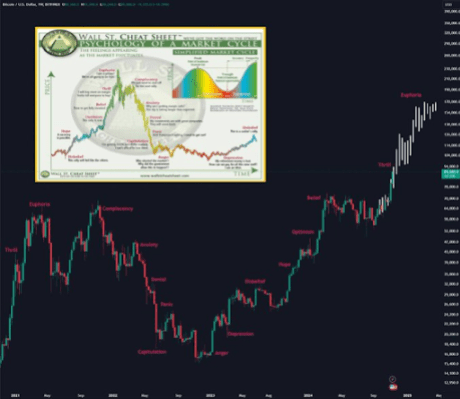

Crypto analyst Ash Crypto has revealed that Bitcoin has entered the ‘thrill’ part. The analyst additional defined what to anticipate from the flagship crypto shifting ahead, having entered this part of the bull run.

What To Count on From Bitcoin In ‘Thrill’ Part

In an X submit, Ash Crypto revealed that Bitcoin is getting into the fun part. Based mostly on this, he instructed market contributors to count on excessive volatility and extra liquidation. Total, the analyst remarked that the Bitcoin worth pattern will likely be to the upside because it continues to hit new all-time highs (ATHs). He predicts that BTC will rally to as excessive as $150,000.

Associated Studying

His accompanying chart confirmed that the fun part of the market cycle is when buyers and merchants might get overexcited concerning the bull rally and resolve to go all in with leverage. Nevertheless, as Ash Crypto indicated, this might go incorrect since there will likely be a whole lot of liquidations throughout this era.

Regardless of this being a bull market, the Bitcoin worth has, at completely different occasions, corrected after reaching new highs and flushing out over-leveraged longs within the course of. Alex Thorn, Head of Analysis at Galaxy Analysis, additionally defined earlier within the yr that bull markets aren’t straight strains up and that vital worth corrections are anticipated.

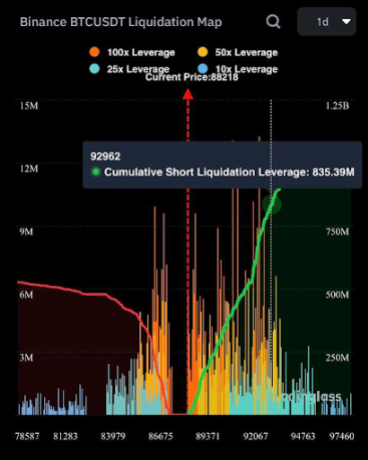

Nevertheless, in the long term, the bears get the quick finish of the stick in a bull run as costs pattern upwards. Crypto analyst Ali Martinez just lately revealed that over $800 million will likely be liquidated if Bitcoin rebounds in the direction of $93,000. It is a worth stage that BTC simply reached two days in the past because it rallied to a brand new ATH of $93,400.

The Bitcoin worth has since corrected and dropped beneath $90,000. This was partly as a result of US PPI inflation data, which was greater than forecasted. That improvement has forged some doubts about whether or not the Fed will likely be keen to additional minimize rates of interest in December.

Extra Worth Correction In The Quick Time period?

Ali Martinez instructed that the Bitcoin worth might expertise additional declines within the quick time period. In an X submit, the crypto analyst stated that the every day Relative Strength Index (RSI) exhibits that Bitcoin is in overbought territory, which generally alerts a possible worth correction forward.

Associated Studying

This worth correction might additionally occur as Bitcoin buyers look to safe income. Martinez revealed that $5.2 billion in BTC income have been realized and that the sell-side danger ratio has surged to 0.524%. He warned market contributors to remain alert and proceed with warning. Bhutan Government falls amongst whales which can be already securing income as they just lately bought $33 million price of BTC, simply weeks after promoting $66 million BTC.

On the time of writing, the Bitcoin worth is buying and selling at round $87,780, down over 2% within the final 24 hours, based on data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com