- Germany transferred giant quantities of BTC throughout accounts, inflicting uncertainty out there.

- Correlation of BTC with conventional investments and asset courses declined.

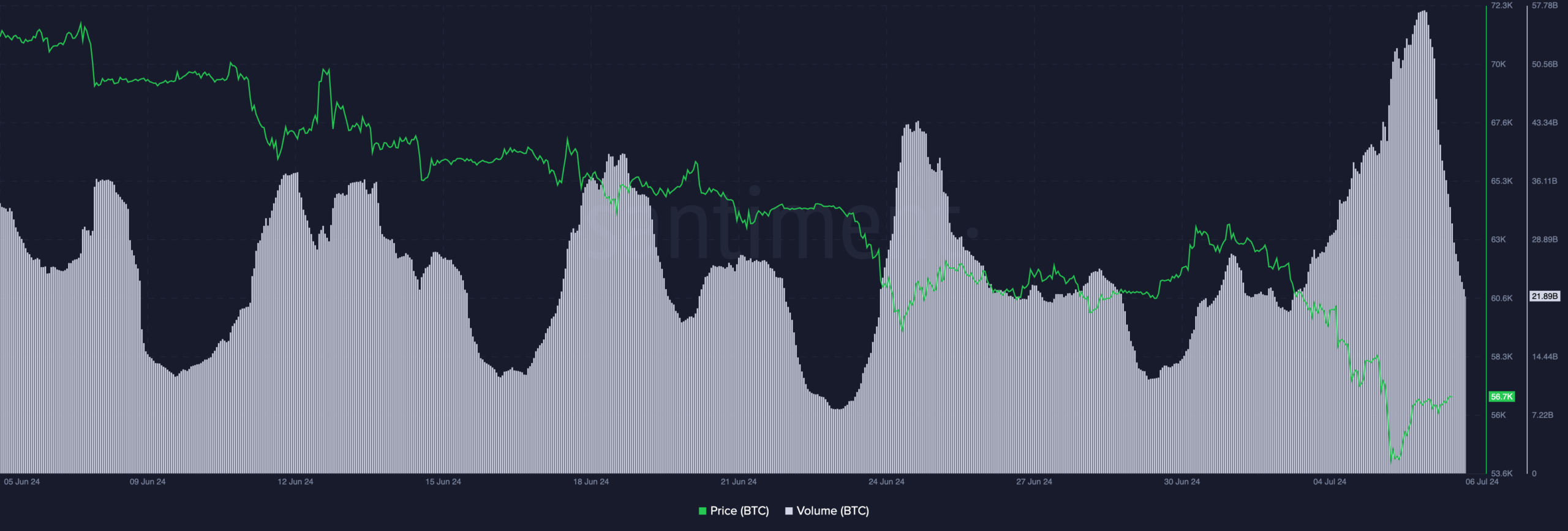

The latest Bitcoin [BTC] crash has triggered a surge of damaging sentiment across the crypto market.

Germany makes a transfer

In a transfer with important monetary implications, the German authorities has transferred 700 Bitcoin on seventh July, in keeping with blockchain knowledge evaluation agency Arkham.

The switch, valued at roughly $40.55 million, was despatched to an unmarked deal with, elevating questions on its objective.

Whereas the particular cause for the transaction stays unclear, the deal with could also be related to a monetary establishment or an over-the-counter (OTC) service.

OTC providers cater to giant traders seeking to commerce giant volumes of cryptocurrency exterior of conventional exchanges.

This transaction comes amidst Germany’s continued holdings of a considerable quantity of Bitcoin. The German authorities at present holds roughly 39,826 BTC, valued at round $2.31 billion.

This sizeable holding suggests a possible long-term technique for the German authorities with regard to cryptocurrency.

The unmarked deal with related to the switch creates uncertainty in regards to the objective. Some would possibly worry it’s a precursor to a big sell-off by the German authorities, main traders to dump their holdings earlier than the worth drops additional.

Co-relation declines

Individually, the connection between Bitcoin and conventional inventory markets has weakened considerably. Which means Bitcoin’s worth actions are now not carefully following the ups and downs of equities, not like what was noticed in earlier years.

This decline in correlation was at its strongest in over 4 and a half years.

Analyst Will Clemente believes that is possible resulting from a novel state of affairs the place there may be an extra provide of Bitcoin overhanging the market.

This provide overhang is considered originating from a number of sources, together with Germany, the USA, and Mt. Gox, a now-defunct Bitcoin change that misplaced an enormous variety of Bitcoins years in the past.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The presence of extra provide is placing downward strain on Bitcoin’s worth, and this strain is unbiased of what’s occurring within the inventory market.

At press time, BTC was buying and selling at $57,482.70 and its worth had surged by 1.42% within the final 24 hours. Coupled with that, the quantity at which BTC was buying and selling at had declined by 47.14% throughout the identical interval.