In response to the most recent on-chain remark, the Bitcoin merchants’ realized losses have reached a stage that has confirmed crucial to the coin’s movement a number of instances in recent times. This begs the query — is the Bitcoin worth bottoming out?

Merchants’ Realized Losses Under -12 Once more — What Occurred Final Time?

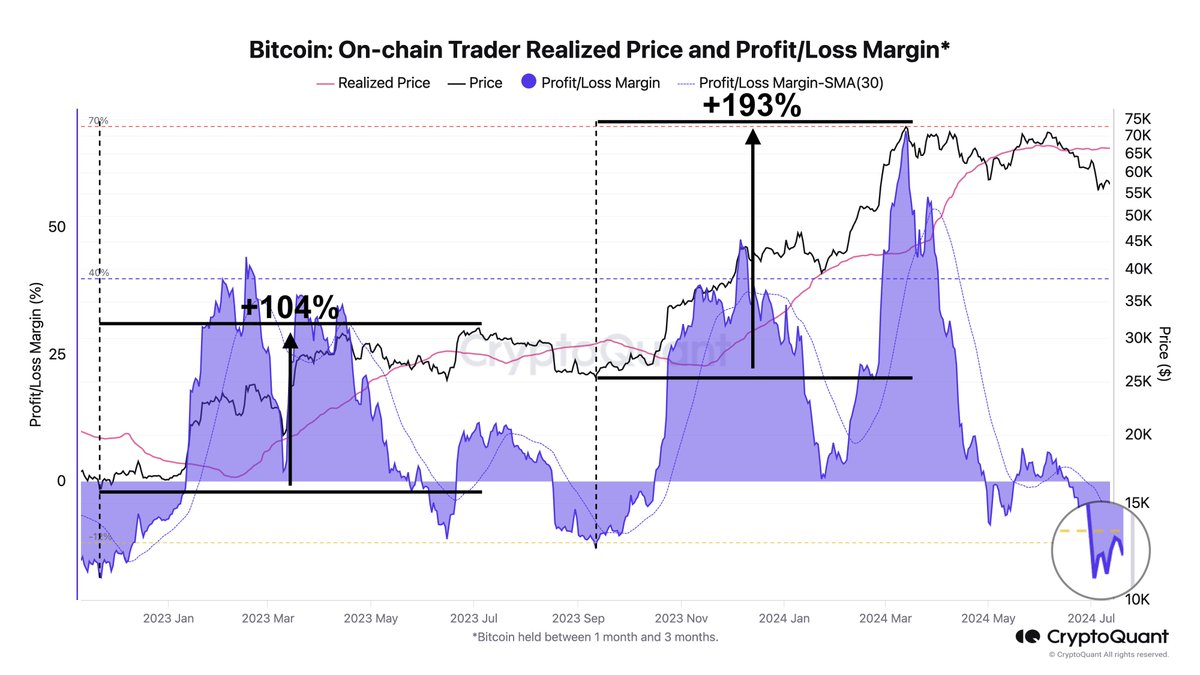

In a latest put up on the X platform, distinguished crypto analyst Ali Martinez pointed out that the quantity of losses being realized by Bitcoin merchants has been rising in latest weeks. This on-chain revelation is predicated on the CryptoQuant Revenue/Loss Margin metric, which aggregates earnings and losses from all Bitcoin transactions.

The Revenue/Loss Margin mainly assesses the general profitability of buyers of a specific cryptocurrency (Bitcoin, on this situation). When the metric’s worth is constructive, it implies that extra BTC is being bought at a revenue. A unfavorable Revenue/Loss Margin, then again, signifies that extra Bitcoin is being bought at a loss.

In response to information from CryptoQuant, the Revenue/Loss Margin is at present beneath the -12 mark, which means that merchants are realizing extra losses than beneficial properties out there for the time being. Traditionally, this level is more significant, contemplating that the metric has been under the -12 mark previously cycles.

Apparently, the latest instances by which the Revenue/Loss Margin has fallen under -12 has been adopted by durations of serious bullish worth motion. As proven within the chart and highlighted by Martinez, the final two instances the metric fell beneath this stage have been marked by 104% and 193% worth rallies, respectively.

Supply: Ali_charts/X

If this historic sample is something to go by, then there’s a chance that the value of Bitcoin may expertise notable bullish exercise within the close to future. Furthermore, remark of serious losses out there can counsel the bottom of a bearish cycle and the beginning of a extra constructive part.

Bitcoin Value To Surge? Right here Are Necessary Ranges To Watch

If the historic sample does maintain true and the Bitcoin price goes on a rally, there are a few worth zones to be careful for. In response to Martinez, the premier cryptocurrency has main resistance ranges across the $61,340 and $64,620 zones.

This revelation is predicated on the price foundation of Bitcoin buyers and the distribution of the BTC provide throughout numerous worth ranges. The scale of the dots within the chart under displays the energy of the resistance and help and the quantity of BTC bought at every worth zone.

Key resistance ranges for #Bitcoin to observe are $61,340 and $64,620. The essential help stage to observe is $57,670! pic.twitter.com/YrBPkJmWzn

— Ali (@ali_charts) July 13, 2024

As of this writing, the value of Bitcoin stands round $59,467, reflecting a 2.7% improve within the final 24 hours. In response to CoinGecko information, the flagship cryptocurrency is up by 2% previously week.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Pexels, chart from TradingView