BitMEX co-founder Arthur Hayes says {that a} shift in coverage from the central banks is about to spice up crypto belongings into a brand new bullish section.

In a brand new essay, Hayes, now the CIO of crypto funding fund Maelstrom, notes that each the Bank of Canada (BOC) and the European Central Bank (ECB) have determined to decrease rates of interest.

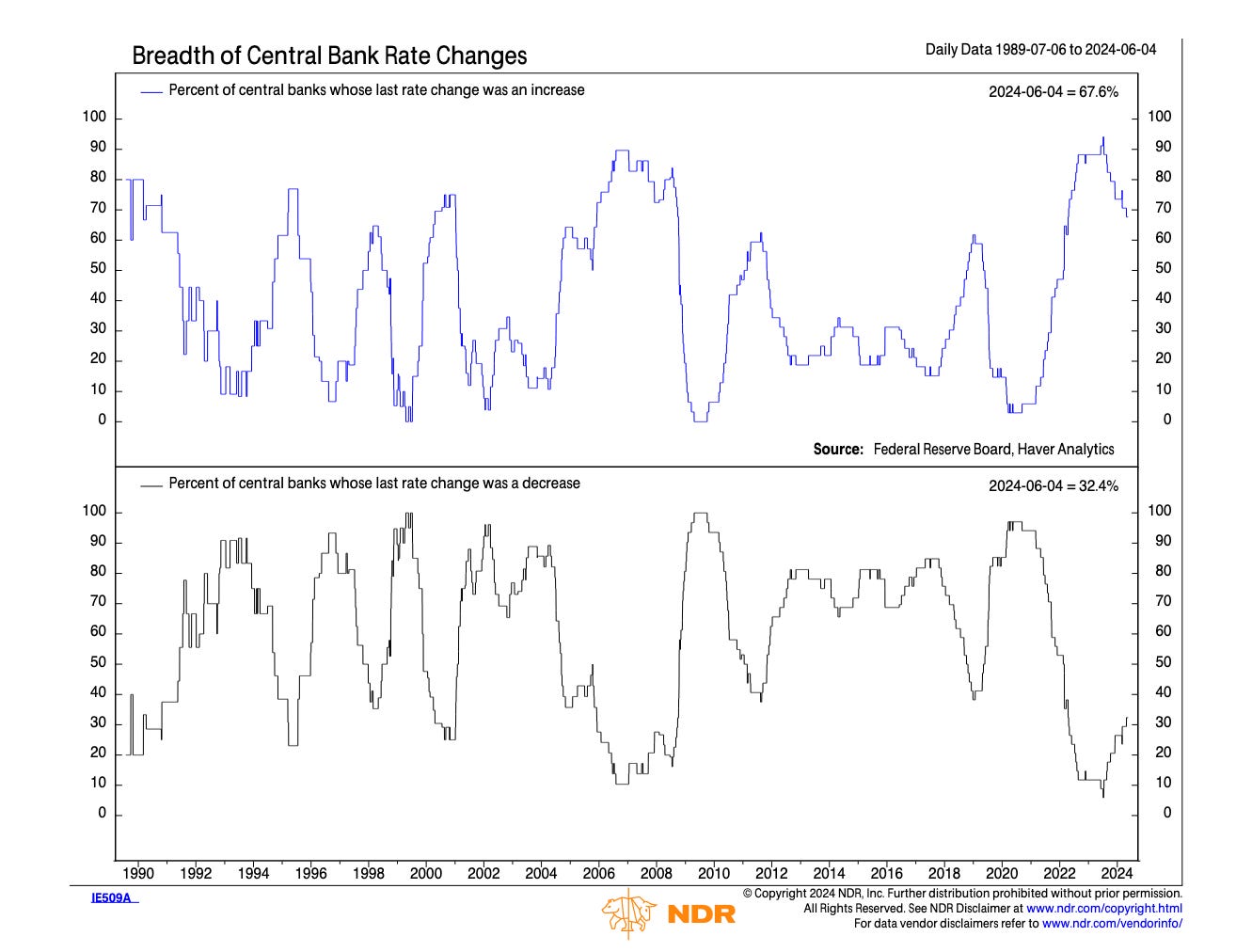

Hayes says the strikes by Europe and Canada recommend {that a} world shift in looser financial coverage could also be underway, and will subsequently sign a bump in threat belongings as soon as the Federal Reserve within the US follows swimsuit.

“The June central banking fireworks kicked off this week by the BOC and ECB charge cuts will catapult crypto out of the northern hemispheric summer season doldrums. This was not my anticipated base case. I believed the fireworks would begin in August, proper round when the Fed hosts its Jackson Gap symposium. That’s sometimes the venue the place abrupt coverage modifications are introduced going into autumn.

The development is obvious. Central banks on the margin are beginning easing cycles.”

In keeping with Hayes, the brand new chapter of financial coverage means it’s time to “go lengthy Bitcoin and subsequently sh*tcoins.”

Says the crypto veteran,

“The macro panorama has modified vs. my baseline. Subsequently, my technique shall change as effectively. For the Maelstrom portfolio initiatives, who requested for my opinion on whether or not to launch their tokens now or later. I say, Let’s F***ing Go!

For my extra liquid crypto synthetic-dollar money, a.okay.a. Ethena’s USD (USDe) that’s incomes some phat APYs (annual proportion yields), it’s time to deploy it once more on conviction shitcoins. After all, I’ll inform readers what these are after I’ve bought them. However suffice it to say, the crypto bull is reawakening and is about to gore the hides of profligate central bankers.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/prodigital artwork