Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Matt Hougan, Chief Funding Officer (CIO) of Bitwise Asset Administration, delivered a hanging long-term forecast for Bitcoin on the most recent episode of the Coinstories podcast. Talking with host Nathalie Brunell, Hougan outlined why he believes that BTC is not going to solely disrupt gold but additionally climb as excessive as $1 million per coin by 2029. He attributed this bullish prediction to speedy institutional adoption, rising regulatory readability, and chronic long-term demand outstripping new provide.

Why Bitcoin May Hit $1 Million By 2029

Throughout the interview, Hougan pointed to the dramatic impression of spot Bitcoin exchange-traded funds (ETFs) as a major issue behind institutional inflows. He described the surge in new capital after the ETFs launched in January 2024 as far bigger than most analysts anticipated. “Earlier than the Bitcoin ETFs launched, essentially the most profitable ETF of all time gathered $5 billion {dollars} in its first 12 months,” he mentioned. “These [Bitcoin] ETFs did thirty-seven billion.”

He added that this astonishing tempo of inflows may proceed, largely as a result of “fewer than half of all monetary advisers within the US can actually have a proactive dialog” about investing in Bitcoin at current. As soon as constraints are lifted and extra advisers are permitted to advocate Bitcoin to their shoppers, he expects an excellent larger inflow of property.

Associated Studying

When requested about competitors amongst high ETF suppliers, Hougan pressured that BlackRock’s entry into the area in the end advantages your entire business by boosting general participation. He highlighted how his agency, Bitwise, focuses on assembly the wants of each institutional traders and crypto specialists who desire a “crypto native” supervisor.

Though Bitwise’s spot Bitcoin ETF launched alongside a number of different distinguished gamers, Hougan mentioned he sees the fierce competitors as constructive for traders, as a result of it has pushed charges to “all-time low.” He famous that his agency’s administration charges are decrease than these of many conventional commodity ETFs and concluded, “It’s an unimaginable deal for the investor.”

Other than these large-scale shifts in institutional finance, Hougan additionally drew consideration to the speedy enlargement of stablecoins. He referred to as them a “killer app,” citing the worldwide urge for food for cheaper, quicker transaction rails and explaining that stablecoins, which choose blockchains, can enhance cross-border cash flows.

He anticipates a stablecoin market measured within the trillions within the coming years, particularly if supportive regulatory frameworks emerge. Whereas he acknowledged america could enact laws that shapes whether or not stablecoin issuers maintain quick or long-dated treasuries, he expressed hope that the market would stay free sufficient to foster continued competitors and innovation.

The dialog additionally touched on mounting company curiosity, which Hougan mentioned faces hurdles equivalent to “bizarre accounting guidelines,” however has nonetheless confirmed sturdy. He identified how firms “purchased a whole bunch of hundreds of Bitcoin final 12 months” and believes these early movers signify a much bigger wave to come back as soon as accounting and due diligence issues are ironed out.

Associated Studying

His agency’s personal surveys, he mentioned, reveal a hanging hole between advisers’ private enthusiasm for Bitcoin—the place “over 50%” already maintain it themselves—and the roughly 15–20% who can formally allocate it on behalf of consumer portfolios. That quantity, he predicts, will hold rising as inner committees grant advisers the inexperienced gentle and as extra establishments understand that “if in case you have a zero % allocation to crypto, you’re successfully quick.”

Regulatory Shifts And The Washington Issue

All through the interview, Hougan repeatedly underscored that the market could also be “underpricing the change in Washington.” He recalled how, till very not too long ago, banks have been unwilling to take deposits from crypto corporations and the way a number of subpoenas, lawsuits, and the chance of “being debanked” had a chilling impact on business development.

Hougan believes that “except you labored in crypto over the past 4 years, you possibly can’t think about how difficult it was,” and that the federal government’s softer stance now removes an unlimited impediment for capital inflows. He additionally sees bipartisan assist for stablecoin laws as a robust signal of regulatory readability on the horizon.

Past regulation, Hougan urged Bitcoin is poised to flourish in a macroeconomic climate rife with uncertainty. He referenced both runaway inflation or a sudden deflationary bust as situations folks concern, asserting that “should you take a look at the market, it’s extra risky or open or unsure than it has been up to now.”

From his perspective, even a small allocation to bitcoin gives a non-sovereign hedge towards potential financial or fiscal turbulence. He mentioned that lots of Bitwise’s massive shoppers are wanting into strategies of producing yield on their Bitcoin—whether or not by means of derivatives or institutional lending—to allow them to keep publicity with out promoting the asset itself. Such curiosity, he believes, displays the sturdy conviction ranges that are inclined to characterize the crypto group.

Hougan’s conclusion circled again to the ability of Bitcoin’s constrained provide and deepening institutional demand. He acknowledged that Bitcoin’s finite issuance schedule, coupled with new consumers nicely outnumbering the quantity of latest bitcoin mined, will possible proceed pushing the worth up over time. “I feel Bitcoin is nicely on its solution to disrupting gold,” he mentioned. “We predict it’s going to cross 1,000,000 {dollars} by 2029.” Though he emphasised that day-to-day value swings may be dramatic, he’s satisfied that the long-term fundamentals stay unassailable.

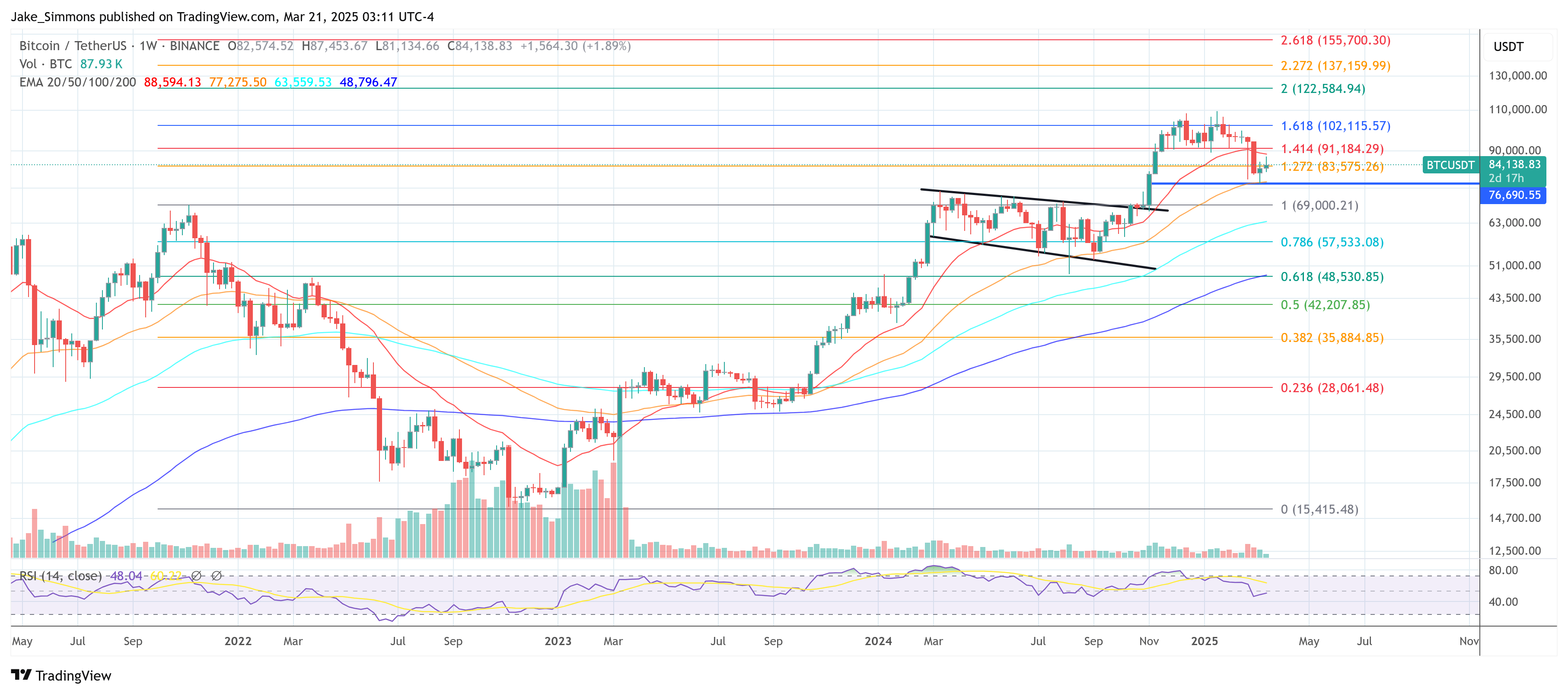

At press time, BTC traded at $84,138.

Featured picture created with DALL.E, chart from TradingView.com