- BTC worth might hit $103K, pushed by liquidity sweep.

- A possible uptick in world longs might mark a possible BTC reversal and bull lure.

For the previous few days, Bitcoin [BTC] has stayed above $100K, however its subsequent course may very well be triggered by the Fed fee minimize determination.

After final week’s U.S. inflation and labor information, the market was pricing a 96% likelihood of one other 25bps curiosity minimize throughout the subsequent Fed fee determination on the 18th of December.

Subsequent BTC strikes

So, which approach will BTC go? In keeping with BTC dealer CrypNuevo, the most probably transfer was a liquidity hunt at $103K/104K, citing latest traits. A part of his evaluation on X read,

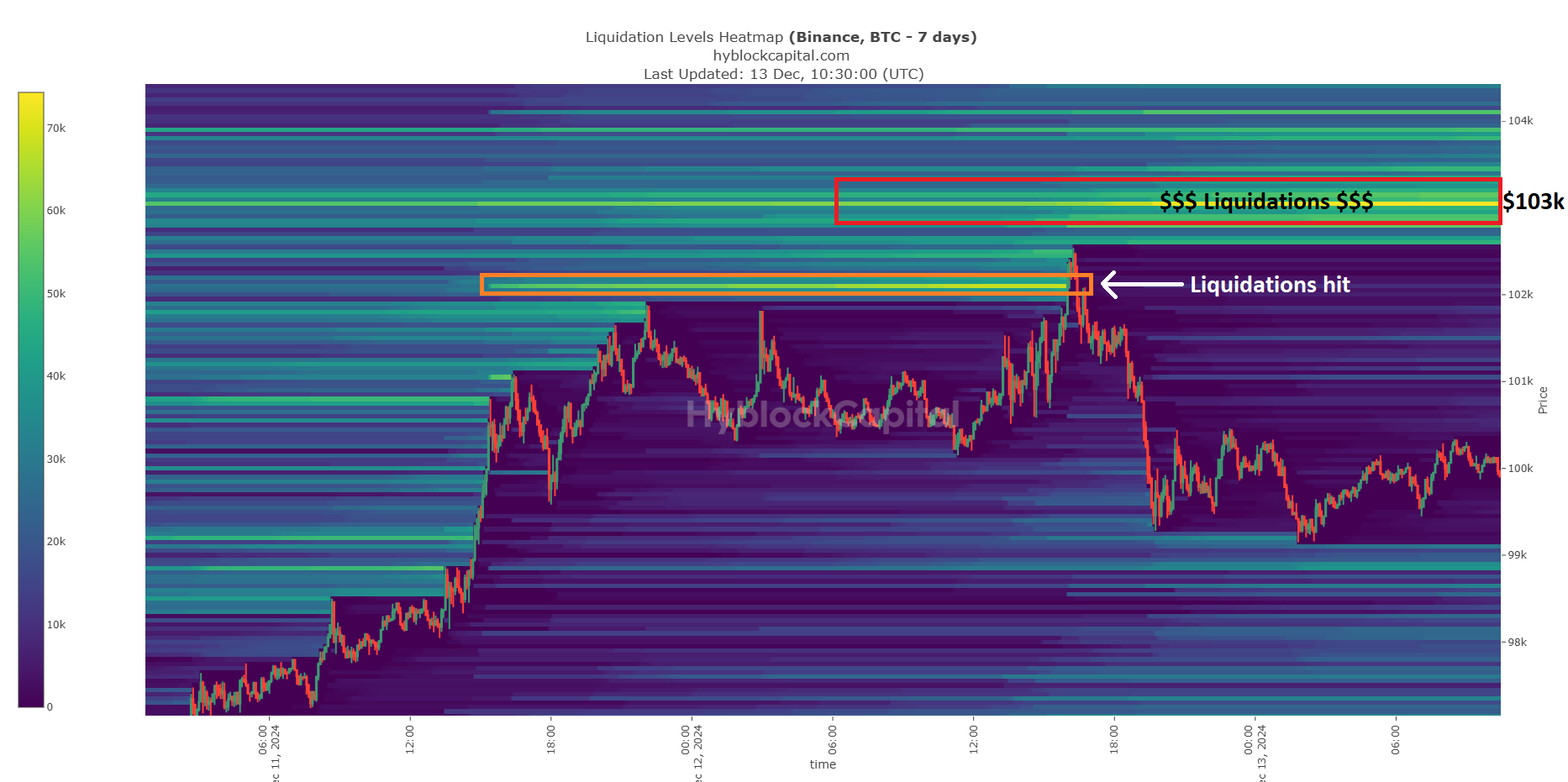

“A variety of brief liquidations at $103k. It could be the fitting time to hunt them…We are able to see how they’ve been persistently targetting these liquidation clusters previously days.”

At press time, there have been nonetheless appreciable leveraged brief positions at $103K-$104K, which strengthened CrypNuevo’s projection.

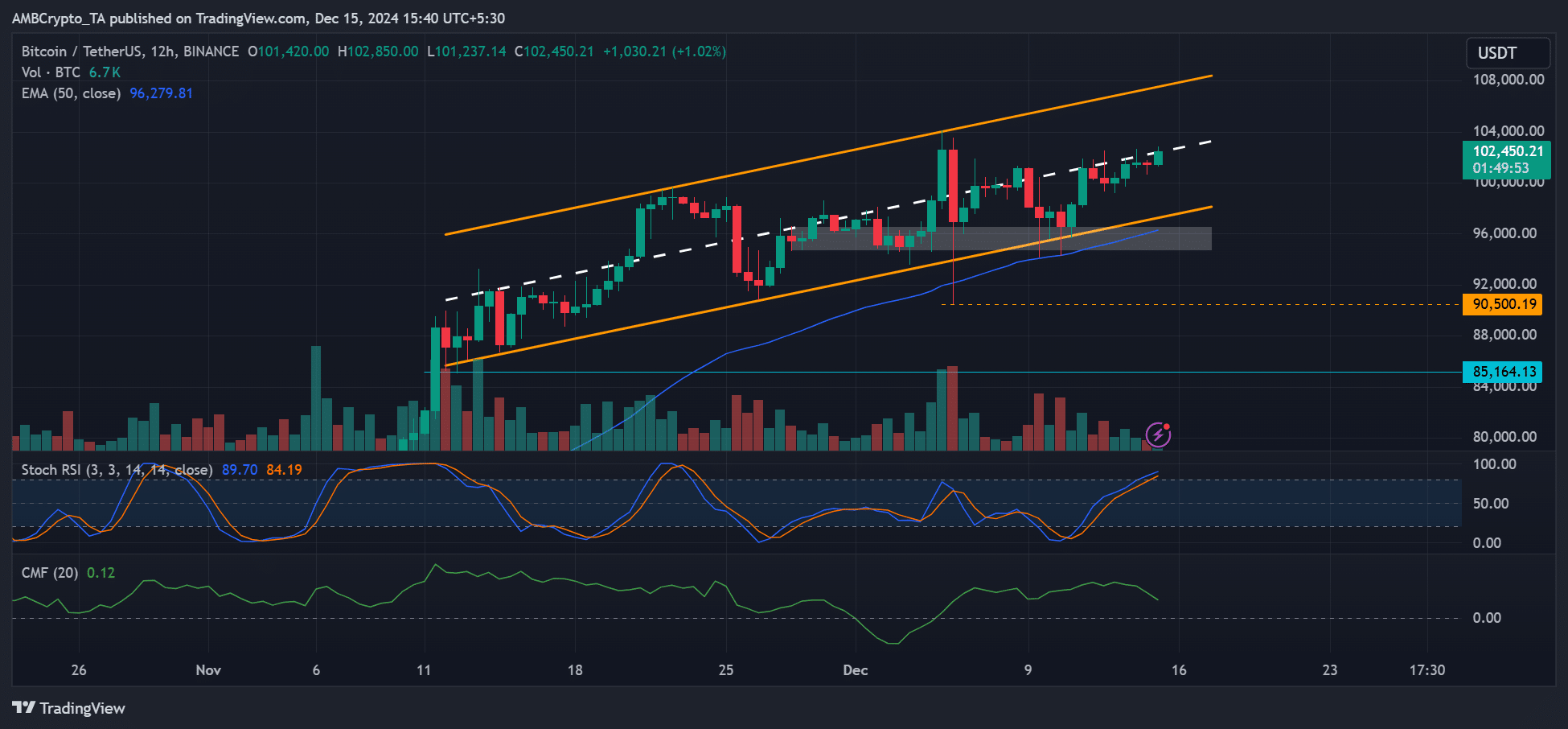

On the 12-hour chart, BTC has been tightly consolidating round its ascending channel’s mid-range. The $103K/$104K goal sat about 2% from the mid-range.

The higher channel goal of $107K was 5% from the mid-range stage, however had much less liquidity and won’t strongly appeal to worth motion because the $103K stage.

If that’s the case, BTC might hit $103K/$104K targets, pushed by liquidity sweep, after which retreat decrease.

The channel’s range-low has stopped earlier retracements, and the potential pullback might ease at $97K. Afterward, BTC might proceed its range-bound motion.

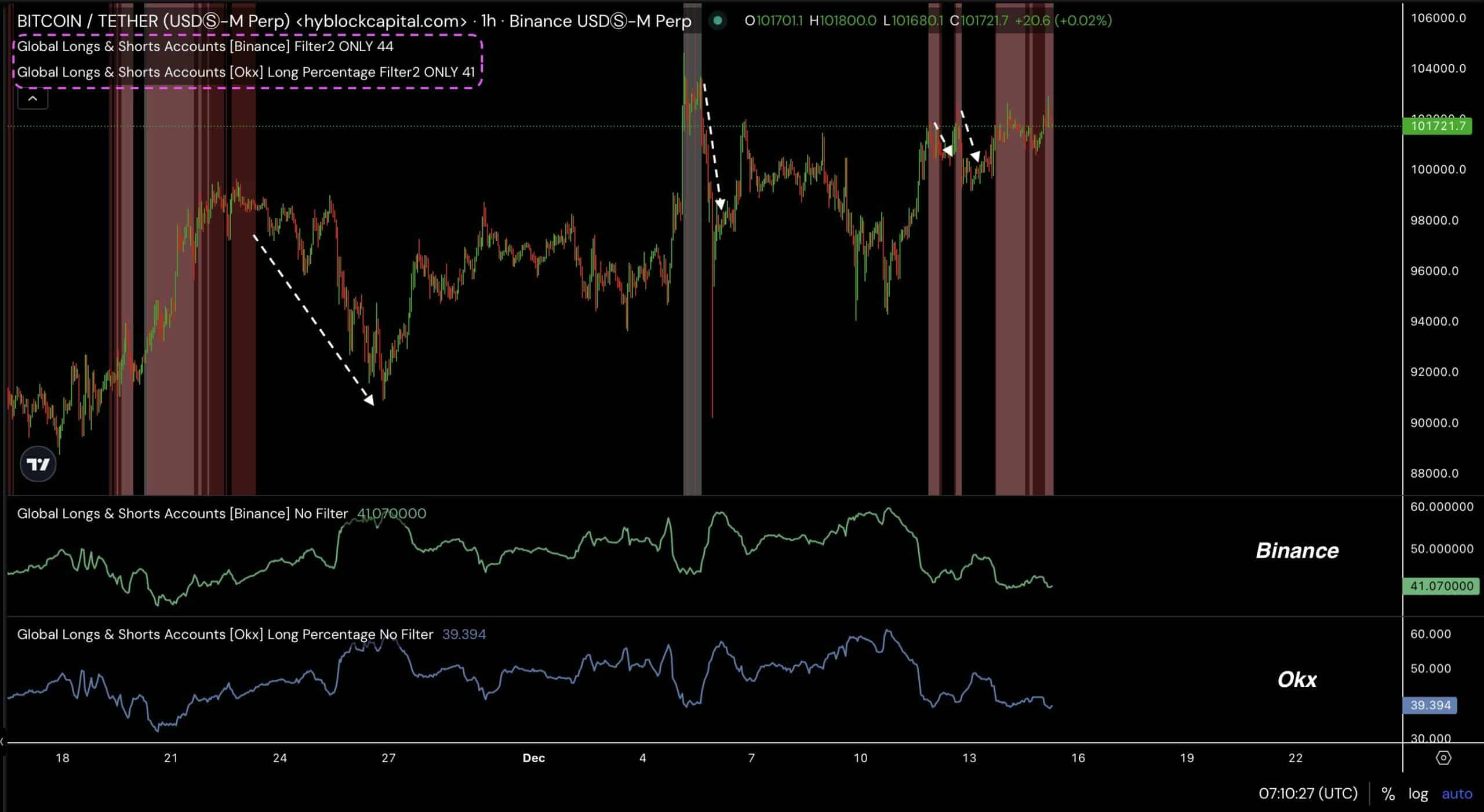

Hyblock’s retreating world longs indicator supported the probably slip to range-low after tapping $103K. The oscillator all the time rises when BTC falls and drops when BTC pumps.

At press time, the indicator was heading to its backside and will reverse, marking a possible BTC retracement and bull lure.

Learn Bitcoin [BTC] Price Prediction 2024-2025

In brief, BTC might push barely above the mid-range to liquidate brief positions at $103K/$104K ranges earlier than going for leveraged longs on the channel’s range-lows close to $97K.

Nevertheless, a breakout on both facet would invalidate the above range-bound outlook.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion