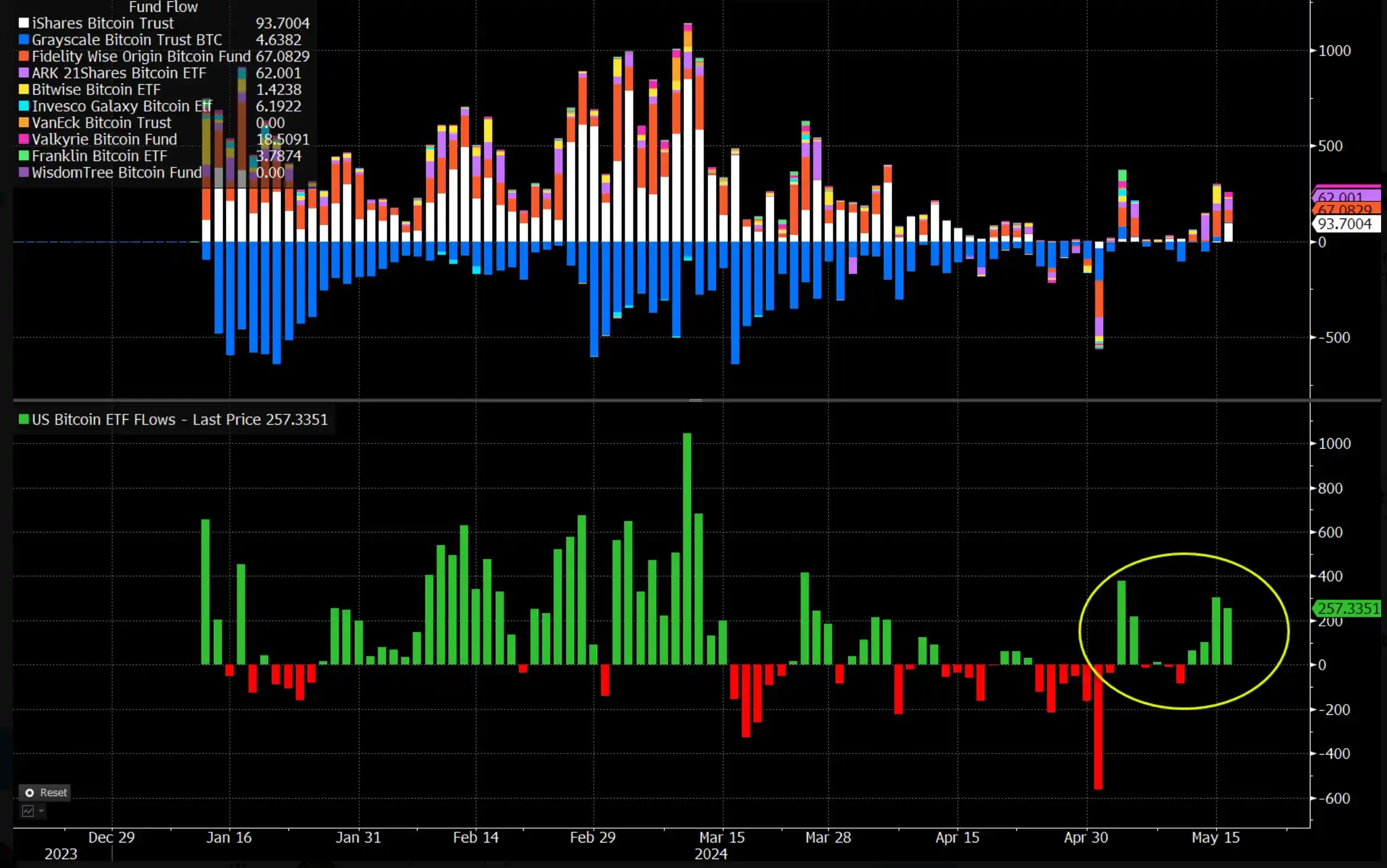

- Institutional curiosity in Bitcoin grows, including liquidity regardless of Grayscale’s latest high-fee withdrawals.

- Retail buyers accumulate Bitcoin, enhancing decentralization, whereas whales present much less curiosity.

Bitcoin [BTC], the main cryptocurrency, is starting to recuperate from a week-long hunch, at the moment valued at $67,093 with a 1.28% improve previously 24 hours.

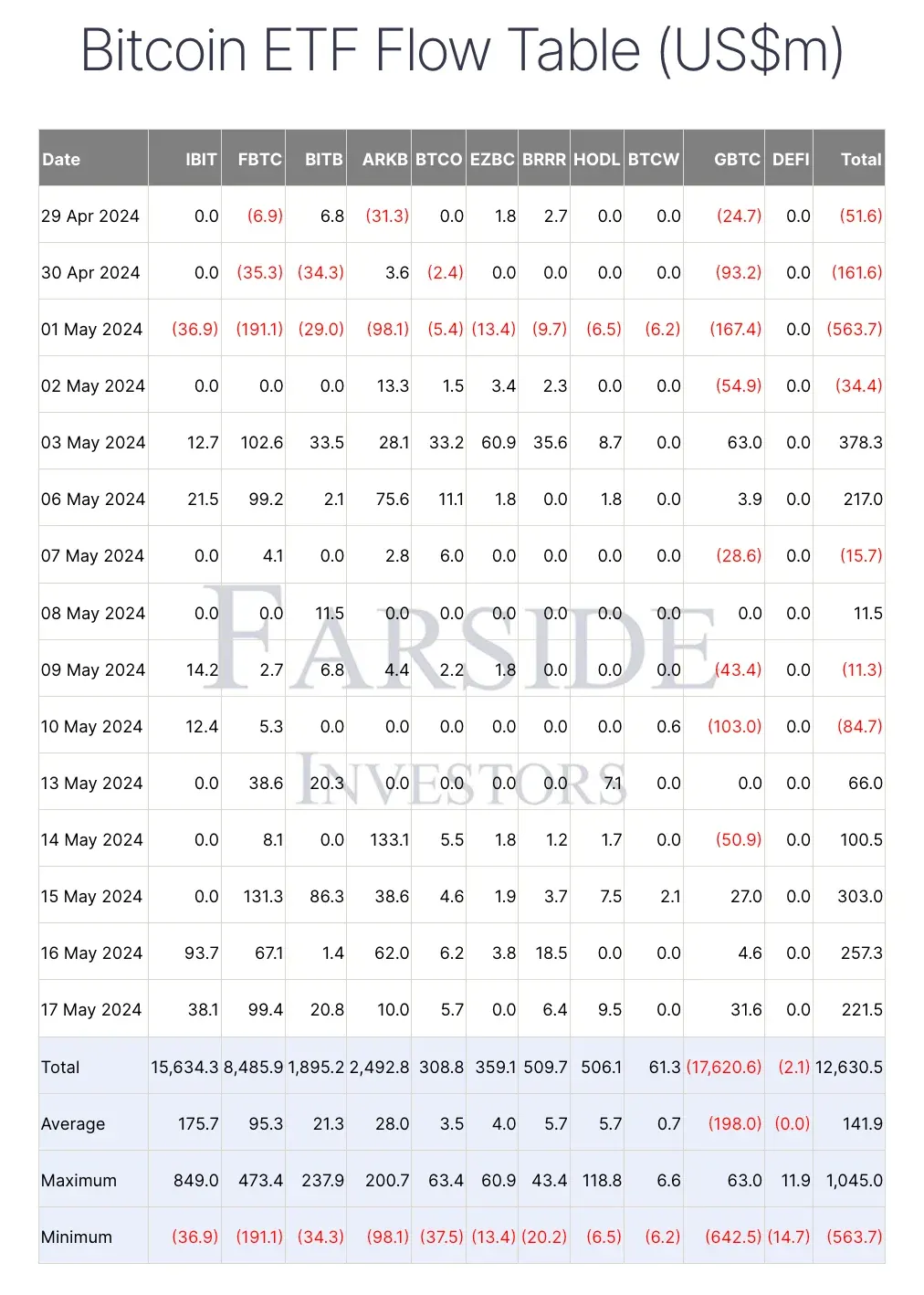

Moreover, on the seventeenth of Might, Farside Investors reported that Grayscale’s spot Bitcoin ETF (GBTC) noticed inflows of $31.6 million, and GBTC now oversaw greater than $18 billion in property.

Nicely, Grayscale has confronted main challenges since changing from a belief to a spot ETF in January. Nevertheless, three consecutive days of inflows have been a boon for GBTC.

What are the execs saying?

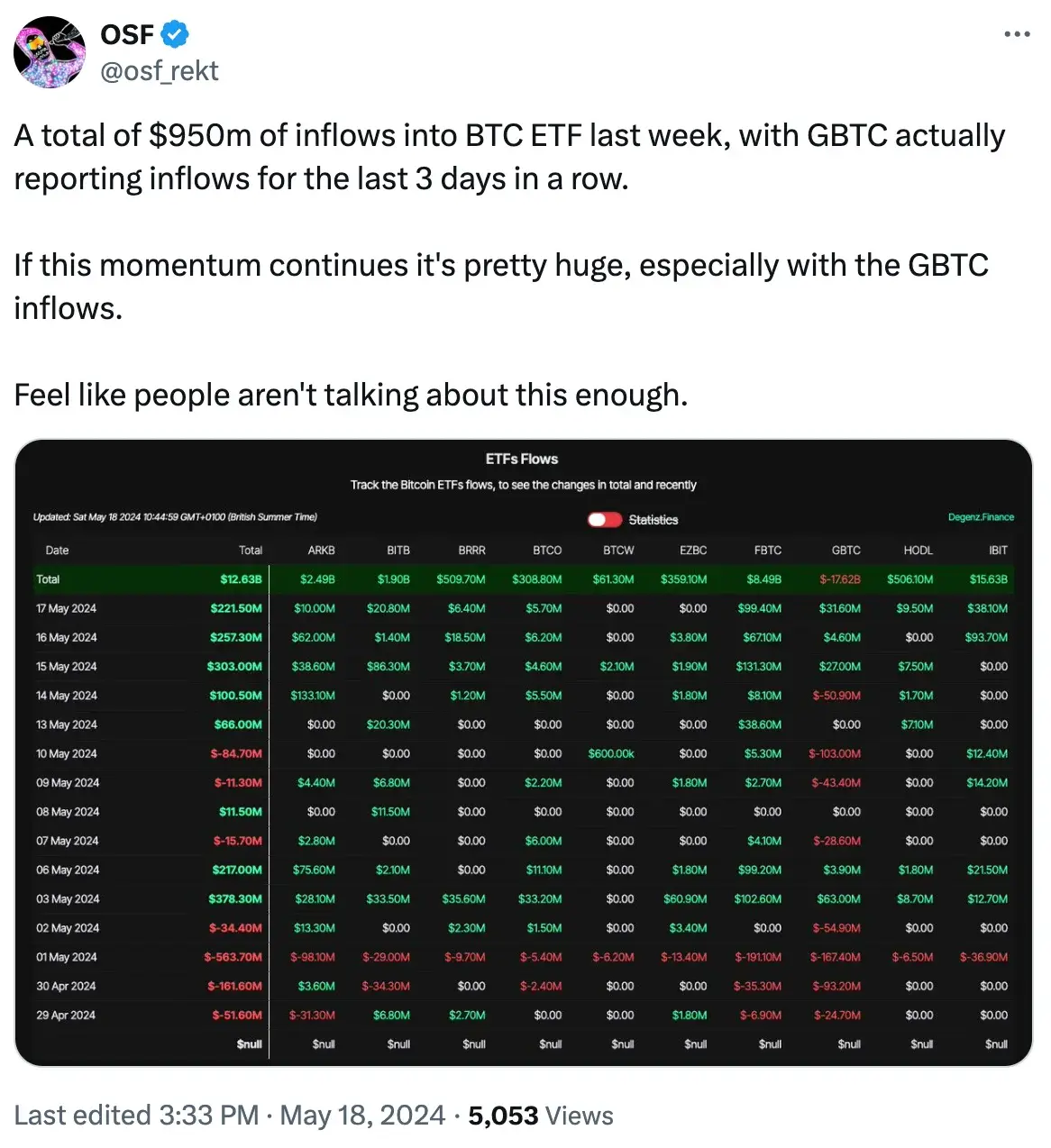

Seeing a constructive outlook of GBTC amongst buyers, an X (previously Twitter) consumer, @osf_rekt stated,

This transition has resulted in over $17 billion in withdrawals, largely as a consequence of greater charges than different choices.

Moreover, a sequence of bankruptcies throughout the crypto business during the last two years compelled firms to withdraw funds to fulfill creditor obligations.

Apparently, on the fifteenth of Might, all spot Bitcoin ETFs, aside from BlackRock’s iShares Bitcoin Belief (IBIT), reported inflows.

Concurrently, on an analogous day, Grayscale’s GBTC notably recorded its first inflows in per week, drawing in $27 million.

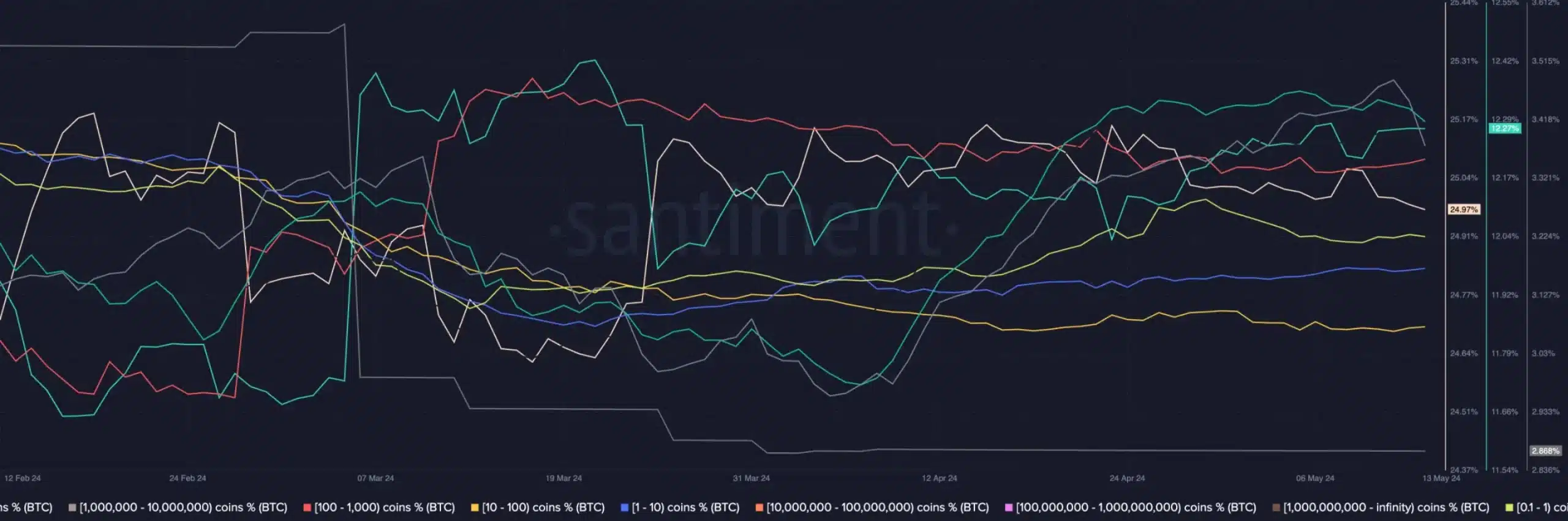

This highlights that institutional buyers are exhibiting curiosity in Bitcoin, bringing liquidity, whereas crypto whales stay much less enthusiastic.

Elevated in retail buyers

Information from Santiment, analyzed by AMBCrypto, point out that whereas whales slowed accumulation, retail buyers are growing, selling community decentralization.

This development of retail accumulation may gain advantage Bitcoin in the long term by selling better community decentralization.

Highlighting Might’s positivity for spot Bitcoin ETFs, Eric Balchunas, Senior Analyst at Bloomberg, famous,

“The bitcoin ETFs have put collectively a strong two weeks with $1.3b in inflows, which offsets the whole lot of the damaging flows in April- placing them again round excessive water mark of +$12.3b web since launch. This key quantity IMO bc it nets out inflows and outflows (that are regular).”

Providing recommendation to buyers, he additional commented,

“Final two mos present why finest to not get emotional over flows which come out and in, a part of ETF life, however a) i feel they’ll web out constructive long-term b) the circulation amts on both aspect are small relative to aum perhaps (1-2%) so it’s by no means SO OVER or SO BACK if you concentrate on it.”