- BTC might prolong losses to final November’s U.S. elections ranges of $72K.

- Cathie Wooden projected higher macro circumstances within the second half of 2025.

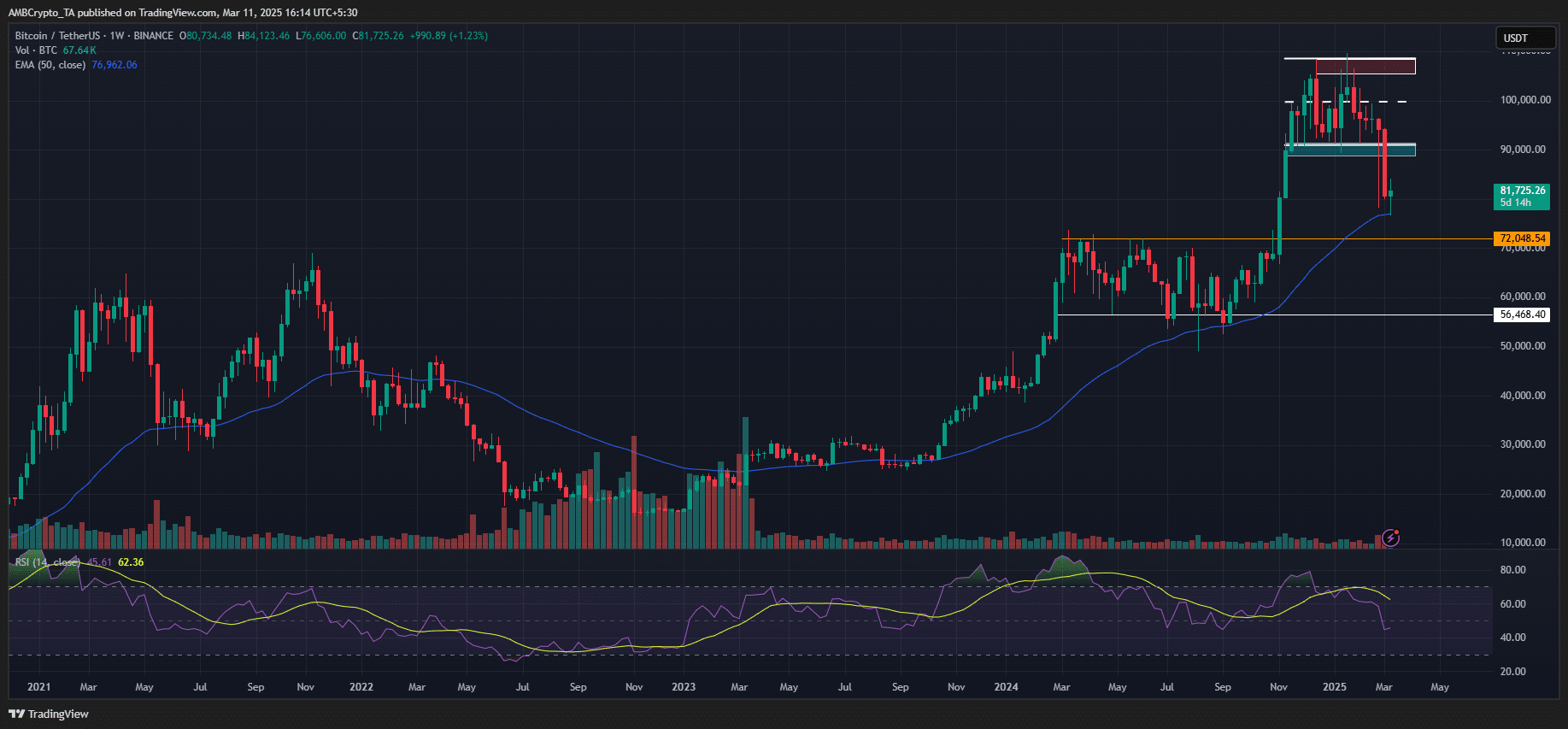

Bitcoin’s [BTC] might slip beneath $75k within the close to time period amid renewed U.S. recession fears. In actual fact, Greg Madagini, Director at crypto choices analytics platform Amberdata, projected that BTC might drop to $72K within the brief time period.

Bitcoin’s potential dip to $72K

In his weekly market report, Magadini stated,

“BTC costs look to be delivering a Bart Simpson sample, which might goal spot costs again to $72k, the Nov fifth election degree.”

The Bart Simpson sample refers back to the formation of a pointy rise, marched by consolidation, after which a pointy retrace.

If the sample is validated, BTC might faucet its final November U.S. election degree, like retracement seen amongst U.S. equities, added Magadini.

“Provided that the SPX (S&P 500 Index) has now retraced again to election value ranges, I feel this sample for spot BTC may very well be within the playing cards.”

An analogous bearish outlook was shared by famend technical analyst Peter Brandt, arguing that BTC structurally topped out and should reclaim $95K to show market sentiment optimistic once more.

Amid the U.S. recession fears, Ark Make investments’s Cathie Wooden assured that the U.S. financial system would expertise a ‘deflationary growth’ within the second half of 2025. She said,

“In our view, the market is discounting the final leg of a rolling recession, which can give the Trump Administration and the Powell Fed many extra levels of freedom than buyers count on, establishing the U.S. financial system for a deflationary growth within the second half of this 12 months!”

One other optimistic replace was the sturdy correlation between BTC and international cash provide (M2). Most analysts have famous that BTC lags behind international M2, and the current drawdown mirrored M2’s drop final quarter.

For the reason that indicator surged in Q1 2025, BTC might bounce again if the correlation holds.

Jon Consorti, head of progress at Theya Bitcoin, noted that with the BTC concern and greed index at typical ‘backside’ ranges, the cryptocurrency may very well be primed for a restoration.

“Concern and greed index at 20, a price reached in bull markets when bitcoin is on its method to making a neighborhood backside.”

At press time, BTC was valued at $81.6K after a short dip to $76K. The extent was additionally a 50 Exponential Shifting Common (EMA) on a weekly chart and essential assist for previous bull markets. It stays to be seen if it is going to maintain within the brief time period.