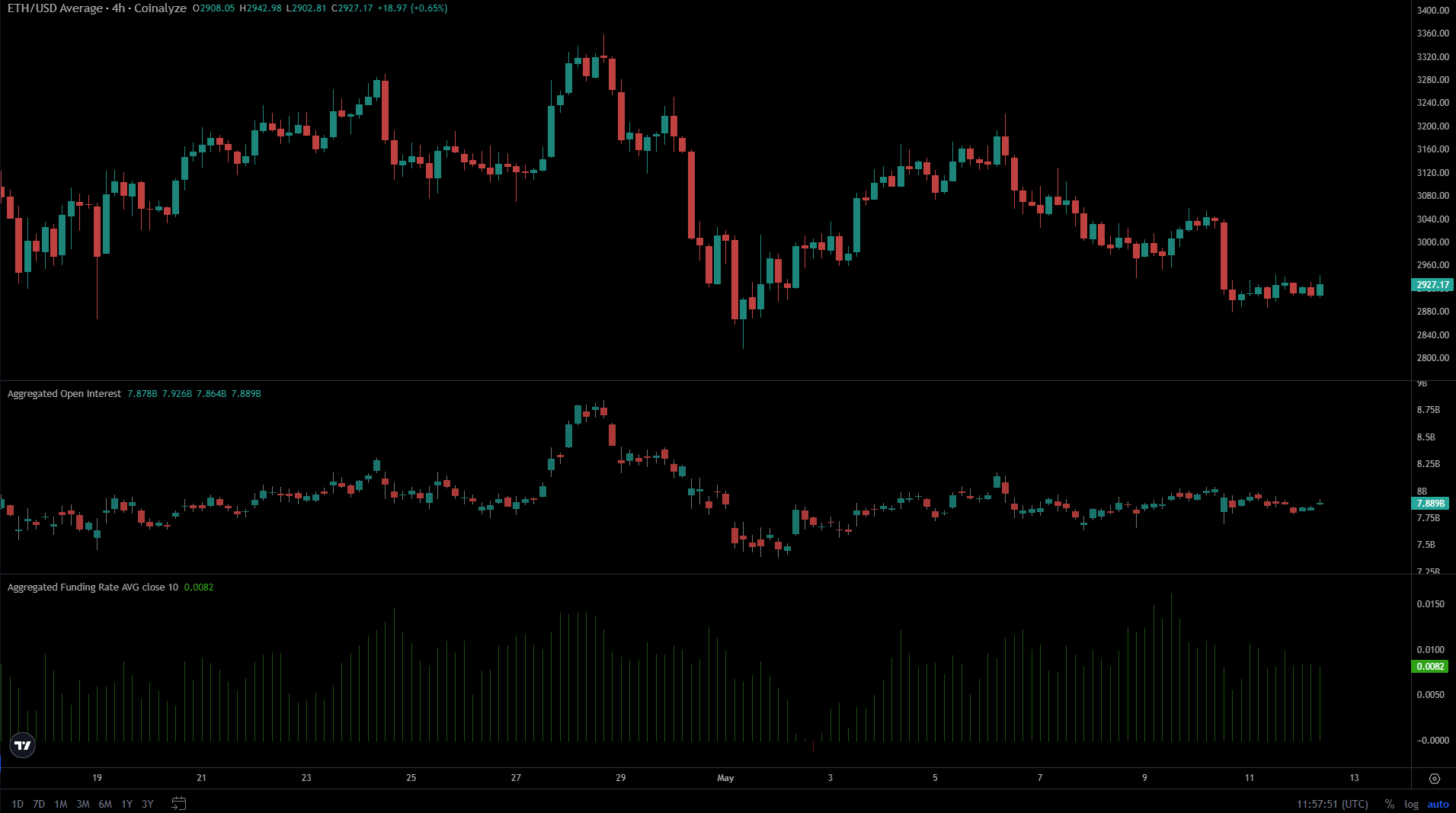

Supply: Coinalyze

Ethereum additionally noticed Funding Charges slip into the adverse territory in early Might however has since recovered. The previous week’s downtrend noticed the funding fee hover across the baseline +0.01 mark.

A slight bounce from $2980 to $3040 on the ninth of Might noticed the Open Curiosity and the funding fee leap greater.

This didn’t repeat with Bitcoin regardless of an identical worth bounce, which recommended that speculators have been extra wanting to lengthy ETH than BTC.

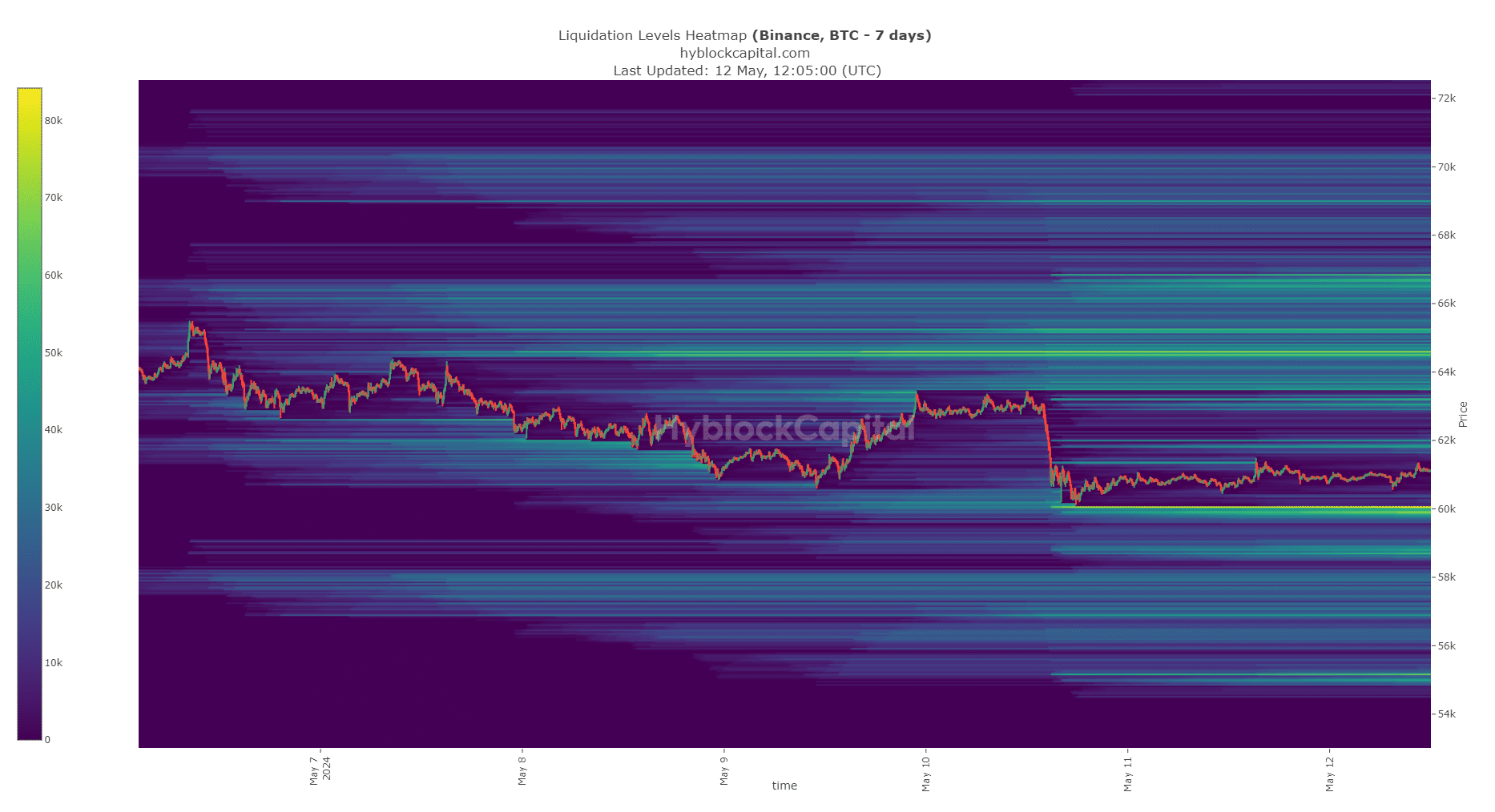

What are the subsequent liquidity pockets that might appeal to costs?

Supply: CryptoQuant

The 7-day liquidation heatmap of Bitcoin confirmed a brilliant cluster of liquidations on the $60k space. To the north, $61.8k and $63k are the subsequent bullish targets.

On the fifth of Might, we noticed costs leap above the $64k mark to gather liquidity earlier than a brutal short-term reversal.

Equally, we’d see a downward plunge on Monday to gather the liquidity at $60k earlier than rebounding greater. Therefore, BTC merchants would need to purchase the dip to the $50.6k-$60k area.

Nonetheless, merchants should even be ready for a transfer under $59.4k for BTC, and set their stop-losses accordingly within the occasion of a dip to $60k.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Price Prediction 2024-25

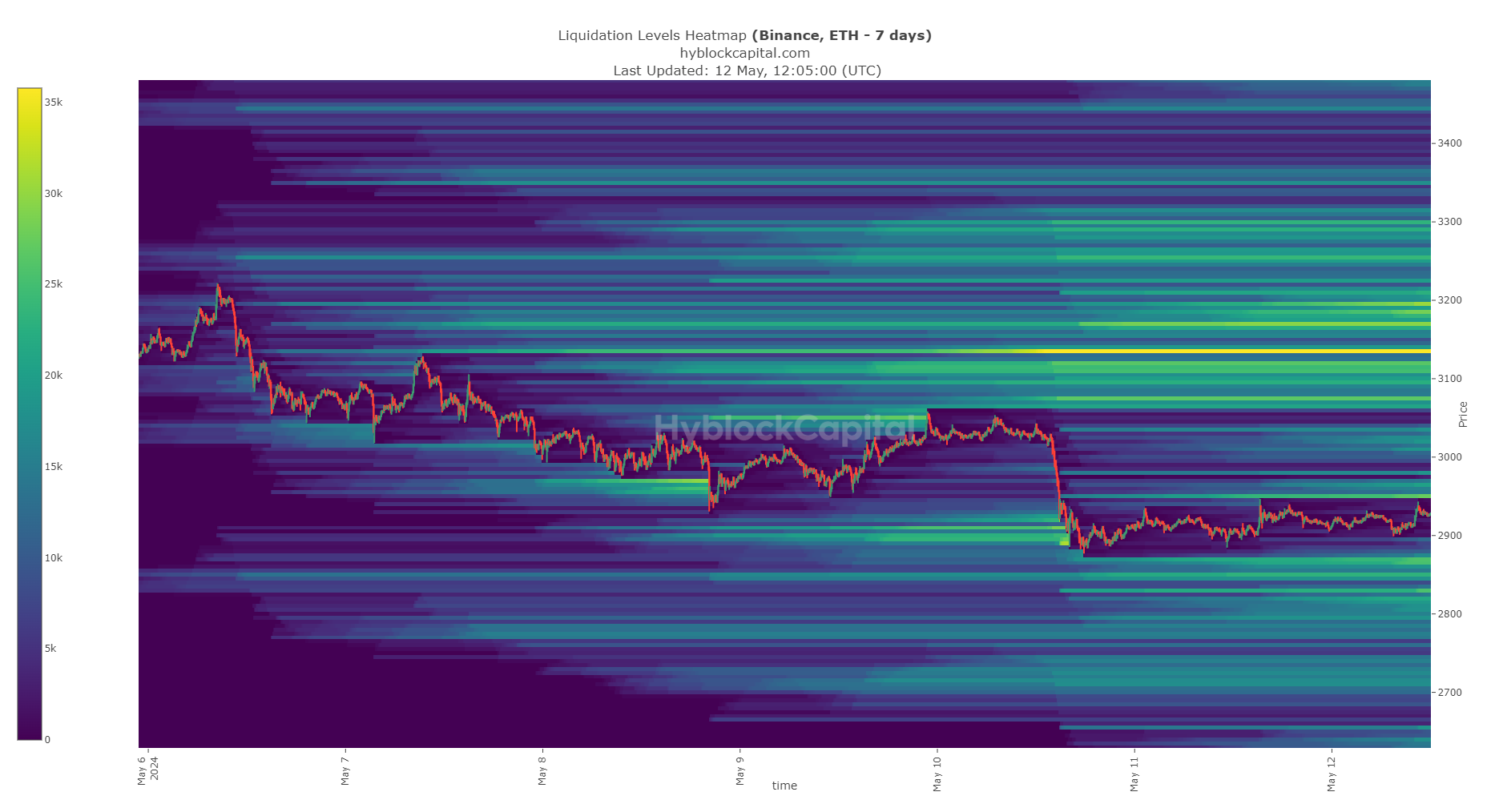

Alternatively, Ethereum has a cluster of liquidity close by to the north at $2950. This was near the present market worth of $2928. A dip to the $2860 area would seemingly current a shopping for alternative.

The liquidation ranges across the $3.1k-$3.2k space current a horny goal. A drop under $2.8k would seemingly herald a robust short-term downtrend, and merchants can lower their losses on this state of affairs.