- Spot Ether ETFs might scale back Ethereum’s value to as little as $2,400.

- Institutional curiosity in Ethereum is much less in comparison with Bitcoin, affecting ETF conversion charges.

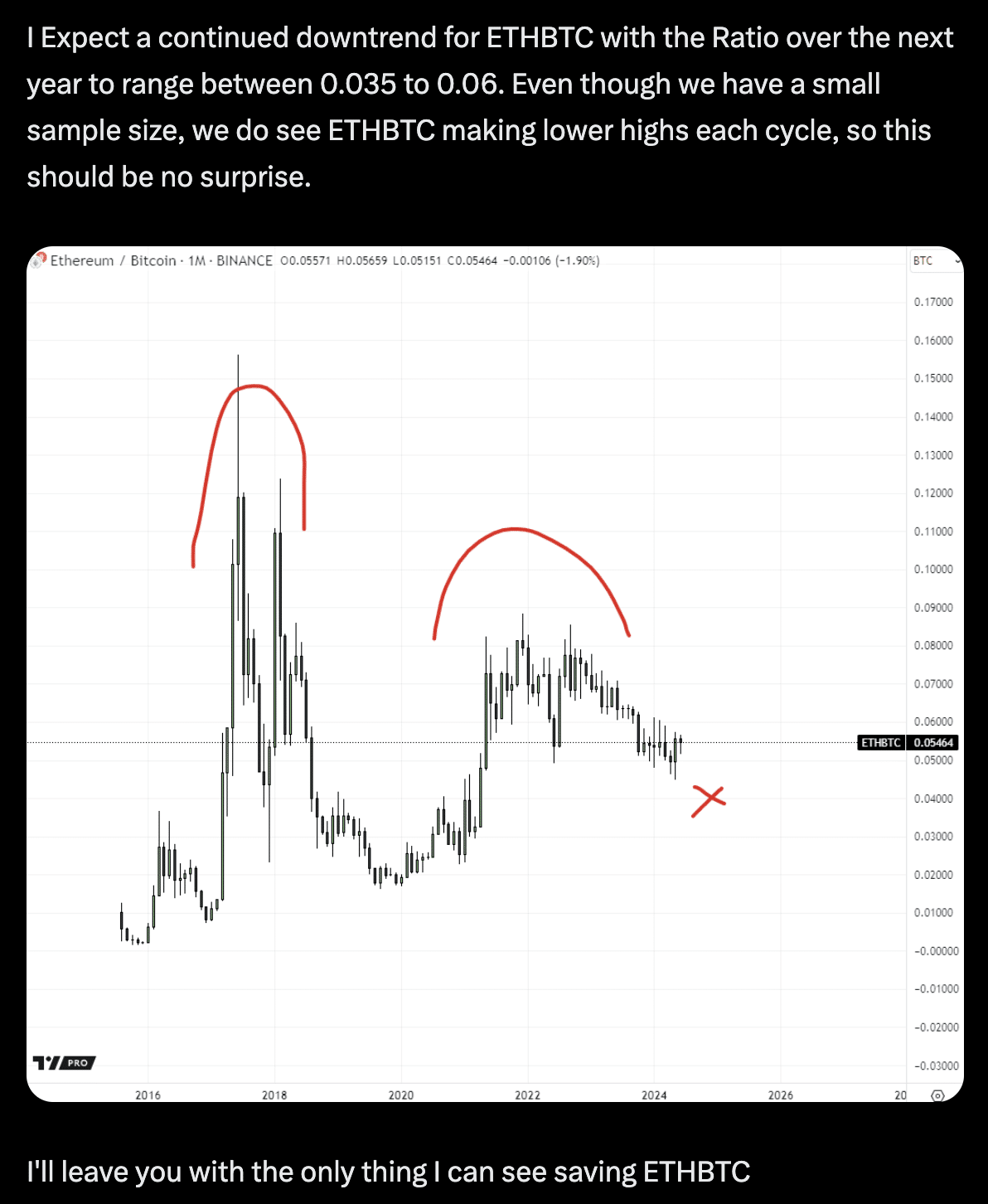

As Ethereum [ETH] trails Bitcoin in efficiency, its value has seen a 5.1% lower over the previous 24 hours, bringing it to a present valuation of $3,315.

This latest downturn in value displays broader market tendencies and investor sentiment. Regardless of this fall, analysts foresee an extra drop probably pushed by new monetary merchandise coming into the market.

Andrew Kang of Mechanism Capital speculates that the introduction of spot Ethereum exchange-traded funds (ETFs) might push Ethereum’s value right down to as little as $2,400.

ETH ETFs to drive down Ethereum’s value?

The rationale behind Kang’s prediction lies within the comparative lack of institutional curiosity in Ethereum versus Bitcoin.

The founding father of Mechanism Capital disclosed that the absence of robust incentives for changing spot ETH into ETFs, coupled with unimpressive community money flows, presents a difficult outlook for Ethereum’s instant future within the ETF market.

These components might contribute to Ethereum’s battle to take care of its market value within the face of evolving market constructions and investor preferences.

Moreover, the potential inflow of ETH into the ETF panorama is estimated to draw about 15% of the flows that Bitcoin ETFs have garnered, primarily based on extrapolations from Bitcoin’s ETF efficiency.

Preliminary knowledge signifies that spot Bitcoin ETFs attracted round $5 billion in new funds inside six months of their launch.

Making use of these figures to Ethereum, it’s projected that Ethereum-based ETFs would possibly see roughly $840 million in true inflows throughout an identical timeframe.

Regarding this, Kang expresses skepticism in regards to the alignment between the crypto group’s expectations and conventional monetary (tradfi) allocators’ preferences, indicating that the market might have already “priced in” the results of the ETF launch.

Challenges in market notion

Moreover, the conceptual pitch of Ethereum as a decentralized monetary settlement layer and a base for Web3 functions carries potential. Nonetheless, in line with Kang, present knowledge counsel that it might be a difficult promote.

Notably, the discount in community transaction charges resulting from decreased exercise in decentralized finance and non-fungible tokens has shifted views, presumably likening ETH to overvalued tech shares by way of monetary metrics.

Moreover, in line with Kang, the latest regulatory inexperienced mild for Ethereum ETFs was considerably sudden, giving issuers restricted time to craft and disseminate efficient advertising and marketing methods.

He added that the removing of staking choices from the ETF proposals might additional dissuade traders from changing their holdings, impacting the anticipated inflow of capital into these funds.

Concluding the perception, Kang famous:

“Does that imply ETH will go to zero? In fact not, at some value will probably be thought of good worth and when BTC goes up sooner or later, will probably be dragged up with it to some extent. Earlier than the ETF launch, I anticipate ETH to commerce from $3,000 to $3,800. After the ETF launch my expectation is $2,400 to $3,000. Nonetheless, If BTC strikes to $100k in late This fall/Q1 2025, then that would drag ETH alongside to ATHs, however with ETHBTC decrease. “

Are there bearish indicators from ETH?

In mild of Andrew Kang’s pessimistic view on Ethereum, it’s price inspecting Ethereum’s fundamentals to validate these considerations.

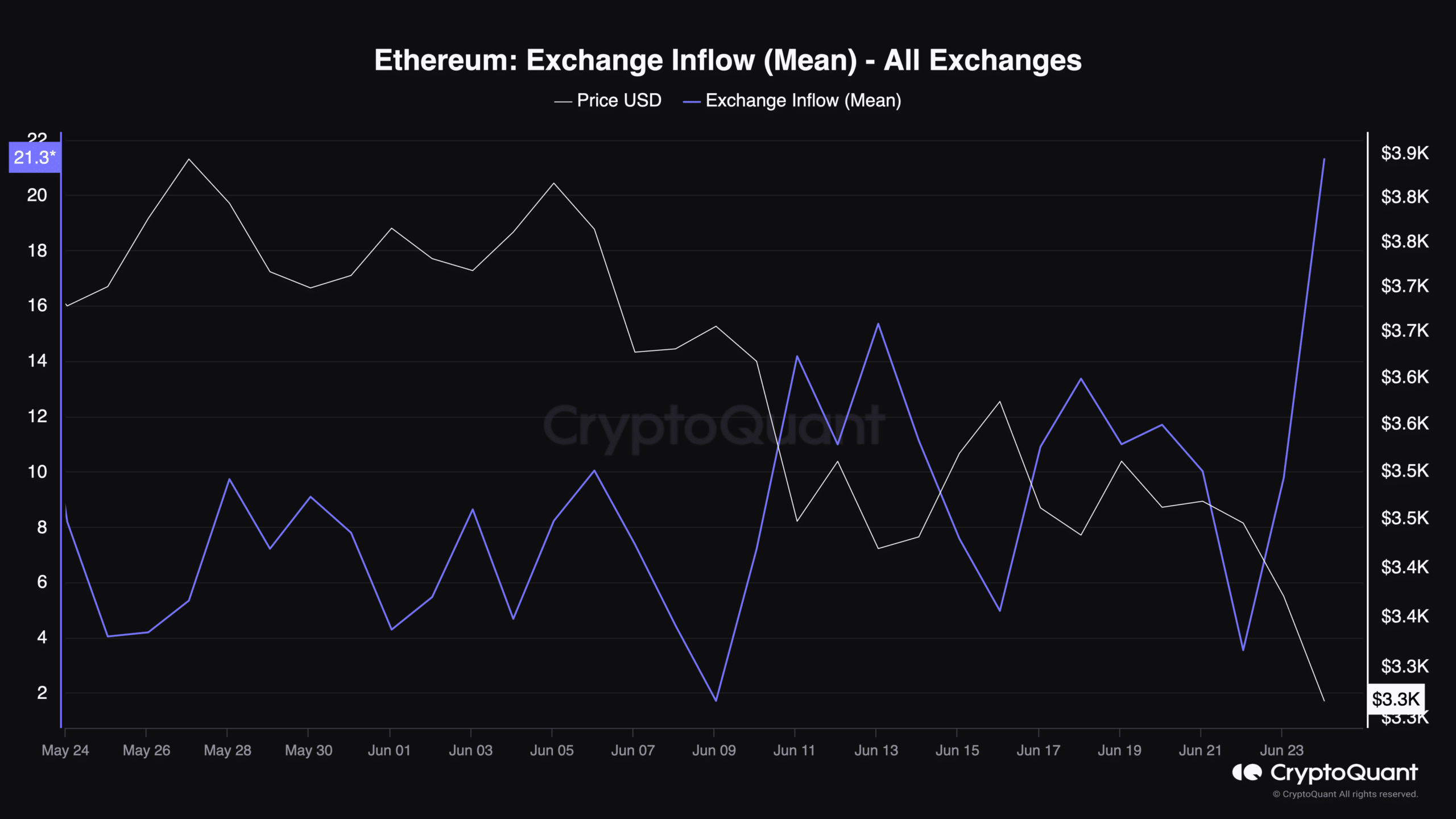

Data from CryptoQuant reveals a worrisome development in one in every of Ethereum’s key metrics—there was a notable enhance in Ethereum deposits on exchanges, suggesting a possible rise in promoting stress.

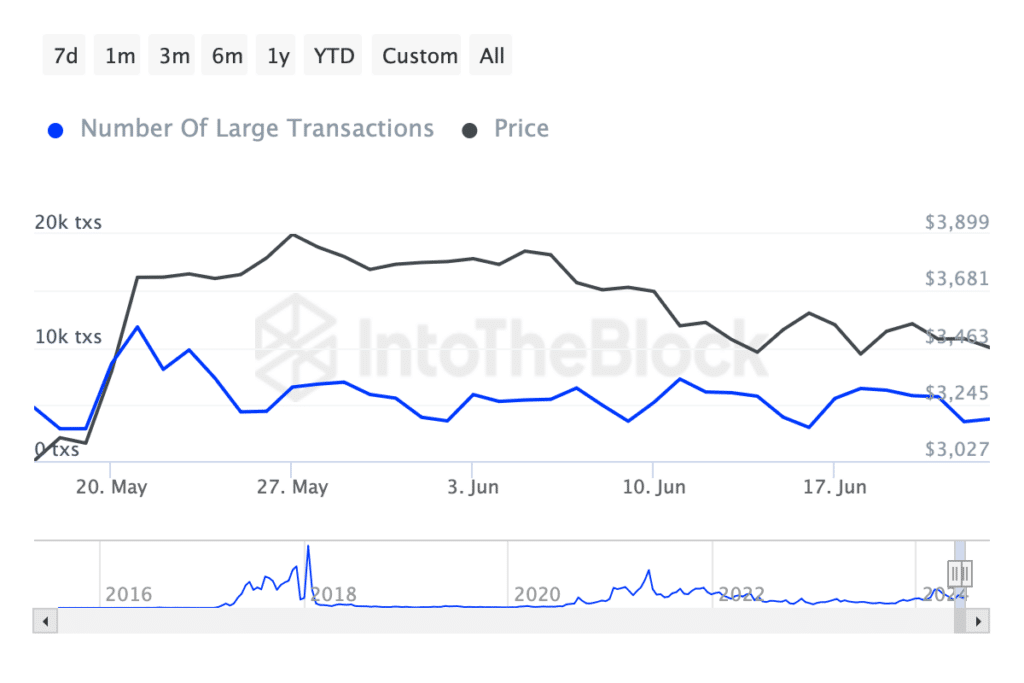

This indicator aligns with IntoTheBlock’s data, which exhibits a major discount in giant ETH transactions (these exceeding $100,000).

Learn Ethereum’s [ETH] Price Prediction 2024-2025

These transactions have decreased from over 10,000 late final month to beneath 4,000 as of immediately.

Supply: IntoTheBlock

Regardless of these bearish indicators, a latest report from AMBCrypto highlights an uptick in Ethereum’s daily active addresses, including a layer of complexity to the market’s dynamics.