- Crypto thefts and ransomware surged in 2024, with record-breaking funds and stolen funds

- Bitcoin’s share in stolen funds rose whereas centralized exchanges turned prime hacking targets too

Cryptocurrencies have steadily gained mainstream traction in 2024, with the identical marked by quite a few optimistic developments on a number of fronts. Nonetheless, it hasn’t precisely been clean crusing for this asset class.

Troubling crypto traits

Whereas total illicit exercise has fallen to year-to-date ranges, in comparison with earlier years, sure troubling traits have emerged too.

Throwing additional gentle on the identical, a latest survey performed by Chainalysis revealed,

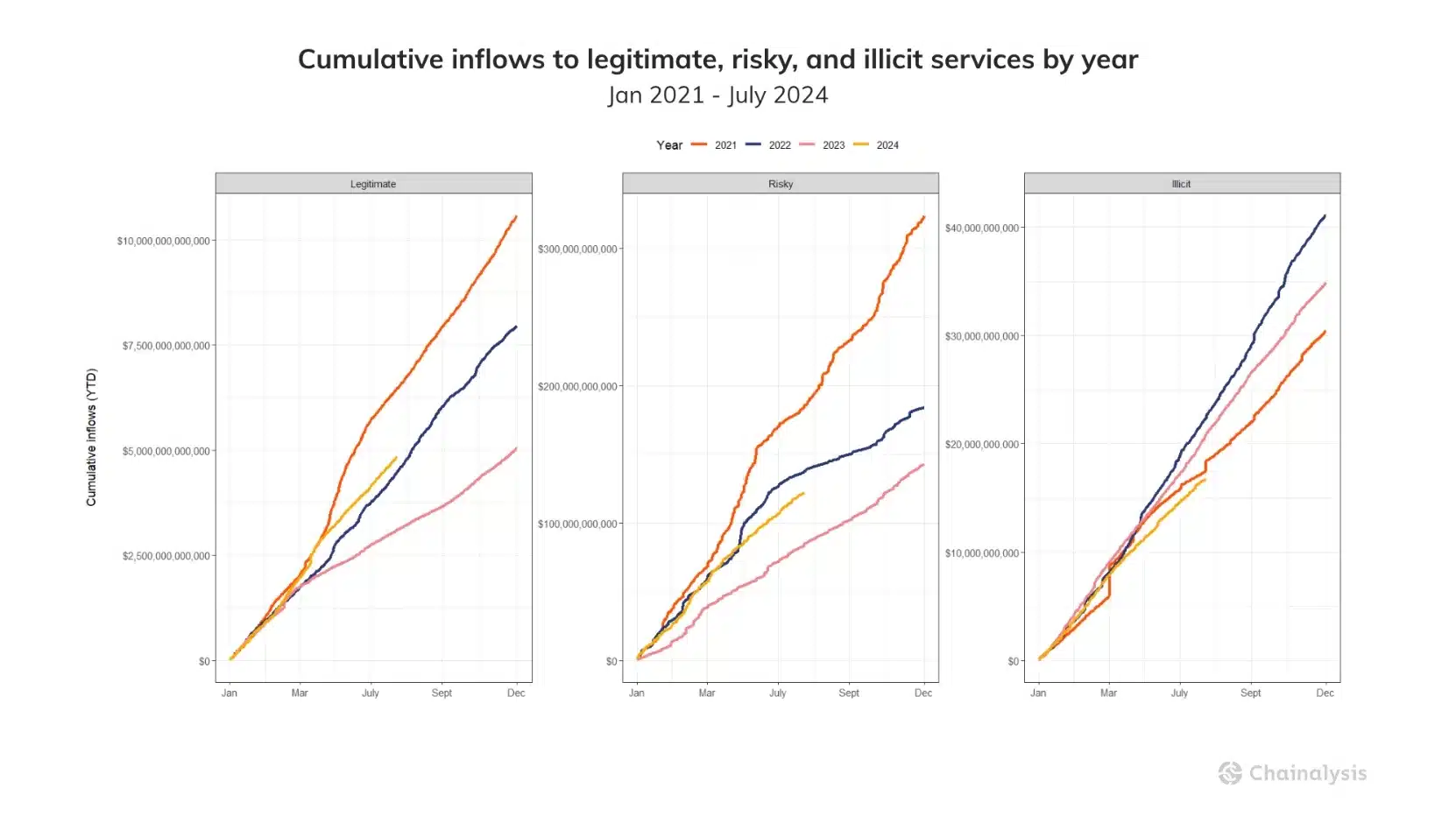

“Combination illicit exercise fell YTD by 19.6%, dropping from $20.9B to $16.7B, demonstrating that reputable exercise is rising sooner than illicit exercise on-chain.”

Notably, in keeping with Eric Jardine, Cybercrimes Analysis Lead at Chainalysis, inflows into reputable crypto providers have reached their highest stage for the reason that 2021 bull market peak. She added,

“The expansion of reputable exercise outpacing that of illicit exercise on-chain demonstrates the continued transition of cryptocurrencies to the mainstream.”

Unwanted effects of rising crypto adoption

Regardless of such progress, nonetheless, better inflows into cybercrime-related entities prompt that whereas crypto’s mainstream adoption grows, so does its exploitation by malicious actors.

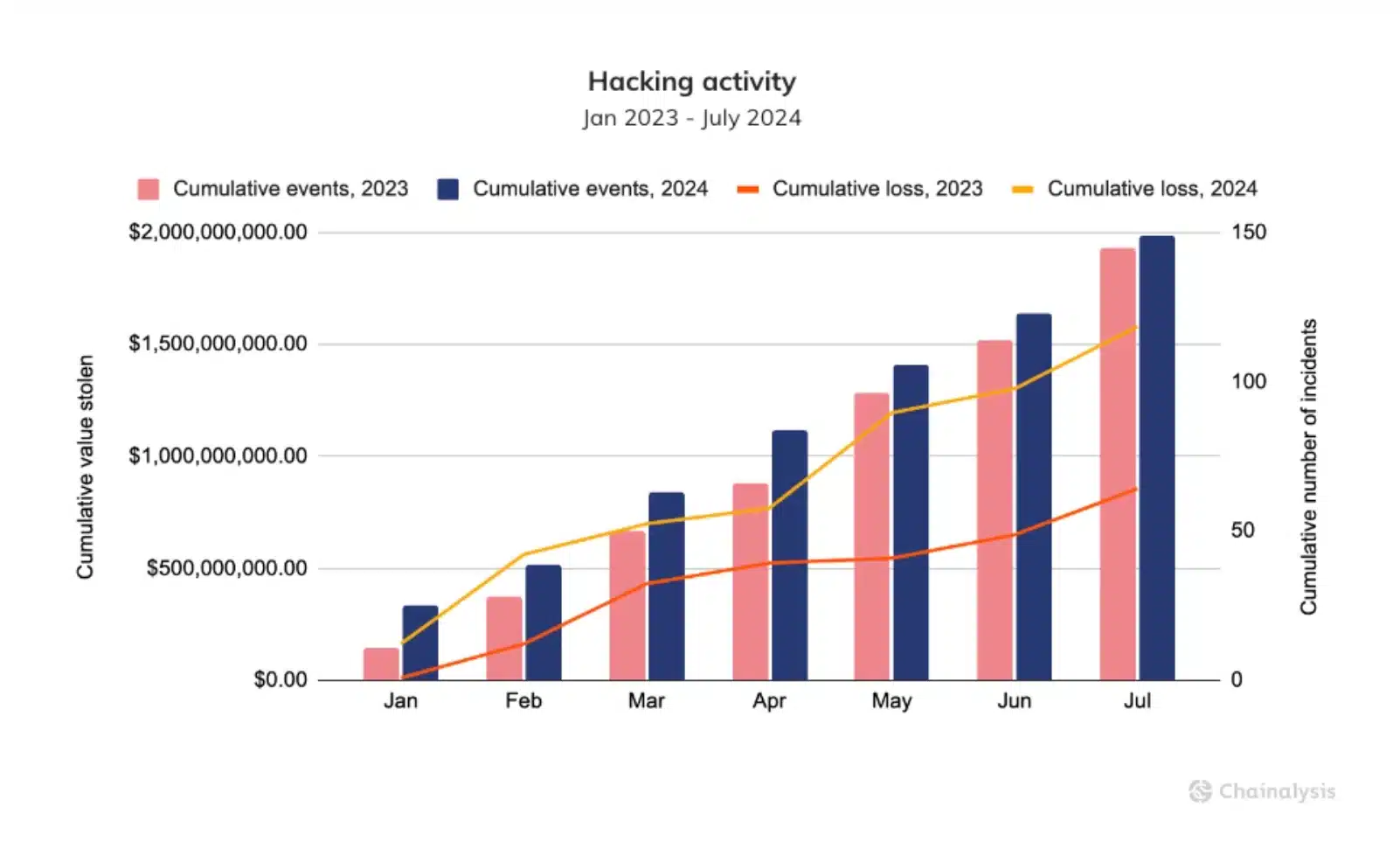

As per the report, crypto thefts have practically doubled year-over-year, escalating from $857 million to $1.58 billion.

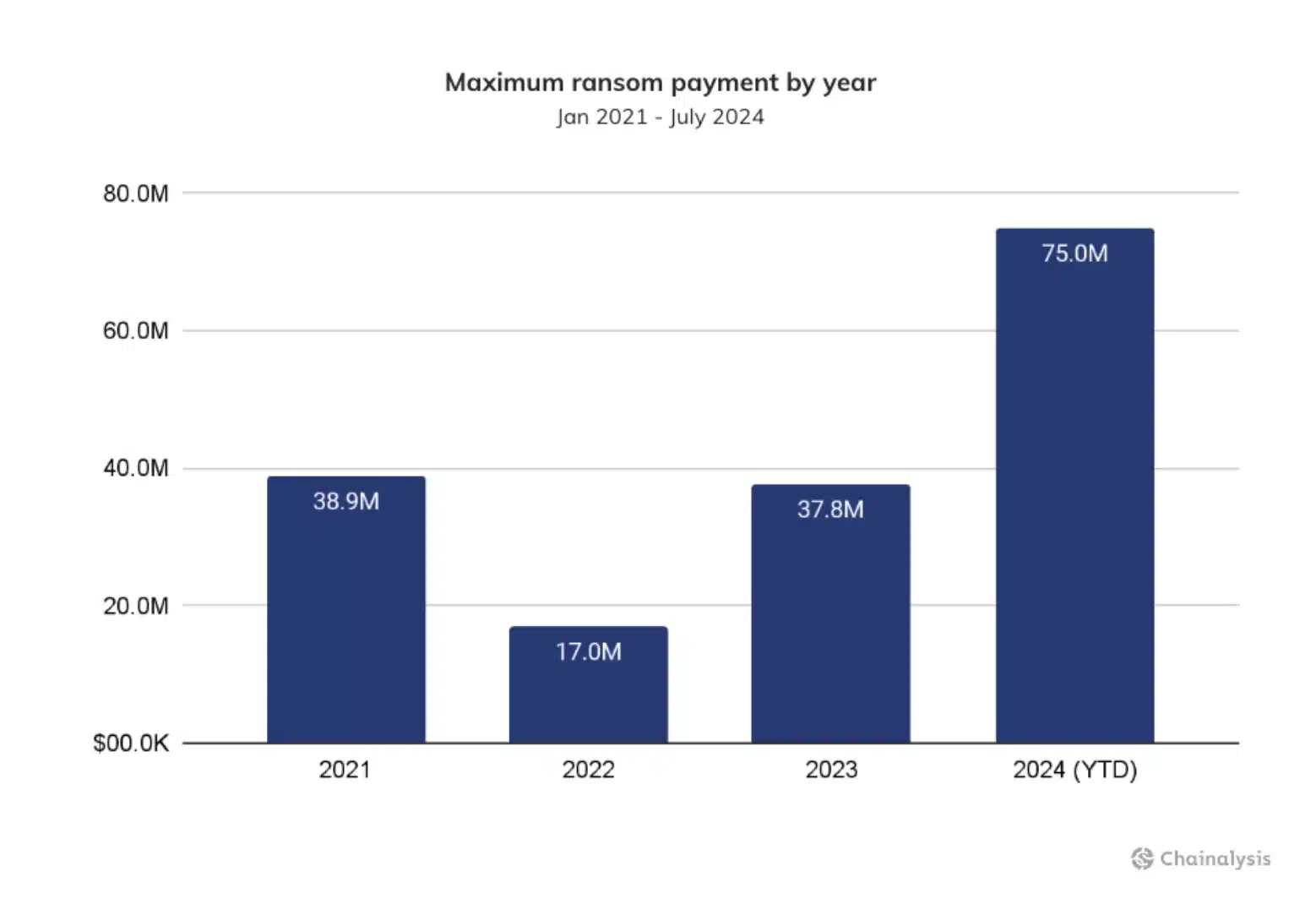

Moreover, ransomware inflows have seen a slight hike too, indicating the opportunity of a record-setting yr for a lot of these crimes.

“2024 has seen the most important ransomware fee ever recorded at roughly $75 million to the Darkish Angels ransomware group.”

The evaluation additionally revealed a pointy resurgence in hacking exercise in 2024, with stolen crypto funds hitting $1.58 billion — An 84.4% enhance from final yr. Moreover, though the variety of incidents rose solely barely, the common stolen per occasion surged by 79.46%, from $5.9 million in 2023 to $10.6 million in 2024.

This uptick has been largely pushed by a big rise in asset costs, notably Bitcoin [BTC], which greater than doubled from a mean of $26,141 to $60,091.

Expressing his frustration, Jardine added,

“It’s extremely encouraging to see that felony exercise continues to turn into an ever-shrinking share of the crypto ecosystem.”

Not all adverse!

As is apparent, the report additionally highlighted a troubling correlation between the rise in ransomware and rising stolen funds, with some main heists linked to organized teams, together with these from North Korea.

Nonetheless, regardless of this surge in high-profile cybercrime, there’s a optimistic pattern inside the crypto sector.

In keeping with the agency’s evaluation, there was a notable shift in crypto-theft traits. Bitcoin’s share of transaction quantity from stolen funds has elevated from 30% final yr to 40% this yr, reflecting a change within the kinds of targets.

However, centralized providers, particularly exchanges like DMM—which misplaced $305 million and had 4500 BTC stolen—at the moment are main targets.

This shift means that after 4 years of specializing in decentralized platforms, thieves are returning to centralized exchanges, which deal with important Bitcoin transactions.

Actions to strengthen safety

Since most crypto-related crimes are performed on the blockchain, regulation enforcement can monitor and analyze these transactions to successfully perceive and break up felony operations.

As Camichel, a researcher with eCrime.ch, stated,

“I imagine takedowns and regulation enforcement actions like Operation Cronos, Operation Duck Hunt, and Operation Endgame are important in curbing these actions and signaling that felony actions may have penalties.”