- Bitcoin’s provide on exchanges dropped over the previous couple of days

- The Cash Circulation Index (MF) repealed an uptick in shopping for stress on the charts

Bitcoin [BTC], at press time, had efficiently climbed above $100k, however there could also be some bother forward. Actually, regardless of crossing this main resistance degree, shopping for stress has remained considerably low.

Therefore, the query – Will this low shopping for stress trigger BTC’s value to drop within the coming days?

What’s up with Bitcoin?

On the time of writing, the king coin was buying and selling at $101.9k with a market capitalization of over $2 trillion. This, after it briefly dropped beneath $97.5k during the last 48 hours alone.

Quickly after, Santiment, a preferred knowledge analytics platform, shared that because the week closed, purchase calls have been quiet on social media. For Bitcoin’s subsequent large swing, this chart shall be extremely helpful as to when to purchase (whereas the group is panicked) and promote (whereas the group is grasping).

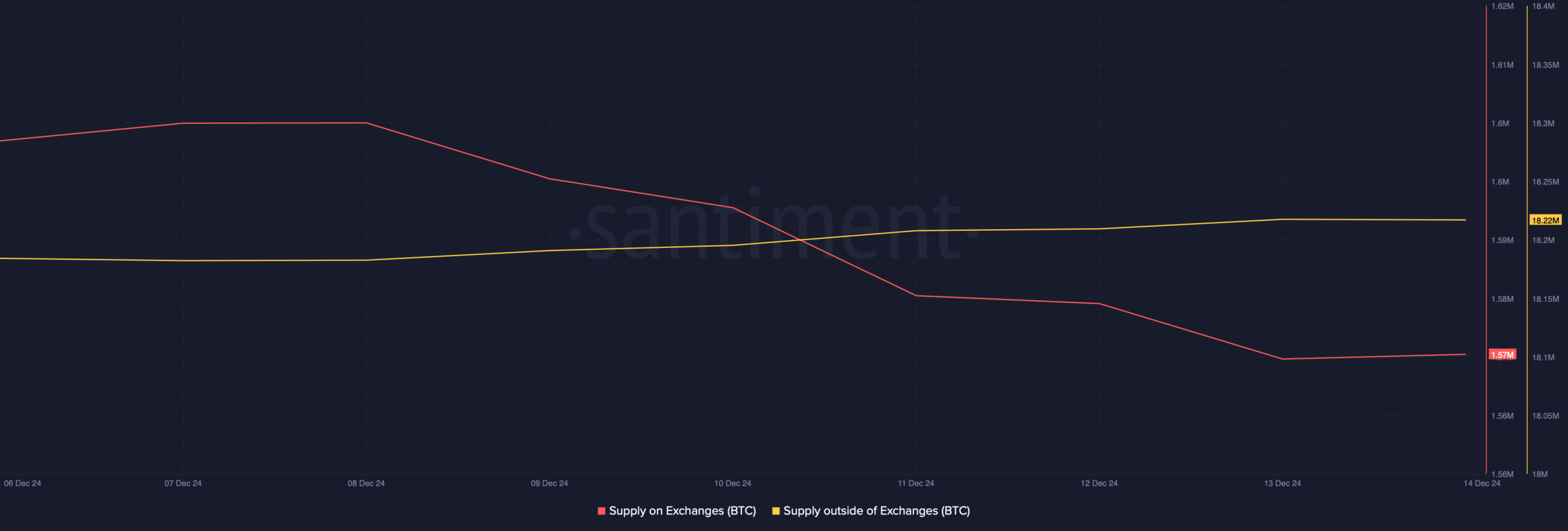

AMBCrypto discovered that over the previous couple of days, BTC’s provide on exchanges dropped too. This meant that purchasing stress on Bitcoin has been rising. Whereas that occurred, the coin’s provide outdoors of exchanges fell too, additional pointing to a decline in promoting stress.

What to anticipate from BTC

Aside from this, BTC’s trade reserves have been falling too, as per CryptoQuant’s knowledge. This additional established the truth that shopping for stress was excessive.

Moreover, Bitcoin’s Rainbow chart revealed yet one more constructive sign. In accordance with the identical, BTC continues to be throughout the accumulation pattern. This instructed that there could also be an extra value hike within the coming days.

Quite the opposite although, the fear and greed index revealed that the market was in a “greed” part during the last 24 hours. This meant that there was a risk of a value correction.

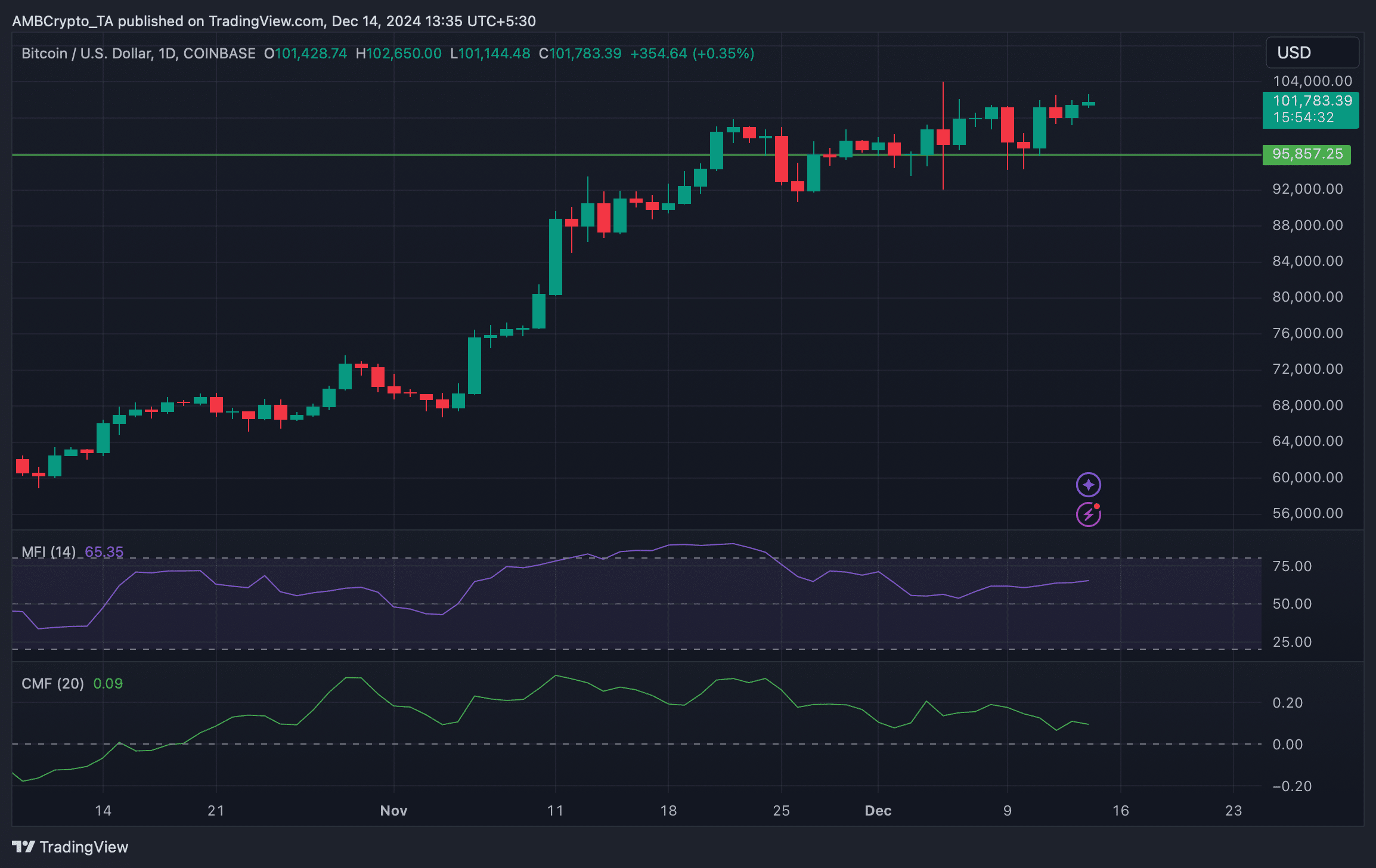

Therefore, AMBCrypto checked Bitcoin’s each day chart. As per our evaluation, BTC’s Cash Circulation Index (MFI) registered an uptick, indicating an increase in shopping for stress. If the uptick in shopping for sustains itself, Bitcoin may quickly breach $102k.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Price mentioning, nonetheless, that the Chaikin Cash Circulation (CMF) moved south. This could maintain again any Bitcoin efforts to go north.