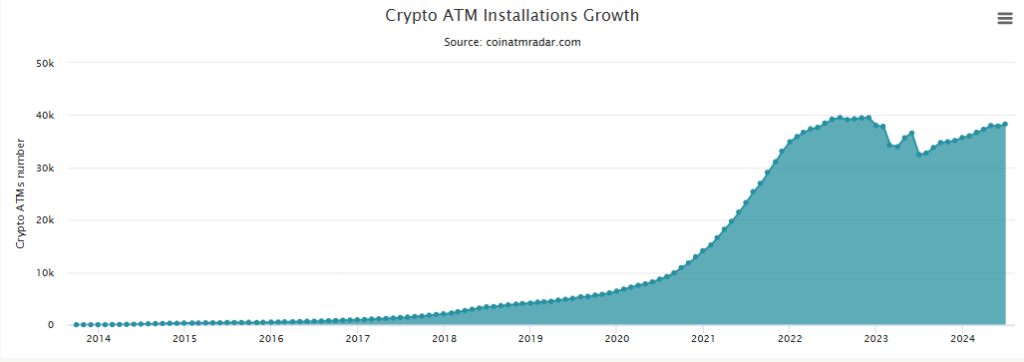

The world of cryptocurrency is witnessing a increase in accessibility, with Bitcoin ATMs main the cost. From a meager 10,000 in October 2020, the variety of these cash-to-crypto converters has ballooned to over 38,000 globally. This surge isn’t only a fad; specialists predict continued development fueled by an ideal storm of comfort, profitability, and strategic enlargement.

Past The Financial institution Department: Stepping Into Crypto With Money

For a lot of, conventional monetary establishments stay a barrier to entry within the crypto world. Bitcoin ATMs bridge this hole by permitting customers to purchase cryptocurrency with money, eliminating the necessity for financial institution accounts or navigating advanced on-line exchanges. This fosters monetary inclusion, notably for the unbanked inhabitants and those that favor the familiarity of bodily money.

Supply: Coin ATM Radar

The advantages prolong past accessibility. Bitcoin ATM transactions usually provide a layer of privateness in comparison with on-line exchanges, the place customers may want to supply intensive private data. Moreover, some customers worth the quick nature of the transaction – money goes in, cryptocurrency goes straight to their digital pockets. This eliminates the ready interval related to financial institution transfers generally used on on-line exchanges.

A Profitable Market With Room To Develop

The expansion of Bitcoin ATMs isn’t solely pushed by consumer demand. Operators are discovering these machines to be a profitable enterprise proposition. Transaction charges charged on high of the spot value of Bitcoin present a wholesome revenue margin.

With the crypto market experiencing a bullish 12 months in 2024, the potential for even larger returns is engaging for entrepreneurs venturing into this area. As of the latest depend, there have been 38,279 deployed Bitcoin ATMs worldwide, in response to statistics obtainable on Coin ATM Radar.

Bitcoin market cap at present at $1.23 trillion. Chart: TradingView.com

Because the cryptocurrency market has recovered over the previous 11 months, about 6,000 new crypto ATMs have been put in; these are made by 43 completely different firms and can be found in 72 nations.

Bitcoin stays the main digital asset utilized in crypto ATM transactions, adopted by Bitcoin Money and Ether, the world’s second-largest cryptocurrency. Whereas over 80% of crypto ATMs are at present put in within the US, a rising market is rising in nations like Canada, El Salvador, Germany, Hong Kong, and Spain.

Governments Greenlight Crypto Progress

Moreover, regulatory environments in lots of nations have gotten more and more crypto-friendly. Governments are recognizing the potential of digital belongings and are implementing frameworks that help the accountable development of the trade. This regulatory readability fosters belief and encourages additional funding in Bitcoin ATMs, increasing their attain and solidifying their function within the monetary panorama.

Challenges And The Highway Forward

Regardless of the optimistic outlook, the Bitcoin ATM trade isn’t with out its hurdles. Some operators lack the required expertise or monetary backing to navigate the complexities of this nascent market. This will result in safety vulnerabilities and finally hinder consumer confidence. Moreover, regulatory uncertainties persist in sure areas, making a wait-and-see strategy for potential traders.

Business leaders are actively addressing these challenges. Instructional initiatives are being rolled out to tell customers about the advantages and dangers related to cryptocurrency transactions. Moreover, sturdy buyer help programs are being established to make sure a easy consumer expertise. Constructing belief and fostering a way of safety will likely be paramount in encouraging wider adoption of Bitcoin ATMs.

Featured picture from Bybit Be taught, chart from TradingView