- Altcoins are transferring in sync with Bitcoin and Ethereum, signaling potential volatility or market tops

- Look ahead to accumulation phases earlier than re-entering with momentum

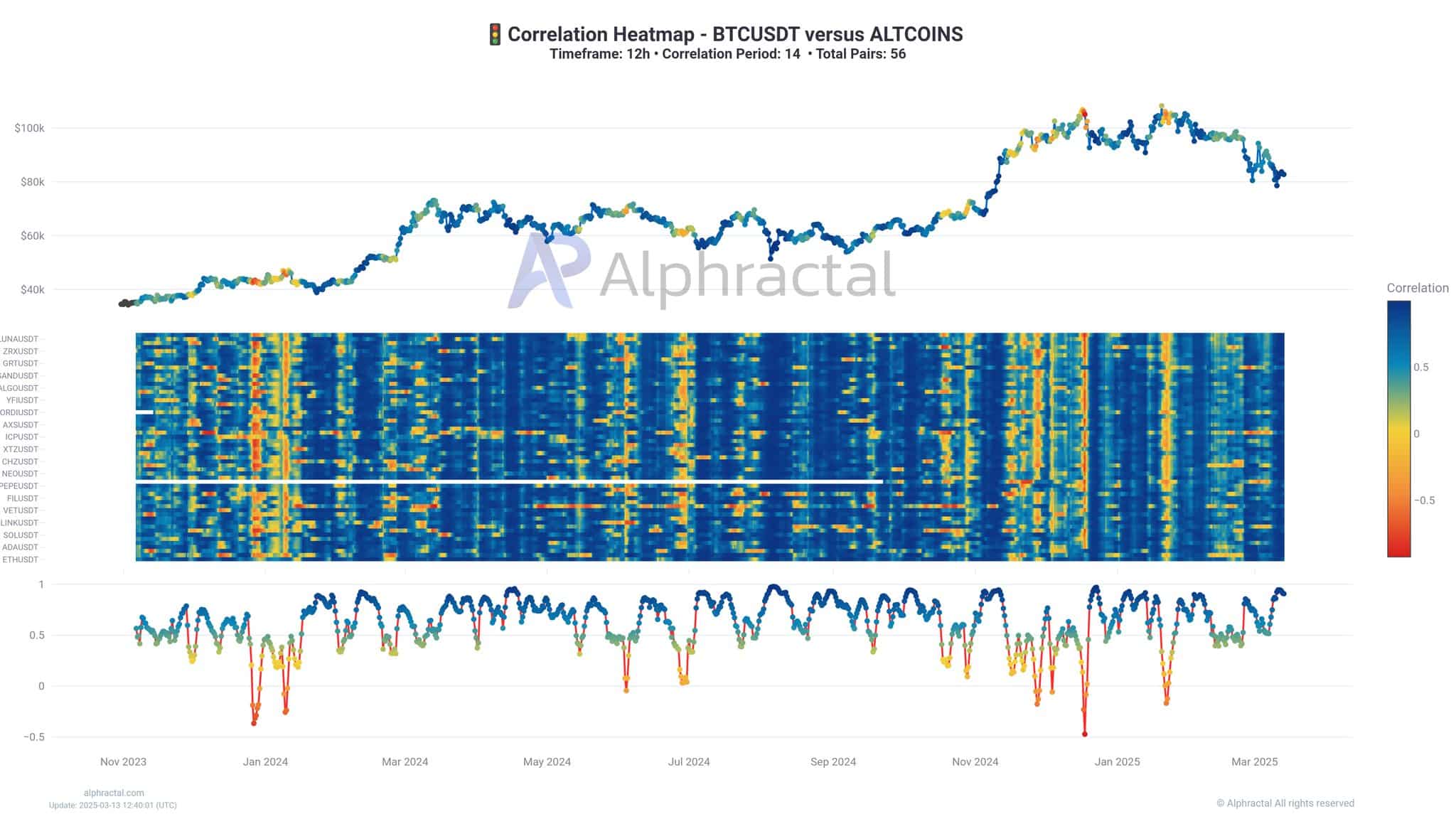

Altcoins are as soon as once more transferring in sync with Bitcoin [BTC] and Ethereum [ETH], signaling a return to a high-correlation market. Whereas this may occasionally seem secure on the floor, historical past reveals such alignment usually precedes sharp volatility or native market tops.

Most altcoins stay in agency downtrends, making untimely entries notably dangerous. At this stage, the secret’s timing – Watch for indicators of accumulation and clear structural shifts earlier than contemplating re-entry.

The state of the market – Correlation returns

The dense blue bands throughout most altcoin pairs recommend that over the previous a number of months, nearly all of altcoins have been transferring in lockstep with BTCUSDT. This pattern indicators a market the place macro tendencies dominate, and distinctive altcoin narratives wrestle to realize traction.

Traditionally, moments of low correlation – when the heatmap turns scattered or crimson – have usually preceded main volatility or native market tops.

On the time of writing, the info revealed tightly clustered habits, which means altcoins are unlikely to outperform independently. Until Bitcoin and Ethereum rally first.

The three phases of altcoin worth motion

Altcoin worth cycles usually observe three distinct phases – Downtrend, accumulation, and uptrend. Most altcoins are at present deep within the downtrend section – Marked by constant decrease lows and sustained promoting strain. That is the hazard zone, the place early entries usually lead to losses.

The buildup section follows as soon as promoting strain fades and worth stabilizes inside an outlined vary. Key indicators embody diminished volatility and repeated protection of a spread low. Lastly, the uptrend section begins when the market construction shifts bullish.

Therefore, search for clear breaks above resistance or sustained pullbacks to re-enter with larger conviction.

Studying vary lows and re-entering with momentum

As altcoins start to stabilize, consideration turns to vary lows – Traditionally, key zones the place sellers lose energy and patrons quietly step in. These ranges usually act as staging grounds for momentum shifts. When costs constantly defend a spread low, it might recommend a change in sentiment is underway.

Structural indicators like larger lows or decisive breakouts can point out the early phases of a development reversal. In earlier cycles, such setups have aligned with broader market recoveries. Whereas not each vary leads to a rally, agency help at key ranges usually marks rising confidence.

For now, Bitcoin and Ethereum stay the lead indicators. And, altcoins are prone to observe provided that momentum carries by means of.