- US ETH ETF might appeal to much less capital flows in comparison with US BTC ETF merchandise

- The analyst based mostly his projection on ETH vs. BTC futures ETFs and Silver vs. Gold.

The much-awaited launch of US spot Ethereum [ETH] ETF (exchange-traded funds) might wrestle to duplicate the success of the Bitcoin [BTC] ETF. In keeping with Bloomberg ETF analyst Eric Balchunas, the much-hyped spot ETH ETFs would possibly seize about ‘20%’ of the BTC ETF’s market share.

A part of Balchunas’ evaluation read,

“I’d at the least divide by 5 relating to expectations across the Ether spot ETFs re-flows/quantity/media/every thing relative to identify bitcoin ETFs. That mentioned, grabbing 20% of what they bought can be enormous win/profitable launch by regular ETF requirements.’

Ethereum ETF vs. Silver ETF

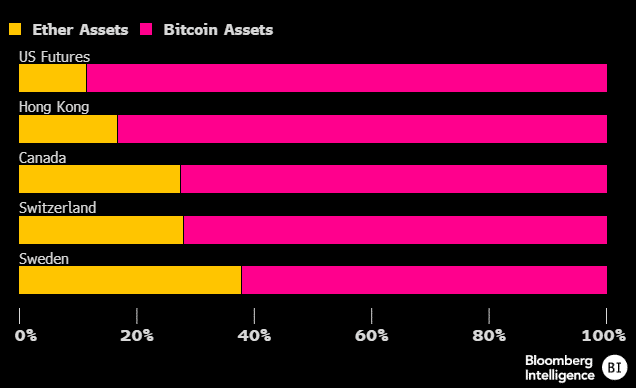

The analyst’s 20% of the BTC ETF market share was based mostly on the present market share on the futures market. ETH ETF devices are already out there in numerous jurisdictions as futures ETF choices.

Primarily based on the futures market share between BTC and ETH, Balchunas showed that ETH solely commanded about 20% on common, a probable state of affairs that would occur to identify ETFs, too.

“The poor exhibiting of the eth futures is an enormous a part of my calculus. That mentioned, the stronger showings in Europe have me splitting the distinction with the ultimate prediction of 20% share.”

Moreover, the analyst equated BTC to Gold and Ethereum to Silver and made one other evaluation and assumption Gold vs Silver ETF foundation. Per Balchunas, Silver ETF at present has solely 15% of Gold ETFs’ market share. He stated,

“Many gained’t really feel the necessity to transcend bitcoin/gold for his or her crypto/valuable metals allocation.”

As of twenty eighth Might, the US spot BTC ETFs had $13.7 billion in total flows. Primarily based on Balchuna’s projection, that would equate to $2.7 billion of ETH ETFs over the identical interval.

Nonetheless, from a Hong Kong perspective, particularly based mostly on the main ETF funds from Bosera, BTC flows had been twice as a lot as ETH flows for the spot merchandise.

In keeping with Farside data, Hong Kong’s Bosera spot BTC ETF noticed complete inflows of $15.3 million, in comparison with its ETF product’s $7.5 million. That interprets to about 50% of BTC ETF flows for Bosera spot ETH ETF.

Nonetheless, in line with CoinMarketCap information, ETH’s $454 billion spot market cap was 34% of BTC’s $1.3 trillion.

That mentioned, the US spot ETH ETF merchandise might launch in July, with some analysts anticipating the ETH price to hit $4.5K earlier than they begin buying and selling.