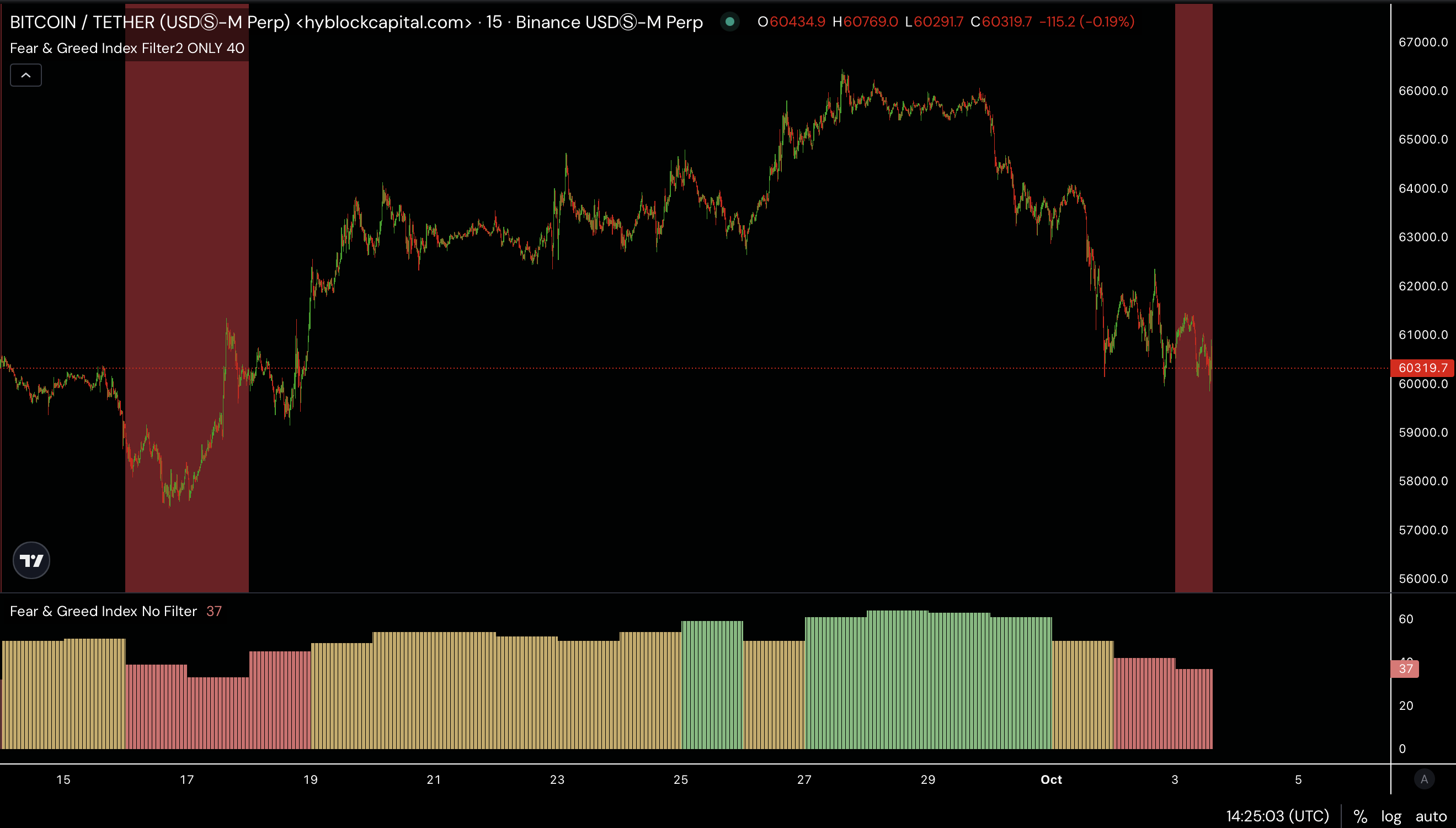

- The market sentiment is again to worry for Bitcoin.

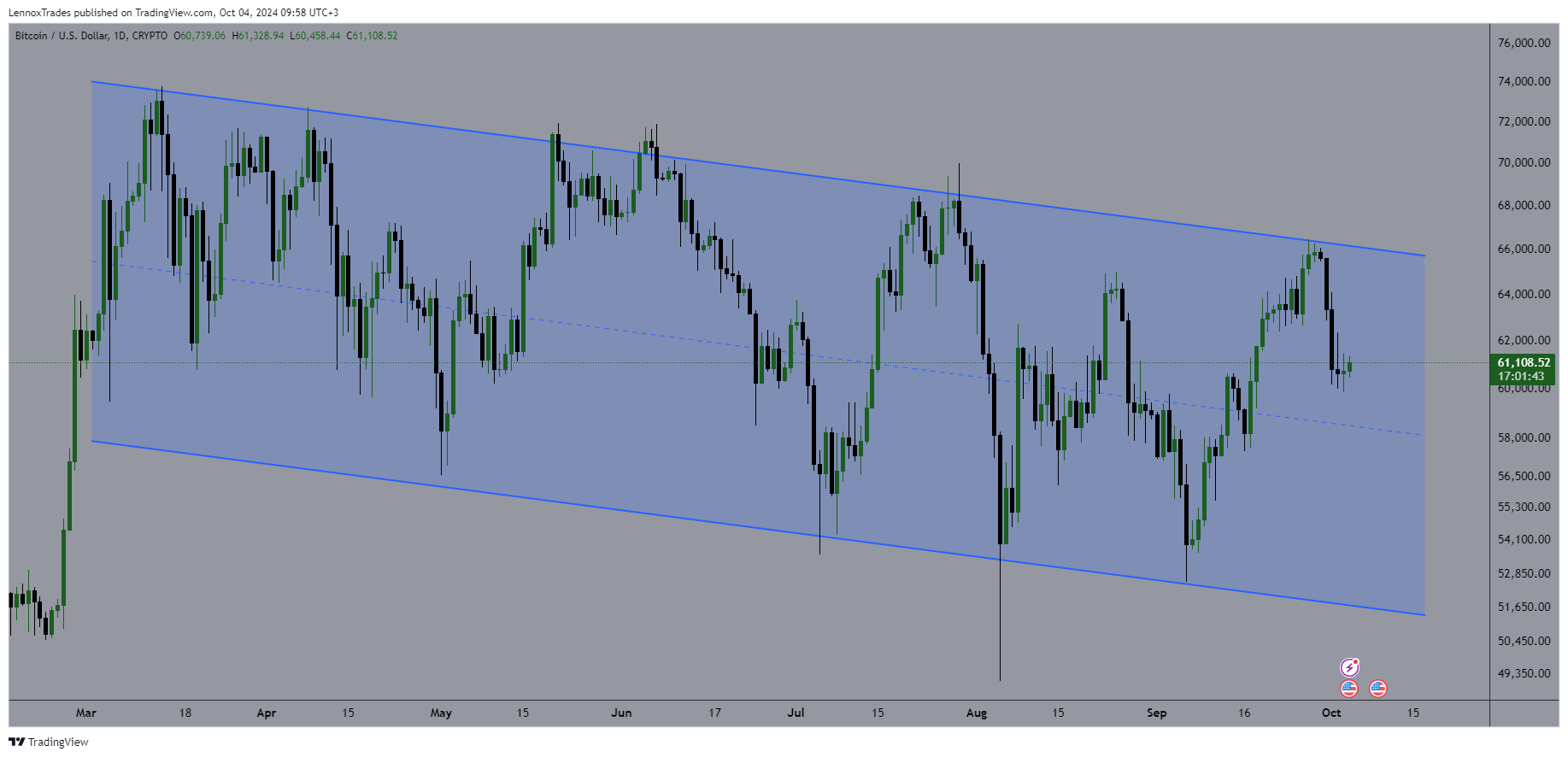

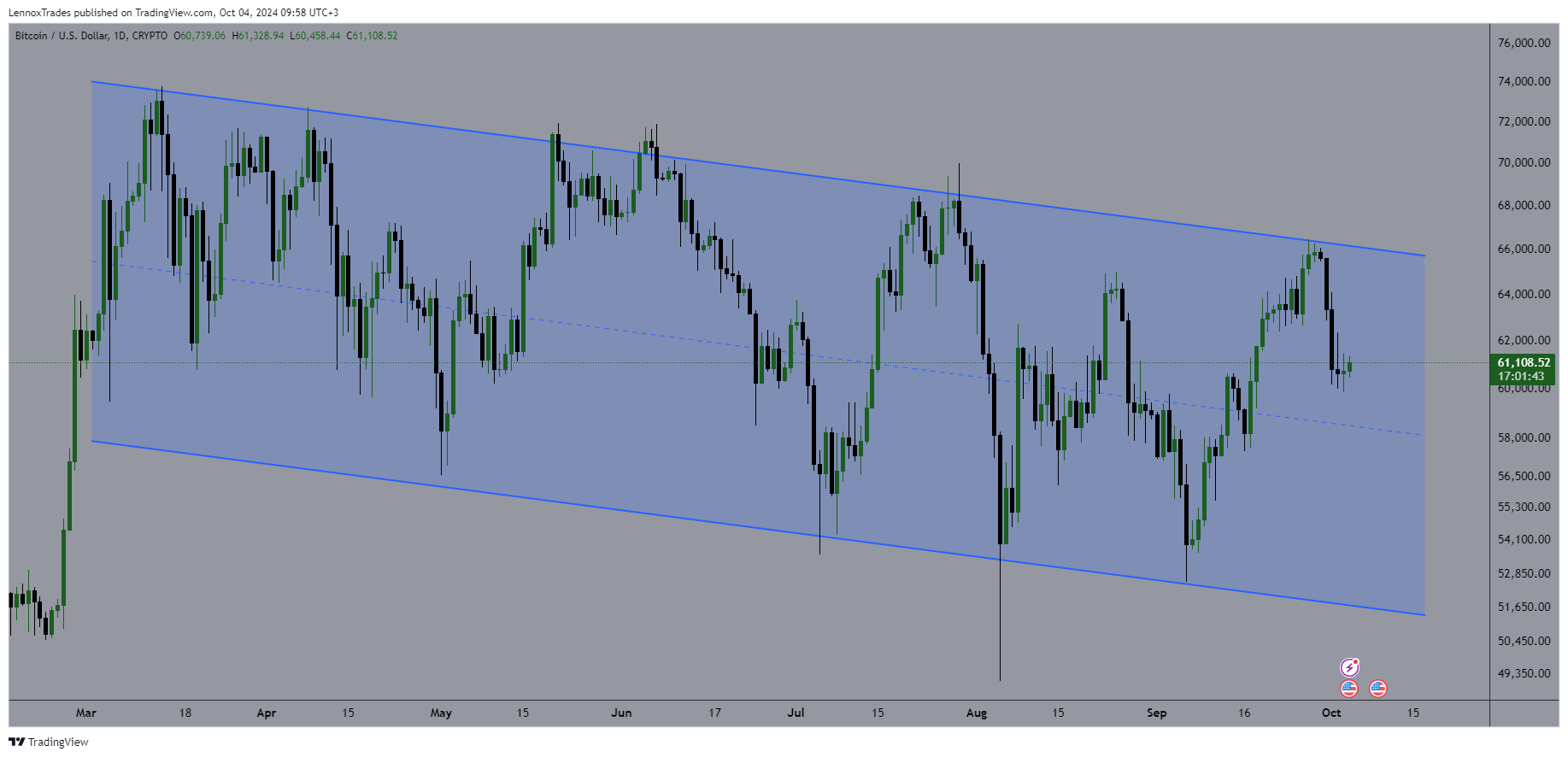

- BTC holding above the imply threshold of the channel.

The cryptocurrency market stays extremely delicate to world occasions, particularly Bitcoin [BTC], with sentiment continuously shifting between worry and greed.

Lately, geopolitical disturbances, significantly within the Center East, have triggered worry amongst buyers, pushing BTC sentiment again into the worry zone.

Traditionally, when Bitcoin enters this worry zone, it indicators a possibility for buyers to “purchase the worry” and promote in periods of greed. As we strategy the final quarter of the 12 months, many are asking: is now the time to purchase Bitcoin?

As September got here to a detailed, Bitcoin had reached the $66K worth mark, transferring sentiment to a impartial stance. Nonetheless, current geopolitical tensions between Israel and Iran have reversed this progress, dropping Bitcoin again into the worry zone.

Regardless of this, the broader crypto market, together with Bitcoin, stays above key help ranges, prompting some to imagine it might be time to purchase BTC in anticipation of additional positive factors within the coming months.

Bid-ask ratio insights

Analyzing the bid-ask ratio helps decide whether or not consumers or sellers dominate the market. Current information reveals that spot bids have outweighed asks, indicating that merchants have been accumulating Bitcoin through the market pullback.

This pullback, triggered largely by the geopolitical tensions, appears to have established a brief backside across the $60,000 stage.

Bitcoin has been holding regular round this level, battling in opposition to promoting strain. As BTC begins to reclaim key transferring averages, this could possibly be an indication that now’s the suitable time to purchase.

BTC holding above the pattern channel equilibrium

Bitcoin’s worth has proven power regardless of dealing with resistance. After briefly rising above $66K, it encountered rejection however continues to commerce close to essential ranges.

BTC has been transferring inside a pattern channel for over seven months, and now has discovered help close to its imply threshold. If Bitcoin manages to interrupt and maintain ranges above the higher trendline, it could possibly be poised to achieve new all-time highs.

Nonetheless, failure to interrupt this key resistance may see BTC persevering with to vary all through the remainder of the 12 months.

Supply: TradingView

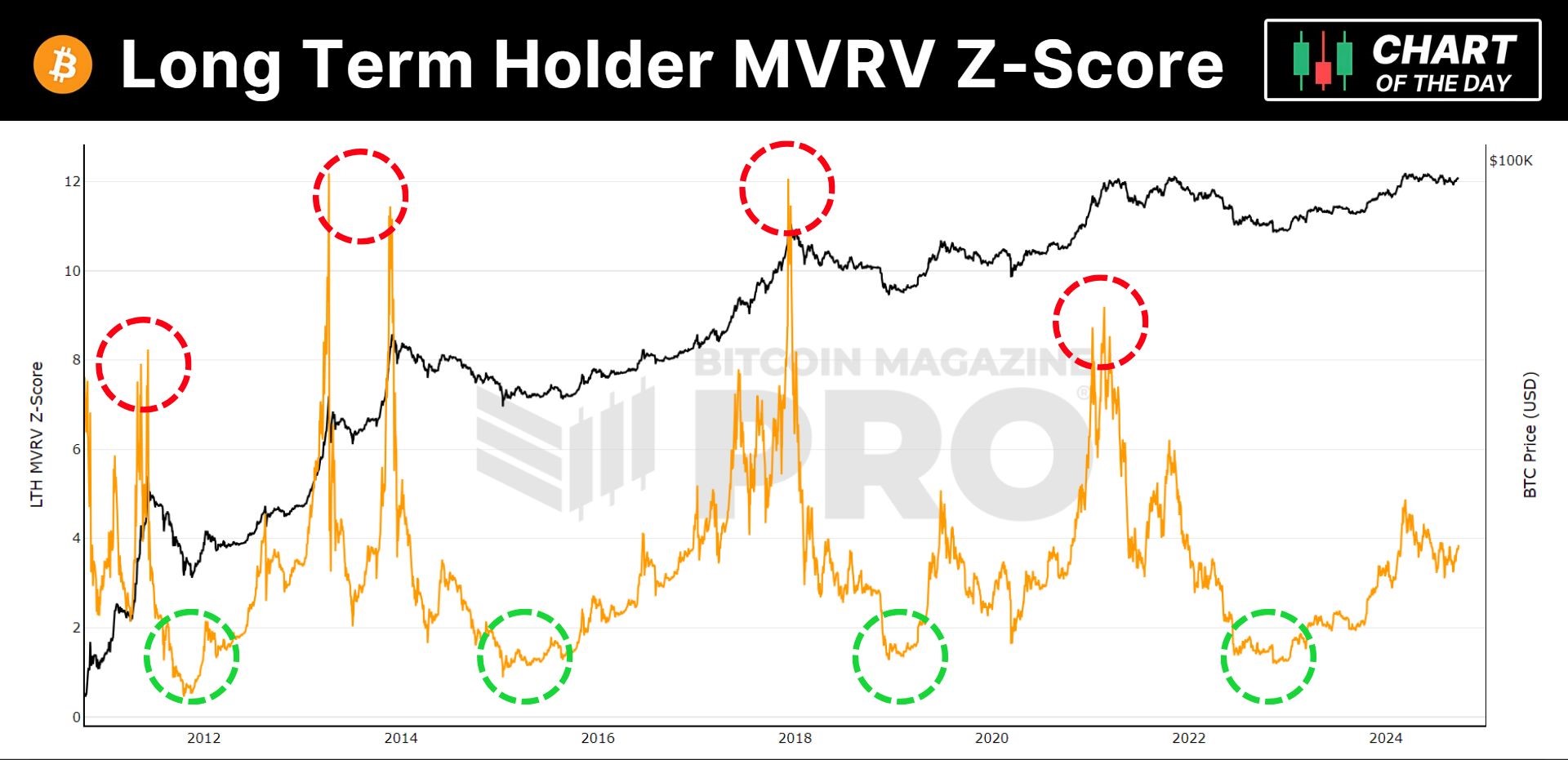

Lengthy-Time period holder MVRV Z-Rating

One key metric that has confirmed efficient in predicting Bitcoin market cycles is the Lengthy-Time period Holder MVRV Z-Rating. This indicator highlights whether or not Bitcoin is overvalued or undervalued, providing perception into potential bottoms and peaks.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

At the moment, the Z-Rating means that BTC has appreciable room for upward motion, reinforcing the concept that now could possibly be the suitable time to purchase, particularly as market sentiment leans towards worry.

With worry gripping the market, now could be the good alternative to build up Bitcoin. The metrics, worth motion, and bid-ask ratio all point out potential upside, making this a really perfect time for buyers to think about shopping for BTC earlier than costs climb greater.