- PEPE’s massive holders bought off vital parts of their holdings within the final 30 days

- On-chain knowledge revealed that the memecoin was undervalued and will rally after the occasion

Many traders available in the market take into account the upcoming Spot Ethereum [ETH] ETF launch to be bullish. Nevertheless, AMBCrypto discovered that giant holders of Pepe [PEPE] appear to not share an analogous sentiment.

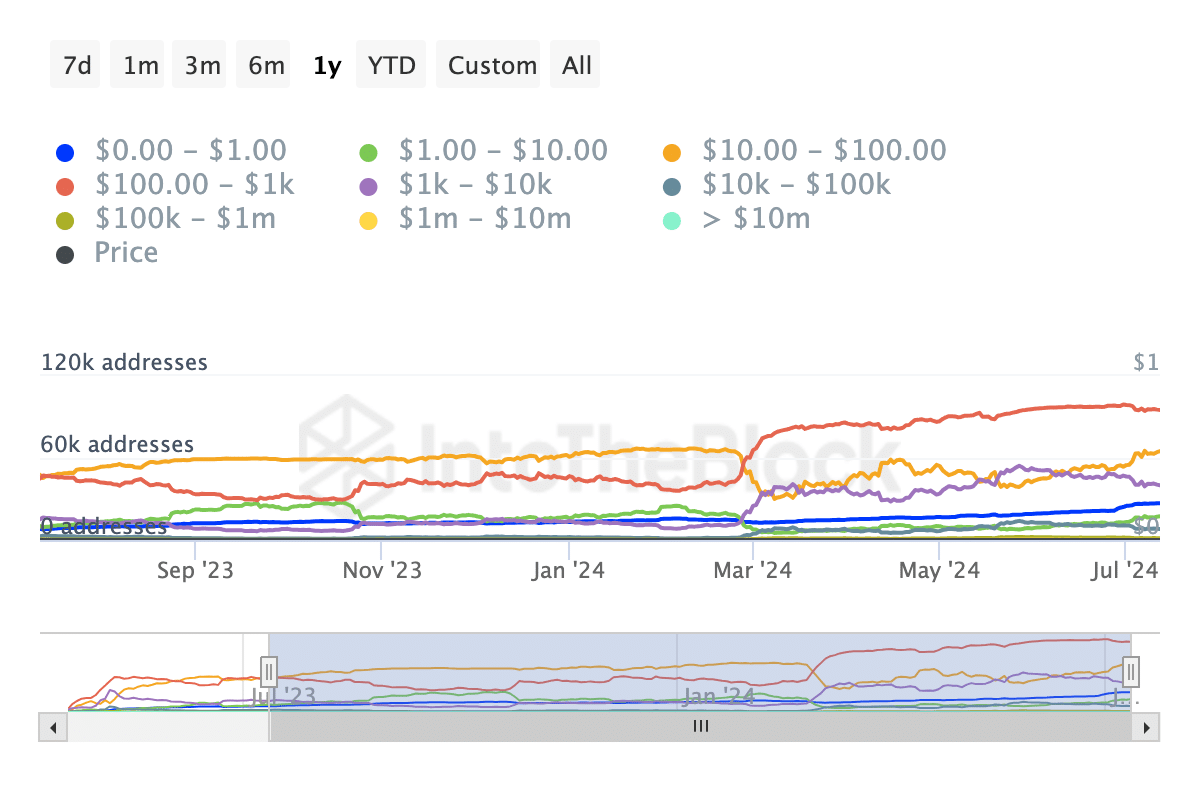

We discovered this info after analyzing the addresses by holdings knowledge. This indicator teams addresses into totally different segments and exhibits if they’re accumulating or promoting off their belongings.

Is the memecoin in chains?

At press time, AMBCrypto noticed that PEPE addresses holding tokens price $100,000 to $10 million fell by double-digits. This decline implies that they’ve bought off a few of their tokens inside the final 30 days.

This can be a shock, primarily as a result of PEPE is the highest memecoin on the Ethereum blockchain. Subsequently, it was anticipated that the massive wigs of the memecoin sector would give the identical bullish cues as the remainder of the bullish market.

If this stays the identical when the spot Ethereum ETFs go live, PEPE’s value may hike on account of the event. Nevertheless, it might be difficult to maintain the hike until shopping for strain will increase.

At press time, the worth of PEPE was. $0.0000087. This value meant that it was down 49.27% from the all-time excessive it hit on 27 Might.

Going by the evaluation above, additional distribution may drag the worth, and the token might be 55% down for the highs. Nevertheless, post-Ethereum ETF’s launch, the token may carry out properly on the charts.

Greater highs will come later

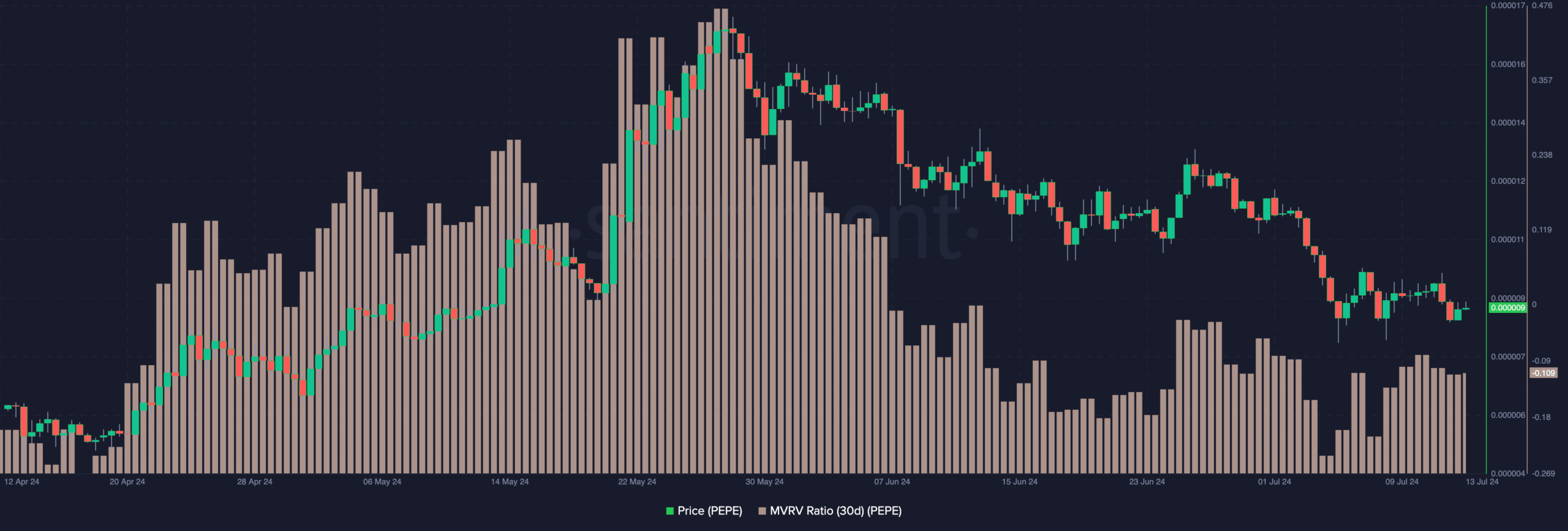

This was the sign the Market Worth to Realized Worth (MVRV) ratio gave. This ratio offers insights into profitability available in the market.

When the ratio rises, it signifies that the market cap is outpacing the realized cap. On this occasion, holders of a cryptocurrency have motive to promote. Nevertheless, if the ratio falls, it signifies that the realized cap is rather more than the market cap.

More often than not, this brings about unrealized losses and there’s little to no motive to promote. On the time of writing, PEPE’s 30-day MVRV ratio was -10.90%, indicating that it skilled a poor degree of demand dynamics recently.

Nevertheless, the great half is that the unfavorable ratio may drive market contributors to carry on to the token. Subsequently, the memecoin might be termed undervalued relative to its present market situations.

As such, if shopping for strain intensifies a lot later, we may see the worth try to revisit its Might highs. Regardless of the bearish indicators pre-ETF launch, some analysts imagine that the memecoin would acquire from the event.

Sensible or not, right here’s PEPE’s market cap in ETH terms

One among them is Donny Dicey, an analyst on X. The quote under is what Dicey thinks of the token’s response to the Ethereum ETF launch.

“This might be sparked by the Ethereum ETF going reside, bringing hype again to the marketplace for upside Not saying it’s possible, however this may trigger one other wave up for memecoins Even when it simply makes it to five.5 billion market cap once more”